Managing risk has never been more complex. From global supply chain disruptions to rising cyberattacks, businesses face threats that evolve faster than traditional systems can handle. According to the PwC Pulse Survey, 75% of organizations admit they cannot keep pace with the rising demands of improving risk management. AI in risk management is emerging as the solution, equipping organizations with intelligent tools to detect, predict, and prevent risks in real time.

Traditional approaches, built on manual reviews and rigid rule-based frameworks, are too slow and reactive to handle the scale and complexity of modern risks. Businesses need faster, smarter, and more predictive systems that can detect threats before they escalate.

This blog provides a comprehensive guide to AI in risk management—exploring its applications across industries, key benefits, leading tools, current challenges, and the future trends shaping how businesses safeguard resilience.

Understanding Risk Management in the AI Era

Traditional risk management has long relied on rule-based frameworks and manual analysis. Risk officers and compliance teams would review spreadsheets, financial reports, and incident logs to identify potential threats. While effective to some extent, this approach was often time-consuming and reactive. Risks were typically addressed only after they materialized, leaving businesses exposed to losses, regulatory penalties, or reputational harm.

However, the complexity of today’s business landscape has made these methods less effective. Modern risks are more dynamic and multifaceted—ranging from cybersecurity threats and supply chain disruptions to regulatory shifts and reputational crises. Moreover, traditional systems also struggle with unstructured data such as social media feeds, customer reviews, or scanned documents. As a result, manual processes can be slow, biased, and limited in scope, often missing early warning signs.

This is where AI-driven risk management comes into play. By using machine learning, natural language processing, and predictive analytics, AI systems can continuously monitor vast amounts of structured and unstructured data. Additionally, they identify anomalies, detect patterns, and generate insights in real time. Instead of simply flagging issues, AI can also predict potential risks before they escalate, enabling businesses to act proactively rather than reactively.

In the AI era, risk management is no longer about merely reducing exposure—it’s about building resilience, agility, and foresight. Companies leveraging AI gain the ability to anticipate threats, automate responses, and make smarter decisions that safeguard long-term growth.

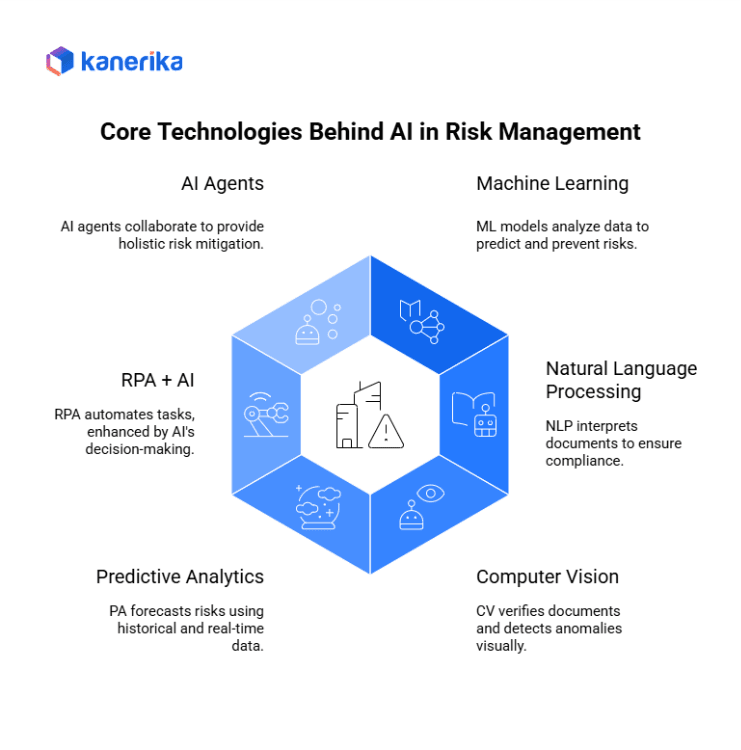

Core Technologies Behind AI in Risk Management

Artificial Intelligence is reshaping how organizations identify, analyze, and respond to risks. Several core technologies form the backbone of this transformation, each addressing different aspects of risk management.

