The financial industry is changing faster than ever, driven by digital transformation in banks, rapid fintech growth, and increasing regulatory pressure. As a result, Modern Data Infrastructure for Financial Services has become a top priority. In fact, research shows that 90% of financial leaders list data modernization as their most important technology goal, highlighting the urgent need for stronger and more reliable systems.

However, many institutions still struggle with legacy platforms, fragmented data sources, and slow batch processes. These challenges make it difficult to deliver real-time insights, support advanced analytics, or meet strict compliance requirements. Because customer expectations are rising and transaction volumes are exploding, outdated systems can no longer keep up.

This is where modern data infrastructure becomes essential. It forms the foundation for AI-driven decisioning, real-time fraud detection, risk assessment, customer personalization, and regulatory reporting.

In this blog, we will explore what a modern financial data ecosystem looks like—its architecture, key components, enabling technologies, use cases, governance principles, compliance needs, and the step-by-step process to build it successfully.

Elevate Your Enterprise Data Operations by Migrating to Modern Platforms!

Partner with Kanerika for Data Modernization Services

Key Takeaways

- Modern data infrastructure is essential for real-time banking, regulatory compliance, and AI-driven decision-making.

- Financial institutions must modernize to keep up with rising digital expectations and massive transaction volumes.

- A strong architecture includes ingestion, storage, processing, semantic, and consumption layers.

- Security, access control, lineage, and compliance frameworks are critical in regulated environments.

- A step-by-step modernization roadmap ensures scalability, accuracy, and operational resilience.

Why Financial Services Need Modern Data Infrastructure?

Financial services are undergoing rapid change, and modern data infrastructure has become essential for staying competitive. To begin with, customer expectations are rising faster than ever. People now demand seamless, digital-first banking experiences—instant account updates, smooth mobile transactions, and frictionless customer support. Because of this shift, banks and fintechs must process and respond to data in real time.

At the same time, real-time payment systems such as UPI, digital wallets, and instant settlements have increased transaction volumes dramatically. As a result, financial institutions must handle high-speed data streams with accuracy, stability, and zero downtime.

In addition, the amount of data generated today has exploded. Customer profiles, transactions, risk assessments, credit scores, system logs, emails, and digital interactions all contribute to complex data ecosystems. Without a modern infrastructure, managing and analysing this information becomes slow and inefficient.

Another major driver is regulatory pressure. Financial organizations must comply with strict frameworks like GDPR, PCI-DSS, Basel III, and RBI/FDIC guidelines. These rules require strong data governance, privacy protection, audit trails, and transparent reporting. Legacy systems often struggle to meet these requirements.

Because of these demands, financial institutions need a data infrastructure that is secure, scalable, and fully integrated across departments and systems. A modern setup supports not only current operations but also prepares the organization for future capabilities.

Finally, as AI and machine learning continue to grow in importance—especially in fraud detection, credit scoring, forecasting, and customer experience—firms must ensure their data platforms can support advanced models.

