Handling accounts payable manually often comes with challenges like delays in approvals and higher processing costs. Research from Ardent Partners shows that automating accounts payable can reduce costs by up to 80% and shorten invoice approval times by 70%. With such clear advantages, businesses are increasingly adopting accounts payable automation to simplify workflows and improve accuracy in their financial processes.

Accounts payable automation represents a transformative shift that shows how businesses manage their financial operations. Let’s say a manufacturing company processes 5,000 invoices monthly, consuming approximately 120 staff hours with manual entry, verification, and approval processes. By implementing accounts payable automation, the same organization can reduce processing time by up to 80%, freeing critical human resources for strategic financial planning and value-added activities.

Enhance Your Invoice Processing Speed and Efficiency with FLIP!

Partner with Kanerika Today.

What is Accounts Payable Automation?

Accounts Payable Automation refers to the use of technology to streamline and manage the accounts payable (AP) process, which involves receiving, processing, and paying invoices from suppliers. Instead of relying on manual tasks like data entry, approvals, and payment processing, automation tools handle these steps efficiently. Key features include automated invoice capture, validation, approval workflows, and electronic payments.

This reduces errors, speeds up processing, and enhances visibility into financial transactions. By integrating with accounting systems, accounts payable automation ensures compliance, strengthens vendor relationships through timely payments, and helps businesses save time and costs while maintaining better control over cash flow. Furthermore, integrating accounts payable into NMI’s white label payment gateway or a similar platform helps your clients pay you faster.

Critical Challenges Business Face with Accounts Payables

1. Manual Data Entry

Manual data entry is a tedious and error-prone process. It increases the risk of inaccuracies, such as incorrect invoice details or payment amounts. These errors lead to delayed payments, disputes with vendors, and additional effort to rectify mistakes, ultimately slowing down the entire accounts payable workflow.

2. High Processing Costs

Processing invoices manually involves substantial labor and administrative costs. These include printing, filing, and postage expenses. The inefficiency of handling physical documents adds up over time, making it costly for businesses to manage high volumes of invoices, especially when compared to the streamlined processes offered by automation.

3. Late Payments

Without clear workflows and automated reminders, businesses often miss payment deadlines. This results in penalties, strained vendor relationships, and missed opportunities for early payment discounts. Late payments also affect a company’s reputation, making it harder to negotiate favorable terms with suppliers in the future.

4. Duplicate Payments

Duplicate payments occur when invoices are processed multiple times due to poor tracking or inconsistent approval processes. This issue not only impacts cash flow but also requires significant effort to identify and recover funds, disrupting financial operations and creating distrust among vendors.

5. Fraud Risk

Accounts payable fraud, such as fake invoices or unauthorized payments, is a growing concern for businesses. Weak internal controls and manual verification processes increase vulnerability to fraud, leading to financial losses and reputational damage. Businesses need robust systems to detect and prevent such activities effectively.

6. Lack of Visibility

Manual accounts payable systems often lack real-time tracking and reporting capabilities. This makes it difficult for businesses to monitor pending invoices, payment statuses, and overall cash flow. Poor visibility can hinder decision-making and create challenges in financial planning and forecasting.

7. Inefficient Approval Workflows

Traditional approval workflows are often paper-based and require multiple signoffs, causing delays. Employees spend unnecessary time tracking down approvers or waiting for approvals to move forward. This inefficiency can bottleneck processes and slow down operations, particularly when dealing with high invoice volumes.

Data Automation: A Complete Guide to Streamlining Your Businesses

Accelerate business performance by systematically transforming manual data processes into intelligent, efficient, and scalable automated workflows.

8 Key Benefits of Accounts Payable Automation

1. Cost Reduction

Automation significantly reduces processing costs by minimizing manual labor, eliminating paper-based processes, and reducing human errors. Organizations can save up to 80% on invoice processing expenses by implementing intelligent automation technologies that streamline repetitive financial tasks.

2. Improved Accuracy

Automated systems dramatically reduce human error in financial transactions. Advanced optical character recognition (OCR) and machine learning technologies accurately capture, validate, and process invoice data, ensuring precision in financial record-keeping and minimizing costly mistakes.

3. Enhanced Operational Efficiency

Automation accelerates invoice processing cycles, reducing approval times from weeks to days. Intelligent workflows automatically route invoices, send notifications, and track approvals, enabling finance teams to focus on strategic financial management rather than routine administrative tasks.

4. Better Cash Flow Management

Real-time visibility into financial obligations allows businesses to optimize payment strategies. Automated systems provide instant insights into outstanding invoices, payment due dates, and potential early payment discounts, enabling more strategic financial decision-making.

