Financial institutions are experiencing one of the fastest technology shifts in history. With digital banking, embedded finance, mobile-first experiences, and real-time payment networks growing rapidly, the pressure on analytics systems has never been higher. In this environment, BI Migration for Financial Services Companies is becoming a strategic priority rather than a technical upgrade.

Today’s financial organizations generate massive amounts of data transactions, risk assessments, credit scores, AML/KYC checks, and customer interactions. Yet, 67% of banking and financial services leaders say legacy systems are their biggest barrier to digital transformation, according to Accenture.

Legacy BI platforms such as SSRS, SAP BO, Cognos, Tableau, and Qlik often struggle to meet modern requirements for agility, governance, and real-time insights. Hence, they lack the flexibility required for AI-driven analytics, predictive reporting, and self-service capabilities.

Furthermore, rising regulatory pressure from Basel III, IFRS 9, and RBI/FDIC guidelines demands stricter data governance, lineage tracking, and audit-ready reporting, which outdated BI systems cannot support efficiently.

Key Learnings

- BI migration is now essential for financial institutions as legacy reporting tools cannot support real-time analytics, AI-driven insights, or modern regulatory requirements.

- There is a contemporary BI architecture that will enhance governance, performance, and accuracy of data and allow a steady reporting of risk, finance, compliance, treasury, and customer analytics.

- Financial services benefit from cloud-native BI platforms such as Microsoft Fabric, Power BI, Databricks, Snowflake, and Looker, which deliver scalability, strong security, and advanced analytics.

- Successful migration requires a structured roadmap that starts with assessment and governance, builds a strong data foundation, modernizes dashboards, validates results, and trains business users.

Elevate Your Enterprise Reporting by Migrating to Power BI!

Partner with Kanerika for Expert Migration Services

Why Financial Services Should Migrate to Modern BI Platforms

Financial services organizations are experiencing a data explosion. Daily transactions, risk score checks, KYC and AML checks, credit bureau reports, system logs, and customer interactions all generate huge amounts of information. However, traditional BI tools are slow, costly to maintain, and not designed for real-time insights and cloud-scale processing. As a result, these limitations make it impossible to respond rapidly to market changes and regulatory demands.

Regulatory pressure is still increasing throughout the sector. Basel III, IFRS 9, MiFID II, RBI, and FDIC guidelines are all calling for proper, timely, and audit-ready reporting. Nevertheless, legacy systems are poor at tracking lineage, implementing access control, and keeping documentation in place. Consequently, these gaps pose great risks in today’s regulated environment.

Moreover, cloud-native analytics with AI and machine learning are becoming standard. These capabilities help banks automate risk scoring, predict market movements, and identify anomalies more efficiently. Yet legacy BI systems simply cannot support such advanced requirements. Additionally, rising costs and competitive pressure are pushing institutions to become more efficient through migration.

- Data volumes are growing rapidly from transactions, risk scores, KYC/AML checks, and customer interactions

- Traditional BI tools are slow, expensive to maintain, and lack real-time capabilities

- Regulatory frameworks require accurate, timely, and audit-ready reporting

- Legacy systems struggle with lineage tracking, access control, and documentation

- Real-time dashboards are needed for fraud detection, liquidity monitoring, and trading insights

- Migration helps reduce costs, standardize reporting, and enable self-service analytics

Therefore, these challenges are addressed directly by modern BI platforms. They provide the speed, flexibility, and intelligence that financial institutions need to stay competitive. As such, organizations that delay migration risk falling behind both technologically and operationally.

