From personal budgeting to corporate forecasting, artificial intelligence is transforming how money is managed, analyzed, and optimized. Finance is no longer a manual, spreadsheet-driven function — AI is now the engine powering smarter, faster, and more accurate financial decisions.

AI finance tools are intelligent software applications that leverage machine learning (ML), natural language processing (NLP), and predictive analytics to automate and enhance financial processes. They help organizations and individuals make data-driven decisions by identifying trends, forecasting outcomes, and reducing human error in critical operations.

The scope of AI in finance spans personal finance management, corporate financial planning, and fintech innovation, enabling everything from automated savings to algorithmic trading and fraud detection.

According to Deloitte, by 2027, over 80% of financial institutions will use AI for risk management and decision support.

This blog explores the types, benefits, examples, challenges, and future trends of AI finance tools that are redefining the financial industry for the next decade.

Key Takeaways

- AI finance tools are transforming financial operations by improving speed, accuracy, and data-driven insight across all processes.

- They combine human intuition with machine precision, enabling smarter and faster decision-making.

- By automating repetitive tasks—such as forecasting, reconciliations, and fraud detection—AI allows finance professionals to focus on strategic initiatives.

- These tools create more efficient, transparent, and agile financial ecosystems for both enterprises and individuals.

- The future of AI in finance is adaptive and autonomous, featuring self-optimizing budgets, automated audits, and real-time predictive analytics.

- Early adopters gain a competitive advantage in financial planning, risk management, and profitability.

- As technology advances, AI finance tools will become essential for sustainable growth and intelligent decision-making in modern financial management.

What Are AI Finance Tools?

AI finance tools are advanced software applications that leverage artificial intelligence (AI) and machine learning (ML) to manage, analyze, and forecast financial data with speed, accuracy, and intelligence. Unlike traditional finance systems that rely on manual inputs and static rules, these tools are context-aware, adaptive, and data-driven, enabling smarter decision-making and automation across financial processes.

Key capabilities of AI finance tools include:

- Predictive Analytics: Anticipating market trends, cash flow fluctuations, or investment outcomes using historical data.

- Natural Language Processing (NLP): Interpreting and generating insights from financial documents, reports, and conversations.

- Fraud Detection & Anomaly Recognition: Identifying irregular patterns or suspicious transactions in real time.

- Intelligent Document Processing: Automating data extraction from invoices, receipts, and financial statements.

- Portfolio Management Automation: Using AI models to optimize investment strategies and asset allocation.

By integrating these technologies, AI in financial services streamlines workflows, enhances accuracy, and delivers real-time insights—making financial automation software a cornerstone of modern finance management.

Achieve 10x Business Growth with Custom AI Innovations!

