What is Insurtech?” Insurtech, blending “insurance” and “technology,” embodies the innovative integration of technology into insurance services and products. By leveraging advancements like artificial intelligence, big data, and the Internet of Things (IoT), insurtech companies aim to enhance customer experience, streamline policy management, and increase efficiency within the insurance industry.

You encounter insurtech whenever you use a mobile app to buy insurance coverage, enjoy personalized rates based on your behavior, or when you file claims through an automated system.

This technological wave has been transforming the traditionally conservative insurance sector into a dynamic and customer-centric industry. Insurtech not only serves to improve the end-user experience but also contributes to advancements in risk management and fraud detection. With real-time data analytics and machine learning algorithms, you can now access policies that are priced more accurately according to your risk profile. Insurers can also identify and prevent fraudulent claims more effectively, ensuring a fairer system for all policyholders.

Table of Contents

- The Concept of Insurtech

- Historical Development of Insurance Technology

- Technologies Surrounding InsurTech

- Impact on the Insurance Industry

- Major Players in InsurTech

- Regulatory Environment

- Challenges and Limitations

- Future of InsurTech

- Kanerika – Creating the Future of Insurance with Insurtech

- FAQs

The Concept of Insurtech

Insurtech, as a subset of fintech, encompasses a wide range of applications, from the way you buy insurance to how claims are processed.

Key Components:

- Data Analytics: You benefit from personalized insurance rates through sophisticated algorithms and big data analytics

- Artificial Intelligence: AI helps in claims processing and fraud detection, streamlining your experience

- Mobile Apps: Insurtech includes the development of user-friendly mobile apps for managing policies and filing claims with ease

| Advantages | Details |

| Customer Experience | Simplified processes and intuitive interactions |

| Cost Efficiency | Lower premiums and operational costs through automation |

| Personalization | Tailored coverage options based on individual risk profiles |

| Accessibility & Convenience | 24/7 access to services and information via mobile apps |

Insurtech is not just for startups; traditional insurers are also integrating tech solutions to stay competitive. Your interactions with insurers are becoming more direct, with less reliance on intermediaries.

Remember, your understanding of Insurtech shapes your expectations and demands from insurance providers. With Insurtech’s growth, your ability to access customer services quickly and efficiently is continually improving.

Historical Development of Insurance Technology

Insurtech’s journey began with the digitization of insurance processes and has rapidly evolved, integrating cutting-edge technology to revolutionize the industry.

Origins of Insurtech

In the early 2000s, you witnessed the birth of Insurtech, arising from the need to modernize the traditional insurance sector. At this time, advancements in Internet technology provided the primary fuel. Companies began using technologies to streamline operations, improve customer service, and reduce costs. The initial phase focused mainly on automating existing processes.

Evolution Over Time

The progression of Insurtech over the past two decades has been characterized by rapid technological innovation and adoption. In the following phases:

- Mid-2000s to 2010s:

- The rise of smartphones and mobile internet increased customer expectations for on-the-go services

- Big Data and analytics started to play essential roles in risk assessment and personalized insurance products

- 2010s to Early 2020s:

- The application of artificial intelligence (AI) and machine learning (ML) significantly advanced risk evaluation, fraud detection, and customer experience

- Blockchain technology began influencing the sector, offering improved transparency and efficiency

- Startups proliferated, offering niche services like pay-per-mile insurance and automated claims processing

By the mid-2020s, Insurtech became inseparable from the movement towards customer-centric services, data-driven risk assessment, and the implementation of IoT (Internet of Things) devices for real-time data collection and monitoring, deeply embedding technology within the insurance landscape.

Also Read- Generative AI For Insurance: Use Cases And Applications

Read More – Telematics in Insurance: How It Works and Benefits You

Technologies Surrounding Insurtech

In the landscape of Insurtech, certain technologies have become pivotal in reshaping how you interact with insurance services. Each technology brings a unique set of capabilities that enhance various facets of the insurance process.

Big Data Analytics

Big Data Analytics plays a critical role in Insurtech by allowing for more precise risk assessment and personalized pricing. Your insurance provider uses vast amounts of data and advanced algorithms to understand risk patterns, which leads to more accurate premium calculations and policy personalization.

