In 2025, JPMorgan Chase saved over 360,000 hours of manual work by using machine learning to review commercial loan agreements. American Express cut credit assessment time from 30 days to just minutes by applying ML algorithms to customer data. These changes highlight how machine learning in fintech is redefining the way financial services operate.

Machine learning in fintech is now used for fraud detection, risk analysis, loan underwriting, algorithmic trading, and customer support. According to recent reports, 85 percent of fintech companies have already integrated ML into their platforms, and the global market is projected to reach $61.3 billion by 2031.

In this blog, we’ll break down how machine learning is driving real change in fintech, where it’s being used most effectively, and what it means for the future of financial services.

What is Machine Learning in Fintech?

Machine learning in fintech refers to the use of artificial intelligence algorithms and statistical models to automate financial processes, analyze data patterns, and make predictions without explicit programming. Unlike traditional rule-based systems, ML models learn from data and improve their accuracy over time.

In the financial context, ML processes vast amounts of transaction data, market information, and customer behavior to identify patterns humans might miss. These systems can spot fraudulent transactions, assess credit risk, optimize investment portfolios, and personalize customer experiences in real-time.

The key difference from traditional finance technology lies in adaptability. Traditional financial software operates on fixed logic. A credit scoring system may use predetermined criteria, such as income, credit history, and debt-to-income ratio. Machine learning systems analyze hundreds or thousands of data points, including non-traditional factors like social media activity, spending patterns, and even smartphone usage. Traditional systems follow preset rules—if this, then that. Machine learning systems adapt to new data, continually refining their predictions and responses.

This flexibility allows fintech companies to serve previously underbanked populations, detect new types of fraud, and create more personalized financial products.

Turn Data Complexity into Clarity with Machine Learning

Partner with Kanerika for end-to-end support.

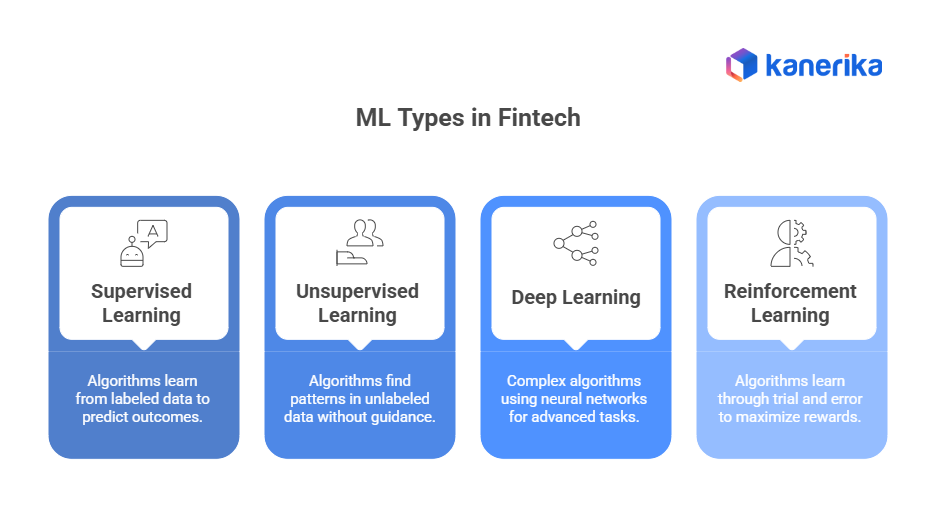

Types of ML Used in Fintech

Fintech companies primarily use four types of machine learning:

1. Supervised Learning

Supervised learning uses labeled historical data to train models that can make predictions on new data.

- Classification and Regression: Classification models predict categories (e.g., fraud/not fraud), while regression models predict numerical values (e.g., loan default probability).

- Credit Scoring Applications: Supervised learning models analyze applicant data to predict creditworthiness and default risk.

- Fraud Detection Models: These models learn from historical patterns of fraud to identify suspicious transactions in real-time.

2. Unsupervised Learning

Unsupervised learning finds hidden patterns in data without labeled examples.

- Anomaly Detection: Unsupervised models identify unusual patterns that might indicate fraud, money laundering, or system errors.

- Customer Segmentation: These models group customers with similar characteristics for targeted marketing and product development.

- Market Analysis: Unsupervised learning identifies market trends, correlations, and hidden relationships in financial data.

3. Deep Learning and Neural Networks

Deep learning models can process complex, unstructured data and identify sophisticated patterns.

- Complex Pattern Recognition: Neural networks excel at identifying non-linear relationships in large datasets that traditional models may overlook.

- Natural Language Processing: Deep learning powers chatbots, document analysis, and sentiment analysis in financial applications.

- Image Recognition for Document Verification: Neural networks can automatically verify identity documents, check signatures, and process handwritten forms.