1. Machine Learning (ML)

Machine learning models excel at pattern recognition and predictive modeling. By analyzing vast datasets—such as transaction histories or market signals—ML can detect anomalies, forecast credit risks, and identify potential fraud before it occurs.

2. Natural Language Processing (NLP)

Risk management involves navigating complex contracts, regulatory updates, and compliance documents. As well as, NLP enables systems to scan, interpret, and extract critical clauses or changes, ensuring businesses remain compliant with evolving regulations and avoid costly penalties.

3. Computer Vision

In industries like insurance or banking, computer vision is used to verify documents, detect forgeries, and analyze security footage. For example, AI can flag inconsistencies in scanned IDs or detect suspicious activity through video surveillance.

4. Predictive Analytics

Unlike traditional reporting, predictive analytics uses historical and real-time data to forecast risks before they escalate. This includes anticipating supply chain disruptions, market volatility, or equipment failures—giving businesses time to act proactively.

5. Robotic Process Automation (RPA) + AI

RPA automates repetitive, rule-based tasks, such as processing compliance reports. When combined with AI, it evolves into intelligent automation—capable of not only executing tasks but also making decisions, such as escalating high-risk transactions for review.

6. AI Agents & Multi-Agent Systems

The next frontier in risk management is the use of AI agents that collaborate across enterprise functions. Moreover, one agent might monitor cybersecurity threats, another regulatory compliance, and a third financial risks. Together, they coordinate responses to provide holistic risk mitigation in real time.

Leading AI Tools & Platforms for Risk Management

1. IBM OpenPages with Watson

Combines governance, risk, and compliance management with smart analytics. Uses machine learning to identify emerging risks and automate compliance reporting across complex organizations.

Pros: Comprehensive platform that handles multiple risk types in one system. Strong regulatory reporting capabilities and established reputation in enterprise risk management.

Cons: High implementation costs and long deployment timelines. Requires significant training and ongoing maintenance resources.

Best for: Large enterprises in regulated industries that need centralized risk management across multiple business units and geographic regions.

2. SAS Risk Management

Provides predictive analytics for risk assessment, stress testing, and regulatory capital calculations. Uses advanced statistical models to forecast potential losses and market volatility.

Pros: Industry-leading analytics capabilities with proven models for financial risk. Strong performance with large datasets and complex calculations.

Cons: Expensive licensing and requires specialized expertise to operate effectively. Limited integration with modern cloud platforms.

Best for: Banks and financial institutions that need sophisticated risk modeling for regulatory compliance and capital planning.

3. Palantir Foundry

Integrates data from multiple sources to create comprehensive risk models and early warning systems. Helps organizations identify patterns and connections across complex data relationships.

Pros: Excellent at handling diverse data sources and finding hidden patterns. As well as, strong visualization capabilities for complex risk scenarios.

Cons: High costs and steep learning curve. Requires significant technical resources for implementation and maintenance.

Best for: Government agencies and large corporations with complex data environments who need to identify systemic risks and threats.

4. FICO AI

Specializes in fraud detection, credit scoring, and financial crime prevention using machine learning algorithms. Provides real-time scoring and decision automation for financial transactions.

Pros: Proven track record in financial risk assessment with fast, accurate scoring. Easy integration with existing financial systems.

Cons: Primarily focused on financial use cases with limited applicability to other risk types. Can be expensive for smaller financial institutions.

Best for: Banks, credit unions, and fintech companies that need real-time fraud detection and credit risk assessment capabilities.

5. Microsoft Azure AI Risk Tools

Cloud-based platform offering various risk analytics services including anomaly detection, predictive modeling, and compliance monitoring. Integrates with existing Microsoft business applications.

Pros: Flexible cloud deployment with pay-as-you-use pricing. Good integration with Microsoft ecosystem and familiar interfaces.