Partner with Kanerika for Expert AI implementation Services

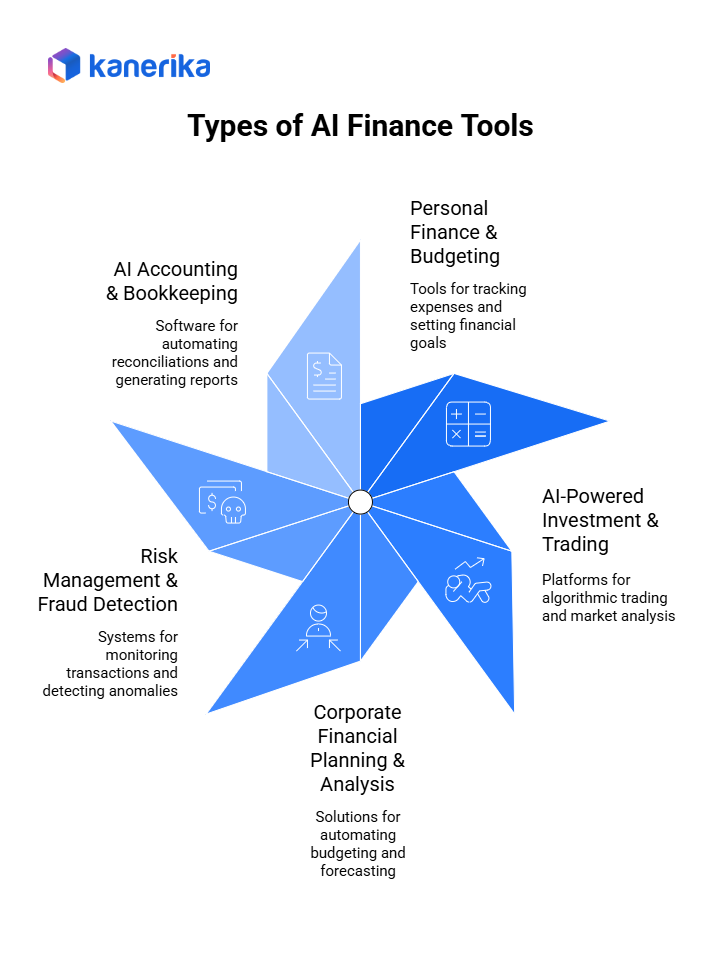

Types of AI Finance Tools

AI finance tools span a wide range of applications designed to automate, analyze, and optimize different financial functions. From personal budgeting to enterprise forecasting, these tools are reshaping how individuals and organizations manage money with greater intelligence and precision.

1. Personal Finance & Budgeting Tools

Examples: Cleo, Mint AI, YNAB (You Need a Budget), WallyGPT

These AI budgeting apps help users track spending, categorize expenses, set savings goals, and even offer personalized financial advice through chat-based interfaces. With predictive budgeting, they analyze spending patterns to suggest smarter saving strategies and detect unusual spending behavior.

2. AI-Powered Investment & Trading Platforms

Examples: Kavout, Zignaly, Trade Ideas, eToro AI, AlphaSense

AI trading tools leverage machine learning, natural language processing, and sentiment analysis to forecast market trends, execute algorithmic trades, and manage portfolio risks. They enable investors to make data-driven decisions and respond to market changes in real time.

3. Corporate Financial Planning & Analysis (FP&A) Tools

Examples: Datarails, Planful, Cube.ai

These platforms automate budgeting, forecasting, and variance analysis, allowing finance teams to focus on strategy rather than manual data entry. They use AI to consolidate financial data, predict future performance, and optimize resource allocation.

4. Risk Management & Fraud Detection Tools

Examples: Darktrace, Feedzai, Kount

These tools specialize in transaction monitoring, anomaly detection, and compliance automation. By analyzing behavioral patterns and data anomalies, they identify fraud risks early and ensure financial integrity.

5. AI Accounting & Bookkeeping Assistants

Examples: QuickBooks AI, Xero Analytics Plus, Vic.ai

These AI accounting software solutions automate reconciliations, categorize invoices, and generate accurate financial reports. They reduce manual workload while improving accuracy and compliance.

