What if your next real estate deal was closed not by an agent—but by an algorithm? From recommending the perfect property to predicting market shifts before they happen, AI is quietly becoming the smartest player in the room. While the industry has long relied on spreadsheets, site visits, and guesswork, the game is changing fast. In fact, AI for real estate is turning once-manual processes into intelligent, automated experiences—cutting costs, boosting speed, and unlocking insights no human could catch alone.

A recent report by McKinsey estimates that AI could unlock up to $1.3 trillion annually in value across the real estate and construction industries—an eye-opening signal of how fast the landscape is shifting. In this blog, we explore how AI for real estate is driving smarter decisions, streamlining operations, and setting the stage for the future of property tech.

Why Real Estate Needs AI

1. The Shift to Data-Driven Decisions

In today’s competitive landscape, gut instinct is no longer enough. Real estate professionals must analyze market trends, buyer behavior, and property performance to make informed decisions. Moreover, AI helps unlock insights from massive datasets—enabling faster, more accurate forecasting and strategy.

2. Meeting Rising Customer Expectations

Modern buyers and renters expect instant responses, personalized listings, and complete transparency. AI chatbots, recommendation engines, and virtual assistants help meet these demands by providing real-time, tailored experiences that traditional methods simply can’t match.

3. Navigating Industry Complexity

The real estate ecosystem involves intricate processes—dynamic pricing, lease negotiations, legal compliance, and property search logistics. Additionally, AI streamlines these complexities through automation and intelligent workflows, reducing human error and saving valuable time.

4. Enabling Smarter Operations

AI is not just about automation—it’s about augmentation. From predictive maintenance in property management to smart portfolio analysis for investors, AI empowers businesses to operate more efficiently, respond proactively, and deliver better service at scale.

Key AI Technologies Involved in Real Estate

1. Machine Learning

- Predictive Analytics: Forecasts property values, market trends, and investment returns using historical data patterns

- Pattern Recognition: Identifies market opportunities and risk factors by analyzing vast datasets of property transactions

- Automated Valuation Models (AVMs): Provides instant property valuations based on comparable sales and market indicators

- Investment Optimization: Recommends optimal buy/sell timing and portfolio diversification strategies

2. Natural Language Processing (NLP)

- Enhanced Property Search: Processes natural language queries to match properties with buyer preferences and requirements

- Customer Interactions: Analyzes client communications to understand needs and preferences for personalized service

- Document Processing: Extracts key information from contracts, leases, and legal documents automatically

- Market Research: Processes news articles, reports, and social media to gauge market sentiment and trends

The Complete Guide to AI in Manufacturing: Benefits, Applications, and Best Practices

AI in manufacturing isn’t just for tech giants anymore. It’s becoming a must-have tool for anyone serious about improving efficiency and staying competitive.

3. Computer Vision

- Automated Property Inspections: Analyzes photos and videos to identify property features, conditions, and potential issues

- Visual Analysis: Evaluates property aesthetics, space utilization, and architectural elements for accurate assessments

- Damage Detection: Identifies maintenance needs and structural problems through image analysis

- Virtual Tours: Creates immersive property experiences using 360-degree imaging and augmented reality

4. Chatbots and Virtual Assistants

- Customer Support: Provides 24/7 assistance for property inquiries, scheduling viewings, and answering common questions

- Lead Qualification: Screens potential buyers and tenants to identify serious prospects and their specific requirements

- Engagement: Maintains continuous communication with clients throughout the buying, selling, or leasing process

- Information Delivery: Instantly provides property details, neighborhood information, and market data to interested parties