Cons: Requires technical expertise to configure and customize. Limited pre-built risk management templates compared to specialized platforms.

Best for: Organizations already using Microsoft Azure who want to build custom risk management solutions without investing in dedicated risk platforms.

6. Ayasdi AI

Automates anti-money laundering detection and compliance monitoring using machine learning to identify suspicious transaction patterns and reduce false positives.

Pros: Significantly reduces false alerts compared to traditional rule-based systems. Adapts to new money laundering techniques automatically.

Cons: Focused primarily on financial compliance with limited broader risk management capabilities. Requires clean, well-structured transaction data.

Best for: Financial institutions that struggle with high false positive rates in their current anti-money laundering systems and need more accurate detection capabilities.

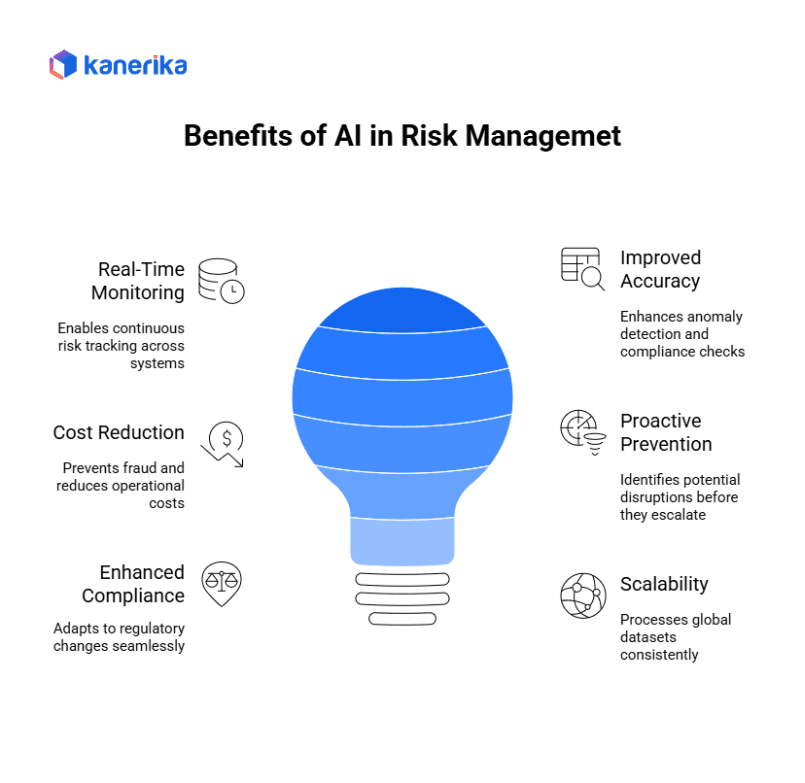

Benefits of AI in Risk Management

The adoption of artificial intelligence in risk management provides businesses with a competitive edge by transforming how risks are identified, monitored, and mitigated. Unlike traditional methods, AI offers speed, scale, and intelligence that make risk frameworks more resilient and adaptive.

1. Real-Time Monitoring

Instead of relying on quarterly or yearly reviews, AI enables continuous, real-time risk tracking across financial systems, supply chains, and customer interactions—detecting threats as they emerge.

2. Improved Accuracy

Human-led risk assessments can be prone to oversight or bias. AI leverages data-driven models to improve accuracy in anomaly detection, credit scoring, and compliance checks, reducing false positives and missed risks.

3. Cost Reduction

By preventing fraud, operational failures, and compliance fines, AI-driven systems help organizations save millions in potential losses. Automation also reduces the reliance on manual processes, further cutting costs.

4. Proactive Prevention

AI transforms risk management from a reactive function to a proactive shield, identifying potential disruptions or breaches before they escalate into crises.

5. Enhanced Compliance

Regulatory environments evolve quickly. AI tools powered by natural language processing scan regulatory changes and ensure organizations adapt to new compliance requirements seamlessly.

