As the insurance industry grapples with rising customer expectations and increasing competition, companies are turning to data analytics to stay ahead. Take Allstate, for example, which leveraged insurance data analytics to personalize their offerings, leading to a significant improvement in customer retention. This shift towards data-driven decision-making is not just a trend; it’s a necessity. The application of advanced analytics in insurance has led to a 25 percent increase the profits of leading insurance companies as per McKinsey.

However, building a robust insurance data analytics infrastructure isn’t as simple as collecting data. It requires a strategic approach, one that integrates the right tools, ensures data quality, and makes analytics accessible to key decision-makers. The question is: How can insurance companies lay the foundation for such a system? Let’s explore the steps to creating an infrastructure that turns data into a powerful asset.

Optimize Your Insurance Operational Costs and Resources with Smart Analytics!

Partner with Kanerika Today!

Understanding Insurance Data Analytics Infrastructure

Insurance data analytics refers to the process of using data-driven techniques to collect, manage, analyze, and interpret vast amounts of data in the insurance industry. This includes everything from customer data, claims information, underwriting records, and operational data. The goal is to turn raw data into valuable insights that can help insurance companies improve decision-making, predict risks, enhance customer experience, and increase efficiency across various processes.

By leveraging data analytics, insurers can make smarter, data-driven decisions that lead to better pricing strategies, risk assessments, fraud detection, and claims management, ultimately transforming how they operate and serve their customers.

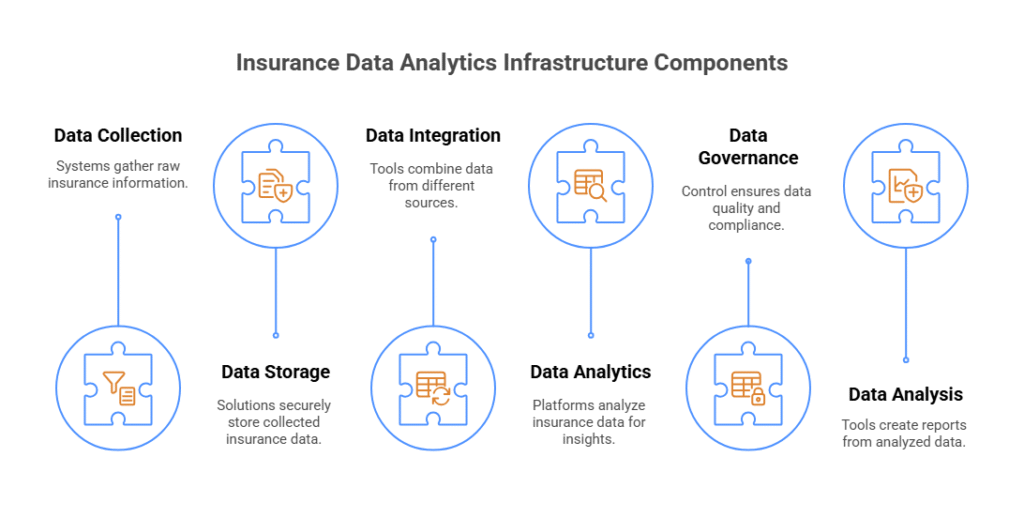

Core Components of Insurance Data Analytics Infrastructure

1. Data Collection Systems

These systems capture data from various sources, including:

- Customer interactions (applications, renewals, claims, etc.)

- IoT devices (e.g., connected cars, home sensors)

- Third-party data providers (e.g., medical records, credit scores)

Collecting clean, accurate, and comprehensive data is essential for effective analytics.

2. Data Storage Solutions

Insurers need to store large amounts of data securely and efficiently. Storage solutions can vary, including:

- Cloud Storage: Offers scalability and flexibility for handling large volumes of data.

- On-Premises Storage: Traditional option for insurers with strict data security policies.

The choice between cloud or on-premises storage depends on factors like budget, security requirements, and scalability.

3. Data Integration Tools

Insurance companies often deal with data that exists in silos across different departments (e.g., claims, underwriting, sales). Integration tools help bring all this data together into a unified view.