Artificial Intelligence

In the realm of Artificial Intelligence (AI), you benefit from automation and machine learning to streamline claims processing and underwriting. AI assists in fraud detection by analyzing patterns that would be impossible to identify manually, thereby saving time and reducing losses.

Blockchain Technology

Blockchain Technology offers a decentralized and transparent ledger which is beneficial for claims management and fraud prevention. By employing smart contracts, insurers can automate claim payouts, reducing the potential for dispute and enhancing trust in your transactions.

IoT and Wearables

The integration of the Internet of Things (IoT) and wearables provides real-time data that insurers use to monitor client behavior and health. This technology allows you to potentially lower your premiums through demonstrated safe habits or healthy lifestyles, as devices like fitness trackers communicate directly with insurance providers.

Impact on the Insurance Industry

The integration of insurance and technology has fundamentally altered how you interact with insurance services.

Disruption of Traditional Models

Your understanding of traditional insurance practices is challenged by insurtech. Startups and established companies harness big data, AI, and machine learning to offer dynamic pricing models, redefine risk assessment, and streamline claims processes. This shift can oblige traditional insurers to adapt or risk obsolescence.

Customization of Policies

You now have access to hyper-customized policies tailored to individual needs. Insurtech innovations allow for the collection of real-time data via devices like smartphones and wearables, enabling insurers to offer you policies based on actual rather than projected behavior.

Read the Case Study- Standardized Data Organization in Insurance systems using RPA

Enhanced Customer Experience

Your experience with insurance firms has transformed dramatically. Insurtech provides you with real-time support and services, mobile applications for managing policies, and automated claims processes which significantly reduce waiting times. This customer-centric approach leads to higher satisfaction and improved engagement with your insurance providers.

Major Players in Insurtech

Within the Insurtech landscape, the industry is shaped by a dynamic mix of startups bringing innovation, established insurers integrating new technologies, and technology providers that enable advancements. Each segment has its key contributors driving change and growth in the market.

Startups and Innovators

- Lemonade: Pioneering the use of AI for claims processing and policy management

- Oscar Health: Focused on customer-centric health insurance using technology to simplify navigation of healthcare

Established Insurance Firms

- Allianz: Actively incorporating digital tools in their product offerings

- AXA: Investing heavily in digital transformation and partnering with tech startups

Technology Providers

- IBM: Offers AI solutions like Watson for data analysis in insurance

- Salesforce: Provides customer relationship management tools tailored for the insurance sector

Read More – 7 Big Data Use Cases and Trends In Insurance

Regulatory Environment

The regulatory environment in insurtech is complex due to the intersection of technology and traditional insurance regulations. This section provides an overview of the compliance challenges you may face and the use of Regulatory Technology (RegTech) to address them.

Compliance Challenges

As an insurtech player, you need to navigate a multifaceted regulatory landscape. Insurance regulations vary significantly by jurisdiction, which means that what is permissible in one area might be restricted in another. For instance:

- Licensing Requirements: You must obtain necessary licenses before offering insurance products. These licenses are specific to different types of insurance, such as life, health, or property

- Consumer Data Protection: Regulations like the General Data Protection Regulation (GDPR) in the EU set strict guidelines on how you must handle customer data

- Capital and Solvency: You are required to maintain certain levels of capital to ensure solvency and protect policyholders

Here is a checklist of common regulatory areas you should consider:

- Licensing and authorization

- Privacy and data security

- Solvency and capital adequacy

- Market conduct and fair treatment of customers

- Anti-money laundering (AML) and counter-terrorism financing (CTF)

Also Read- Secrets Of Being GDPR And CCPA Compliant

Regulatory Technology (RegTech)

RegTech solutions are essential tools that can help you comply with regulatory requirements more efficiently. By leveraging technologies such as AI and blockchain, RegTech can improve reporting accuracy and speed. Key benefits include:

- Automated Compliance Monitoring: Continuous monitoring of your operations to ensure compliance with existing regulations

- Data Management: Effective handling and reporting of large volumes of data are facilitated by adopting RegTech solutions

- Regulatory Reporting: Streamlines the process of compiling and submitting necessary reports to regulatory bodies

Consider the following applications of RegTech:

- Risk management systems

- Identity management and control

- Transaction monitoring

- Compliance data management

- Regulatory reporting software

Challenges and Limitations

While Insurtech innovates the insurance industry, it faces significant challenges and limitations. These barriers must be understood to appreciate the sector’s intricacies and potential growth areas.

