What happens when a major bank’s mortgage system shows customers owing $0 on million-dollar loans? Or credit card balances suddenly disappear after a system upgrade? These aren’t hypotheticals, they’re real consequences of failed Data Migration in Banking projects.

The financial sector faces unprecedented data challenges. According to IBM’s Financial Services Data Management Report, banks now manage 2.5 quintillion bytes of data daily from core banking systems, payment networks, mobile apps, and risk platforms. This explosion creates massive migration complexity.

Yet many institutions still treat migration as a simple IT task. The results? According to Deloitte research, 60% of banking technology transformations fail to deliver expected outcomes, often due to data quality issues discovered too late.

Poor migration quality doesn’t just frustrate customers as it triggers regulatory violations, compliance failures, and financial reporting errors. Regulators like the Federal Reserve and OCC now scrutinize data management practices during examinations.

Therefore, banks cannot afford treating data migration as an afterthought. Quality, compliance, and governance must be built into every migration decision from day one. Your institution’s reputation depends on it.

Key Learnings

- Data quality is the foundation of successful banking migrations – Migrating data without validation and reconciliation leads to reporting errors, compliance risks, and loss of trust. Quality must be built into every migration step.

- Automation significantly reduces migration risk and effort – Using intelligent migration accelerators minimizes manual work, preserves business logic, and ensures consistent outcomes across complex banking systems.

- Legacy reporting tools limit speed and regulatory readiness – Modern BI platforms like Power BI provide faster insights, better governance, and improved auditability compared to static legacy reports.

- Governance and compliance cannot be added after migration – Banking migrations require security, access control, lineage, and audit trails to be embedded from the start to meet regulatory expectations.

- Outcome-driven frameworks deliver long-term value – A structured, quality-first migration approach improves data trust, supports future analytics and AI use cases, and enables scalable digital banking operations.

Modern Banking Runs On Clear Data Migration

Kanerika is ready to support your migration from start to finish.

Understanding Banking Data Ecosystems

Banking ecosystems involve interwoven systems in charge of important financial activities. This complexity is a critical element in the knowledge of successful migration planning.

1. Core Banking Systems and Platforms

The core banking systems handle the daily transactions, account handling and balances of customers. CRM systems monitor the customers and the sales prospects. The payment systems also deal with wire transfer, ACH and card processing. Lending companies handle loan originations, underwriting as well as servicing. In addition, cash management and investment portfolios are managed through treasury systems. The credit, market and operational risks are measured using risk management tools. Also, regulatory compliance and error-free reporting can be guaranteed with compliance platforms.

2. Structured vs Unstructured Banking Data

Structured banking data includes transaction records, account balances, and customer profiles stored in databases. Conversely, unstructured data encompasses loan documents, customer emails, KYC documentation, and compliance reports. Both types require different migration strategies and validation approaches.

3. Data Dependencies Across Operations

Banking data relationships connect intricately. Customer records link to multiple accounts. Accounts tie to transaction histories. Transactions affect risk calculations and compliance reporting. Additionally, loan data connects to collateral information, payment schedules, and credit assessments. Breaking these data dependencies during migration causes system failures.

4. Why Banking Data Is Complex and Sensitive

Banking data migration complexity stems from strict regulatory requirements, 24/7 operational demands, and zero-tolerance for errors. Account balances must remain accurate to the penny. Additionally, audit trails require complete preservation. Security regulations mandate encryption and access controls. Therefore, banking migrations demand exceptional precision and comprehensive planning.

What Is Data Migration in Banking?

Banking data migration can be defined as transferring financial data of legacy or older systems to new systems or platforms without compromising accuracy, security, and compliance. This is a process to transfer customer accounts, transaction history, loan history and compliance information in a safe manner.

Legacy to Modern Platforms

Banks are moving away out of old legacy banking systems to new cloud-based systems, data lakeshouses, and the world of sophisticated analytics. Such contemporary systems facilitate real-time processing, enhanced scalability and enhanced customer experiences. Also cloud platforms save money on infrastructure at the same time increasing the disaster recovery.

Role in Digital Banking Initiatives

The transformation of digital banking relies on successful data migration. New platforms facilitate mobile banking facilities, customized services and real-time payments. Furthermore, open banking API needs common data available across systems. Artificial intelligence banking processes migrated data to detect fraud, credit score, and customer suggestions. Migration quality hence has a direct effect on the success of digital innovation.