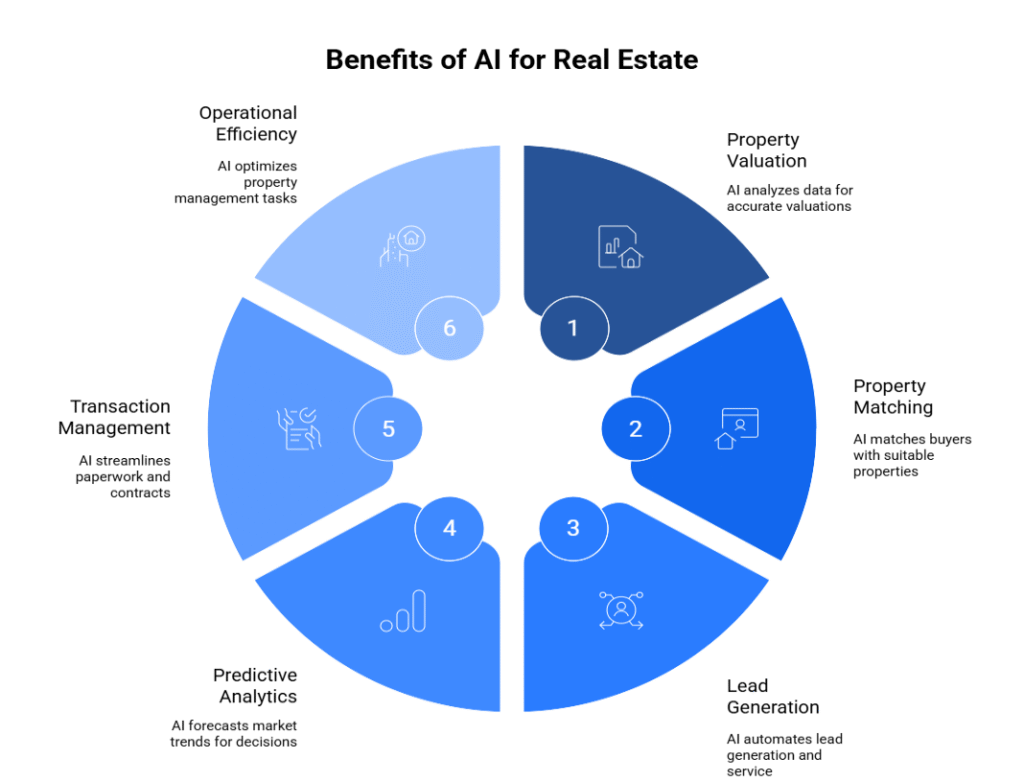

Benefits of AI for Real Estate

Artificial intelligence is transforming the real estate industry by streamlining operations, enhancing decision-making, and improving customer experiences across multiple touchpoints.

- Property Valuation and Market Analysis – AI algorithms analyze vast datasets including comparable sales, neighborhood trends, economic indicators, and property characteristics to provide more accurate valuations and market predictions. This helps investors, agents, and buyers make informed decisions based on data-driven insights rather than intuition alone.

- Enhanced Property Search and Matching – Machine learning systems can understand buyer preferences and automatically match them with suitable properties, saving time for both agents and clients. AI-powered platforms analyze search behavior, preferences, and budget constraints to deliver personalized property recommendations.

- Automated Lead Generation and Customer Service – Chatbots and virtual assistants handle initial client inquiries, schedule viewings, and qualify leads 24/7. This automation allows agents to focus on high-value activities while ensuring no potential client is overlooked.

- Predictive Analytics for Investment Decisions – AI models forecast market trends, rental yields, and property appreciation rates by analyzing historical data, demographic shifts, and economic factors. This enables investors to identify emerging opportunities and mitigate risks.

- Streamlined Transaction Management – AI automates paperwork processing, contract analysis, and due diligence procedures, reducing human error and accelerating closing times. Document recognition technology can extract key information from contracts and flag potential issues.

- Operational Efficiency – Property management companies use AI for maintenance scheduling, tenant screening, and rent optimization, resulting in reduced costs and improved tenant satisfaction while maximizing property performance.

Key AI Use Cases in Real Estate

1. AI in Property Valuation

• Predictive Analytics for Accurate Pricing: AI analyzes thousands of data points including property features, neighborhood characteristics, market trends, and historical sales data to provide more accurate valuations than traditional methods. Machine learning models continuously improve by learning from new transaction data and market patterns.