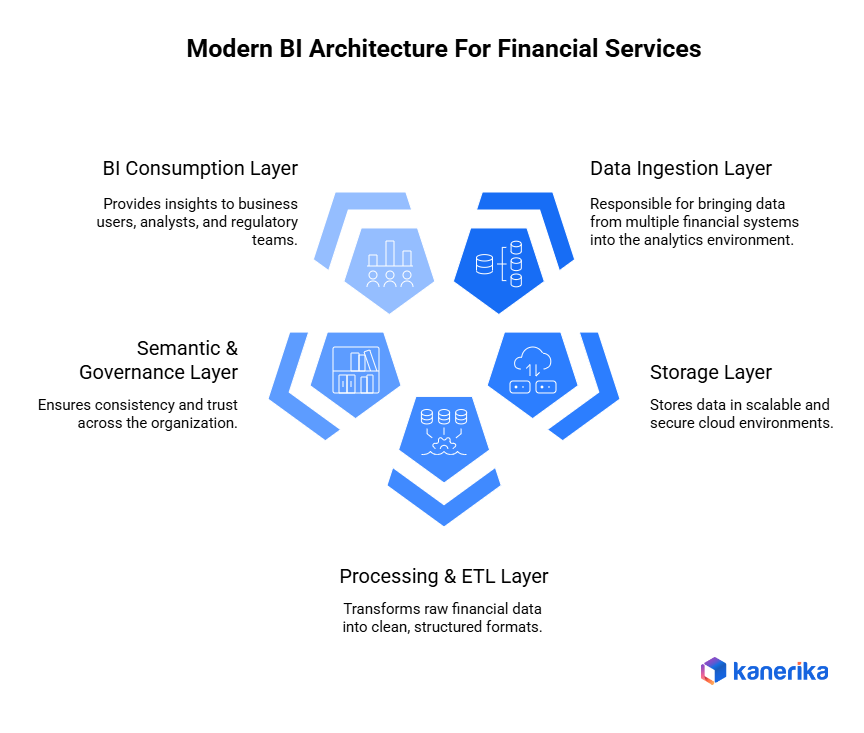

Modern BI Architecture for Financial Services

A contemporary BI system in the financial industry should be able to handle large volumes of data, a high level of regulatory compliance, and real-time analytics. To do this, financial institutions depend on a modular, layered structure that can be scaled, governed, and perform well. Hence, the architecture of this is a clear breakdown as indicated below.

1. Data Ingestion Layer

The ingestion layer is responsible for bringing data from multiple financial systems into the analytics environment.

- It supports batch ingestion using ETL/ELT tools to move large datasets such as historical transactions, credit files, or policy data.

- At the same time, streaming ingestion via platforms such as Kafka, Azure Event Hubs, AWS Kinesis, or MQ enables real-time processing of payments, fraud signals, trading events, and logs.

- This layer also integrates with core banking systems (CBS), insurance platforms, treasury systems, payment networks such as UPI and SWIFT, and external sources, including credit bureaus and market data feeds.

2. Storage Layer

Once the data is ingested, it is stored in scalable and secure cloud environments.

- Financial services organizations typically rely on cloud data lakes such as ADLS, Amazon S3, or Google Cloud Storage to store raw, semi-structured, and historical data.

- A Lakehouse with Microsoft Fabric, Databricks, or Snowflake is the best choice for analytical workloads because of its low-cost storage and high-performance compute.

- Moreover, this layer should also be able to maintain regulatory-compliant storage, encryption, retention, access auditing, and disaster recovery.

3. Processing & ETL Layer

This layer transforms raw financial data into clean, structured, and analysis-ready formats.

- ELT pipelines push transformations into powerful cloud warehouses for efficiency.

- Spark, Flink, and Databricks process real-time data streams for fraud analytics, liquidity alerts, and trading signals.

- Good data quality guidelines guarantee the correctness of sensitive figures of exposure, capital sufficiency, risk rates, and NPA typology.

4. Semantic & Governance Layer

The semantic layer ensures consistency and trust across the organization.

- It defines governed datasets, certified tables, and shared business logic.

- A business glossary standardizes terms such as NPA%, RoA, RoE, risk exposure, liquidity ratios, or underwriting metrics.

- Lineage tracking and access control support regulatory audits and internal governance.

5. BI Consumption Layer

This layer provides insights to business users, analysts, and regulatory teams.

- Tools like Power BI, Tableau, and Looker deliver dashboards, scorecards, and visual analytics.

- Self-service features empower teams to explore data while still respecting governance policies.

- Embedded analytics allows insights to appear directly inside banking portals, CRM systems, or internal risk tools.

Tools and Platforms for BI Migration

The migration of BI systems in the financial services sector will require a mix of up-to-date BI tools, cloud data platforms, governance tools, and rapid integration tools. In addition, both categories are important for long-term performance, compliance, and scalability. Thus, a breakdown of the key tools and platforms to be employed during BI migration projects is given below.

1. Modern BI Tools

Recent BI systems offer interactive dashboards, real-time analysis, and robust connectivity to cloud solutions. These tools enable self-service reporting while maintaining controlled access for compliance.

- Power BI – Ideal for financial services due to deep integration with Microsoft environments, strong governance, and enterprise-grade semantic models.

