Did you know that the Barbie co-star, America Ferrera, had her smile insured for a staggering $10 million? That’s right! The home teeth-whitening product Aquafresh White Trays apparently bought the policy for her at the British insurance firm Lloyd’s.

Insurance is surely an interesting industry.

And so are its claims.

Today, the importance of customer experience cannot be overstated. To stay competitive, insurance and health insurance businesses are increasingly focusing on enhancing their front-end services.

Here’s where the concept of automation in insurance becomes a game-changer.

The benefits of automation in the insurance industry are extensive, including rapid processing for claims and fraud detection, enhanced decision-making, and significant cost reduction. Notably, insurance automation software and intelligent automation in insurance play crucial roles in innovating services and ensuring data security.

In fact, according to McKinsey, automation in the insurance industry can reduce claims processing costs by up to 30%.

In this article, we explore the impactful use cases, benefits, and strategies of automation in insurance, a current necessity driving innovation in the insurance landscape.

Table of Content

- Defining Insurance Automation and Its Significance in 2024

- Top 7 Use Cases for Automation in the Insurance Sector

- Benefits of Automation In The Insurance Industry

- Implementing Automation for Insurers: A Step-by-Step Process

- Insurance Automation Trends for 2024

- Kanerika: Your Partner in Insurance Automation

- FAQs

Defining Insurance Automation and Its Significance in 2024

It takes weeks and sometimes, even months to make a single-digit change in pricing in a legacy system. This sluggish process starkly contrasts with the agility of automation in insurance.

But that’s not all.

Insurance automation is a fundamental transformation of the industry’s operational framework.

Process automation in insurance involves leveraging technology and software to streamline and improve the efficiency of repetitive, labor-intensive, and error-prone tasks in insurance operations. Key areas like underwriting, claims processing, and policy management are ripe for this transformation.

By adopting automation in the insurance industry, companies can dramatically enhance operational efficiency, freeing staff from routine tasks to focus on more strategic activities. Moreover, automation in the insurance industry plays a crucial role in reducing costs associated with manual labor and paper-based processes.

Let’s take a look at 7 unique use cases that shape automation in the insurance industry.

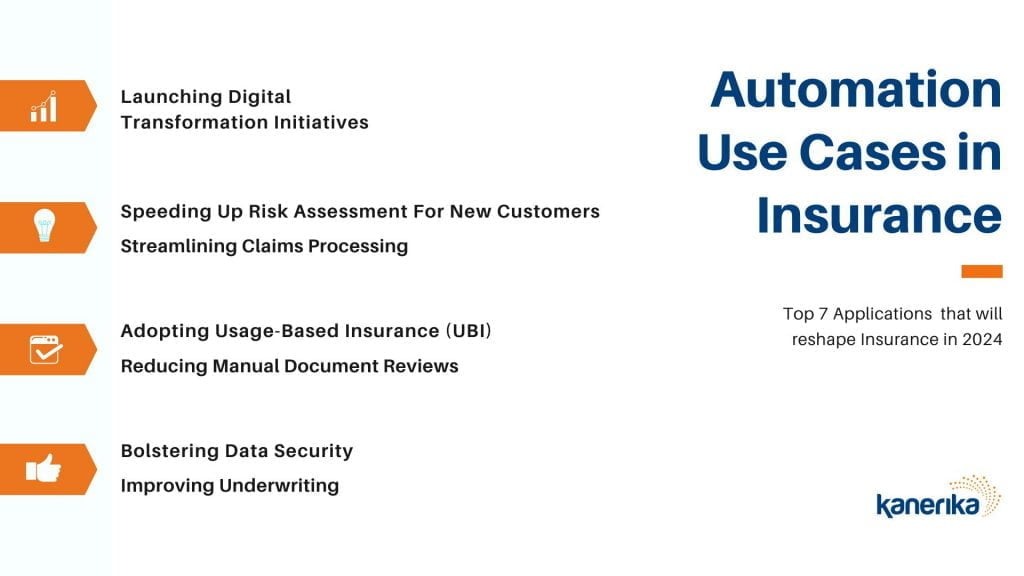

Top 7 Use Cases for Automation in the Insurance Sector

Launching Digital Transformation Initiatives

The insurance industry is increasingly prioritizing digital transformation. According to Accenture, 68% of insurers have identified digital solutions as their top strategic priority.

Customers today expect digital services as a standard offering. Insurance companies that hesitate to embrace automation risk falling behind their competitors, who are increasingly providing faster, more efficient, and more personalized services through advanced technological solutions.