• Real-time Market Comparisons: Advanced algorithms enable instant valuation adjustments based on current market conditions, seasonal fluctuations, and recent comparable sales. Automated Valuation Models (AVMs) provide instant property estimates with confidence intervals, reducing appraisal timelines from weeks to minutes.

• Image Recognition for Property Assessment: Computer vision technology analyzes property photos to assess condition, identify renovations, and factor visual elements into valuation calculations, including architectural styles and interior finishes.

• Examples: Zillow’s Zestimate and Redfin’s automated valuation models deliver instant property estimates with confidence scores, reducing appraisal costs and eliminating human bias. Enterprise solutions like HouseCanary and Collateral Analytics provide sophisticated AVM tools for lenders and investors.

2. AI in Property Search & Recommendations

• NLP and Chatbots for Personalized Property Search: Natural Language Processing understands conversational queries and provides personalized recommendations based on user preferences and search patterns. Advanced chatbots interpret complex requests like “find me a 3-bedroom house with good schools nearby under $500K.”

• Machine Learning to Recommend Listings: Algorithms analyze user behavior, preferences, and search history to suggest relevant properties that match specific criteria and lifestyle needs. These systems learn from user interactions to continuously improve recommendation accuracy.

• Virtual Tours Powered by AI: Computer vision and 3D modeling create immersive experiences, allowing remote property exploration with automated feature identification and optimal viewing angles. AI generates walkthrough scripts and highlights key selling points.

• Visual Search Capabilities: Users can upload photos of desired property features, and AI matches similar properties in the database using image recognition technology.

• Behavioral Analytics: AI tracks user engagement patterns, time spent viewing properties, and click-through rates to optimize search results and identify serious buyers versus casual browsers.

• Smart Filtering Systems: Advanced algorithms consider lifestyle factors, commute patterns, and personal preferences to filter listings beyond basic criteria like price and square footage.

3. AI in Lead Scoring & Customer Service

• Intelligent Chatbots for 24/7 Inquiries: AI-powered chatbots handle customer inquiries, qualify leads, schedule viewings, and answer property questions without human intervention. Advanced bots provide market insights, mortgage calculations, and neighborhood information.

• Predicting High-Intent Leads: Machine learning models analyze online behavior patterns, engagement metrics, and demographic data to identify prospects with highest conversion probability. Systems score leads based on website activity, email engagement, and social media interactions.

• CRM Automation: Streamlined follow-up processes, personalized communication, and interaction tracking optimize marketing campaigns and improve client relationships. AI automates email sequences, social media posting, and appointment scheduling.

• Sentiment Analysis: AI analyzes customer communications to gauge satisfaction levels, identify potential issues, and prioritize urgent inquiries for immediate human attention.

• Dynamic Pricing Alerts: AI monitors market changes and automatically notifies interested buyers when properties matching their criteria experience price reductions or new listings become available.

• Predictive Customer Lifetime Value: Machine learning calculates potential revenue from each lead, helping agents prioritize their time and resources on high-value prospects.

• Voice Recognition and Processing: AI-powered phone systems transcribe calls, extract key information, and automatically update CRM records with conversation summaries.

4. AI in Property Management

• Predictive Maintenance Using IoT + AI: Combined IoT sensors and AI algorithms monitor building systems, predict equipment failures, and schedule maintenance before costly breakdowns occur. Systems track HVAC performance, elevator usage, and plumbing conditions to optimize maintenance schedules.

• Automated Tenant Screening and Rent Collection: AI analyzes credit scores, employment history, and behavioral patterns to identify reliable tenants, while automated systems handle rent collection and payment reminders. Machine learning models predict tenant retention and identify potential problem tenants.

• Energy Efficiency Monitoring: Smart sensors optimize HVAC systems, lighting, and utilities, reducing operational costs while maintaining tenant comfort levels. AI learns occupancy patterns to automatically adjust climate controls and lighting schedules.