- Looker – Excellent for organizations needing governed metrics and a strong semantic modelling layer using LookML.

- Tableau Cloud – Preferred for rich visualization and analytics storytelling, especially in customer insights and portfolio analytics.

2. Cloud Data Platforms

Cloud platforms serve as the analytical backbone for modern BI migration. These platforms offer security, elasticity, and compliance necessary for financial workloads.

- Microsoft Fabric – Unified Lakehouse, governance, pipelines, and Power BI all in one platform.

- Databricks – Ideal for large-scale ETL, ML, real-time processing, and interactive analytics.

- Snowflake – Highly scalable for financial data warehousing, multi-cloud support, and secure data sharing.

- BigQuery – Suitable for high-speed analytics and serverless operations in Google Cloud environments.

3. Governance Tools

Strong governance is essential for meeting regulatory requirements. These tools ensure data integrity, auditability, and controlled access.

- Azure Purview – Provides lineage, classification, and metadata management across Microsoft ecosystems.

- Alation – Enterprise data catalog with user-friendly governance workflows.

- Collibra – Comprehensive governance for regulated industries requiring strict oversight.

4. Migration Accelerators

Accelerators help financial institutions modernize legacy BI with minimal downtime. They reduce manual effort, improve accuracy, and shorten migration timelines.

- Converters for Tableau → Power BI, Cognos → Power BI, and SSRS → Power BI.

- Informatica-to-Fabric/Databricks connectors for automated ETL migration.

5. Integration Tools

Reliable integration tools ensure consistent data flow across the ecosystem.

- Fivetran, Informatica IICS, Talend – Automate ingestion from core banking, CRM, underwriting, and trading systems.

- API pipelines + Kafka – Enable real-time data streaming for fraud detection and risk analytics.

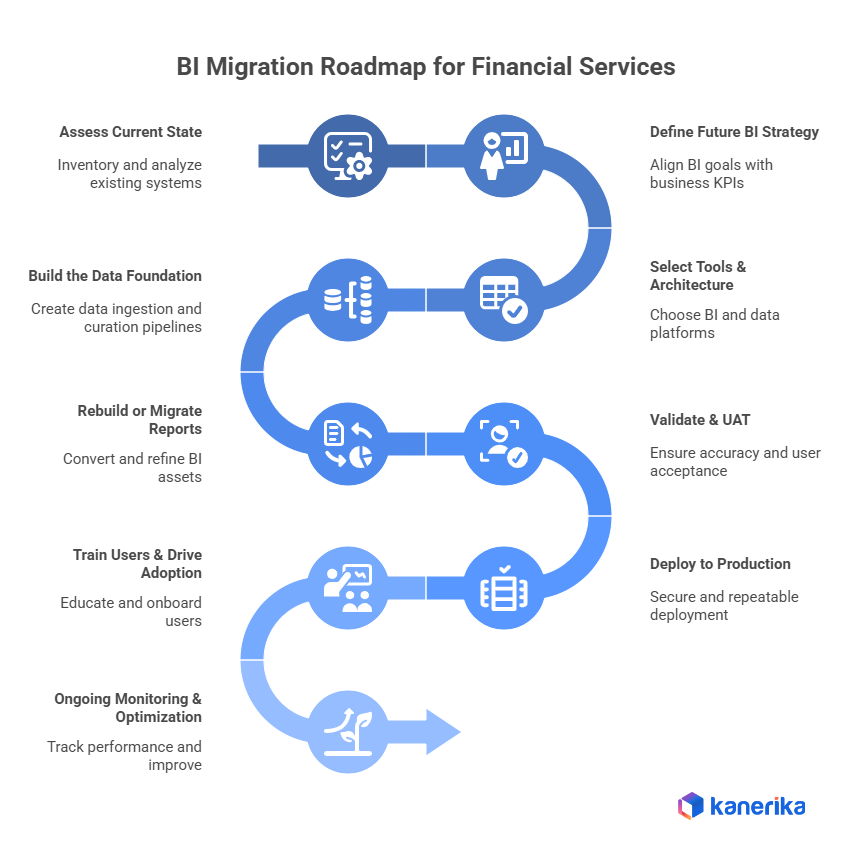

Step-by-Step BI Migration Roadmap for Financial Services

Migrating BI systems in financial services needs a structured approach. Banks, insurance companies, and capital markets all operate in heavily regulated environments. Each step needs to be accurate, governed, and cause minimal disruption. The following roadmap gives a clear, enterprise-ready approach to achieving a successful BI migration.