Importance of Critical Data Attributes

Banking data accuracy ensures customers see correct balances and transaction histories. Completeness guarantees no financial records disappear during transfer. Data lineage tracks information flow for regulatory audits. Furthermore, auditability provides complete trails showing when, how, and why data changed.

Regulatory bodies like the Federal Reserve and OCC require banks to demonstrate data integrity throughout migration. Consequently, banking migrations demand higher precision standards than most industries, making structured approaches absolutely essential for success.

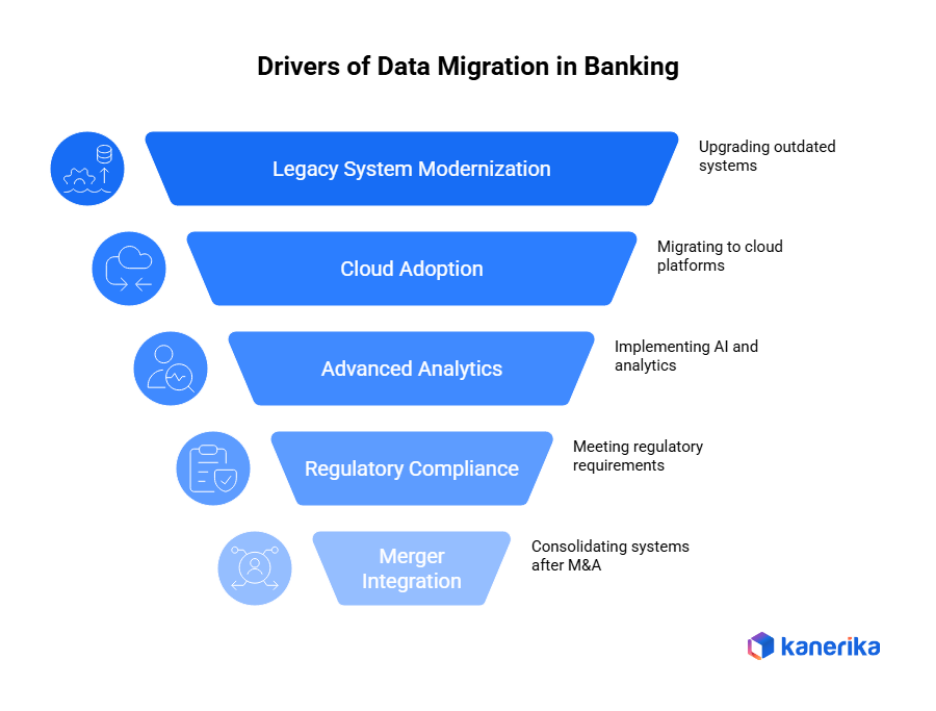

Key Drivers of Data Migration in Banking

Information flow within the banking sector is improved by the modernization of banking operations to address the requirements of regulatory bodies and customers. This transformation is driven by several factors which are critical.

1. Legacy System Modernization and Technical Debt Reduction

Legacy banking systems built decades ago struggle with modern demands. Mainframe platforms require expensive specialized skills becoming increasingly scarce. Additionally, technical debt accumulates as workarounds pile up over years. Outdated systems limit innovation and increase operational risks. Therefore, banks migrate to modern platforms reducing maintenance costs while improving agility.

2. Cloud Adoption and Scalability Requirements

Banking migration to the cloud also removes limits to the infrastructure at times of high traffic. Old on-premises systems cannot add capacity due to a holiday shopping spurt or tax season spikes. On the other hand, the capacity of cloud platforms scales automatically, responding to changes in volume. Besides, cloud solutions lower the cost of the data centers and enhance the data recovery and the stability of the system.

3. Advanced Analytics, AI, and Fraud Detection

The AI banking systems need quality data that is closely integrated to make effective predictions. Machine learning models identify fraudulent transactions by identifying the patterns in millions of records. Also, predictive analytics predict customer requirements so as to give individualized product recommendations. Through credit risk models, loan applications are evaluated based on detailed data. These are capabilities that require the migration of disaggregated information into integrated platforms providing sophisticated algorithms.

4. Regulatory Reporting, Compliance, and Audit Readiness

Stricter banking compliance regulations like Basel III, Dodd-Frank, and AML requirements need better data management. Regulatory reporting demands accurate historical records accessible instantly. Additionally, stress testing requires comprehensive data spanning multiple years. Audit trails must document complete transaction lineage. Furthermore, data governance frameworks ensure information quality meets regulatory standards.