• Smart Security Systems: AI-powered security cameras use facial recognition and behavioral analysis to identify unauthorized access, suspicious activities, and safety hazards in real-time.

• Automated Lease Management: AI systems handle lease renewals, rent increases, and contract modifications based on market conditions and tenant history, reducing administrative workload.

• Maintenance Request Processing: Natural language processing categorizes and prioritizes maintenance requests, automatically dispatching appropriate technicians and tracking completion times.

• Occupancy Optimization: AI analyzes tenant patterns, lease expirations, and market demand to optimize unit pricing and minimize vacancy periods.

• Utility Management: Machine learning algorithms detect unusual consumption patterns that may indicate leaks, equipment malfunctions, or unauthorized usage.

5. AI in Investment and Risk Analysis

• Identifying High-Performing Neighborhoods: AI analyzes demographic trends, development patterns, infrastructure projects, and economic indicators to identify emerging investment opportunities before they become obvious to traditional analysis methods.

• Forecasting Market Trends: Machine learning models predict price appreciation and rental yield potential across different locations and property types using comprehensive market data. Advanced algorithms consider economic indicators, population growth, and development plans.

• Portfolio Optimization: Algorithms help investors diversify holdings, balance risk and return, and identify optimal buying and selling opportunities through data-driven investment recommendations. AI analyzes market cycles, cash flow projections, and risk factors to maximize returns.

• Risk Assessment: AI evaluates multiple risk factors including market volatility, economic conditions, and property-specific risks to provide comprehensive investment risk profiles.

• Market Timing Analysis: Machine learning systems analyze historical patterns and current market indicators to suggest optimal timing for property acquisitions and disposals.

• Competitive Analysis: AI monitors competitor activities, pricing strategies, and market positioning to identify competitive advantages and investment opportunities.

Real-World Examples & Case Studies

1. Zillow, Redfin & Opendoor

- Zillow’s flagship Zestimate AI model powered its iBuyer venture “Zillow Offers.” However, its inability to accurately predict market shifts contributed to the program’s shutdown in late 2021

- Redfin uses AI for pricing, market analysis, and customer satisfaction. Though its iBuyer operations were smaller, it generated strong revenue by combining data insights with agent-led services.

- Opendoor, another AI-driven iBuyer, utilizes predictive analytics and sophisticated models to make cash offers. Still, losses on some sales highlight the volatility of algorithm-based pricing in fluctuating markets

2. REimagine Home: AI-Powered Virtual Staging

- This PropTech startup uses AI to virtually furnish empty spaces, redesign interiors, and update exteriors within seconds—no physical staging required

- Serving realtors and developers, their photo-realistic staging elevates listing appeal and significantly reduces time and cost

3. Startups Offering AI-Based Investment Insights

- Early-stage PropTech firms focused on investor analytics are attracting capital and attention. These startups help investors identify undervalued assets and predict market trends using AI-driven data models.

4. The Growing PropTech Ecosystem

- Global market: Estimated at $36–40 billion in 2024, with growth projected to $41.5 billion in 2025 and nearly double by 2032 (~$88 billion) at a 12–15% CAGR

- Venture capital: In Q1 2025, PropTech raised $2.06 billion, and U.S. startups alone saw $297 million invested across 27 companies

- Investor confidence: Nearly half of PropTech investors plan to increase deal flow, signaling sustained momentum and trust in AI-powered real estate innovation.

These examples highlight AI’s transformative influence in real estate:

| Area | Example |

| Valuation & Buying | Zillow, Redfin, Opendoor use algorithms for pricing and offers |

| Marketing & Listing | REimagine Home uses virtual staging to enhance property visuals |

| Investment Insights | Startups offer AI-driven investment tools, spotting deals early |

| Market Growth | Strong funding ($2B+ in Q1 2025), compounded by high growth (~15% CAGR) |

The Future of AI in Real Estate

AI is pushing the boundaries of what’s possible in real estate. From automating daily tasks to enhancing sustainability, its impact is expanding rapidly. Here’s what the near future looks like.