Step 1: Assess Current State

The migration starts with understanding what exists today. Organizations shouldn’t just track their reports, dashboards, data sources, semantic models, and data pipelines; they should also produce an inventory of these assets.

Additionally, dependency relationships between core banking platforms, underwriting engines, risk systems, CRM, and treasury systems need to be mapped. Reports should be classified as critical, medium, or low usage to avoid migrating redundant assets. This assessment defines the project scope and goes a long way toward decreasing migration risk.

- Inventory all reports, dashboards, data sources, semantic models, and pipelines

- Identify dependencies between core banking, underwriting, risk, CRM, and treasury systems

- Categorize reports as critical, medium, or low usage

- Analyze performance, refresh frequency, security models, and data lineage

Step 2: Identify Future BI Strategy

Financial institutions need to determine what their new BI landscape should look like, as this influences all the decisions that follow. Organizations must decide between cloud-first, Lakehouse, or multi-cloud based on their technology strategy. BI goals should be directly linked to business goals such as fraud detection, better risk exposure monitoring, regulatory reporting, and customer analytics. Governance, compliance, and data privacy requirements should be mapped out from the very beginning.

- Select between cloud-first, Lakehouse, or a multi-cloud strategy

- Align BI goals with business KPIs such as fraud detection, risk exposure, and regulatory reporting

- Establish governance, compliance, and data privacy requirements at the outset

Step 3: Choose Tools and Architecture

Choosing the right tools is crucial to long-term scalability. Organizations need to select their future BI platform from options such as Power BI, Tableau, or Looker based on existing user skills, integration needs, and licensing costs. Data platform selection is also critical, with options including Microsoft Fabric, Databricks, Snowflake, and BigQuery. Integration tools, governance tools, and data quality frameworks round out the architecture.

- Choose a BI platform (Power BI, Tableau, Looker)

- Decide on data platform (Microsoft Fabric, Databricks, Snowflake, BigQuery)

- Define integration tools, governance tools, and data quality frameworks

Step 4: Build the Data Foundation

A strong data foundation is the backbone of a successful BI migration, as poor data quality is the source of errors throughout the ecosystem. Subsequently, organizations should design ingestion pipelines from source systems to staging layers that handle different formats and frequencies. Curated layers must be constructed in the data lake or warehouse for consumption, converting raw data into business-ready datasets. Data quality checking using rules, validation logic, and standardized schemas ensures accuracy.

- Create ingestion pipelines from source systems to staging layers

- Build curated layers in the data lake or warehouse for consumption

- Implement data quality rules, validation logic, and standardized schemas

Step 5: Rebuild or Migrate Reports

Once the data foundation is ready, BI assets can be migrated using automation tools that convert reports from legacy to modern formats. Critical dashboards should be rebuilt with a better user experience and refined KPIs. Duplicate reports should be removed and business definitions unified to establish a single source of truth. This rebuild provides cleaner, more efficient reporting.

- Use migration accelerators to convert legacy reports to modern BI formats

- Rebuild critical dashboards with improved UX and refined KPIs

- Eliminate duplicate reports and consolidate business definitions

Step 6: Validate and User Acceptance Testing

Financial analytics require high accuracy, so validation ensures that migrated reports produce accurate results. The arithmetic of key ratios such as NPA, exposure, NAV, liquidity, and risk weights must be checked. User acceptance testing should involve business teams who understand the context. Validation builds trust and ensures regulatory compliance.

- Verify the arithmetic of important financial ratios (NPA, exposure, NAV, liquidity, risk weights)

- Conduct UAT with business teams

- Ensure trust and regulatory compliance through validation

Step 7: Deploy to Production

Once approval is in place, the BI system is ready for production deployment via CI/CD pipelines for secure, repeatable releases. Certified datasets, semantic models, and dashboards should be published in a controlled manner. Access control and row-level security should be applied properly according to organizational roles and hierarchies.

- Use CI/CD pipelines for secure and repeatable deployment

- Publish certified datasets, semantic models, and dashboards

- Apply access control and row-level security appropriately

Step 8: Train Users and Drive Adoption

User adoption is key to whether migration will succeed. Training should extend to all user groups, including risk teams, traders, executives, and analysts, and address the different needs of each group. User guides, onboarding modules, and demo sessions should be provided in different formats. Change management practices facilitate the transition.