Tools like ETL (Extract, Transform, Load) systems help cleanse and prepare data for analysis by removing inconsistencies and errors.

4. Data Analytics Platforms

These are the tools that allow insurers to analyze their data and generate actionable insights. Key technologies include:

- Predictive Analytics: To forecast future trends, such as customer behavior, claims likelihood, or risk events.

- Machine Learning Algorithms: These algorithms can improve over time by learning from new data, helping to automate decisions such as underwriting or claims validation.

- AI (Artificial Intelligence): Used for tasks such as automating claim processing or detecting fraud patterns.

- Business Intelligence (BI) Tools: Dashboards and visualization tools that make data insights easier for decision-makers to understand.

5. Data Governance and Quality Control

A solid insurance data analytics infrastructure also requires strong data governance to ensure the integrity, accuracy, and security of the data.

This includes:

- Setting policies for data privacy (e.g., GDPR compliance)

- Ensuring high data quality standards (accuracy, completeness, and consistency)

- Data security measures to prevent breaches and unauthorized access.

6. Data Analysis and Reporting Tools

After data is collected, cleaned, and stored, it needs to be analyzed. Reporting tools help convert complex datasets into actionable reports, charts, and insights.

These tools help business leaders track performance, spot trends, and make data-backed decisions, especially in areas like risk management, fraud detection, and customer retention.

Why AI and Data Analytics Are Critical to Staying Competitive

AI and data analytics empower businesses to make informed decisions, optimize operations, and anticipate market trends, ensuring they maintain a strong competitive edge.

Why a Strong Data Analytics Infrastructure is Crucial for Insurers

1. Boosting Operational Efficiency

Data analytics helps insurers streamline key processes like underwriting, claims handling, and customer service by automating routine tasks, improving accuracy, and reducing processing times, leading to faster decisions and cost savings.

2. Enhancing Customer Experience

By analyzing customer data, insurers can personalize offerings, predict needs, and improve communication, fostering deeper customer relationships and loyalty through tailored experiences.

3. Supporting Risk Management

Data analytics allows insurers to assess risks more precisely by identifying patterns and trends, enabling better predictions, proactive risk mitigation strategies, and more accurate pricing models.

4. Staying Competitive

Top insurers like Progressive use data analytics to refine pricing models and improve claims processing, gaining a significant market edge. According to Deloitte, 80% of insurers view analytics as essential to staying competitive in an increasingly crowded market.

Real-Time Data Transformation: The Key To Instant Business growth

Unlock instant business growth by leveraging real-time data transformation to enable swift decision-making and optimize operational efficiency.!

Insurance Data Analytics Applications

1. Underwriting and Risk Assessment

Advanced analytics transforms underwriting from an art to a science by processing vast datasets beyond traditional actuarial tables. Modern platforms integrate thousands of variables to create highly accurate risk profiles, enabling personalized policies while maintaining portfolio health.

- Machine learning algorithms can analyze 1000+ risk factors simultaneously, improving loss prediction accuracy by up to 20% (McKinsey, 2023)

- Automated risk scoring reduces underwriting time from days to minutes while maintaining or improving risk selection quality

- Real-time data integration allows for continuous risk assessment rather than point-in-time evaluations

2. Claims Management and Fraud Detection

Analytics-driven claims processing creates a paradigm shift from reactive investigation to proactive fraud prevention. By analyzing historical patterns and detecting anomalies in real-time, insurers can accelerate legitimate claims while flagging suspicious activities before payments occur. A verification of benefits platform enhances this process by verifying claim details against existing records, ensuring that only valid claims move forward

- Predictive modeling identifies potentially fraudulent claims with 80% higher accuracy than traditional methods (Coalition Against Insurance Fraud)

- Natural language processing extracts insights from unstructured data in claims documents, reducing manual review time by 65%

- Network analysis techniques uncover organized fraud rings by identifying subtle connections across seemingly unrelated claims

3. Customer Acquisition and Retention

Data analytics revolutionizes customer lifecycle management by enabling insurers to target high-value prospects, personalize interactions, and identify at-risk policies before cancellation. A single customer view across touchpoints drives meaningful engagement and loyalty.