6. Scalability

AI systems can process global datasets across multiple regions, ensuring consistent monitoring and reporting regardless of scale or geography.

Table: Traditional Risk Management vs AI-Powered Risk Management

| Aspect | Traditional Approach | AI-Powered Approach |

| Monitoring | Periodic reviews | Real-time continuous monitoring |

| Accuracy | Prone to human bias | Data-driven, high accuracy |

| Cost Management | Losses absorbed after incidents | Preventive savings, reduced losses |

| Response | Reactive fixes | Proactive prevention |

| Compliance | Manual interpretation | Automated, real-time updates |

| Scalability | Limited by resources | Handles global, large-scale datasets |

Applications of AI in Risk Management

1. Financial Risk Management

- Credit scoring systems analyze thousands of data points beyond traditional credit reports, including spending patterns, social media activity, and employment history to predict loan default probability. These models often outperform traditional scoring methods.

- Fraud detection monitors transaction patterns in real-time, flagging unusual activities like purchases in unexpected locations or amounts that don’t match customer behavior. Modern systems reduce false positives while catching sophisticated fraud attempts that rule-based systems miss.

- Algorithmic trading risk management uses machine learning to monitor trading algorithms for potential malfunctions or market manipulation.

2. Operational Risk Monitoring

- Process monitoring tracks key performance indicators across business operations, identifying potential failures before they cause major disruptions. Also, manufacturing companies use these systems to predict equipment failures and schedule maintenance proactively.

- Supply chain disruption alerts analyze news feeds, weather data, and logistics information to predict potential delays or shortages. Correspondingly, this early warning capability helps companies adjust inventory levels and find alternative suppliers before problems affect operations.

3. Compliance Risk Management

- Regulatory monitoring automatically tracks changing regulations and identifies how new rules affect business operations. Legal teams receive alerts about relevant regulatory updates without manually monitoring multiple government sources.

- Anti-money laundering (AML) and Know Your Customer (KYC) checks use pattern recognition to identify suspicious transactions and verify customer identities more accurately than traditional methods. These systems reduce compliance costs while improving detection rates.

4. Cybersecurity Risk Detection

- Threat detection analyzes network traffic, user behavior, and system logs to identify potential security breaches before they cause damage. Machine learning models learn normal patterns and flag deviations that might indicate malicious activity.

- Anomaly detection monitors user access patterns, file movements, and system changes to catch insider threats and advanced persistent attacks that traditional security tools often miss.

5. Reputation Risk Analysis

- Sentiment analysis monitors social media, news articles, and review sites to track public perception of brands and products. Companies receive early warnings about potential reputation issues before they become major problems.

Marketing teams use these insights to address negative sentiment proactively and capitalize on positive trends in real-time.

6. Strategic Risk Planning

- Scenario planning models use economic data, market trends, and historical patterns to predict how different events might affect business performance. Companies can stress-test their strategies against various economic conditions and market changes.

- Market analysis combines multiple data sources to identify emerging risks and opportunities that might not be visible through traditional research methods.

Case Study: Enabling Real-Time Compliance and Risk Detection Through an AI Agent

A global leader in knowledge-sharing, with a network of over one million experts, faced significant compliance bottlenecks. Their compliance team manually vetted experts by screening negative news across public sources—news portals, social media, and professional profiles. The process was time-intensive, error-prone, and backlog-heavy, often delaying client engagements and creating frustration across teams.

Kanerika stepped in to transform this process with an AI-powered compliance agent. The solution automated expert profiling by integrating with internal databases, performed intelligent web scraping of news and social channels, and mapped findings directly to compliance criteria. This shifted the team’s role from manual research to streamlined review, ensuring speed and consistency.

The impact was remarkable:

- 60% faster negative news screening

- 3X quicker expert vetting

- 70% reduction in backlog cases

- 40% fewer delays in client events

By leveraging AI, Kanerika not only cleared backlogs but also standardized risk assessments with auditable reports—helping the client deliver faster, more reliable expert engagements at scale.