- Provide training to risk teams, traders, executives, and analysts

- Develop user guides, onboarding modules, and demos

- Apply change management to support the transition

Step 9: Continuous Monitoring and Optimization

Migration does not end with deployment; constant attention keeps performance and governance in check over time. Dashboard usage, performance, and refresh reliability should be monitored. Cloud costs and compute resources need continuous optimization. Dashboards, semantic models, and pipelines should be continually improved.

- Improve dashboards, semantic models, and pipelines continuously

- Track dashboard usage, performance, and refresh reliability

- Monitor cloud costs and optimize compute resources

Top Banking and Finance Firms Benefiting from BI Modernization

Case Study 1: ABN AMRO Modernizes Legacy Analytics with Microsoft Power BI

Challenge

ABN AMRO managed reporting across multiple legacy BI systems that weren’t connected. Different teams used different KPI definitions, creating mismatches during audits and regulatory submissions. Risk and finance teams relied heavily on manual spreadsheet processes, slowing reporting cycles and increasing the effort needed for monthly close and compliance reporting.

Solution

The bank migrated to Microsoft Power BI, Azure Synapse, and Azure ML to create a unified analytics ecosystem. A shared semantic model standardized KPI definitions across departments. Automated pipelines replaced manual reconciliation, ensuring consistent, near-real-time data for decision‑making across risk, finance, and compliance functions.

Outcomes

- Reporting cycles became 40% faster.

- BI operations effort dropped by 30%.

- Data accuracy improved by 25%, reducing audit issues.

Case Study 2: Standard Chartered Bank Centralizes Analytics with Looker

Challenge

Across 50+ markets, Standard Chartered struggled to keep KPI definitions aligned. Legacy dashboards in disconnected tools produced conflicting financial metrics. Compliance reporting was slowed by inconsistent data and manual validation, increasing governance risk.

Solution

The bank adopted Looker on Google Cloud and created a governed semantic layer using LookML. All legacy dashboards were migrated into Looker with centralized logic that ensured consistent KPI definitions across regions. Teams gained reusable modelling components, speeding up the development of new reports.

Outcomes

- KPI consistency improved by 50% globally.

- Dashboard development time reduced by 35%.

- Compliance reporting became 45% faster.

Crystal Reports to Power BI Migration 2025: Key Considerations

Learn how to migrate from Crystal Reports to Power BI for modern, interactive analytics.

Case Study 3: Morgan Stanley Builds Unified Lakehouse Analytics on Databricks

Challenge

Quant teams, trading desks, and risk management functions worked from siloed data sources, making unified modelling difficult. High‑volume market and transactional data required more computing power than traditional warehouses could support for intraday calculations and portfolio analytics.

Solution

Morgan Stanley deployed the Databricks Lakehouse to unify structured, semi‑structured, and streaming data. Delta Lake improved governance and versioning, while MLflow standardized model tracking and deployment. This provided a scalable platform for quantitative research, risk modelling, and portfolio analytics.

Outcomes

- Risk models ran 60% faster.

- Portfolio analytics improved by 40%.

- ML governance improved by 35%.

Future Trends in BI Migration for Finance

As financial institutions continue modernizing their analytics landscape, several emerging trends are shaping the future of BI migration. Also, these trends focus on automation, intelligence, real-time insights, and seamless interoperability across platforms. Below are the key developments to watch.

- AI-Powered Semantic Modelling – Modern BI platforms are beginning to use AI to automatically generate data models, metric definitions, and relationships. Moreover, this speeds up migration and ensures consistency across risk, finance, compliance, and treasury teams.

- LLM-Driven BI Assistants (e.g., Copilot for Power BI) – Large Language Models will enable users to create reports, write DAX, build dashboards, and explore insights using natural language. As well as, this reduces the skill barrier and accelerates self-service analytics.

- Real-Time Reporting at Scale – Financial institutions will increasingly adopt streaming architectures for fraud detection, liquidity management, credit exposure, and trading analytics. Hence, BI migration will move from batch to real-time insights.

- Automated Lineage and Governance – Tools like Microsoft Purview, Collibra, and Alation will automate metadata capture, lineage diagrams, and data classification, reducing compliance effort and improving audit-readiness.

- Predictive Dashboards Instead of Descriptive BI – AI and ML outputs will be embedded directly into dashboards, enabling proactive decision-making, early risk detection, and scenario forecasting.