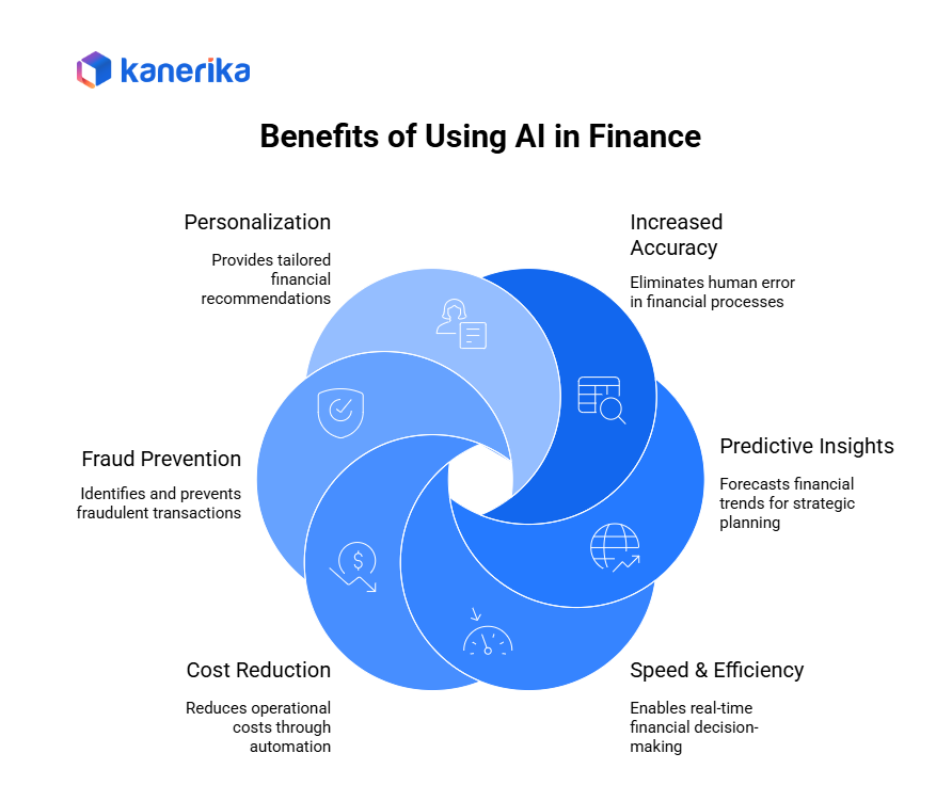

Benefits of Using AI in Finance

Artificial intelligence delivers measurable value across financial operations, transforming how businesses and individuals manage money. The impact spans accuracy, speed, and strategic decision-making.

1. Increased Accuracy

AI eliminates human error from financial processes by automating calculations, data entry, and reconciliation. Manual spreadsheet work introduces mistakes that cascade through financial systems, creating audit problems and bad decisions. AI systems process data consistently without fatigue or distraction, significantly improving data reliability. Banks report error rates dropping dramatically when AI handles transaction processing and account reconciliation compared to human-based approaches.

2. Predictive Insights

Rather than reacting to financial situations, organizations now anticipate them. AI analyzes historical patterns and current market conditions to forecast cash-flow trends before they occur. Businesses prepare for seasonal fluctuations, identify revenue shortfalls early, and adjust spending proactively. Investors receive early warnings about market shifts, allowing portfolio adjustments before prices move. This forward-looking capability transforms finance from reactive to strategic.

3. Speed & Efficiency

AI enables real-time financial decision-making that would be impossible manually. Fraud detection happens instantly rather than through monthly review cycles. Investment opportunities are identified and acted upon in seconds. Loan approvals complete in minutes instead of days. This velocity creates competitive advantage while improving customer experience.

4. Cost Reduction

Automating repetitive tasks like reconciliations, invoice processing, and report generation frees finance teams from mechanical work. Organizations reduce staffing needs for routine tasks while redirecting talent toward strategic analysis. Studies show automation typically reduces finance operational costs by 20-40% depending on starting conditions.

5. Fraud Prevention

AI identifies anomalous transactions and patterns instantly by comparing current activity against historical norms. Unusual spending, suspicious wire transfers, and fraudulent transactions get flagged before completion, preventing losses entirely rather than discovering them later.

6. Personalization

Individual investors receive tailored recommendations matched to their risk tolerance, time horizon, and financial goals. Consumers get customized budgeting guidance and savings suggestions based on their specific spending patterns. Businesses receive forecasting models calibrated to their industry and operations rather than generic templates.

Key Technologies Behind AI Finance Tools

Modern AI finance tools combine several core technologies to deliver sophisticated capabilities. Understanding what powers these tools clarifies why they work so effectively.

1. Machine Learning (ML)

Machine learning enables pattern recognition that powers predictions and recommendations. ML algorithms analyze historical financial data to identify patterns that humans might miss. These systems improve automatically as they process more information, becoming increasingly accurate over time.

Investment platforms use ML to recognize market patterns and identify opportunities. Loan underwriting systems learn which applicants historically default, improving approval decisions. Additionally, the more data ML systems process, the smarter they become.

2. Natural Language Processing (NLP)

NLP allows AI systems to understand financial language the way humans do. Users ask questions in normal English, and NLP interprets meaning even when phrased differently. Financial documents like earnings reports and contracts get analyzed automatically.

Chatbots in banking apps understand customer inquiries and respond appropriately. Also, NLP extracts information from unstructured text like news articles and earnings calls, converting written language into actionable financial insights.

3. Robotic Process Automation (RPA)

RPA automates routine workflows that previously required manual human work. These systems handle invoice processing, transaction reconciliation, and expense categorization without human intervention.

RPA works 24/7 without breaks or errors, dramatically reducing processing times. Thus, finance teams redirect effort from mechanical tasks toward analysis and decision-making.

4. Predictive Analytics

Predictive analytics uses historical data to model future financial scenarios. Additionally, forecasting tools simulate how businesses perform under different conditions. Also, cash-flow projections anticipate future liquidity needs. These capabilities enable proactive financial planning instead of reactive management.

5. Generative AI

Generative AI creates original content including financial summaries, reports, and analysis. AI copilots in accounting software now draft variance reports automatically, explaining why actual results differed from budgets.