4. Reinforcement Learning

Reinforcement learning optimizes decisions through trial and error, learning from the consequences of actions.

- Trading Algorithms: RL models learn optimal trading strategies by testing different approaches and learning from market feedback.

- Portfolio Optimization: These models continuously adjust portfolio allocations to maximize returns while managing risk.

- Dynamic Pricing: RL algorithms optimize pricing for financial products based on market conditions and customer behavior.

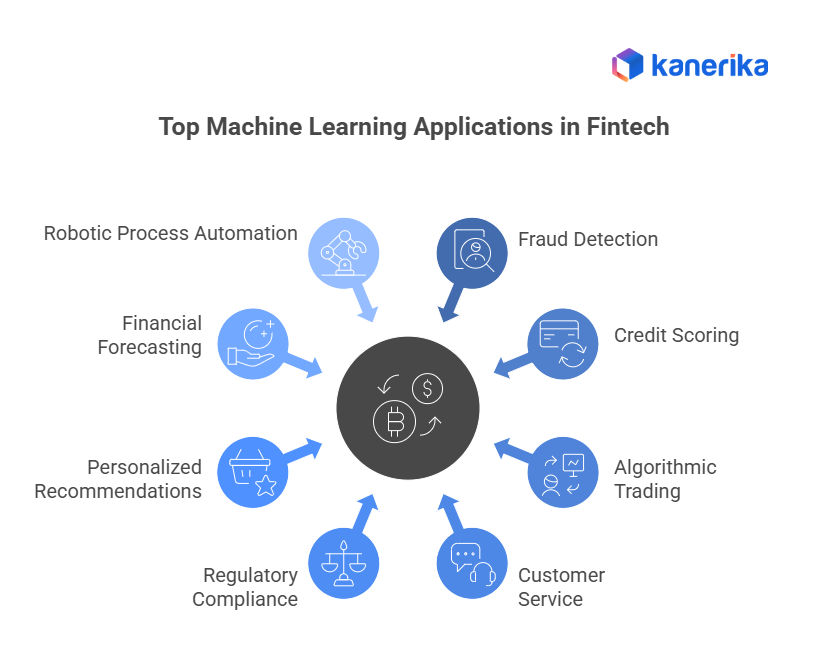

Top Machine Learning Applications in Fintech

1. Fraud Detection and Prevention

Machine learning has revolutionized fraud detection by moving from rule-based systems to behavioral analysis. ML algorithms analyze transaction patterns, device fingerprints, and user behavior to identify suspicious activity in real-time.

- Real-time Transaction Monitoring: Modern fraud detection systems process transactions as they happen, evaluating dozens of risk factors in milliseconds. They consider location, time, amount, merchant type, and historical patterns to calculate a risk score.

- Pattern Recognition for Suspicious Behavior: ML models identify subtle patterns that indicate fraud. For example, legitimate users typically have consistent typing rhythms and navigation patterns. Fraudsters often exhibit different behavioral signatures.

Case Example: Mastercard’s AI Fraud Detection – Mastercard’s AI system analyzes over 75 billion transactions annually, utilizing behavioral data, device signals, and spending patterns to detect fraud in real-time. Their Decision Intelligence platform assigns a risk score instantly, helping banks block suspicious activity while approving legitimate purchases without delay. This approach has reduced false declines and improved the accuracy of fraud detection across global markets.

2. Credit Scoring and Risk Assessment

Traditional credit scoring relies heavily on credit bureau data. Machine learning enables lenders to evaluate creditworthiness using alternative data sources and more sophisticated risk models.

- Alternative Data Sources: ML-powered credit scoring considers utility payments, rental history, education, employment stability, and even social media activity. This approach helps lenders serve thin-file borrowers who lack traditional credit history.

- Predictive Modeling for Loan Defaults: Machine learning models predict default probability more accurately than traditional scoring methods. They identify complex relationships between different risk factors and continuously update them based on new data.

Case Example: Scienaptic’s AI Credit Scoring – Scienaptic’s AI platform helps lenders approve more borrowers by analyzing thousands of data points beyond traditional credit scores. One bank using their system saw a 3x increase in approvals for thin-file applicants without raising default rates.

3. Algorithmic Trading and Portfolio Management

Machine learning enables sophisticated trading strategies and automated portfolio management that adapts to changing market conditions.

- High-frequency Trading Algorithms: ML algorithms execute thousands of trades per second, identifying arbitrage opportunities and market inefficiencies faster than human traders. These systems analyze news sentiment, technical indicators, and order flow patterns to inform trading decisions.

- Robo-advisors and Automated Investing: Robo-advisors use ML to create and manage investment portfolios based on individual risk tolerance, goals, and market conditions. They automatically rebalance portfolios and optimize for tax efficiency.

