How are investment firms keeping up with exploding market data, rising client expectations, and the need for faster, more accurate decisions? As digital transformation accelerates, AI in Asset Management has shifted from an optional advantage to a strategic necessity. Today’s asset managers must process massive volumes of information, including price movements, macroeconomic indicators, ESG disclosures, and alternative datasets like satellite imagery or transaction signals. This complexity is growing rapidly, and according to Deloitte, over 77% of investment managers believe AI will significantly transform their operating models in the coming years.

Against this backdrop, AI is emerging as a powerful force that enhances decision-making, boosts returns, strengthens risk frameworks, and automates high-volume workflows. AI in asset management includes machine learning models, natural language processing, predictive analytics, and intelligent automation working together to analyze data and support investment strategies.

In this blog, we will explore why AI matters, the top use cases, key technologies, real-world examples, challenges, and how enterprises can get started.

Key Learnings

- AI is now essential in asset management because it helps firms handle growing data complexity, fast-moving markets, and the increasing need for accurate, real-time insights.

- A combination of machine learning, NLP, predictive analytics, alternative data, and automation is driving major improvements in research, portfolio construction, risk intelligence, and operations.

- Asset managers using AI gain measurable value through better returns, earlier risk detection, greater efficiency, personalized advisory, and faster decision-making.

- AI adoption does come with challenges such as data quality issues, model transparency concerns, regulatory obligations, cybersecurity risks, and talent shortages, all of which must be managed carefully.

- Successful AI adoption requires a structured roadmap that starts with strong data foundations, focuses on high-impact use cases, selects the right tools, builds cross-functional teams, applies MLOps, and scales gradually.

Transform Your Business with AI-Powered Solutions!

Partner with Kanerika for Expert AI implementation Services

Why AI Matters in Asset Management?

The asset management industry is undergoing rapid change, and AI has become essential for staying competitive. To begin with, the volume of financial data continues to grow at an overwhelming pace. Market data, economic indicators, ESG reports, news sentiment, and alternative datasets such as satellite imagery or transaction feeds all create complexity that traditional tools cannot handle. As a result, identifying alpha using only manual research or rule-based models has become increasingly difficult.

Moreover, markets move faster than ever. Portfolio managers and analysts need real-time insights to react to volatility, identify risks early, and adjust portfolios quickly. AI supports this by processing millions of data points instantly and generating predictions, alerts, and signals that humans may miss.

At the same time, competition is rising. Robo-advisors and digital-first firms deliver low-cost, automated investment solutions. To keep pace, asset managers must embrace AI-driven decision support, automated rebalancing, and intelligent portfolio optimization.

AI also helps reduce operational burdens. Manual tasks like reconciliation, compliance checks, reporting, and document review consume valuable time and introduce errors. With AI-driven automation, firms can streamline these workflows, cut costs, and improve accuracy.

Additionally, AI provides scalability. As assets under management grow and data sources expand, AI-powered systems maintain efficiency without requiring large increases in staff or infrastructure.

Key AI Technologies Transforming Asset Management

AI is reshaping asset management by improving research, portfolio decisions, risk management, and operational efficiency. Several core technologies stand out because they directly enhance how investment teams analyze data, generate insights, and execute investment strategies. Below are the most influential AI capabilities, explained clearly and simply.

1. Machine Learning (ML)

Machine learning is one of the most widely used AI technologies in asset management. It enables systems to learn from historical and real-time market data and then make predictions or recommendations.

- Predictive modelling helps estimate asset performance by analyzing patterns in price movements, volumes, macroeconomic indicators, and sentiment.

- Clustering algorithms for group securities or clients based on behavior, risk profiles, or market segments. This helps with diversification strategies and targeted advisory.

- Reinforcement learning allows algorithms to simulate market conditions and optimize dynamic portfolio allocations by continuously adjusting weights based on rewards and penalties.

Together, these ML techniques support more informed investment decisions and adaptive strategies.

2. Natural Language Processing (NLP)

Financial markets are influenced heavily by unstructured text data, and NLP enables systems to read and interpret it efficiently.

- NLP models analyze financial news, analyst research reports, economic statements, and earnings call transcripts to identify sentiment and key themes.

- Sentiment scoring allows asset managers to assess how markets perceive specific stocks, commodities, currencies, and even cryptocurrency movements.

By transforming textual information into actionable signals, NLP helps investment teams stay ahead of market-moving events.

3. Alternative Data Analytics

Asset managers increasingly rely on alternative data for deeper insights that traditional datasets cannot offer.

- Examples include satellite imagery, credit card transactions, footfall data, supply chain monitoring, shipping routes, and weather patterns.