Security and Privacy Concerns

Your data is precious, and Insurtech companies handle a vast amount of sensitive information. Protecting this data against breaches is paramount. Regulatory compliance with data protection laws like GDPR and HIPAA adds layers of complexity to security measures. Consistent vigilance and investment in robust cybersecurity systems are non-negotiable necessities.

- Data Risks: Potential for data theft and unauthorized access

- Compliance Requirements: Need to adhere to various international, regional, and local regulations

Integration with Legacy Systems

You may find that integrating cutting-edge Insurtech solutions with existing legacy systems is a considerable hurdle. These older systems can be inflexible, complex, and often do not support the agility that Insurtech offers.

- Compatibility Issues: Difficulties in aligning new tech with old systems

- Cost Implications: Significant investment required for systems update or replacement

Scaling Insurtech Solutions

As Insurtech companies grow, scaling their technology and business models sustainably is a challenge. You need to consider not just the technical scalability but also how to maintain service standards and manage regulatory requirements across different markets.

- Managing Growth: Balancing rapid growth with service quality and regulatory compliance

- Resource Allocation: Ensuring adequate capital and talent are available to support scaling efforts

Future of Insurtech

The Insurtech landscape is rapidly evolving with technological advancements propelling new capabilities and offerings. Here’s what you can expect to see in key areas of development:

Predictive Analytics

You’re going to see a surge in the use of predictive analytics. Insurance providers will leverage big data and machine learning models to forecast future claims better, enhancing pricing precision and risk assessment. This will enable you to benefit from more personalized insurance premiums that more accurately reflect your risk profile.

- Personalization: Tailored policies using individual risk assessment

- Risk Mitigation: Proactive measures suggested to minimize claim likelihood

Peer-to-Peer (P2P) Insurance

Peer-to-Peer (P2P) Insurance is gaining traction. In this model, small groups pool their premiums together to insure against a collective risk. You’ll witness:

- Transparency: Clearer visibility on the use of pooled funds

- Control: Group members have input on claim payouts

- Savings: Potential return of unused premiums to you at the end of the policy period

On-Demand Insurance

With on-demand insurance, you gain flexibility and control over your insurance coverage. Policies become more granular, switching on and off in response to your immediate needs.