5. Vendor Relationship Optimization

Consistent, timely payments and transparent communication improve vendor relationships. Automated systems ensure invoices are processed quickly, payments are made on time, and vendors receive real-time status updates, fostering trust and potentially negotiating better terms.

6. Compliance and Risk Mitigation

Automated AP systems create comprehensive audit trails, ensuring regulatory compliance and reducing fraud risks. Built-in validation checks, approval workflows, and detailed transaction logs provide robust protection against financial irregularities.

7. Data-Driven Insights

Advanced analytics and reporting capabilities transform accounts payable from a transactional function to a strategic information source. Businesses can analyze spending patterns, identify cost-saving opportunities, and make more informed financial decisions.

8. Scalability

Automation solutions easily adapt to business growth, handling increasing invoice volumes without proportional increases in staff or processing time. Cloud-based systems provide flexible, scalable infrastructure that grows with organizational needs.

FLIP: Your #1 Choice for Accounts Payable Automation

FLIP, a SaaS-based solution built on scalable architecture, helps simplify your accounts payable and invoice processing. Designed for Azure, AWS, and GCP, Flip automates end-to-end workflows—from purchase orders to payment processing. Gain real-time alerts, insightful analytics, and a user-friendly dashboard to monitor trends effortlessly. Flip transforms tedious manual tasks into seamless operations, boosting efficiency and accuracy across your accounts payable process.

Important Features of FLIP AP Automation

1. Independent of Invoice Formats

FLIP seamlessly processes invoices in PDF, scanned documents, JPEG, and more, ensuring flexibility and compatibility across diverse input formats.

2. Leverages Gen AI for Accurate Data Extraction

Powered by Generative AI, FLIP delivers unmatched accuracy in extracting critical data, reducing errors and manual intervention.

3. Low-Code/No-Code Platform

FLIP is easy to configure with minimal or no coding expertise, enabling quick adoption and reduced implementation time.

4. Real-Time Alerts and Notifications

Stay informed with instant alerts for missing or inconsistent data, ensuring smoother operations and fewer delays.

5. Pay-as-You-Go Model with Free Trial

Experience FLIP risk-free with a 14-day free trial, and scale effortlessly with a flexible, pay-as-you-go pricing model.

Hyperautomation Trends Guide 2024: Everything you need to know

Elevate enterprise performance through intelligent, comprehensive automation technologies and strategic digital transformation.

6. Open-Source Microservices Architecture

FLIP’s architecture is built on open-source microservices, ensuring reliability, scalability, and easy integration with existing systems.

7. Pre-Built Transformation and Validation Rules

FLIP includes ready-made rules to validate and transform data, simplifying complex workflows and improving accuracy.

8. Adaptable to Dynamic Business Environments

With built-in intelligence, FLIP adapts to changing invoice formats, keeping up with evolving business needs effortlessly.

9. Interactive Dashboards

Visualize trends and insights with FLIP’s easy-to-use dashboards, empowering data-driven decision-making.

10. Pre-Built Connectors for Data Integration

FLIP integrates seamlessly with multiple data sources through pre-built connectors, ensuring efficient and error-free workflows.

Key Capabilities of FLIP Accounts Payable Automation Platform

1. AI-Enabled Document Processing

FLIP leverages advanced AI to intuitively extract data from images and PDF invoices. This smarter data capture ensures accurate, streamlined document and accounts payable automation, minimizing manual input while boosting speed and reliability in processing.

2. ERP Integrations

FLIP seamlessly integrates with leading ERP systems, enabling further data cleaning, transformation, and analytics. This integration ensures that businesses can extract meaningful insights to optimize financial workflows and make informed decisions effortlessly.

3. Auto Detect Discrepancies

FLIP automatically identifies discrepancies in invoices, such as mismatched amounts or missing data, and suggests corrective measures. This reduces errors, prevents overpayments, and ensures compliance with financial processes.

4. No Code/Low Code Automation

FLIP offers an intuitive drag-and-drop interface for easy mapping, transformation, and rule creation. Its low-code/no-code environment supports version control and empowers users to customize workflows without needing technical expertise.

5. Multiple Formats Processing

FLIP efficiently processes invoices in various formats, including PDFs, JPEGs, and scanned images. This flexibility eliminates format-related delays, ensuring a smooth and consistent workflow across diverse invoice sources.

6. Multiple Invoice Identification

FLIP can identify and process multiple invoices embedded within a single file. This capability saves time, reduces manual effort, and accelerates processing for high-volume accounts payable operations.

UiPath vs Automation Anywhere: Choosing the Best RPA Tool

Compare and evaluate enterprise-level robotic process automation platforms to identify the optimal solution for organizational efficiency and digital transformation.