- AI models convert these unconventional datasets into tradeable insights, such as estimating retail sales before earnings or predicting commodity supply disruptions.

This gives asset managers an edge in alpha generation and risk of anticipation.

4. Predictive Analytics & Time-Series Forecasting

Financial markets operate on complex time-series data, and AI significantly improves forecasting accuracy.

- Models help predict volatility, interest rate changes, currency movements, and market cycles.

- AI also supports NAV projections, liquidity forecasting, and scenario simulations.

These capabilities enhance both short-term trading and long-term asset planning.

5. AI Agents & Automation

Finally, AI agents bring operational intelligence to asset management by automating multi-step workflows.

- They can perform tasks such as portfolio rebalancing, compliance monitoring, document extraction, client reporting, and risk checks.

- AI agents work continuously and make decisions based on predefined rules, improving accuracy and reducing manual effort.

This results in faster, more reliable operations across front, middle, and back office processes.

Core Use Cases of AI in Asset Management

AI is reshaping asset management by enabling deeper analysis, faster decisions, and more efficient operations. Below are the most impactful use cases where AI delivers meaningful value across investment, risk, compliance, and client experience. Each category reflects how firms can use AI to enhance performance while keeping processes scalable and reliable.

1. Portfolio Construction & Optimization

To begin with, AI significantly improves how portfolios are built and managed. Traditional optimization relies on historical correlations and linear models, but AI expands this by analyzing thousands of variables at once.

- ML-based optimization models evaluate market conditions, factor exposures, macroeconomic trends, and sentiment to identify optimal weight allocations.

- AI can scan vast datasets, including alternative data more quickly than human analysts, resulting in more data-driven diversification.

- With real-time insights, AI enables dynamic rebalancing, adjusting portfolios instantly during volatility spikes or macro events.

This helps portfolio managers maintain risk-adjusted returns while responding faster to market changes.

2. Risk Management & Scenario Modelling

Risk management is one of the areas most transformed by AI.

- AI supports stress testing by generating thousands of simulated market scenarios, including rare tail events that traditional models may ignore.

- It enhances risk visibility by predicting market shocks, liquidity crunches, and credit risks based on complex patterns.

- AI improves risk forecasting through correlation analysis, volatility predictions, and exposure modelling.

These capabilities allow risk teams to anticipate vulnerabilities well before they become major issues.

3. ESG Investing & Sustainability Analytics

As ESG becomes a core part of asset management, AI helps firms measure sustainability accurately and on a scale.

- NLP models review sustainability disclosures, CSR reports, regulatory filings, and company statements.

- AI generates real-time ESG scores by analyzing news articles, social media, controversies, and sentiment patterns.

- It also helps detect greenwashing by comparing a firm’s public claims with actual behavioral data.

This real-time, multi-source approach allows asset managers to build more transparent and responsible portfolios.

4. Quant Research & Alpha Generation

AI has become a central tool for quantitative investment strategies.

- Asset managers now rely on alternative data such as satellite images, credit card spending, shipping routes, and weather signals to uncover early insights.

- AI assists with factor extraction, identifying hidden variables driving asset performance.

- Advanced models support signal generation for systematic strategies, including intraday opportunities for high-frequency trading (HFT).

These capabilities create new sources of alpha that traditional research cannot easily uncover.

5. Fraud Detection & Compliance

AI strengthens trust and compliance in regulated markets.

- Anomaly detection models flag suspicious trading behavior or abnormal account activity.

- AI agents continuously monitor rule breaches, market abuse patterns, and regulatory violations in real time.

This helps compliance teams respond more quickly and reduce financial and reputational risk.

6. Client Advisory & Personalized Wealth Management

AI enhances investor experience by making wealth management more personalized and accessible.

- Robo-advisors deliver automated, low-cost investment guidance tailored to each client’s risk profile and goals.

- Recommendation engines analyze spending, income, goals, and market trends to offer personalized investment and savings strategies.

This enables firms to serve more clients on a scale.

7. Operational Automation

Finally, AI improves middle- and back-office operations by removing manual effort.

- AI automates reporting, reconciliation, and document extraction, helping teams process large volumes of data quickly.

- Automated workflows reduce errors, improve accuracy, and free staff to focus on higher-value work.

These efficiencies result in lower costs and faster service delivery.