These systems generate investment theses, executive summaries, and financial narratives without human authorship. So, this technology dramatically accelerates financial reporting and communication.

Top AI Finance Tools

The AI finance tools market has matured significantly, with specialized platforms delivering measurable value across investment, accounting, personal finance, and enterprise planning. Here are the top performers reshaping financial operations in 2025.

| Tool Name | Primary Use | Key Feature |

| Kavout | AI investment analytics | Predictive stock scoring |

| QuickBooks AI | Accounting automation | Smart reconciliation & insights |

| Cleo | Personal finance chatbot | Conversational budgeting |

| Feedzai | Fraud prevention | Behavioral analytics |

| Datarails | FP&A automation | Automated forecasting |

| AlphaSense | Financial intelligence | NLP-driven market research |

| Planful | Enterprise planning | AI-driven financial modeling |

| Xero Analytics Plus | Accounting insights | AI-generated trend analysis |

| Trade Ideas | Market analysis | High-probability trade identification |

| YNAB | Personal budgeting | AI income allocation |

| Vic.ai | Invoice processing | Intelligent expense categorization |

1. Investment & Market Analysis

Kavout leads AI-powered investment analytics by delivering predictive stock scoring that identifies undervalued opportunities. Also, the platform analyzes company fundamentals, market sentiment, and historical patterns to generate buy and sell signals. Investors use Kavout to backtest strategies and identify stocks before institutional investors recognize opportunities, giving users an informational edge in competitive markets.

AlphaSense combines natural language processing with financial intelligence to surface market research insights from earnings calls, SEC filings, and industry reports. Rather than manually reading thousands of documents, AlphaSense extracts relevant information and identifies emerging themes. Financial analysts save weeks of research time while uncovering insights competitors might miss.

2. Accounting & Bookkeeping

QuickBooks AI automates accounting workflows through smart reconciliation that matches transactions across accounts automatically. Moreover, the platform categorizes expenses intelligently and generates financial insights from accounting data. Small business owners spend less time on bookkeeping and more time analyzing business performance.

Vic.ai specializes in invoice processing and expense categorization using machine learning that learns your company’s coding standards. Consequently, the platform handles vendor management, payment scheduling, and compliance documentation automatically, reducing accounts payable processing time by up to 80%.

3. Personal Finance Management

Cleo transforms personal budgeting through conversational AI that acts as a financial advisor. Users ask questions about spending, savings goals, and financial decisions in natural language. Additionally, Cleo provides personalized recommendations, identifies unnecessary subscriptions, and helps users build better financial habits through interactive guidance.

AI In Cybersecurity: Why It’s Essential for Digital Transformation

Explore AI tools driving threat detection, proactive security, and efficiency in cybersecurity.

4. Fraud Prevention & Risk Management

Feedzai delivers behavioral analytics for fraud prevention by monitoring transaction patterns in real time. The platform identifies anomalous activity instantly, preventing fraudulent transactions before completion. Financial institutions reduce fraud losses while maintaining positive customer experiences through rapid, accurate detection.

5. Financial Planning & Analysis

Datarails automates the traditionally time-consuming financial planning process. So, the platform consolidates data from multiple sources and generates automated forecasts based on historical trends and current conditions. Finance teams complete monthly forecasting in days instead of weeks, enabling faster strategic decision-making.

Planful serves enterprise planning needs through AI-driven financial modeling that accounts for variables and scenarios. Also, the platform combines planning, consolidation, and reporting into unified workflows. Additionally, organizations model budget scenarios quickly and give resources more intelligently based on AI-generated recommendations.

6. Additional High-Value Tools

Xero Analytics Plus provides accounting businesses with AI-generated insights from client financial data. Correspondingly, the platform identifies trends, flags anomalies, and generates recommendations automatically, transforming accountants into financial advisors.

Trade Ideas scans markets continuously to identify high-probability trading opportunities. Also, the AI analyzes technical indicators, market sentiment, and volume patterns to surface trades meeting your specific criteria, enabling faster decision-making.

YNAB (You Need a Budget) uses AI to help individuals allocate income purposefully before spending occurs. As well as, the platform learns spending patterns and suggests budget categories automatically, making budgeting less painful and more effective.