1. Generative AI for Contracts, Listings, and Marketing

- Automatically drafts leases, purchase agreements, and legal documents

- Writes customized property descriptions based on features and buyer profiles

- Generates emails, social media posts, and ad content for real estate campaigns

- Saves time for agents and improves consistency in communication

2. Integration with AR/VR for Immersive Experiences

- Virtual tours powered by AI adjust in real time to what buyers focus on

- Features like lighting, layout, or design can be highlighted based on user interest

- Makes remote property viewing more realistic and engaging

- Useful for international buyers or early-stage home browsing

3. Autonomous Leasing and Portfolio Management

- AI handles tenant screening, rent pricing, renewals, and queries

- Property managers can automate large parts of the leasing process

- AI monitors entire portfolios—flagging underperforming assets or suggesting reallocation

- Helps optimize returns with minimal manual input

4. AI in ESG and Smart Cities

- Tracks and analyzes energy consumption and carbon output

- Optimizes HVAC, lighting, and waste management systems in smart buildings

- Supports real estate firms in meeting ESG goals with real-time data

- Plays a key role in shaping smarter, greener urban development

As AI continues to improve, its role in real estate will go beyond automation—it will help redefine how people buy, sell, manage, and live in properties.

Power Your Business with Kanerika’s AI Expertise

At Kanerika, we help businesses tap into the full potential of AI to solve real problems, improve operations, and stay ahead of the competition. Our AI solutions are built to drive efficiency, reduce costs, and unlock smarter decision-making across industries—while upholding the highest ethical standards.

We build AI with a strong foundation in responsible design, prioritizing data security, privacy, and transparency. Our practices align with globally recognized standards including ISO 27701 & 27001, SOC 2, GDPR, and other compliance frameworks to ensure trustworthy and legally sound implementations.

We also offer advanced capabilities in AI-powered surveillance, enabling real-time behavior detection, cross-camera tracking, 3D scene reconstruction, and facial analytics. These solutions empower clients in public safety, education, retail, and manufacturing to transition from traditional monitoring to intelligent, proactive security.

From process automation and predictive analytics to intelligent data governance, our services are built for impact. We also support end-to-end data migration, enabling businesses to modernize infrastructure and unlock future-ready capabilities without disruption.

With Kanerika as your AI partner, you’re not just adopting new tech—you’re building smarter, faster, and more resilient operations that scale up with your goals.

Transform Your Business with AI-Powered Solutions!

Partner with Kanerika for Expert AI implementation Services

Frequently Asked Questions

1. What is AI for real estate?

AI for real estate refers to the use of artificial intelligence technologies—like machine learning, natural language processing, and computer vision—to automate, optimize, and enhance real estate operations such as pricing, property search, customer service, and investment analysis.

2. How does AI help in property valuation?

AI analyzes large datasets, including market trends, location data, historical pricing, and demand patterns, to generate accurate and dynamic property valuations—often in real time.

3. Can AI improve the property search experience?

Yes. AI powers smart search engines and recommendation systems that match buyers or renters with properties based on preferences, behavior, and past interactions, often using chatbots or virtual assistants.

4. Is AI used in real estate marketing?

Absolutely. AI tools can generate personalized ads, automate listing descriptions, analyze customer engagement, and optimize campaign performance to reach the right audience at the right time.

5. What role does AI play in property management?

AI assists with predictive maintenance, tenant screening, rent forecasting, energy management, and automating routine tasks—reducing costs and improving tenant satisfaction.

6. Are there risks in using AI for real estate?

Yes. Challenges include data privacy concerns, bias in algorithms, high implementation costs, and the need for regulatory compliance.

7. Is AI affordable for small real estate firms?

While enterprise-grade AI can be costly, many affordable, SaaS-based tools now offer AI features suitable for small and mid-sized agencies—making it increasingly accessible.