Benefits of AI in Asset Management

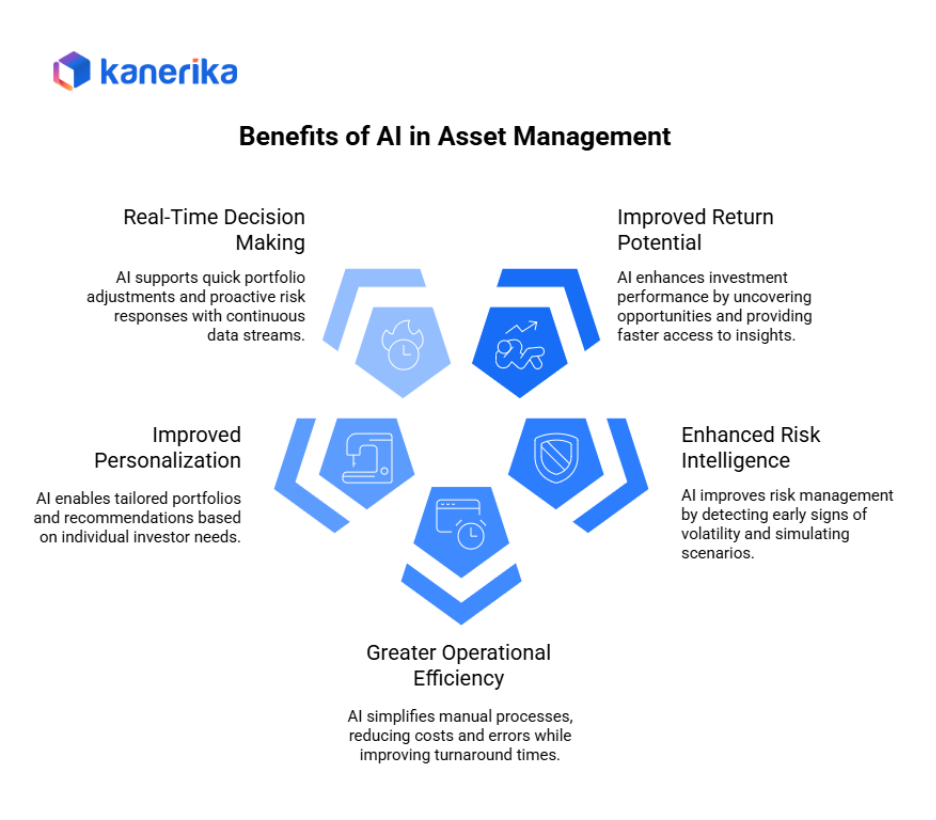

AI brings significant advantages to asset management by enhancing decision-making, improving efficiency, and enabling more personalized investor experiences. These benefits span across front-, middle-, and back-office functions, making AI a transformative force for the industry.

1. Improved Return Potential

To begin with, AI strengthens investment performance by uncovering opportunities that traditional methods may be missed.

- Predictive models analyze market movements, sentiment, macro trends, and alternative data to generate stronger alpha signals.

- AI also provides faster access to insights, helping portfolio managers act quickly on emerging opportunities and adjust positions ahead of competitors.

This leads to more informed and timely investment strategies.

2. Enhanced Risk Intelligence

Next, AI improves how risks are identified, measured, and managed.

- Models detect early signs of volatility, liquidity stress, credit deterioration, and market abnormalities.

- AI can analyze complex correlations and simulate thousands of scenarios to reveal hidden vulnerabilities.

This boosts resilience and helps firms prepare for unexpected market shifts.

3. Greater Operational Efficiency

AI also simplifies time-consuming, manual processes that slow teams down.

- Automation reduces repetitive tasks such as reconciliation, reporting, and document review.

- It cuts operational costs and minimizes human error while improving turnaround times.

This frees staff to focus on higher-value analysis and client service.

4. Improved Personalization

Investors expect tailored guidance, and AI makes this possible on a scale.

- AI-powered advisory tools customize portfolios and recommendations based on goals, risk appetite, and behavior.

- This strengthens client engagement and trust.

5. Real-Time Decision Making

Finally, AI supports decisions with continuous streams of market data, news, and alternative signals.

- It processes information instantly, enabling quicker portfolio adjustments and proactive risk responses.

This agility is crucial in fast-moving markets.

Challenges & Risks of AI Adoption in Asset Management

While AI offers major advantages to asset managers, its adoption also brings several challenges and risks that firms must address carefully. These issues impact model accuracy, regulatory compliance, and operational stability. Below are the key challenges explained clearly and simply.

1. Data Quality & Availability

To begin with, AI models are only as good as the data they learn from.

- Poor-quality, incomplete, or inconsistent data leads to weak predictions.

- Asset managers often struggle to integrate data from legacy systems, third-party feeds, and alternative sources.

Ensuring clean, governed, and timely data is essential for reliable AI outcomes.