Common Challenges in Accounts Payable Management and FLIP’s Solutions

1. Lack of Integration with ERP Tools

FLIP seamlessly integrates with ERP systems, enabling smooth data flow for analysis and reporting. This eliminates manual data transfers, reduces errors, and ensures an efficient, unified financial workflow.

2. Difficulty Processing Multiple Invoice Formats

With AI-ML-powered OCR technology, FLIP accurately extracts data from PDFs, scanned images, and JPEGs. This ensures fast, error-free processing across diverse formats, improving efficiency and reducing manual intervention.

3. Lack of Visibility for Processed Invoices

Real-time alerts and a live dashboard provide complete visibility into processed invoices. These features offer actionable insights, empowering businesses to track, monitor, and optimize their accounts payable processes effectively.

4. Higher OpEX and CapEX

FLIP offers flexible pricing, starting with a 14-day free trial and a Pay-as-You-Go model. This approach reduces upfront investment while allowing scalability, making it cost-effective for businesses of all sizes.

DataOps Benefits: Ensuring Data Quality, Security, And Governance

Transform organizational data strategies by integrating advanced operational practices that optimize quality, security, and governance.

Case Studies: FLIP’s Accounts Payable Automation Capabilities

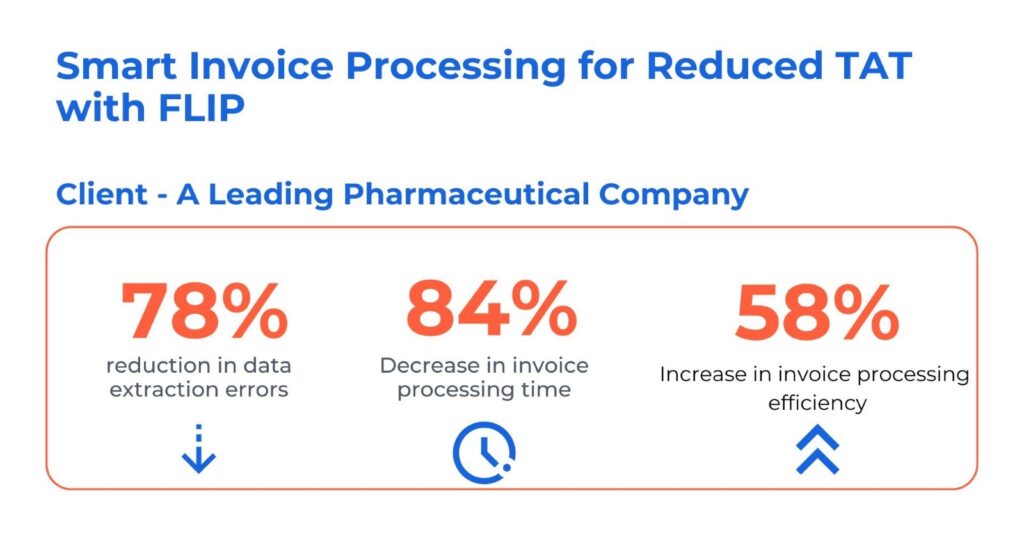

1. Smart Invoice Processing for Reduced TAT

The client is a leading pharmaceutical company in the USA. They faced challenges with a complex invoice tracking system spanning 20 disparate portals and email channels. The diverse document formats and manual data extraction processes significantly increased error rates and financial risks across their invoice management workflow.

By leveraging the capabilities of FLIP, the team at Kanerika helped resolve the client’s challenges by providing the following solutions:

- Centralized invoice collection from various state portals and emails, enhancing payment efficiency and financial tracking

- Standardized diverse invoice formats into a unified data structure, streamlining processing

- Instituted format-specific validation checks for each invoice, ensuring accuracy and reducing financial errors