Challenges & Limitations of AI in Risk Management

While AI offers immense promise for risk management, it also introduces new challenges that organizations must carefully navigate.

1. Data Quality Issues

AI models are only as good as the data they rely on. Poor-quality, incomplete, or biased data can lead to inaccurate predictions—reinforcing the old adage: “garbage in, garbage out.” Businesses must invest in strong data governance to ensure reliable outcomes.

2. Model Transparency

Many AI algorithms function as black boxes, making it difficult to explain how decisions are made. As well as, in regulated industries like finance and healthcare, the inability to provide transparency can undermine trust and hinder compliance with legal requirements.

3. Ethical Risks

Bias in AI systems is a persistent concern. If not properly addressed, algorithms may unintentionally discriminate—impacting credit approvals, hiring decisions, or fraud detection outcomes. As well as, ensuring fairness and ethical use is critical.

4. Integration Challenges

Many organizations still operate on legacy systems that were not designed to integrate with modern AI tools. Moreover, bridging this gap requires significant effort, including middleware solutions, API development, and cultural shifts in IT strategy.

5. High Implementation Costs

Building and deploying AI-driven risk management systems demands substantial investment in infrastructure, expertise, and ongoing monitoring. Moreover, for smaller firms, the cost barrier may slow down adoption despite clear long-term benefits.

6. Overreliance on AI

AI should augment, not replace, human judgment. Overreliance on algorithms without human oversight can create blind spots, especially when facing novel risks that AI has not been trained to recognize.

Microsoft Purview Information Protection: What You Need to Know

Explore how Microsoft Purview Information Protection safeguards your data with advanced classification, labeling, and compliance tools, ensuring secure and seamless data management.

![]() Learn More

Learn More

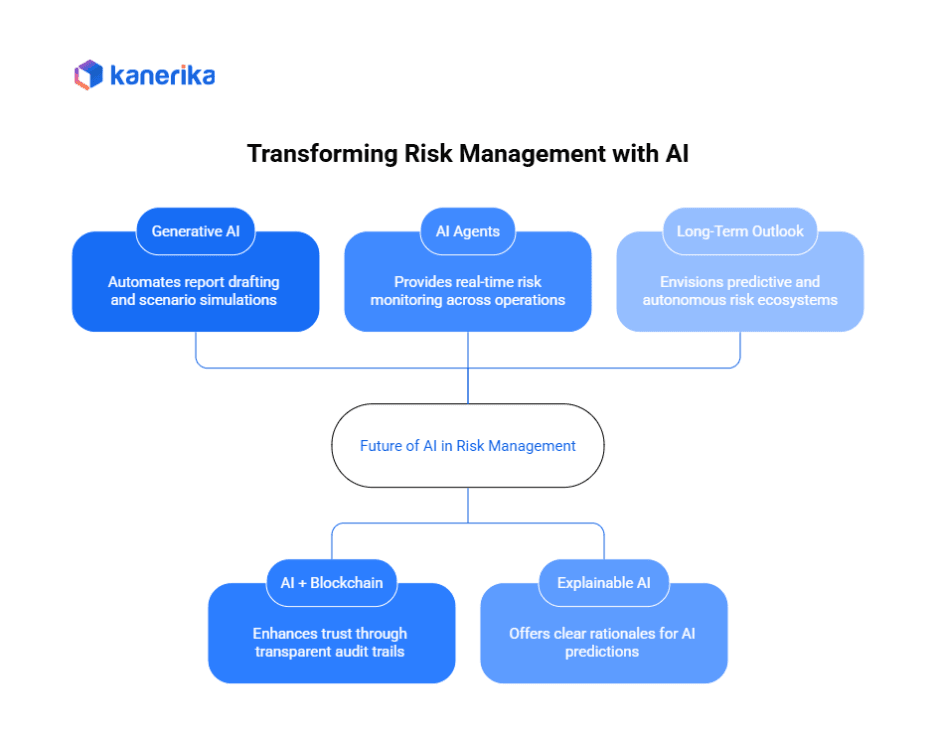

Future of AI in Risk Management

The future of risk management is being reshaped by rapid advances in artificial intelligence, pushing the field from reactive oversight to proactive, autonomous systems.