2. Model Transparency & Bias

Many advanced AI models operate like black boxes, making it difficult to understand how they reach decisions.

- This lack of transparency creates trust issues for portfolio managers and clients.

- Bias in training data can lead to unfair or risky decisions.

Explainable AI (XAI) practices are necessary to ensure accountability.

3. Regulatory Compliance

Asset management operates under strict regulations covering reporting, suitability, and governance.

- AI-driven decisions must comply with frameworks such as MiFID, SEC rules, GDPR, and local regulatory guidelines.

- Misaligned models can trigger compliance violations and penalties.

4. Cybersecurity & Data Privacy Issues

AI systems process sensitive financial data, making them attractive targets for cyberattacks.

- Strong cybersecurity controls and privacy protections are required.

- Third-party data sharing increases exposure risks.

5. Talent Shortage

Adopting AI requires skilled professionals such as data scientists, quant engineers, and ML specialists.

- Many firms face difficulty hiring and retaining such talent.

6. Over-Reliance on Models

Finally, AI models may fail in unexpected or extreme market conditions.

- Black-swan events can break assumptions and produce misleading outputs.

- Human oversight is necessary to balance automation with judgement.

Top AI Agent Development Companies You Should Know in 2025

AI agent development companies building autonomous agents for smarter enterprise automation.

Real-World Examples of AI in Asset Management

Leading asset management firms have successfully implemented AI technologies to improve investment performance, enhance client service, and streamline operations. These real-world applications demonstrate AI’s transformative impact on the industry.

1. BlackRock (Aladdin Platform)

BlackRock leverages its proprietary Aladdin platform to deliver AI-powered risk management and portfolio construction capabilities.

Predictive Analytics uses AI to analyze vast datasets, including historical market data, financial reports, and macroeconomic indicators, to forecast market trends and asset performance. The system provides predictive risk analytics that anticipate market movements and stress test portfolios under hypothetical scenarios. Natural Language Processing automatically parses earnings reports, central bank communications, and news sentiment to inform investment decisions.

Aladdin enables portfolio managers to assimilate vast amounts of data—over 15 billion data points daily, with 88% of BlackRock’s equity funds outperforming their benchmarks during challenging market conditions. The platform uses AI for portfolio construction and surveillance, helping clients manage risk and optimize returns systematically.

Source: Medium – BlackRock’s AI Revolution | BlackRock Aladdin Official Site

2. Vanguard

Vanguard has deployed AI-driven robo-advisors serving millions of clients through automated portfolio management.

Vanguard Digital Advisor automatically rebalances portfolios, maintaining investments aligned with retirement goals and adjusting holdings to keep clients on target. The platform rebalances portfolios automatically when allocations drift more than 5% from recommended targets. As of June 30, 2024, Digital Advisor manages more than $19 billion in assets, demonstrating significant client adoption.

The service gives personalized recommendations based on client financial profiles, risk tolerance, and goals. Enhanced tax-efficiency through an automated tax loss harvesting service seeks to reduce tax bills by selling Vanguard equity index funds at a loss and replacing them with similar securities to maintain market exposure. This automation enables cost-effective wealth management to be accessible to investors with lower account minimums.

Source: Vanguard Digital Advisor Official Site

3. JPMorgan Asset Management

JPMorgan employs machine learning models for signal generation, fraud detection, and earnings analysis using natural language processing.

AI-driven fraud detection systems have prevented $1.5 billion in losses by analyzing transactions in real time with 98% accuracy, while machine learning models evaluate behavioral signals for credit card fraud. NLP detects business email compromise scams by identifying anomalies in payment instructions, and in AML surveillance, AI reduces false positives by 60%.

For investment analysis, Spectrum, the internal investing platform for JPMorgan Asset Management, has been enhanced with embedded large language models and tracks the holding period of stocks against estimated optimal holding times. AI-enhanced client advisory tools like Coach AI improved response times by 95% during market volatility, and AI-driven tools contributed to a 20% increase in gross sales between 2023-2024 in asset and wealth management.

Source: AIX – JPMorgan AI Revolution | Klover.ai – JPMorgan AI Agents

4. Goldman Sachs Asset Management

Goldman Sachs uses AI agents for portfolio insights, automated reporting, and extracting investment intelligence from unstructured data.

Goldman Sachs Asset Management’s Quantitative Investment Strategies team leverages AI to extract investment insights from large, unstructured data sets including financial articles, earnings call transcripts, analyst reports, and regulatory filings. The firm employs acoustic features alongside AI to identify ambiguity, emotion, or evasiveness in audio files to complement information from text transcripts—understanding not just what a CEO says, but how they say it.