- Propensity models increase marketing conversion rates by 2-3x by targeting prospects most likely to purchase specific policy types

- Customer lifetime value analysis allows precise allocation of retention resources to the most profitable segments

- Churn prediction algorithms identify at-risk policyholders 60-90 days before cancellation with 75%+ accuracy

4. Pricing Optimization

Analytics-driven pricing transforms static rate tables into dynamic, responsive systems that balance competitive positioning against profitability goals. Modern pricing platforms rapidly adapt to changing market conditions while maintaining actuarial soundness.

- Microsegmentation techniques identify premium optimization opportunities worth 2-3% of gross written premium (Boston Consulting Group)

- Competitive intelligence analytics track market positioning across thousands of customer segments in near real-time

- Price elasticity modeling predicts revenue impact of pricing changes with 85%+ accuracy, reducing adverse selection

Data Profiling: A Comprehensive Guide to Enhancing Data Quality

Understand how data profiling techniques improve data quality by identifying inconsistencies and ensuring accurate, reliable information for better decision-making.

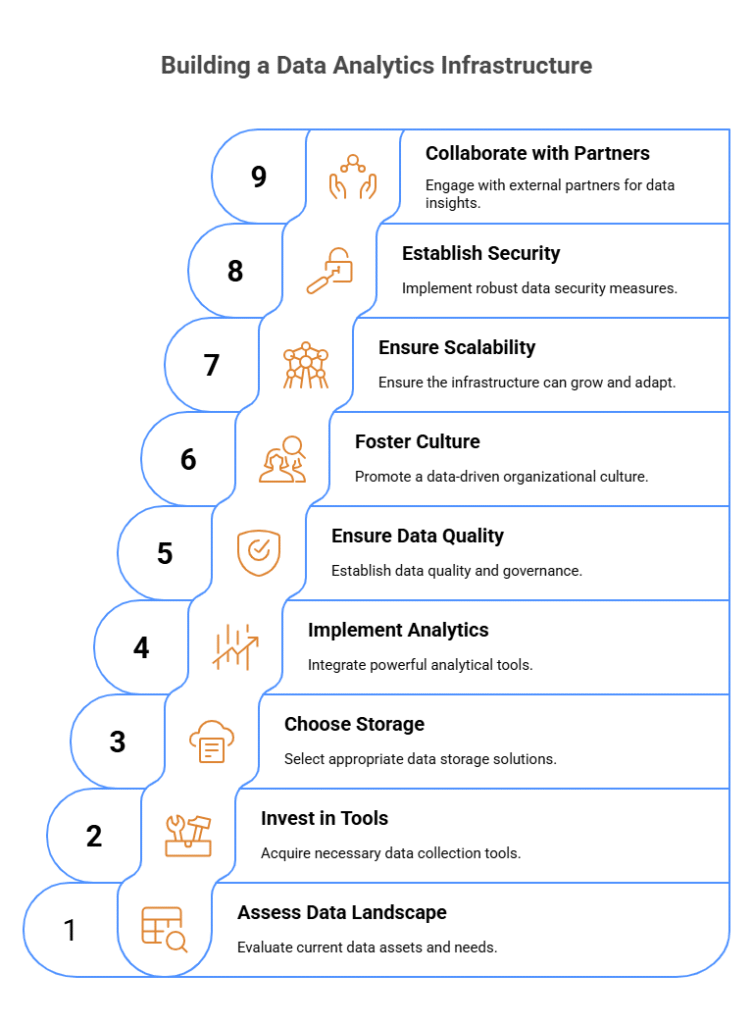

Key Steps to Building a Robust Insurance Data Analytics Infrastructure

1. Assess Your Current Data Landscape

Start by evaluating the existing data sources, tools, and systems within the organization. Identify where data resides (e.g., databases, spreadsheets, cloud services) and assess how well it’s being utilized. Understanding the current state helps pinpoint gaps and opportunities for improvement.

2. Invest in the Right Data Collection Tools

Insurance companies need reliable methods for collecting data from a variety of sources, including customer interactions, IoT devices, third-party providers, and more. Choosing the right tools (e.g., sensors, APIs) ensures that the data gathered is relevant, timely, and accurate.