- Cross-Cloud BI Interoperability – BI systems will integrate seamlessly across platforms like Microsoft Fabric, Snowflake, and Databricks, allowing financial institutions to query data wherever it resides.

BI Modernization: How to Migrate from Legacy BI Tools in 2025

Explore BI modernization strategies to improve analytics and decision-making.

Kanerika: Accelerating BI Migration for Financial Services Companies

Kanerika assists organizations that provide financial services to update their analytics and data infrastructure with fast, secure, and intelligent migration strategies. Further, legacy BI systems often struggle with high transaction volumes, regulatory reporting, and real-time risk information. To that end, our strategy will ensure an unobtrusive transition to the new platforms without interfering with key financial processes.

We provide end-to-end migration services across multiple areas:

- BI Migration: Move from legacy tools like Tableau, Cognos, SSRS, and Crystal Reports to Power BI for interactive dashboards, regulatory reporting, and real-time portfolio insights.

- Data Warehouse to Data Lake Migration: Shift from rigid warehouse setups to flexible data lakes or Lakehouse platforms capable of handling structured, semi-structured, and real-time financial data.

- Cloud Migration: Transition workloads to secure, scalable environments such as Azure or AWS for improved performance, resilience, and cost optimization.

- ETL and Pipeline Migration: Modernize data pipelines for faster ingestion, risk calculations, fraud analytics, and automated data transformations.

- RPA Platform Migration: Upgrade automation infrastructure from UiPath to Microsoft Power Automate to streamline compliance workflows, reconciliations, and operational processes.

Our proprietary platform, FLIP, powers these migrations with Smart Migration Accelerators. Additionally, FLIP automates up to 80% of the migration process, reducing risk, preserving business logic, and enabling financial institutions to adopt cloud-native, AI-ready architectures in weeks instead of months. Hence, it supports complex transitions like Tableau to Power BI, SSIS to Microsoft Fabric, and Informatica to Talend, while ensuring zero data loss and operational continuity.

Kanerika ensures compliance with global standards, including ISO 27001, ISO 27701, SOC 2, and GDPR, throughout the migration process. Additionally, with deep expertise in automation, AI, and cloud engineering, we help financial services companies unlock predictive insights, enhance operational efficiency, strengthen compliance, and build a future-ready data ecosystem.

Migrate to Power BI for Smarter Analytics and Real-Time Insights!

Partner with Kanerika for Seamless Migration Services.

FAQs

1. Why is BI migration important for financial services companies?

Financial services firms rely on timely, accurate data for risk management, compliance, and decision-making. Legacy BI tools often struggle with performance, scalability, and regulatory needs. BI migration enables faster reporting, better data governance, and improved security. This helps financial institutions stay competitive and compliant.

2. What BI systems are commonly migrated in financial services?

Banks and financial institutions often migrate legacy BI platforms such as Cognos, BusinessObjects, and on-prem reporting tools. These systems typically support risk reporting, regulatory submissions, and financial dashboards. Migration modernizes analytics while maintaining historical data and audit trails. A structured approach ensures continuity during transition.

3. How can financial services companies ensure regulatory compliance during BI migration?

Compliance must be built into the migration process from the start. This includes enforcing access controls, encryption, and audit logging throughout the migration. Regulations such as GDPR, SOX, and PCI-DSS require traceability and data lineage. Strong data governance ensures compliance is maintained at every stage.

4. What are the key challenges in BI migration for financial services?

Common challenges include sensitive data handling, complex reporting logic, and minimal tolerance for downtime. Financial systems often have tightly coupled dependencies that increase migration risk. Without careful planning, migration can disrupt critical reporting. Phased execution helps reduce these risks.

5. How can organizations minimize risk and downtime during BI migration?

Financial services companies can reduce risk by using phased migrations and parallel report validation. Testing migrated reports alongside legacy systems builds confidence. Automation and migration accelerators also reduce manual errors. This approach ensures uninterrupted access to critical financial insights.

6. What role does data governance play in BI migration success?

Data governance ensures data accuracy, security, and consistency throughout the migration process. It defines ownership, standards, and validation rules. For financial services, governance is essential to meet audit and regulatory expectations. Governed BI migration builds trust in post-migration reporting.

7. How do companies measure success after BI migration?

Success is measured through faster reporting cycles, improved data accuracy, and reduced BI costs. User adoption and self-service capabilities are also key indicators. Additionally, improved compliance readiness and audit confidence signal long-term success. A successful BI migration supports business growth and resilience.