Case Example: Betterment uses machine learning to optimize portfolio allocations and minimize taxes through intelligent rebalancing. Their algorithms consider individual tax situations, market volatility, and investor goals to maximize after-tax returns.

4. Customer Service and Chatbots

Natural language processing and machine learning power intelligent chatbots that can handle complex customer inquiries and provide personalized assistance.

- Natural Language Processing: ML-powered chatbots understand customer intent, context, and emotion. They can handle multiple languages and adapt their responses based on customer history and preferences.

- 24/7 Automated Support: AI chatbots provide instant responses to customer questions, handle routine transactions, and escalate complex issues to human agents when necessary.

Case Example: Bank of America’s Erica, a virtual assistant, serves over 32 million users. The AI assistant utilizes natural language processing to assist customers in checking balances, paying bills, and receiving personalized financial insights. Erica handles over 100 million requests annually.

5. Regulatory Compliance and AML

Machine learning automates compliance processes and enhances anti-money laundering (AML) detection capabilities.

- Automated Reporting: ML systems automatically generate regulatory reports, ensuring accuracy and compliance with changing regulations across different jurisdictions.

- Anti-Money Laundering Detection: Traditional AML systems rely on rules-based approaches that generate many false positives. ML systems analyze transaction patterns, customer behavior, and network relationships to identify suspicious activity more accurately.

Case Example: HSBC implemented ML-powered AML systems that reduced false positives by 20% while improving the detection of actual money laundering activities. The system analyzes complex transaction networks and identifies previously hidden suspicious patterns.

6. Personalized Financial Recommendations

Machine learning helps fintech platforms deliver tailored financial advice by analyzing user behavior, transaction history, and financial goals. These systems offer personalized budgeting tips, investment suggestions, and product recommendations based on individual patterns. ML models track spending habits, income trends, and lifestyle choices to guide users toward smarter financial decisions.

Case Example: Wally’s Smart Budgeting – Wally uses machine learning to analyze bills, cash flow, and spending behavior, offering personalized financial insights and savings advice.

7. Financial Forecasting and Analytics

ML algorithms are widely used to predict market trends, customer behavior, and business performance. These models process large volumes of financial data to generate forecasts that support investment, lending, and strategic planning. They analyze historical data, real-time signals, and external factors like news sentiment to identify patterns and correlations.

Case Example: Renaissance Technologies employs ML-driven trading strategies that have delivered annual returns of up to 66%, demonstrating how predictive analytics can drive high-performance investing.

8. Robotic Process Automation (RPA) in Financial Operations

Machine learning enhances robotic process automation by enabling bots to handle repetitive financial tasks with greater accuracy and speed. These tasks include data entry, document verification, account updates, and transaction processing. ML-powered bots learn from past actions to improve efficiency and reduce errors over time.

Case Example: Zurich Insurance used RPA to automate data validation and system balancing, cutting processing time and reducing customer service requests.

Benefits of Machine Learning in Fintech

- Personalized Services – ML enables financial institutions to deliver customized recommendations, credit offers, and investment advice, thereby enhancing customer engagement and loyalty.

- Faster Processing – Automates routine operations like loan approvals and KYC, reducing manual intervention and speeding up decision-making.

- Predictive Insights – Accurately forecasts customer needs, spending patterns, and default risks, enabling proactive financial planning.

- Operational Efficiency – Cuts costs by automating repetitive tasks, minimizing human errors, and improving overall workflow efficiency.

- Stronger Risk Management – Enhances fraud detection, credit scoring, and portfolio monitoring with real-time analytics and anomaly detection.

Challenges of Machine Learning in Fintech

- Data Privacy Risks – Financial data is highly sensitive, making security breaches or poor data handling a major concern for compliance.

- Regulatory Pressure – Strict regulations demand transparency and explainability in ML models, which many complex algorithms lack.

- Legacy System Barriers – Outdated banking systems often struggle to integrate advanced ML tools, leading to inefficiencies.

- Talent Shortage – Skilled professionals who understand both finance and ML are in high demand but short supply.

- Bias Concerns – Poorly trained models risk reinforcing unfair lending practices or discriminatory behavior, potentially damaging brand trust.

AI in Finance Use Cases: 10 Ways Artificial Intelligence Delivers Better ROI

Explore top AI use cases in finance—fraud detection, credit scoring, trading, customer service.

Case Studies – Machine Learning in Action

1. PayPal – Fraud Prevention with ML

PayPal faces unique fraud challenges due to its global reach and diverse user base. Traditional rule-based systems generated too many false positives, frustrating legitimate users while missing sophisticated fraud attempts.

- The Challenge: PayPal needed to reduce fraud while maintaining a smooth user experience. Their legacy system flagged many legitimate transactions as suspicious, requiring manual review that slowed processing times.