5. Merger and Acquisition Integration

Bank M&A activities create urgent migration needs when institutions consolidate operations. Acquiring banks must integrate customer accounts, loan portfolios, and transaction systems quickly. Moreover, the regulatory principles provide uniform continuity of customer service in transition. The key to successful integration is to migrate and consolidate the information across various sources and ensure that the accuracy and compliance are upheld during the whole integration.

Common Data Migration Challenges in Banking

The migration of banking data presents special barriers that demand specific skills and a detailed strategy. Knowledge of such challenges assists institutions to develop solutions to them.

1. Massive Historical Data Volumes and Long Retention Periods

Banking data volumes span decades due to regulatory retention requirements. Banking institutions are required to maintain a history of transactions of 7-10 years or more. Moreover, records of mortgages and loans must be saved during the whole life of the loans- even 30 years. The mobility of terabytes of historical data and their accessibility and compliance is a major challenge in technical terms. In addition, the old systems hold data in a format that cannot be used with the current systems.

2. Data Silos Across Business Units and Systems

Banking data silos develop when departments implement separate systems independently. Retail banking uses different platforms than commercial lending. Wealth management operates distinct systems from treasury operations. Additionally, acquired banks often maintain separate infrastructure for years. These silos create fragmented customer views and prevent comprehensive risk assessment. Furthermore, reconciling data across silos during migration reveals inconsistencies requiring resolution.

3. Inconsistent Data Formats and Business Rules

Different systems follow varying data format standards. One platform stores account numbers with dashes while another uses continuous digits. Date formats differ between applications. Additionally, currency precision varies as some systems round to two decimals, others maintain four. Business rules conflict across regions and products. Interest calculation methods differ between legacy and modern systems. These inconsistencies complicate transformation and validation efforts significantly.

4. Strict Regulatory and Audit Requirements

Banking compliance regulations demand perfect accuracy during migration. Regulators require complete audit trails documenting every data change. Additionally, customer account balances must reconcile precisely amd not approximately. Anti-money laundering systems need complete transaction histories without gaps. Furthermore, stress testing and risk reporting depend on data integrity. Migration failures can trigger regulatory examinations and penalties.

5. High Risk of Data Quality Issues

Data quality problems multiply during banking migrations. Customer records contain duplicates with slight name variations. Address standardization fails across international operations. Additionally, product codes lack consistent mapping between systems. Relationship data connecting accounts to customers breaks during transfer. Moreover, sensitive information like social security numbers requires special handling preventing automated cleansing.

6. Zero Downtime Requirements

24/7 banking operations cannot stop for migration activities. ATMs, online banking, and payment processing must continue uninterrupted. Additionally, regulatory deadlines for daily reporting cannot be missed. Batch processing windows shrank as real-time banking expanded. Therefore, migrations require parallel running strategies and instant rollback capabilities ensuring continuous service availability throughout projects.

Why Ensuring Data Quality During Migration Is Critical for Banks

Banking migration has a direct effect on financial stability, regulatory compliance, and customer trust, which are determined by data quality. Poor quality triggers ripple effect problems with severe effects.

1. Impact on Financial Reporting and Risk Models

Inaccurate data corrupts financial reporting accuracy that regulators and investors depend on. Balance sheets reflect wrong totals. Income statements misstate revenue. Additionally, risk assessment models produce faulty calculations when fed poor-quality data. Credit risk scores become unreliable. Market risk exposure gets miscalculated. Furthermore, stress testing results lose validity, potentially hiding dangerous vulnerabilities. Basel III compliance requires precise data, approximations trigger regulatory violations.

2. Customer Trust and Reputational Risk

Nothing destroys banking customer trust faster than account balance errors. Customers discovering incorrect balances switch banks immediately. Moreover, payment failures due to bad data damage relationships permanently. Social media amplifies complaints, creating reputational risk affecting stock prices and customer acquisition. One major data quality incident can erase years of brand-building efforts.

3. Data Quality as Regulatory Mandate

Banking data governance is a nonnegotiable issue to the regulators. Federal Reserve, OCC and FDIC examinations are intense in data management practices. Furthermore, Dodd-Frank Act also requires aggregation of risk data to be done correctly. Anti-money laundering laws demand full and precise information about the customers. In addition, data lineage should be fully documented as audit trails. Low quality instigates enforcement measures, penalty fines, and stricter regulation.