Market Trends in 2025

The most successful AI finance tools share common characteristics: they eliminate manual work that wastes time, improve accuracy beyond human capability, and provide insights humans might overlook. Additionally, integration capabilities matter increasingly, as tools that connect seamlessly with existing financial systems gain adoption faster. Hence, organizations and individuals adopting these platforms in 2025 are gaining competitive advantages through faster decisions, fewer errors, and smarter resource allocation.

AI Inventory Management: Tools, Benefits, and Best Practices for 2025

Learn how AI Inventory Management leverages machine learning and predictive analytics to optimize stock levels, reduce costs, and enhance supply chain efficiency.

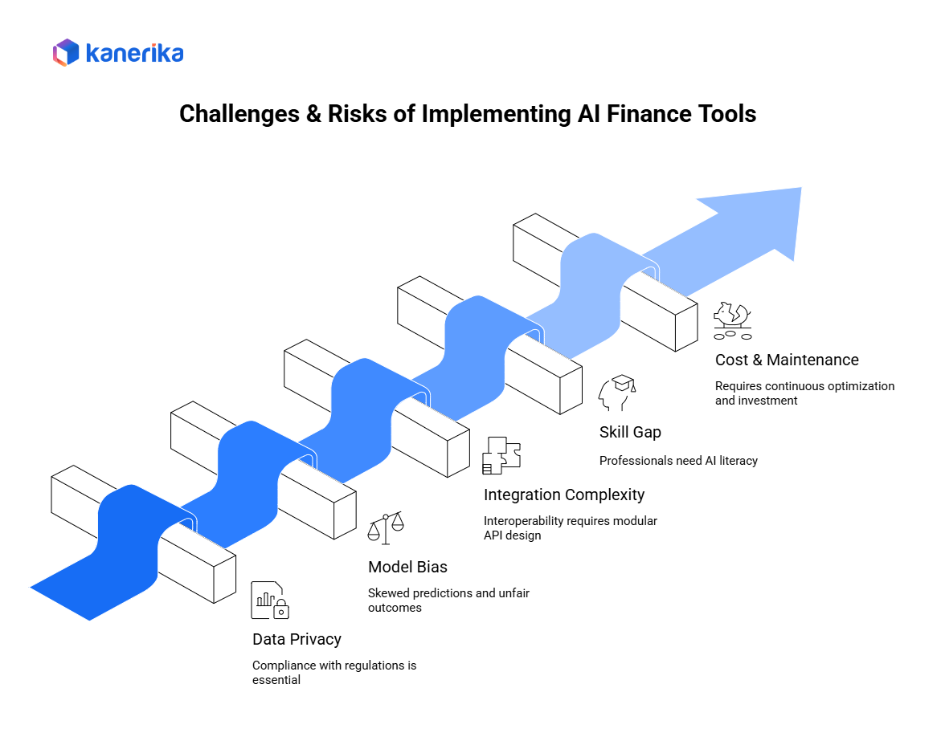

Challenges and Risks of Implementing AI Finance Tools

While AI finance tools deliver efficiency and intelligence, their implementation comes with several challenges that organizations must address to ensure security, fairness, and sustainability.

1. Data Privacy & Compliance

AI systems handle highly sensitive financial data, making compliance with regulations like GDPR and SOC 2 essential. Additionally, any data leak or unauthorized access can lead to legal and reputational risks.

2. Bias in Models

AI-driven financial recommendations can reflect underlying data biases, leading to skewed predictions or unfair outcomes in credit scoring or investment decisions. Regular audits and transparent model evaluation are crucial.

3. Integration Complexity

Many financial institutions still rely on legacy systems, making API and data integration difficult. Also, seamless interoperability requires an API-first architecture and modular design.

4. Skill Gap

Finance professionals must develop AI literacy to interpret outputs, validate results, and manage AI-powered workflows effectively.

5. Cost & Maintenance

Initial deployment, data infrastructure, and model retraining demand significant investment and continuous optimization.

Future of AI Finance Tools

- Rise of autonomous finance: budgets that self-optimize, automated audits, and treasury functions driven by intelligent systems.

- AI copilots for CFOs: embedded assistants that deliver real-time financial insights, scenario planning, and decision support.

- Convergence of blockchain & AI: enhancing fraud detection, transparency, traceability, and secure financial flows.

- Formation of predictive finance ecosystems: networks of AI agents collaborating to make real-time decisions across functions (investing, risk, operations).

According to recent research from McKinsey & Company, generative AI could automate up to 70% of business activities by 2030, which strongly suggests the transformative potential of AI in finance.