Consider the case of Kanerika’s client, a global leader in the insurance sector, which exemplifies the transformative power of digital initiatives.

Faced with the challenges of time-consuming manual data integration, leading to errors and compliance risks, the company embraced a digital overhaul. We implemented automated data extraction using Kafka, enhancing efficiency and accuracy. Talend was used for standardizing data, and generative AI models like TensorFlow and PyTorch streamlined data integration.

This approach led to significant improvements: a 22% increase in customer satisfaction, a 29% reduction in fraud, and a 37% cut in claim processing time, demonstrating the powerful role of automation in insurance.

Also Read- Improved Processes: Streamlining Operations with Generative AI in Insurance

Streamlining Claims Processing

Claims processing marks the primary interaction point between customers and insurers.

This service is prime for digital transformation because it has historically experienced delays and onerous paperwork. Automation in insurance, particularly in claims processing, offers a revolutionary solution to these challenges.

Kanerika’s experience with a leading global insurance company illustrates the profound impact of digital transformation in claims processing. The client grappled with inefficient manual processes and lacked a robust fraud detection system, leading to financial losses and vulnerability to fraudulent claims.

Implementing AI/ML-driven Robotic Process Automation (RPA) revolutionized their approach, significantly reducing fraud-related financial losses and improving customer satisfaction. By leveraging predictive analytics, AI, and NLP, the company not only enhanced fraud detection but also streamlined operational processes.

The result was a remarkable 20% reduction in claim processing time, a 25% boost in operational efficiency, and a 36% increase in cost savings.

Speeding Up Risk Assessment For New Customers

We can all agree that customers today don’t like to wait.

However, the insurance industry has a dent. According to the American Academy of Actuaries, claims-based risk-assessment models typically utilize data from a 12-month period.

Moreover, the manual handling of such data can be slow and prone to errors, not aligning with the rapid response expected by today’s customers.

Automation in insurance offers a powerful solution to this challenge by enabling insurers to conduct risk assessments quickly and accurately. Here’s how —

One of Kanerika’s client was dealing with diversely formatted data from over 280 Managing General Underwriters (MGUs), involving policies, premiums, claims, and other services.

Their Data Operations team relied on manual Standard Operating Procedures (SOPs) to transform, enrich, and clean this data for their internal systems, struggling to keep pace with the growing business demands.

Kanerika developed a solution implementing an AI/ML algorithm to automatically detect data mapping from various sources to the insurance systems. This approach also addressed challenges in data formats, such as dates and Social Security Numbers.

The outcomes of this digital transformation were substantial: a 94% accuracy in AI-based mapping and automation, a 30% reduction in new customer onboarding time, and the ability to support 38% more business with less staff.

Adopting Usage-Based Insurance (UBI)

Forbes claims that Usage-based insurance (UBI) is best for those “looking for a type of car insurance that better reflects your good driving skills.”

The global market for UBI is expected to soar, with projections suggesting it could reach over $190 billion by 2026, and some estimates even predicting a rise to over $300 billion.

UBI programs collect telematics data from vehicles using technologies like cellular and GPS. This data includes various driving behaviors such as speed, acceleration, hard braking, hard cornering, miles driven, time of day, and phone use while driving.

However, the growing popularity of UBI presents a challenge for insurers: the need to keep pace with daily changes in how customers use their insurance.

Traditional manual methods for adjusting premiums in response to this data are not only time-consuming but also prone to errors.

Here, automation in insurance becomes a game-changer. Automation in the insurance industry, particularly in the context of UBI, allows for real-time data processing and premium adjustments, aligning insurance costs more closely with individual driving behaviors.

Reducing Manual Document Reviews

In the insurance industry, documentation is abundant and often complex.

Traditional processes involving manual document reviews can be time-consuming and error-prone, necessitating a significant amount of human intervention.

This is where the power of automation in insurance becomes evident. Automation can efficiently handle bulk document reviews for simpler cases, thereby freeing up employees to concentrate on more intricate and unique issues.

Kanerika’s work with a leading global insurance company serves as a prime example of the transformative impact of automation. The client faced challenges with the manual processing of claim files from over 500 partners, leading to delays, errors, and late payments. Additionally, the lack of standardized data formats contributed to scalability challenges.

These issues caused bottlenecks that hindered profitability.

The solution involved automating bordereau processing, including data transformations, to increase efficiency and accuracy in claims processing.