4. Link to Operational Stability

Clean data enables stable banking operations through accurate processing, reliable reporting, and automated workflows. Conversely, poor quality forces manual verification, creates exception handling overhead, and slows transaction processing. Additionally, operational incidents stemming from data quality issues increase operational risk capital requirements. Therefore, quality directly affects both day-to-day efficiency and regulatory capital calculations.

Enhancing strict data quality and quality control in the migration process prevents institutions not only financial and regulatory losses but also reputation damage and guarantees a stable functioning.

Microsoft Fabric Vs Databricks: A Comparison Guide

Explore key differences between Microsoft Fabric and Databricks in pricing, features, and capabilities.

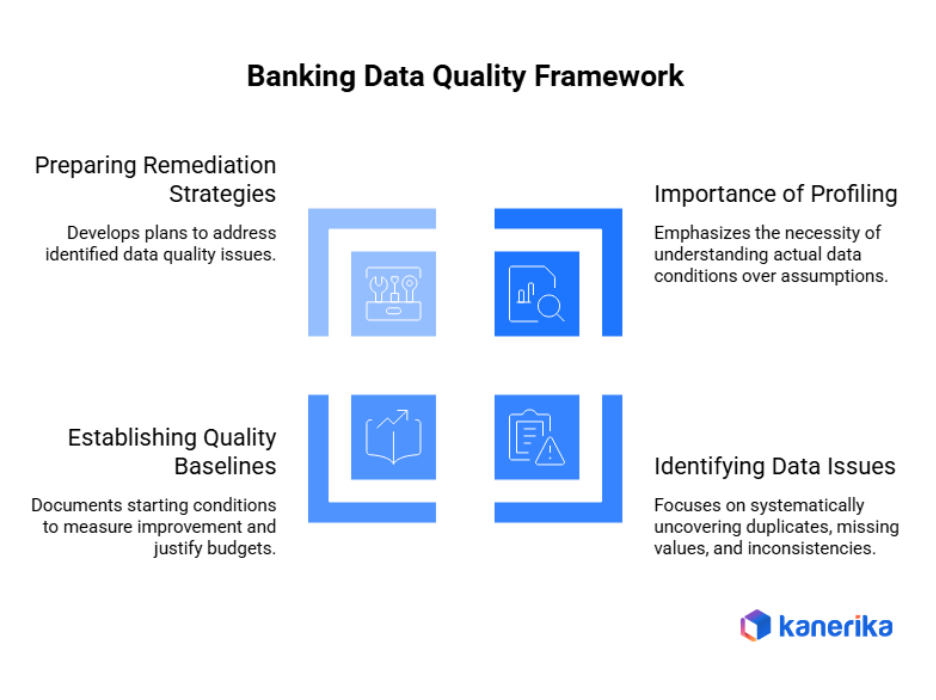

Pre-Migration Data Quality Assessment and Profiling in Banking

Banking data profiling reveals hidden quality issues before they disrupt critical financial operations. Thorough assessment prevents expensive post-migration failures.

1. Importance of Profiling Banking Data

Pre-migration assessment examines actual data conditions rather than assumptions about quality. Profiling uncovers how many customer accounts lack complete KYC information, which transaction records contain errors, and where account relationships break. Additionally, automated profiling tools scan millions of financial records quickly, providing comprehensive insights that guide remediation priorities and resource allocation.

2. Identifying Duplicates, Missing Values, and Inconsistencies

Profiling exposes banking data quality issues systematically. Duplicate customer records with slight name variations surface immediately. Missing social security numbers in required fields become visible. Inconsistent account number formats like some with branch codes, others without and get flagged. Moreover, profiling identifies orphaned transactions referencing non-existent accounts and broken relationships between customers and their holdings.

3. Establishing Quality Baselines for Reconciliation

Data quality baselines document starting conditions objectively. Record that 12% of customer addresses are incomplete or 5% of loan records lack proper collateral linkage. These metrics establish realistic expectations and measure improvement progress. Furthermore, baselines help justify cleansing budgets to executives by quantifying problem severity with specific financial impact estimates.

4. Preparing Cleansing and Remediation Strategies

Profiling results directly inform data cleansing plans for banking systems. High duplicate rates prioritize deduplication efforts using fuzzy matching algorithms. Significant gaps in regulatory fields demand fill strategies complying with KYC requirements. Additionally, format inconsistencies guide standardization rules ensuring target systems accept migrated data without validation failures.