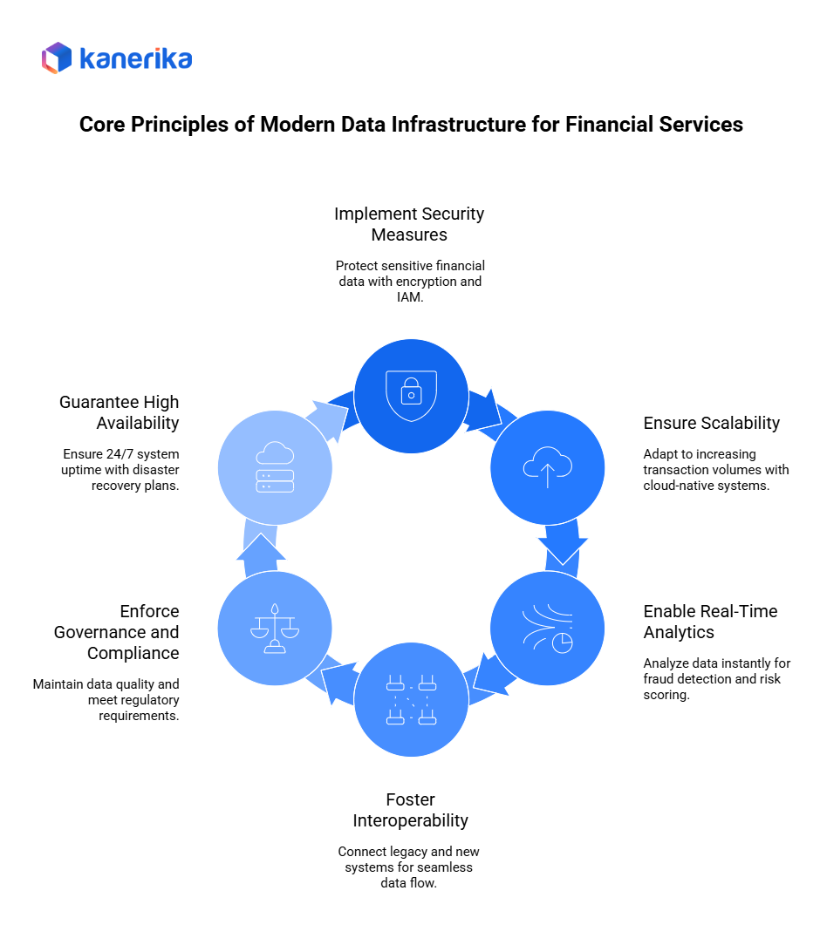

Core Principles of Modern Data Infrastructure for Financial Services

Building a modern data infrastructure in financial services requires a strong foundation based on a few clear principles. These principles ensure that banks, fintechs, and financial institutions can operate securely, scale effectively, and respond quickly to changing business needs.

1. Security-First Architecture

A modern data infrastructure in financial services must begin with a security-first approach. Sensitive financial data requires strong protection through encryption, tokenization, and strict identity and access management (IAM). These measures help prevent unauthorised access and ensure customer privacy. By building security into every layer of the system, organizations reduce risk and stay aligned with regulatory expectations.

2. Scalability

In today’s digital era, financial institutions must handle millions of transactions per minute. Therefore, infrastructure must scale quickly without delays or performance issues. Cloud-native systems, elastic storage, and distributed processing allow banks and fintechs to adapt smoothly as transaction volumes increase.

3. Real-Time Analytics

Fraud detection, risk scoring, and transaction monitoring require real-time analytics. Modern systems use stream processing to analyze data the moment it arrives. As a result, teams can act instantly on suspicious activity, improving both security and customer trust.

4. Interoperability

Financial organizations often run a mix of legacy banking systems and new cloud-native applications. Because of this, interoperability is essential. A modern data infrastructure must connect these systems seamlessly, enabling smooth data flow across departments, platforms, and external partners.

5. Governance and Compliance

Strong governance and compliance frameworks ensure data quality, transparency, and regulatory alignment. Financial institutions must enforce consistent standards for metadata, lineage, access control, and auditability to meet requirements such as GDPR, PCI-DSS, and Basel III.

6. High Availability and Disaster Recovery

Finally, modern financial systems must support 24/7 availability. Outages can disrupt payments, trading, and critical services. High-availability architectures and robust disaster recovery plans ensure continuity even during failures or unexpected events.

AI Adoption and Business Transformation Explained

Discover how AI adoption transforms businesses through automation, smarter decisions, and improved efficiency across every department.

Architecture Overview: What a Modern Financial Data Stack Looks Like

A modern data stack for financial services brings together several interconnected layers, each designed to support secure, scalable, and real-time operations. By understanding these components, financial institutions can create a data ecosystem that meets both business and regulatory needs. Below is a clear overview of the key layers.

1. Data Ingestion Layer

- Real-time ingestion using tools like Kafka, along with batch pipelines such as ETL/ELT.

- API-based ingestion and log streaming for continuous data flow.

- Smooth integration with core banking systems, credit bureaus, ERP platforms, CRM systems, and payment networks.

2. Storage Layer

- Data Lakes such as AWS S3, Azure Data Lake Storage (ADLS), and Google Cloud Storage (GCS) store raw and semi-structured data.

- Data Warehouses like Snowflake, BigQuery, and Redshift provide fast analytical queries.

- Lakehouse platforms such as Databricks and Microsoft Fabric combine both lake and warehouse capabilities for unified analytics.