GS AI is Goldman Sach’s Assistant, designed to support bankers, traders, and asset managers, intended to evolve into a sophisticated system that emulates the decision-making capabilities of a seasoned Goldman Sachs employee. This tool provides tailored investment advice, portfolio recommendations, and automated reporting capabilities, enhancing both analyst productivity and client service delivery.

5. Schroders

Schroders has developed AI platforms for ESG scoring using natural language processing and alternative datasets to assess sustainability factors.

Schroders utilizes proprietary tools including SustainEx and Context for evaluating environmental, social, and governance factors. Nearly 70% of institutional investors expect sustainable investing techniques like ESG to be integrated into investment decisions, according to Schroders research. The firm addresses data challenges through natural language processing to analyze different sources of alternative data, with platforms monitoring ESG ratings on more than 20,000 companies worldwide based on 150 ESG metrics.

ESG tools analyze unstructured information from company disclosures, news articles, and regulatory filings to produce sustainability scores. The technology helps investors wade through greenwashing by providing contextual analysis beyond simple keyword matching, enabling more informed sustainable investment decisions aligned with both financial returns and environmental impact goals.

How Enterprises Can Get Started with AI in Asset Management

1. Assess Current Capabilities & Data Maturity – Evaluate data quality, existing tools, model readiness, and team skills to understand where gaps exist before adopting AI.

2. Build a Strong Data Infrastructure – Create a modern Lakehouse architecture with proper governance, lineage, security, and clean data pipelines to support scalable AI.

3. Start with Small, High-Impact Use Cases – Begin with focused areas such as risk analytics, sentiment analysis, or automated research summaries to deliver quick wins.

4. Choose the Right Tools & Platforms – Adopt scalable solutions like Databricks, Snowflake, Azure ML, Microsoft Fabric, or Bloomberg APIs based on business needs and data volume.

5. Scale Gradually with Automation & Real-Time Capabilities – Expand AI use by integrating automated agents, real-time data ingestion, and end-to-end workflow automation across investment and operations.

Leading Agentic AI Startups & Platforms in 2025: What Sets Them Apart

Agentic AI companies reshaping enterprise automation with autonomous, multi-agent systems.

Kanerika: Driving Digital Transformation with Data and AI

Kanerika helps businesses turn complex data challenges into actionable insights through advanced AI and data management solutions. Our knowledge spans Data Integration, Analytics, AI/ML, and Cloud Management, enabling organizations to build scalable, smart systems that improve decision-making and operational efficiency.

We prioritize security and compliance with ISO 27701 and 27001 certifications, SOC II compliance, GDPR adherence, and CMMi Level 3 appraisal, ensuring every solution meets global standards. These benchmarks guarantee robust, secure, and enterprise-ready performance.

Our strong partnerships with Microsoft, AWS, and Informatica allow us to deliver innovative solutions that combine cutting-edge technology with agile practices. At Kanerika, our mission is simple: help organizations unlock the full potential of their data and drive growth through innovative, AI-powered solutions.

To make this possible, Kanerika has developed specialized AI agents — DokGPT, Jennifer, Alan, Susan, Karl, and Mike Jarvis — that automate tasks like document processing, risk scoring, customer analytics, and voice data analysis. These agents are trained on structured data and integrate smoothly into enterprise workflows, enabling faster insights and improved operational efficiency.

Boost Your Business Efficiency with Intelligent AI Solutions!

Partner with Kanerika for Expert AI implementation Services

FAQs

1. What is AI in asset management?

AI in asset management refers to the use of machine learning, NLP, predictive analytics, and automation to improve investment decisions, risk management, operations, and client services.

2. How does AI improve investment performance?

AI analyses large datasets, identifies hidden patterns, generates alpha signals, supports portfolio optimization, and reacts quickly to market changes — improving return potential.

3. What role does AI play in risk management?

AI predicts volatility, detects anomalies, runs stress scenarios, and identifies emerging risks earlier than traditional models, enhancing overall risk intelligence.

4. How is AI used in ESG investing?

AI reads sustainability reports, news, and social media using NLP, scores ESG behaviour in real time, and helps identify greenwashing and compliance issues.

5. Can AI replace human portfolio managers?

No. AI enhances decision-making but does not replace human judgement. Most firms use AI as a co-pilot to support portfolio managers, not replace them.

6. What data do AI models need?

AI uses market data, macroeconomic indicators, company financials, ESG documents, sentiment data, alternative datasets, and historical price time series.

7. What challenges do firms face when adopting AI?

Key challenges include poor data quality, model transparency issues, regulatory compliance, privacy risks, talent shortages, and over-reliance on models.