Data Cleansing and Standardization for Banking Systems

Banking data cleansing transforms inconsistent information into reliable datasets meeting regulatory standards. Proper cleansing prevents operational and compliance issues in new systems.

1. Standardizing Customer, Account, and Transaction Data

Banking data standardization creates consistency across all financial records. Normalize customer names removing extra spaces and special characters. Standardize address formats with validated postal codes and country codes. Additionally, ensure account numbers follow uniform patterns across all products. Convert transaction amounts to consistent decimal precision. Furthermore, standardize date formats, time zones, and currency codes across international operations preventing processing errors.

2. Removing Obsolete and Redundant Records

Eliminate outdated banking data no longer serving business or regulatory purposes. Delete closed accounts beyond retention requirements. Remove inactive customer profiles dormant for years. Additionally, purge duplicate transaction records from system errors. Archive historical data meeting compliance requirements but not needed in operational systems. This cleanup reduces migration scope, lowers storage costs, and improves query performance.

3. Aligning Data Definitions Across Departments

Different business units often define data elements inconsistently. Retail banking’s “customer” definition differs from wealth management’s. Data alignment establishes enterprise-wide standards everyone follows. Create common product codes, customer identifiers, and risk ratings. Additionally, standardize calculation methods for interest, fees, and penalties across all systems ensuring consistent customer experience.

4. Deciding What Data Should Be Archived

Smart migration planning includes archiving rather than migrating certain information. Don’t migrate data beyond regulatory retention periods. Archive completed loan files closed over seven years ago. Additionally, move historical transaction details to separate archive systems while keeping summary balances accessible for reporting and compliance purposes.

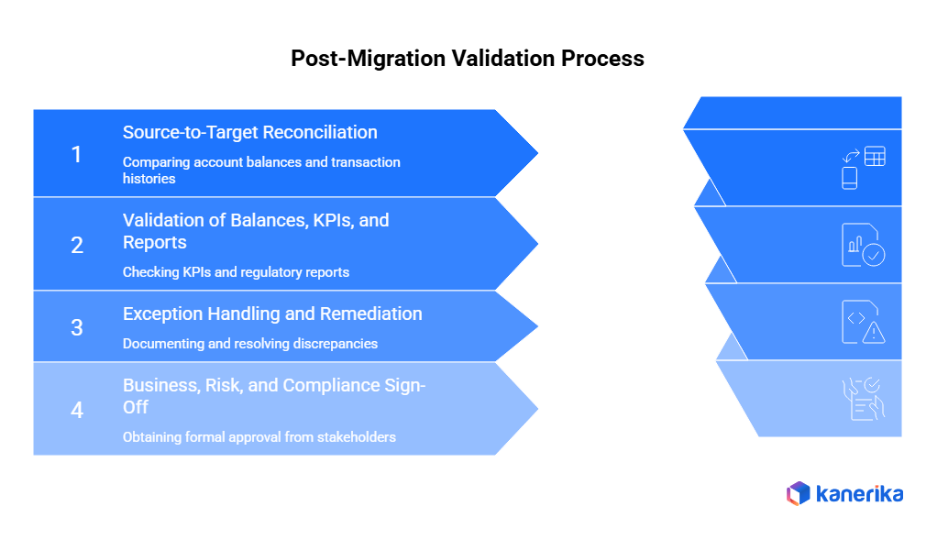

Post-Migration Validation and Reconciliation

Banking Post-migration validation The validation ensures that the transferred financial data has been transferred correctly and that the systems comply with regulatory standards. Close checking helps to avoid expensive mistakes and non-compliance.

1. Source-to-Target Reconciliation

Compare legacy and new systems comprehensively at account level. Verify every customer account balance matches precisely between platforms. Additionally, validate transaction histories, loan balances, and investment holdings align exactly. Banking reconciliation tools automate these comparisons across millions of accounts faster than manual reviews. Even penny-level discrepancies require investigation and resolution before declaring migration successful.

2. Validation of Balances, KPIs, and Regulatory Reports

Beyond raw data, confirm banking KPIs calculate correctly in new systems. Check that total deposits, loan portfolios, and capital ratios match legacy system outputs. Run regulatory reports like Call Reports, liquidity coverage ratios, and risk-weighted assets in both environments. Additionally, compare customer statements, interest calculations, and fee assessments ensuring identical results.