- Customization: Activate or deactivate coverage based on real-time needs

- Convenience: Immediate coverage with the tap of a button on your mobile device

Kanerika – Creating the Future of Insurance with Insurtech

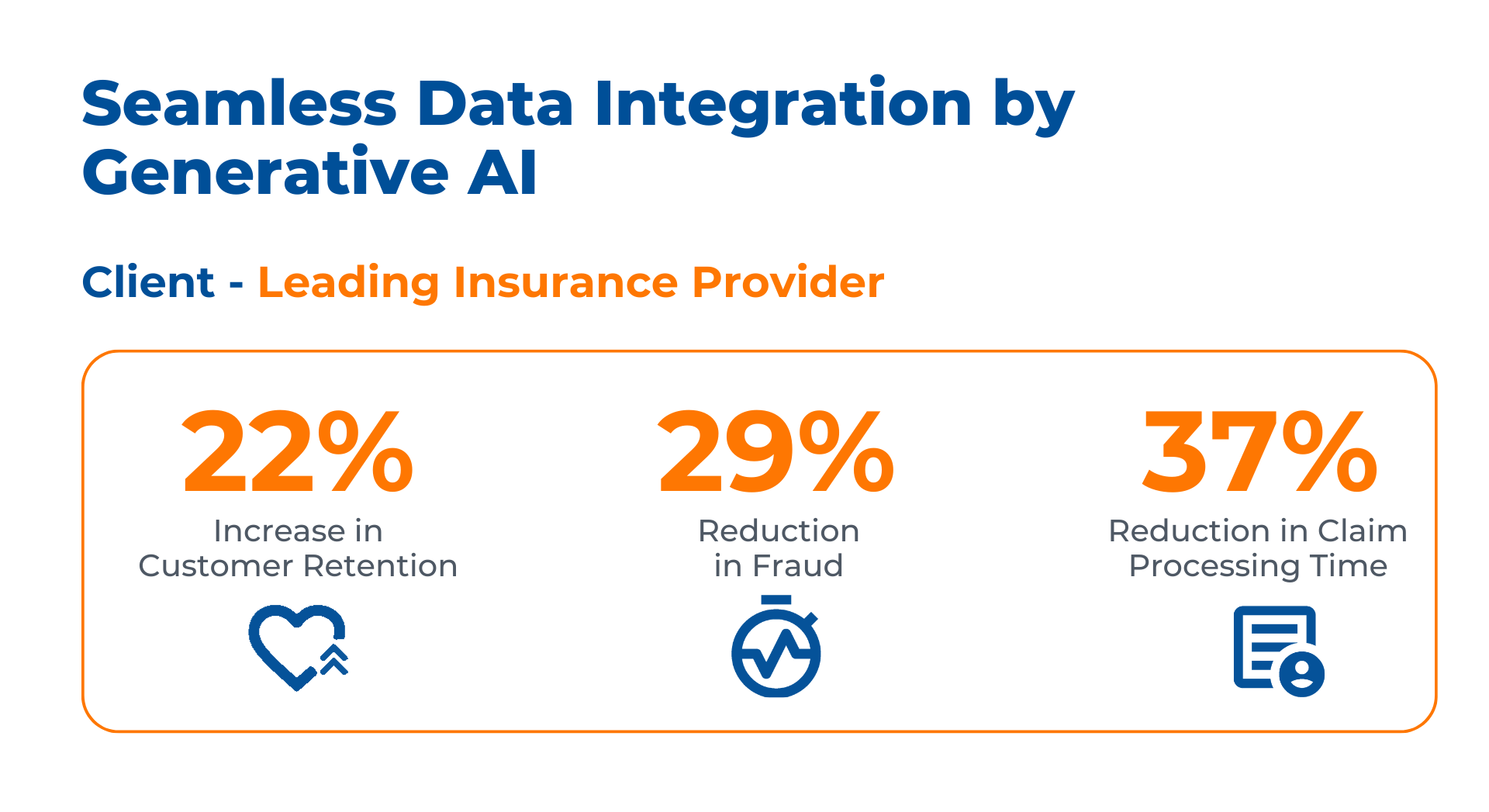

Case Study of Successful Generative AI Implementations

Facing a client’s challenge with error-prone manual processes, delays, and compliance issues, exacerbated by the complexity of integrating new data sources like wearables, we implemented a solution using Kafka for automated data extraction, Talend for data standardization, and Generative AI models like TensorFlow and PyTorch for efficient data alignment. This approach led to a remarkable improvement in operational efficiency and customer service, evidenced by a 22% increase in customer satisfaction, a 29% reduction in fraud, and a 37% acceleration in claim processing times, showcasing our ability to leverage Generative AI to deliver transformative results and address critical challenges in customer satisfaction, fraud, and claim processing.

Kanerika is revolutionizing the insurance industry by leveraging Insurtech to craft the future of insurance services. By incorporating state-of-the-art technologies like artificial intelligence, big data analytics, and the Internet of Things (IoT), Kanerika aims to deliver insurance solutions that are not only efficient but also personalized and focused on the customer experience. Moreover, this innovative approach streamlines every aspect of insurance, from policy acquisition to claims processing, making insurance more accessible and tailored to individual needs.

As a trailblazer in the Insurtech domain, Kanerika is committed to overcoming traditional industry challenges and meeting the modern consumer’s evolving demands. Through advancements in real-time data analytics, machine learning, and blockchain technology, Kanerika enhances risk management and fraud detection, setting new benchmarks for security and fairness in the insurance ecosystem. Kanerika’s vision is to lead the insurance industry into a future where technology enhances the connectivity between insurers and policyholders, fostering a more inclusive, efficient, and customer-centric market.

FAQs

How does insurtech differ from traditional insurance models?

What types of technologies are commonly used in insurtech?

What impact does insurtech have on the insurance industry?

Can you provide some examples of how insurtech is applied in health insurance?

What are the primary benefits of using insurtech for consumers?

How might insurtech change the future landscape of the insurance sector?