3. Processing Layer

- Stream processing tools like Spark Streaming, Flink, and Kafka Streams support real-time analytics.

- Batch processing through SQL, ETL tools, and ELT transformations ensures structured and reliable data preparation.

4. Semantic Layer

- Curated and governed datasets that maintain consistency across the organization.

- Reusable KPIs, metrics, and business definitions for analytics teams, improving accuracy and standardization.

5. Data Consumption Layer

- Dashboards and BI tools such as Power BI and Tableau for decision-making.

- AI/ML platforms like MLflow, Vertex AI, and Azure ML for predictive and generative insights.

- APIs for application integration and secure partner data sharing.

Cognos vs Power BI: A Complete Comparison and Migration Roadmap

A comprehensive guide comparing Cognos and Power BI, highlighting key differences, benefits, and a step-by-step migration roadmap for enterprises looking to modernize their analytics.

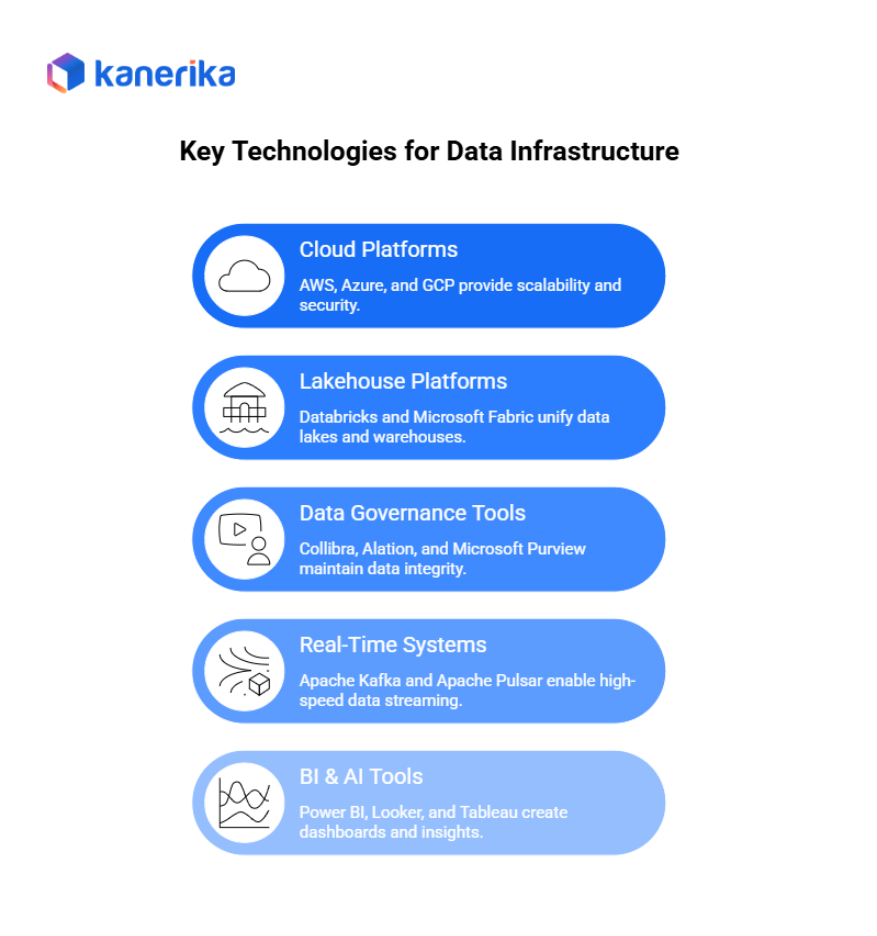

Key Technologies Powering Modern Data Infrastructure

Modern financial data infrastructure relies on a combination of advanced technologies that support scale, security, and real-time intelligence. Each category plays a crucial role in keeping data systems reliable and future-ready. Below are the key technologies that power today’s financial data ecosystems.

1. Cloud Platforms

AWS, Azure, and GCP provide the scalability financial institutions need as data volumes grow. These platforms offer strong resilience, built-in security, and compliance features required for regulated industries.

2. Lakehouse Platforms

Databricks and Microsoft Fabric bring together data lakes, data warehouses, and AI capabilities in one unified system. This helps simplify data architecture while improving performance and governance.