3. Exception Handling and Remediation

Document every discrepancy discovered during validation. Prioritize issues by regulatory and customer impact and account balance errors need immediate fixes while archival mismatches can wait. Additionally, establish clear resolution workflows with assigned owners tracking progress. Root cause analysis prevents similar issues in remaining migration phases.

4. Business, Risk, and Compliance Sign-Off

Require formal approval from multiple stakeholders before go-live. Business units must confirm their operations work correctly. Risk management validates exposure calculations. Additionally, compliance officers verify regulatory reporting accuracy. Furthermore, conduct user acceptance testing with actual banking workflows. Obtain documented business acceptance proving systems support operations reliably and meet all regulatory requirements.

Role of Data Governance and Compliance in Banking Migration

Banking migration involves data governance that is used to ensure that the institutions have control, compliance, and data integrity in the entire migration process. Effective systems of governance avert failure of operations and law breakages.

1. Data Ownership and Stewardship Models

Assign clear data ownership for each banking domain before migration begins. Retail banking owns customer account data. Treasury manages investment portfolios. Risk department controls credit assessments. Additionally, data stewards enforce quality standards daily, validate migration results, and approve exceptions. Without defined ownership, accountability disappears and quality suffers.

2. Access Control, Audit Trails, and Lineage

Enforce a high level of access control over sensitive financial data access or access by individuals to migrate. Follow up all activities by means of detailed audit trails that will indicate who has accessed what information and at what time. Further, have full records of the data lineage of the flows of customer balances, transaction histories, and risk measures across systems. Regulators require this traceability for examinations.

3. Regulatory Considerations

Different regulations impose specific banking compliance requirements. GDPR protects European customer privacy requiring consent management. SOX compliance ensures financial reporting accuracy through controls and documentation. PCI-DSS standards protect payment card data with encryption. Furthermore, AML regulations demand complete customer transaction histories. Basel III requires accurate risk data aggregation capabilities.

4. Governance as Quality Foundation

Effective governance frameworks enable rather than hinder migration. Clear policies eliminate confusion about quality expectations. Defined processes ensure consistent data handling. Therefore, governance provides structure maintaining quality standards at enterprise scale throughout complex banking migrations.

How BI Migration for Logistics Organizations Improves Efficiency

BI migration helps in streamline data, improve decision-making, and modernize systems for faster, clearer operations.

Case Study 1: Cloud Data Migration for a Banking Institution

Challenge

A banking institution was running critical customer, transaction, and reporting workloads on legacy on-premise systems. Data was fragmented across core banking, risk, and compliance platforms, leading to reconciliation issues, slow reporting, and limited scalability. As regulatory demands increased, the bank needed to migrate data to a secure cloud platform without disrupting daily operations.

Solution

Kanerika used its FLIP Intelligent Migration Accelerators to automate data extraction, mapping, and validation. Core banking, risk, and reporting data was migrated into a cloud-based analytics platform with built-in reconciliation and governance. FLIP ensured business logic preservation, strong data quality controls, and zero data loss during migration.

Results

- 80% migration effort automated

- 3x faster financial and regulatory reporting

- Reduced reconciliation issues post-migration

- Improved data accuracy and scalability

Case Study 2: Modernizing Banking Reporting by Migrating to Power BI

Challenge

A financial services organization relied on Crystal Reports and SSRS for finance and compliance reporting. Reports were static, slow, and highly dependent on IT teams. Meeting regulatory timelines was difficult, and insights lacked real-time visibility.

Solution

Kanerika leveraged FLIP accelerators to automate the conversion of legacy reports into Power BI. Report logic and formulas were preserved, while data was centralized into a governed analytics layer. Interactive dashboards enabled self-service analytics with built-in security and audit controls.

Results

- 85–90% automation in report conversion

- 70% faster insight delivery

- Major reduction in manual reporting effort

- Improved audit readiness and governance

Kanerika Enables Seamless Banking Data Migration with Automation and AI

Kanerika helps banks and financial institutions modernize their data architecture and analytics through fast, secure, and intelligent data migration strategies. Traditional banking environments often struggle with high-volume transactional data, fragmented core banking systems, siloed risk and compliance platforms, and the growing demand for real-time insights across channels. As banks scale across products, regions, and digital services, these challenges limit agility, accuracy, and regulatory confidence.