3. Choose the Right Storage Solutions

Data storage should be scalable, secure, and efficient. Companies can opt for cloud-based solutions, which offer flexibility and cost-effectiveness, or on-premises storage if stricter security controls are required. The choice depends on factors like volume, security needs, and future growth.

4. Implement Powerful Analytical Tools

To turn data into actionable insights, insurers must deploy advanced analytics platforms. This includes tools for predictive modeling, machine learning, and business intelligence. These tools will enable the company to predict customer behavior, assess risks, detect fraud, and more.

5. Ensure Data Quality and Governance

Strong data governance practices are essential to maintaining data integrity. This involves establishing clear policies on data quality, privacy, and compliance (e.g., GDPR). Insurers must also implement data cleansing techniques to remove inconsistencies and ensure accurate, reliable data.

6. Foster a Data-Driven Culture

Building a robust analytics infrastructure goes beyond technology—it requires a mindset shift. Insurers should invest in training their teams to leverage data analytics in decision-making, creating a culture where data is central to business operations. Collaboration between IT and business units is crucial for success.

7. Ensure Scalability and Flexibility

As the volume of data grows, the infrastructure needs to scale accordingly. It’s important to choose systems and tools that can handle increased data flow without compromising performance. Building a flexible infrastructure also ensures that the system can adapt to new technologies and evolving business needs.

8. Establish Clear Data Security Measures

Protecting customer data is critical in the insurance industry. A robust analytics infrastructure must include strong security measures such as encryption, access controls, and regular audits. Compliance with regulations like GDPR is essential to safeguard sensitive information and maintain customer trust.

9. Collaborate with External Partners

Insurance companies should consider working with tech vendors, startups, or consulting firms to enhance their analytics capabilities. Collaboration can provide access to new technologies, best practices, and insights that improve the overall infrastructure and make it more effective.

Data Visualization Tools: A Comprehensive Guide to Choosing the Right One

Explore how to select the best data visualization tools to enhance insights, streamline analysis, and effectively communicate data-driven stories.

Challenges of Implementing Insurance Data Analytics

Insurance companies always look for ways to improve their services and stay ahead of the competition. One of the ways they can achieve this is through the use of data analytics.

However, implementing it is not without challenges.

One of the main challenges of insurance data analytics is the quality and availability of data. Insurers need access to high-quality data to perform accurate analyses and make informed decisions. However, data can often be inaccurate or outdated, which can hinder the effectiveness of the process.

1. Data Quality and Availability

Another challenge of data analytics is the need for technical expertise. Analyzing data requires specialized skills and knowledge. Insurers may struggle to find or develop the necessary talent for insurance data analytics. Additionally, the rapid technological change means insurers must stay up-to-date with the latest tools and techniques to remain competitive.

2. Technical Expertise

Legacy systems and processes can make implementing data analytics in many insurance companies difficult. These systems may not be designed to handle large data volumes or integrate with insurance data analytics tools. Additionally, many processes may be manual or paper-based, making capturing and analysing data difficult.

3. Legacy Systems and Processes

Data security and privacy are major concerns for insurers implementing data analytics. Insurers must ensure their data is protected from breaches while remaining compliant with evolving privacy regulations.

In many organizations, outdated legacy systems create hidden security vulnerabilities and make regulatory compliance harder to maintain. Using legacy modernization tools can help insurers update and refactor these systems, strengthening security controls, enabling modern encryption and access management, and ensuring sensitive data is handled in line with current privacy standards.

4. Data Security and Privacy

Finally, cultural resistance can be a challenge for insurers implementing insurance data analytics. Employees may resist change, particularly if they feel it will undermine their existing roles. There may be a lack of understanding or trust around data analytics, making it difficult to get stakeholder cooperation.

5. Cultural Resistance

Finally, cultural resistance can be a challenge for insurers implementing insurance data analytics. Employees may resist change, particularly if they feel it will undermine their existing roles. There may be a lack of understanding or trust around data analytics, making it difficult to get stakeholder cooperation.