3. Data Governance Tools

Tools like Collibra, Alation, and Microsoft Purview help maintain trust and integrity across data assets. They support cataloguing, data lineage, metadata management, and access control policies.

4. Real-Time Systems

Technologies such as Apache Kafka and Apache Pulsar enable high-speed streaming for real-time transactions. These systems support fraud detection, instant alerts, and rapid decisioning.

5. BI & AI Tools

Platforms like Power BI, Looker, and Tableau help business teams create dashboards and visual insights. In addition, LLM-powered tools bring automated reporting, predictive analytics, and faster decision support.

Data Governance, Security & Compliance in Modern Data Infrastructure for Financial Services

In financial services, data governance, security, and compliance are absolutely essential. Because the industry handles sensitive customer information and high-value transactions, every system must operate within a tightly regulated environment. This makes strong governance practices a core part of modern data infrastructure.

To begin with, financial organizations must implement robust access controls such as RBAC (Role-Based Access Control) and ABAC (Attribute-Based Access Control). These models ensure that only authorised users can view or modify data. In addition, all information must be protected through encryption at rest and in transit, reducing the risk of data breaches.

Strong identity management is also important. Many institutions now use zero-trust frameworks, which verify every user and device at every step. This approach limits internal and external threats.

Modern data platforms must also support data lineage, metadata management, and detailed access logs. These features help teams trace how data moves through systems, maintain accuracy, and demonstrate compliance during audits.

Financial services must comply with multiple regulations, including:

- GDPR for data privacy in the EU

- PCI-DSS for payment card security

- SOX for financial audit trails

- RBI/FDIC/SEC for banking oversight

- Basel III for risk data aggregation and reporting

Because these standards are complex, organizations benefit from automating compliance checks. Automation reduces manual effort, improves accuracy, and keeps systems aligned with regulatory requirements.

How to Migrate from SSRS to Power BI: Enterprise Migration Roadmap

Discover a structured approach to migrating from SSRS to Power BI, enhancing reporting, interactivity, and cloud scalability for enterprise analytics.

Modern Data Infrastructure Use Cases in Financial Services

Modern data infrastructure enables financial institutions to operate with greater speed, accuracy, and intelligence. By supporting real-time processing, scalable storage, and advanced analytics, it opens the door to powerful use cases across the entire organization. Below are some of the most impactful applications.

1. Fraud Detection & Prevention

Fraud prevention is one of the most critical areas in finance. With modern systems, institutions can use stream processing and machine learning to analyze transactions instantly. This enables real-time scoring, where suspicious activity is flagged as it occurs. In addition, anomaly detection models help identify unusual patterns that might signal fraud, reducing financial losses and improving customer trust.

2. Risk Management & Credit Scoring

A unified data infrastructure creates a single view of risk exposure, allowing banks to make more accurate decisions. Machine learning supports credit decisioning, improving approval accuracy and reducing defaults. With real-time systems, institutions can also calculate exposure and portfolio risk instantly instead of relying on batch reports.

3. Customer 360 and Personalization

By combining data from multiple channels, institutions can build unified customer profiles. This supports next-best-action recommendations, helping relationship managers offer the right product at the right time. As a result, opportunities for cross-sell and upsell increase significantly.

4. Regulatory Reporting

Modern infrastructure automates compliance tasks by creating reporting pipelines that generate accurate submissions. Strong data lineage ensures audit readiness, while automation reduces manual effort and improves consistency across reporting cycles.

5. Treasury & Investment Analytics

Treasury teams rely on market data integration, allowing them to make informed trading decisions. Data pipelines support daily liquidity forecasting, while scenario modelling helps teams prepare for market shocks or interest rate changes.

6. Operational Intelligence

With real-time monitoring, institutions can track core banking systems for performance issues. Machine learning enables predictive maintenance of IT infrastructure, reducing downtime. Additionally, transaction flow analysis helps identify bottlenecks and optimize customer journeys.