1. Generative AI in Risk

Generative AI will play a growing role in drafting compliance reports, risk assessments, and scenario simulations. Instead of manual documentation, AI can automatically generate regulatory filings or run “what-if” models to prepare organizations for complex scenarios.

2. AI + Blockchain

The combination of AI with blockchain technology will create transparent and tamper-proof audit trails. Consequently, this will enhance trust, making it easier for regulators and auditors to verify compliance and trace decision-making.

3. AI Agents

We are entering the age of autonomous AI agents—specialized systems that can monitor risks across global operations in real time. For example, one agent may track cyber threats, while another ensures compliance with evolving financial regulations. Moreover, together, they provide coordinated risk intelligence at scale.

4. Explainable AI (XAI)

One of the biggest challenges today is the black box problem. Future AI models will become more explainable and auditable, providing clear rationales for their predictions. Additionally, this will help enterprises and regulators build confidence in AI-driven decisions.

5. Long-Term Outlook

The long-term vision for AI in risk management points toward predictive, prescriptive, and fully autonomous ecosystems. Predictive analytics will anticipate risks, prescriptive models will recommend actions, and autonomous systems will execute responses with minimal human intervention. Businesses that adopt these innovations will be better positioned to handle the uncertainties of global markets.

Prevent Data Security Risks in Your AI with Kanerika’s Robust Governance Solution

As AI adoption accelerates, so do the risks tied to data exposure, poor governance, and regulatory gaps. For enterprises, effective data governance is no longer optional—it’s essential for survival. Kanerika, a leading data and AI solutions company, helps organizations secure their data ecosystems with enterprise-grade tools that go beyond surface-level fixes.

At the heart of Kanerika’s offering is a powerful trio: KANGovern, KANComply, and KANGuard—a comprehensive suite built on the foundation of Microsoft Purview. These solutions work together to maintain data integrity, enforce compliance, and block unauthorized access across the full data lifecycle.

Whether it’s controlling shadow AI risks, ensuring regulatory readiness, or improving decision-making through clean, reliable data—Kanerika’s integrated approach delivers. Businesses can confidently embrace AI without compromising security or control. With Kanerika, data stays secure, usable, and in the right hands—every step of the way.

FAQs

1. What is AI in risk management?

AI in risk management uses technologies like machine learning, NLP, and predictive analytics to detect, assess, and mitigate risks in real time. It helps businesses move from reactive fixes to proactive prevention.

2. How does AI improve traditional risk management?

Unlike manual, rule-based frameworks, AI can process large, complex, and unstructured data quickly. This leads to more accurate risk detection, faster decision-making, and better compliance monitoring.

3. What types of risks can AI address?

AI supports financial risk (fraud, credit scoring), operational risk (supply chain disruptions), compliance risk (AML, KYC), cybersecurity, reputational risks, and strategic planning.

4. Which industries benefit most from AI in risk management?

Banking, insurance, healthcare, retail, energy, and manufacturing see the highest adoption. These sectors handle large datasets and face strict regulatory or security requirements.

5. What are the main challenges of using AI for risk management?

Challenges include poor data quality, lack of model transparency, integration with legacy systems, high implementation costs, and the risk of algorithmic bias.

6. Can AI replace human risk managers?

No. AI is designed to augment, not replace humans. It handles data-heavy tasks and predictions, while humans provide oversight, ethical judgment, and context for complex decisions.

7. What is the future of AI in risk management?

The future points toward explainable AI, autonomous AI agents, integration with blockchain for audit trails, and predictive systems that prevent risks before they occur.