Kanerika’s approach ensures a smooth transition from legacy banking systems to modern, cloud-native platforms without disrupting core operations, customer transactions, or regulatory reporting. Data quality, security, and compliance are embedded throughout the migration lifecycle.

Our End-to-End Banking Data Migration Services

We provide comprehensive migration services across critical banking data domains:

1. BI Migration

Migrate from legacy reporting tools such as Tableau, Cognos, SSRS, and Crystal Reports to Power BI, enabling real-time dashboards for financial reporting, risk monitoring, customer analytics, and regulatory insights.

2. Data Warehouse to Data Lake Migration

Transition from rigid, on-premise data warehouses to modern data lakes or lakehouse platforms capable of handling structured and semi-structured banking data, including transactions, customer records, risk metrics, and audit logs.

Move banking workloads to secure, scalable cloud environments such as Azure or AWS to improve performance, resilience, and cost efficiency while meeting strict regulatory and data residency requirements.

4. ETL and Pipeline Migration

Modernize data pipelines to support faster ingestion, transformation, and orchestration of data from core banking systems, CRM, payments, lending, treasury, and compliance platforms, ensuring consistent data quality across domains.

5. RPA Platform Migration

Upgrade automation workflows from UiPath to Microsoft Power Automate to streamline banking processes such as account reconciliation, KYC validation, reporting automation, and compliance workflows.

Reliable Data Migration Supports Better Operations

Kanerika will help you move your data the right way.

Powered by FLIP: Smart Migration Accelerators

Kanerika’s proprietary FLIP platform accelerates banking data migration using Smart Migration Accelerators. FLIP automates up to 80% of the migration process, significantly reducing manual effort while preserving business rules, financial logic, and data accuracy.

FLIP supports complex banking transitions such as Tableau to Power BI, SSIS to Microsoft Fabric, Informatica to Databricks, and legacy reporting to modern analytics platforms, while ensuring zero data loss, strong validation, and uninterrupted banking operations.

Security, Governance, and Compliance by Design

Throughout the migration journey, Kanerika ensures adherence to global banking and data protection standards, including ISO 27001, ISO 27701, SOC 2, GDPR, and industry-specific compliance requirements. Security controls, access management, audit trails, and data lineage are enforced at every stage.

By combining deep expertise in automation, AI, cloud engineering, and data governance, Kanerika enables banks to improve data quality, regulatory confidence, fraud detection, and analytics performance, while building a scalable, future-ready data foundation that supports real-time decision-making and long-term digital transformation.

Frequently Asked Questions

1. What is data migration in banking?

Data migration in banking is the process of moving data from legacy core banking, risk, and reporting systems to modern platforms such as cloud or lakehouse architectures. It includes customer, account, transaction, and regulatory data. Accuracy and continuity are critical because even small errors can impact customers and compliance.

2. Why is data quality critical during banking data migration?

Banks rely on accurate data for financial reporting, risk calculations, and regulatory submissions. Poor data quality can cause reconciliation issues, incorrect balances, and audit failures. Ensuring data quality during migration protects trust and prevents costly post-go-live corrections.

3. What are the biggest data quality challenges in banking migrations?

Common challenges include duplicate customer records, inconsistent transaction histories, missing fields, and mismatched business rules across systems. Large volumes of historical data also increase complexity. Without proper profiling and validation, these issues can scale quickly.

4. How do banks ensure data security during migration?

Banks use encryption for data at rest and in transit, role-based access control, and secure identity management. Continuous monitoring and audit logging help track data access. Security controls must be enforced throughout the migration lifecycle, not just after go-live.

5. How does data migration support regulatory compliance in banking?

A compliant migration maintains audit trails, data lineage, and access logs required by regulations such as GDPR, SOX, PCI-DSS, and local banking laws. Validation and reconciliation ensure regulatory reports remain accurate. Compliance teams are typically involved from the planning stage.

6. What role does automation play in banking data migration?

Automation reduces manual errors and speeds up migration tasks such as mapping, transformation, and validation. Automated reconciliation and quality checks help ensure consistency across large data volumes. This is especially important for complex banking environments.

7. How can banks measure the success of a data migration project?

Success is measured by data accuracy, reduced reconciliation issues, faster reporting, and regulatory readiness. Minimal business disruption and strong user confidence in reports are also key indicators. Ultimately, trusted data after migration defines success.