- The ML Solution: PayPal implemented a comprehensive ML platform that analyzes over 1,000 data points per transaction in real-time. The system considers device fingerprints, behavioral patterns, transaction history, and network analysis.

- Results: PayPal reduced its fraud rate to below 0.32% while processing over 19 billion payments annually. False positives decreased by 50%, improving customer experience while maintaining strong fraud protection.

2. Upstart – ML-powered Credit Scoring

Traditional credit scoring excludes millions of potential borrowers who lack sufficient credit history. Upstart wanted to expand access to credit while maintaining responsible lending practices.

- The Challenge: Conventional credit models rely heavily on FICO scores and credit bureau data, which can exclude young adults, immigrants, and others with limited credit history.

- The ML Solution: Upstart developed ML models that analyze over 1,000 data points, including education, employment history, and area of study. Their algorithms identify creditworthy borrowers whom traditional models might reject.

- Results: Upstart approves 27% more borrowers than traditional models while maintaining the same loss rates. Their average APR is five percentage points lower than that of traditional lenders, saving borrowers money.

The Ultimate Guide to Machine Learning Consulting

Learn how machine learning consulting guides businesses from strategy to deployment with expert support.

Kanerika’s Machine Learning Solutions for Financial Services

Kanerika helps fintech companies build machine learning solutions that solve real problems. We support everything from planning to deployment, with a focus on financial services. Our systems are built for fraud detection, credit scoring, customer support, and other key areas, while staying compliant with data privacy laws and industry regulations.

We design ML architectures that fit your business and work with your existing systems. Our tools are built for scale and speed. They automate decisions, monitor transactions in real time, and improve accuracy across operations. We also focus on explainable AI, so your models stay transparent and regulator-friendly.

Our team brings deep fintech experience and technical expertise. We use deep learning for document checks, NLP for chatbots, and predictive analytics for risk scoring. Whether you’re modernizing legacy systems or launching new ML features, Kanerika helps you move faster, reduce costs, and deliver better results.

Case Study: Fraud Detection in Fintech with ML-Powered RPA

Client

A digital payments company serving the healthcare and travel sectors

Challenge

The client’s fraud detection relied on manual checks. This slowed down transaction approvals and missed hidden patterns of fraud. They needed a scalable solution that could detect anomalies without increasing headcount.

Solution

Kanerika built an ML-powered RPA system using anomaly detection, NLP, and image recognition. It scanned transactions, flagged suspicious entries, and routed them for deeper review. The system has learned from past fraud cases and has improved its detection capabilities over time.

Impact

- 20% faster transaction review

- 25% boost in operational efficiency

- 36% cost savings from reduced fraud and manual effort

- Fraud detection became proactive instead of reactive

Ready to build ML features into your fintech product? Talk to Kanerika’s experts today.

Accelerate Innovation with Machine Learning Solutions

Partner with Kanerika for Expert AI implementation Services

FAQs

1. How is machine learning disrupting traditional banking and finance?

Machine learning is transforming banking by automating routine processes, enabling faster fraud detection, and improving decision-making. It helps financial institutions reduce operational costs, deliver personalized services, and gain insights from large volumes of data that would be impossible to process manually.

2. Can machine learning really predict loan defaults better than humans?

Yes, machine learning models can predict loan defaults more accurately than human judgment or traditional methods. They analyze thousands of data points, including spending behavior, employment history, and alternative data, to identify patterns that indicate risk. This allows lenders to make smarter, data-driven credit decisions.

3. What makes machine learning more effective than rule-based fraud detection?

Rule-based fraud detection relies on predefined conditions, which makes it rigid and easy for fraudsters to bypass. Machine learning, on the other hand, continuously learns from new data and adapts to evolving fraud patterns. This dynamic approach reduces false positives while improving the accuracy of fraud detection.

4. Is machine learning in fintech only for big companies, or can startups use it too?

Machine learning is no longer limited to large enterprises. With cloud-based platforms and AI-as-a-service tools, even startups can implement machine learning for tasks like credit scoring, compliance monitoring, and chatbot support. This levels the playing field and helps smaller players innovate quickly.

5. How does machine learning improve customer experience in digital banking?

Machine learning enhances customer experience by offering personalized recommendations, real-time support, and predictive financial insights. AI-driven chatbots provide instant answers to queries, while advanced analytics helps banks anticipate customer needs and deliver tailored solutions, improving engagement and satisfaction.

6. What are the biggest challenges of adopting machine learning in fintech?

The major challenges include ensuring data privacy, meeting regulatory requirements, and maintaining high-quality data for model training. Additionally, the cost and complexity of developing machine learning systems can be significant, requiring skilled talent and robust infrastructure to implement successfully.