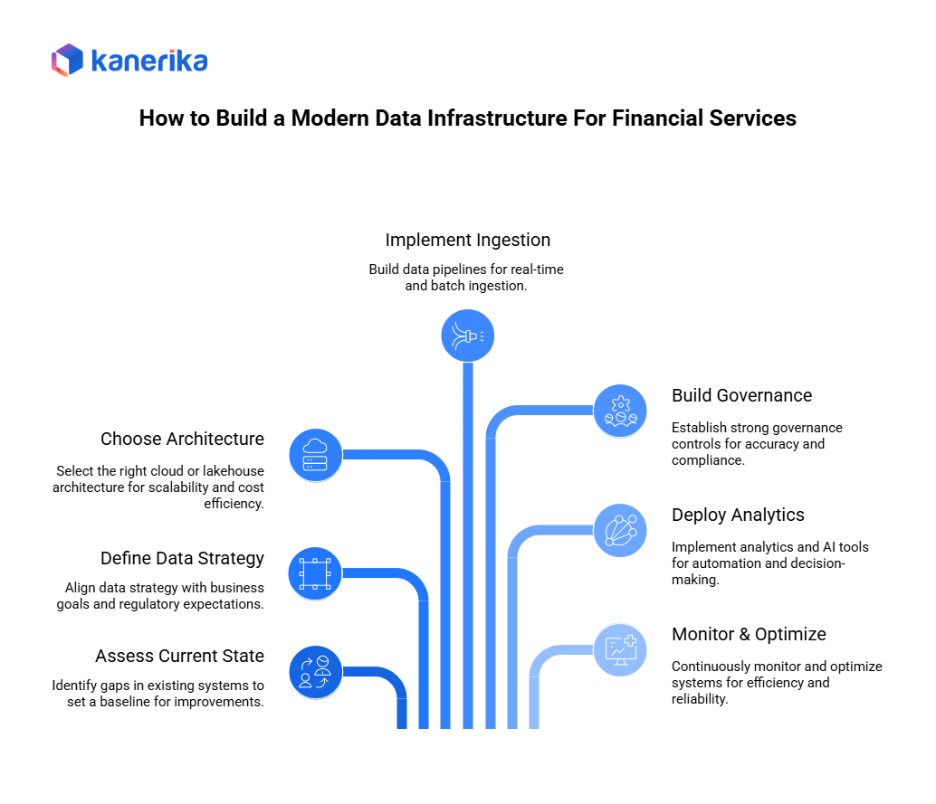

Steps to Build a Modern Data Infrastructure for Financial Services

Building a modern data infrastructure in financial services requires a structured and thoughtful approach. Each step plays an important role in ensuring scalability, security, and long-term success. Below is a practical roadmap that financial institutions can follow.

Step 1: Assess Current State

To begin with, organizations must review their existing systems, including legacy core banking platforms, data silos, and overall data maturity. This assessment helps identify gaps in integration, quality, security, and analytics capabilities. It also sets a baseline for future improvements.

Step 2: Define Data Strategy

Next, institutions should create a clear data strategy. This strategy must align with business goals such as customer experience, operational efficiency, or risk reduction—as well as regulatory expectations. Defining priorities early helps guide technology choices and investment decisions.

Step 3: Choose Cloud/Lakehouse Architecture

After setting the strategy, organizations need to select the right cloud or lakehouse architecture. Decisions should consider scale, cost efficiency, performance needs, and compliance requirements. Cloud platforms and lakehouse systems offer flexibility and support real-time analytics.

Step 4: Implement Ingestion & Processing Layers

Once the architecture is defined, teams can begin building data ingestion pipelines. This includes both real-time and batch ingestion from payment systems, banking applications, credit bureaus, and more. Processing layers using ETL/ELT, Spark, or stream processing prepare the data for analysis.

Step 5: Build Governance Framework

At this stage, institutions must establish strong governance controls. This includes metadata management, access policies, role-based permissions, data lineage tracking, and compliance rules. Effective governance ensures accuracy, transparency, and regulatory readiness.

Step 6: Deploy Analytics & AI Layers

With data structured and governed, organizations can deploy analytics and AI tools. This may include BI dashboards, ML models, fraud-detection algorithms, and LLM-powered insights to support automation and decision-making.

Step 7: Establish Monitoring & Optimization

Finally, continuous monitoring is essential. Teams should track pipeline health, system performance, and usage patterns. Cost monitoring and observability tools help keep operations efficient, while optimisation ensures long-term reliability.