As such, the future of AI in finance is trending toward fully autonomous finance models, embedded AI assistance, and enterprise-scale decision automation — shaping the major AI trends 2025 and beyond.

Kanerika’s AI Agents: Revolutionizing Workflows with Smart Automation

Alan – AI Legal Document Summarizer

Alan simplifies legal processes by converting lengthy, complex documents into concise, actionable summaries, saving time and enhancing productivity.

What Alan Can Do:

- Analyze extensive legal contracts and documents.

- Create customized summaries tailored to user-defined rules.

- Generate unlimited summaries for consistent and efficient results.

Key Features and Benefits:

- Customizable summarization using natural language rules.

- Saves countless hours spent on legal reviews and contract analysis.

- Enhances decision-making by highlighting key legal points.

How It Works:

- Receive a clear and actionable summary directly in your inbox.

- Upload your legal document.

- Define the summarization rules.

Susan – AI PII Redactor

Susan ensures your documents meet data privacy regulations by redacting sensitive information securely.

What Susan Can Do:

- Identify and redact PII such as names, phone numbers, and addresses.

- Deliver redacted documents quickly and securely.

Key Features and Benefits:

- Compliant with global data privacy standards.

- Customizable redaction fields for precision.

- Reduces the risk of data breaches and ensures compliance with regulations.

How It Works:

- Upload your document.

- Specify the fields to be redacted.

- Receive a secure, redacted file directly in your inbox.

Mike – AI Quantitative Proofreader

Mike enhances document accuracy by validating numerical data and ensuring consistency.

What Mike Can Do

- Verify arithmetic accuracy across quantitative data.

- Cross-check data consistency across multiple documents.

- Flag errors and discrepancies for review.

Key Features and Benefits

- Reduces manual proofreading efforts and errors.

- Provides detailed discrepancy reports.

- Ensures reliable, error-free documentation for critical business needs.

How It Works

- Upload your documents.

- Allow Mike to analyze and cross-validate numerical data.

- Receive an error report and suggestions for corrections.

Transform Your Business with Kanerika’s AI Solutions

Kanerika brings deep expertise in agentic AI and machine learning, helping businesses transform how they operate. From manufacturing and retail to finance and healthcare, we build AI solutions that improve productivity, reduce costs, and support innovation. Also, our focus is on solving real-world problems with models that are tailored to each industry’s needs.

We’ve developed purpose-built AI and generative AI tools that help organizations overcome bottlenecks, streamline workflows, and scale with confidence. Moreover, these solutions cover a wide range of use cases—faster information retrieval, video analysis, real-time data processing, smart surveillance, and inventory optimization. In areas like finance and operations, our AI agents support tasks such as sales forecasting, financial planning, data validation, and vendor evaluation.

At Kanerika, we design AI systems that deliver measurable results. Whether it’s improving decision-making, automating complex processes, or enabling smarter pricing strategies, our models are built to adapt and perform. Consequently, by combining deep technical knowledge with industry-specific insight, we help businesses stay efficient, agile, and ready for what’s next.

With Kanerika as your partner, achieve sustainable growth and success through AI solutions that redefine your business approach. Let’s work together to build a future of innovation and excellence.

Redefine Enterprise Efficiency With AI-Powered Solutions!

Partner with Kanerika for Expert AI implementation Services

FAQs

1. What are AI finance tools?

AI finance tools are intelligent software solutions that use artificial intelligence to automate financial processes, analyze data, and enhance decision-making accuracy

2. How do AI finance tools work?

They leverage machine learning, predictive analytics, and natural language processing to interpret complex financial data, detect patterns, and generate actionable insights in real time.

3. What are some examples of AI finance tools?

Popular AI finance tools include QuickBooks AI for accounting, Cleo for personal budgeting, Kavout for investment analytics, and Feedzai for fraud detection.

4. Are AI finance tools secure and compliant?

Yes, most AI finance platforms adhere to global standards like GDPR and SOC 2, using encryption, access controls, and audit trails to protect sensitive data.

5. How do AI finance tools benefit organizations?

They increase operational efficiency, reduce manual errors, improve financial forecasting, and help businesses make faster, data-driven decisions with higher accuracy

6. What is the future of AI finance tools?

The future points toward autonomous finance systems with AI copilots that handle forecasting, budgeting, and compliance seamlessly across industries.