The outcomes of this automation were significant: the process speed increased from weeks to minutes, there was a 50% improvement in partner engagement, and partner onboarding became 65% faster.

Bolstering Data Security

Data breaches are a significant concern in the insurance industry.

The 2023 DBIR from Verizon reported 1,832 incidents, including 480 with confirmed data disclosure.

Automation offers a robust solution to enhance data security, implementing comprehensive security protocols for end-to-end data protection. It not only secures sensitive information but also ensures compliance with evolving regulatory requirements.

Underwriting

What if a chef spent most of their time taking orders? That would be weird, right? Well, that’s exactly what Accenture’s study found when it comes to underwriters – the average underwriter spends 70% of their time on non-underwriting activities, with 40% dedicated to administrative tasks, 30% to negotiation and sales support, and only 30% to actual underwriting.

Automation in insurance presents a revolutionary solution to this imbalance.

By integrating automation into underwriting processes, insurers can leverage the power of predictive analytics to analyze large datasets, leading to more accurate risk assessments and policy decisions.

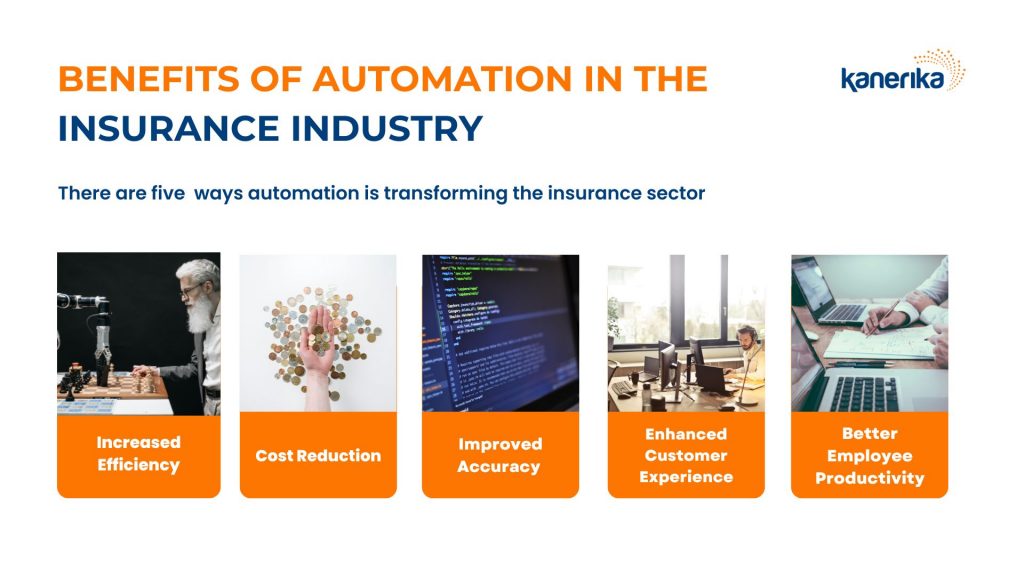

Benefits of Automation In The Insurance Industry

Automation in insurance is expected to play a significant role for insurers in 2024. Here are some of the primary benefits of automation in insurance:

- Increased Efficiency: Automation in insurance significantly streamlines processes like claim handling and policy management, leading to faster turnaround times and reduced manual effort. For instance, by using AI-driven tools, insurers can automate insurance claims processing, which minimizes human error and accelerates resolution times.

- Cost Reduction: By implementing insurance automation software, insurers can cut down on operational costs, mainly through reduced labor expenses and minimized error-related losses.

- Improved Accuracy in Insurance Processes: Automating insurance processes helps reduce human errors. Intelligent automation ensures higher data accuracy in underwriting, claims processing, and customer interactions.

- Enhanced Customer Experience: Automation enables quicker response times and more personalized service, boosting customer satisfaction and loyalty. This is especially significant while using intelligent chatbots for customer service.

- Better Employee Productivity: Automation in the insurance industry frees employees from repetitive tasks, allowing them to focus on more strategic and value-added activities, thus enhancing overall productivity and job satisfaction.

Implementing Automation for Insurers: A Step-by-Step Process

Successfully onboarding intelligent automation in insurance involves a strategic, step-by-step approach:

- Assess Automation Opportunities: Identify processes that are rules-based, time-consuming, and performed frequently.

- Build a Business Case: Evaluate the benefits of automation for each process. Consider how freed-up resources can be reallocated and the value of improved accuracy and speed.