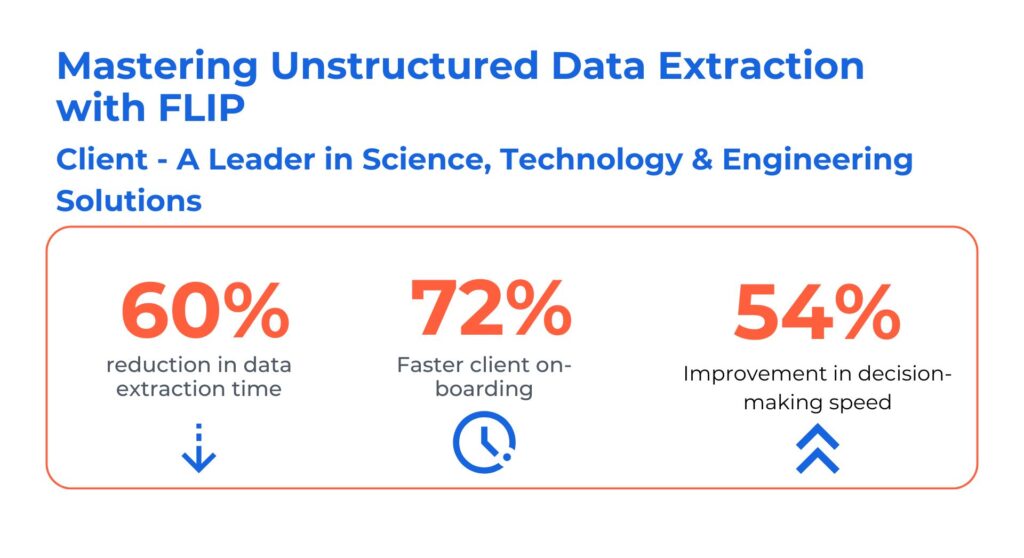

3. Mastering Unstructured Data Extraction with FLIP

The client is a global leader in science, technology, and engineering solutions, providing services to customers in over 80 countries. The company faced challenges with streamlining operations and improving efficiency. They needed a state-of-the-art AI-driven data extraction solution to automate data processing from complex, unstructured documents.

By leveraging FLIP’s advanced capabilities, Kanerika offered the following solutions:

- FLIP efficiently extracted content from PDFs and Excel files, including complex tabular data and AI-generated summaries, meeting the client’s specific requirements.

- The extracted data was stored in structured formats (XLS, JSON, SQL tables), enabling easy analysis and integration with the client’s existing systems.

- FLIP’s intuitive drag-and-drop interface and auto-mapping features allowed their team to create data pipelines easily, while the Monitor Page streamlined exception handling and error management.

FLIP: Simplifying Accounts Payable and DataOps with AI-powered Automation

FLIP by Kanerika is a powerful AI-driven, low-code/no-code platform designed to streamline accounts payable (AP) and DataOps processes for modern businesses. Built on a scalable SaaS architecture and compatible with Azure, AWS, and GCP, FLIP automates the entire AP workflow—from purchase orders and invoice processing to payment execution—ensuring faster, error-free operations.

The platform simplifies data transformation pipelines, enabling businesses to process and analyze data with unparalleled speed. Its intuitive drag-and-drop interface allows users to configure workflows effortlessly, reducing reliance on IT teams and accelerating implementation.

With features like real-time alerts, insightful analytics, and interactive dashboards, FLIP provides complete transparency, helping businesses monitor trends and make informed decisions. The system is designed to handle multiple invoice formats, detect discrepancies, and integrate seamlessly with ERP systems, ensuring a unified and efficient financial ecosystem.

Businesses benefit from FLIP by reducing operational costs, minimizing errors, and improving efficiency. Whether you’re looking to enhance financial workflows or unlock insights from your data, FLIP offers the tools to transform manual tasks into automated, scalable solutions.

Frequently Asked Questions

Can you automate accounts payable?

Yes, accounts payable (AP) can be automated using software solutions. These platforms streamline tasks like invoice processing, data entry, approvals, and payments. Automation reduces errors, accelerates workflows, and improves visibility, enabling businesses to save time and costs while maintaining better financial control.

Is AP automation worth it?

AP automation is highly worth it for businesses looking to optimize operations. It lowers processing costs, minimizes errors, and enhances efficiency by eliminating manual tasks. Additionally, automation improves cash flow visibility, strengthens vendor relationships through timely payments, and enables scalability as invoice volumes grow.

What is the full cycle of AP?

The full cycle of accounts payable includes receiving invoices, verifying details, obtaining approvals, processing payments, and maintaining accurate financial records. This process ensures suppliers are paid on time, maintains compliance, and provides visibility into a company’s financial obligations.

What is AP software?

Accounts payable (AP) software automates and manages the AP process, including invoice capture, approval workflows, and payment processing. It reduces manual effort, improves accuracy, and provides analytics for better financial management, making it an essential tool for modern businesses.

What is AP in banking?

In banking, accounts payable (AP) refers to the management of a company’s short-term financial obligations, such as unpaid bills or invoices from suppliers. Efficient AP processes ensure timely payments, maintain vendor trust, and support overall financial health.

Why is accounts payable important?

Accounts payable is vital for managing a company’s financial obligations. It ensures timely payments to suppliers, maintains strong vendor relationships, and helps manage cash flow effectively. A well-managed AP process also supports compliance and reduces financial risks.