Level Up Your Enterprise Data Strategy with Kanerika’s Advanced Data Analytics Solutions

Kanerika is a premier data and AI solutions company offering innovative data analytics services that help businesses gain fast, accurate insights from their vast data estates. As a certified Microsoft Data and AI solutions partner, we utilize Microsoft’s powerful analytics and BI tools, including Fabric and Power BI, to deliver robust solutions. These tools help businesses not only address current challenges but also enhance their data operations, driving growth and innovation.

Advanced analytics plays a pivotal role in enabling businesses across various industries to overcome operational pitfalls. By optimizing resources, reducing costs, and increasing efficiency, our solutions help you make informed decisions that improve productivity and profitability. Whether it’s streamlining processes, enhancing customer experiences, or boosting decision-making capabilities, Kanerika’s advanced analytics solutions empower your business to thrive in a competitive marketplace. Let us help you unlock the full potential of your data and fuel sustainable growth.

Elevate Your Insurance Operations with Advanced Analytics Today!!

Partner with Kanerika Today!

FAQs

What is data analytics in insurance?

Data analytics in insurance uses massive datasets to understand risk better, personalize pricing, and improve efficiency. It helps insurers predict claims, detect fraud, and tailor products to specific customer needs, all leading to better profits and customer satisfaction. Essentially, it’s using smart data analysis to make the insurance industry smarter and more effective. This results in more accurate risk assessments and ultimately more affordable and relevant insurance.

What are the use cases of insurance analytics?

Insurance analytics helps companies understand risk more accurately, leading to better pricing and more tailored products. It pinpoints fraud and inefficient processes, saving money and improving operational efficiency. Ultimately, it allows insurers to offer better customer experiences and enhance profitability through data-driven decision making. This improves everything from claims processing to customer retention.

What are the 4 pillars of data analytics?

Data analytics rests on four key cornerstones: Data acquisition (gathering the right information), data preparation (cleaning and transforming it), data analysis (uncovering patterns and insights), and data visualization (effectively communicating those findings). These stages work together to extract meaningful knowledge. Without a solid foundation in each, the entire process falters.

What is the role of data in insurance?

Data is the lifeblood of modern insurance. It fuels everything from risk assessment and pricing individual policies to detecting fraud and improving customer service. Essentially, insurers use data to understand and manage risk more effectively, leading to fairer premiums and better claims handling. Without robust data analysis, the entire insurance industry would be far less efficient and reliable.

What kind of data do insurance companies use?

Insurance companies use a massive amount of data to assess risk and price policies. This includes your personal information (age, location, driving history), claims history (yours and others with similar profiles), and even external data like credit scores and geographic accident rates. Essentially, they build detailed profiles to predict the likelihood of you filing a claim. The goal is to accurately price policies while managing their overall risk.

What is insurance analysis?

Insurance analysis digs deep into insurance policies and practices to understand their risks and financial implications. It involves evaluating things like claims frequency, payout amounts, and the adequacy of reserves to ensure a company’s stability and profitability. Essentially, it’s about figuring out how well an insurance program (or company) is managing its risks and paying out claims. This helps inform better decision-making related to pricing, reserving, and overall risk management.

How is data science used in insurance?

Data science revolutionizes insurance by precisely predicting risk. It analyzes massive datasets – from driving habits to medical history – to personalize premiums and detect fraud more effectively. This leads to fairer pricing for customers and improved profitability for insurers, ultimately creating a more efficient and transparent insurance market. Ultimately, it’s about using data to make insurance smarter and more beneficial for everyone.

What is data visualization in insurance?

Data visualization in insurance uses charts and graphs to make complex insurance data understandable. It reveals trends in claims, customer behavior, and risk factors, allowing insurers to make better decisions. Essentially, it translates raw numbers into actionable insights, improving efficiency and profitability. This helps insurers understand their business more effectively, manage risk, and improve services.

How is big data used in the insurance industry?

Big data dramatically improves insurance. It lets companies assess risk more accurately by analyzing vast amounts of data – from driving habits to medical records – leading to more personalized pricing. This also allows for faster and more efficient claims processing, ultimately benefiting both the insurer and the policyholder. Fraud detection is also significantly enhanced through identifying patterns otherwise impossible to spot.