- Determine Your Automation Model: Choose between establishing an internal strategic automation capability or aiming for automated outcomes with minimal effort.

- Identify Automation Partners: Select your automation partners carefully, considering their industry experience and process expertise.

- Prepare an Automation Roadmap: Develop a comprehensive roadmap that goes beyond initial deployment. Include plans for communication, training, and change management.

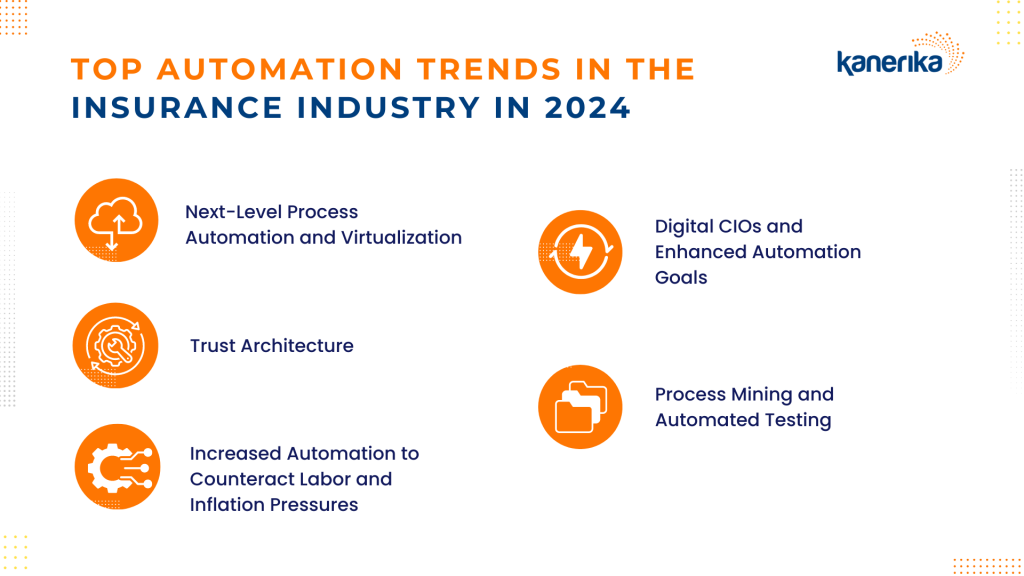

Insurance Automation Trends for 2024

For 2024, several key trends are shaping this landscape, integrating automation and intelligent solutions into core insurance processes.

Here’s how these trends incorporate crucial elements like insurance automation, intelligent automation in insurance, and the benefits of automation in the insurance industry:

Next-Level Process Automation and Virtualization

Insurance companies are moving beyond basic robotic process automation, especially in back-office operations, and are starting to leverage emerging technologies to fundamentally rethink product and service offerings.

Technologies like IoT for predictive maintenance and digital twins are transforming claims experiences and underwriting processes.

Trust Architecture

With the increasing amount of sensitive customer data handled by insurers, technologies like blockchain are becoming crucial for managing risk and customer data more effectively.

This approach is key to evolving towards a model of insurance that emphasizes prediction and prevention, with a focus on data sharing and claims prevention.

Increased Automation to Counteract Labor and Inflation Pressures

Insurance companies are ramping up their automation efforts in response to rising labor costs and inflation. Automating repetitive tasks like claims processing and policy issuance helps reduce labor costs and improves operational efficiency.

Digital CIOs and Enhanced Automation Goals

The role of Chief Information Officers (CIOs) in the insurance sector is growing, with a focus on leading digital transformation and maximizing the benefits of automation.

CIOs are now more involved in identifying and implementing automation technologies that align with business goals and strategies.

Process Mining and Automated Testing

To achieve best-in-class automation, insurance companies are increasingly adopting process mining and automated testing.

Process mining helps identify inefficiencies in business processes, while automated testing ensures that automation solutions are functioning as intended.

Kanerika: Your Partner in Insurance Automation

The integration of automation and data analytics is vital for insurers, but it does not have to be a solitary process.

At Kanerika, we specialize in helping insurers modernize their processes.

Kanerika’s expertise lies in guiding insurance companies toward adopting hybrid cloud-based solutions,. Which are instrumental in reducing costs, boosting revenue, and minimizing risks.

However, our role extends beyond just consultation; we offer tangible solutions and real-time demonstrations. We invite you to experience our capabilities firsthand – Book a free demo with us today. Take the first step towards reimagining your insurance business for the digital age.