Future Trends in Financial Data Infrastructure for Financial Services

Looking ahead, several important trends are shaping the future of data infrastructure in financial services. These developments will help institutions stay competitive, secure, and ready for the next wave of digital innovation. Below are the key trends to watch.

- Rise of privacy-preserving AI: Technologies such as federated learning and synthetic data are gaining traction. These methods allow banks to train models without exposing sensitive customer information, improving both privacy and compliance.

- Real-time AI-driven decisioning: Financial institutions are increasingly moving toward real-time decision-making for fraud detection, credit approvals, and transaction monitoring. This improves accuracy and reduces operational risk.

- Adoption of LLMs for compliance and audit: Large Language Models are becoming useful tools for automated compliance checks, risk analysis, and audit support. They help quickly analyze documents, flag risks, and summarise regulatory requirements.

- Autonomous data pipelines with AI agents: AI agents are beginning to manage end-to-end pipeline operations, including monitoring, error correction, and optimisation. This reduces manual work and improves data reliability.

- Multi-cloud and hybrid cloud strategies: Many financial institutions are adopting multi-cloud setups for better resilience, cost management, and regulatory alignment. Hybrid cloud also helps connect legacy systems with modern platforms.

- Embedded finance and open banking: As open banking expands, API-first architectures are becoming essential. These architectures support seamless integration with third-party apps, fintech services, and partner ecosystems.

Kanerika: Your Trusted Partner for Modern Data Migration in Financial Services

Kanerika is a trusted partner for financial institutions seeking to modernize their data ecosystems with speed, security, and zero operational risk. Modernizing legacy banking systems unlocks real-time insights, unified customer data, scalable cloud solutions, and AI-driven decision-making—capabilities that are now essential in a fast-changing financial landscape. Traditional modernization approaches can be slow, complex, and prone to errors. However, Kanerika overcomes these challenges through purpose-built accelerators, strong governance frameworks, and our FLIP platform, ensuring smooth, accurate, and compliant transitions to modern data infrastructure.

Our accelerators support a wide range of financial data migrations and modernizations, including legacy BI to Power BI, on-prem databases to cloud platforms, SSIS to Microsoft Fabric, SSAS to semantic models, and complex reporting migrations across banking, insurance, and fintech systems. Through automation, standardized templates, and deep domain expertise, Kanerika helps financial institutions reduce downtime, maintain data integrity, meet regulatory expectations, and accelerate the adoption of secure, scalable analytics platforms. With Kanerika, financial organizations can confidently future-proof their data environment and maximize ROI on every modernization effort.

Kanerika’s partnership with Databricks further enhances its ability to deliver modern financial data platforms. Together, Microsoft Fabric, Databricks, and Kanerika form a robust foundation combining strong governance, high-quality data management, advanced analytics, and enterprise AI to power the next generation of financial data infrastructure.

Move Beyond Legacy Systems and Embrace Modern Data Infrastructure!

Partner with Kanerika Today.

FAQs

1. What is Modern Data Infrastructure for Financial Services?

It refers to the cloud-ready, secure, and scalable architecture that financial institutions use to manage, process, and analyze data in real time for better decision-making.

2. Why do financial organizations need modern data infrastructure?

Banks and fintechs need it to support real-time transactions, meet regulatory requirements, prevent fraud, enhance customer experience, and run AI/ML models efficiently.

3. What are the key components of a modern financial data stack?

A complete stack includes ingestion pipelines, cloud/lakehouse storage, processing layers, a semantic layer, governance tools, and BI/AI consumption layers.

4. How does modern infrastructure improve compliance?

It offers built-in governance, lineage tracking, encryption, access controls, and audit logs to meet frameworks like GDPR, PCI-DSS, SOX, RBI, FDIC, and Basel III.

5. What technologies power modern data infrastructure?

Cloud platforms, lakehouse systems, streaming tools like Kafka, governance platforms such as Purview or Collibra, and BI/AI tools like Power BI and Azure ML.

6. How does modern infrastructure support AI and ML?

It provides clean, high-quality data, scalable compute, real-time processing, and governed environments needed to train and deploy reliable ML and LLM-based models.

7. How can a financial institution start modernising its data infrastructure?

Start with an assessment of legacy systems, define a data strategy, adopt cloud or lakehouse platforms, build ingestion and processing layers, and establish strong governance.