At FloQast’s TakeControl 2025 event, accountants were shown how to build their own AI agents—no coding needed. These agents can now flag errors in ledgers, auto-tag invoices, and even run first-pass audit checks. This isn’t just automation. It’s a shift in how accounting teams work. AI in accounting is moving from back-office support to front-line strategy. And firms that embrace it are seeing faster closes, fewer errors, and better insights.

According to CPA Practice Advisor, 73% of accounting firms now utilize AI to automate routine tasks. 65 percent use AI-powered audit tools. AI-driven automation has reduced processing time by up to 60% and decreased manual data entry errors by 30%. The global AI in accounting market is projected to grow from $6.68 billion in 2025 to $37.6 billion by 2030, according to MarketsandMarkets.

In this blog, we’ll explore how AI is transforming accounting—from bookkeeping and audits to forecasting and fraud detection. Keep reading to see what’s working, what’s still broken, and how firms are adapting.

Accounting 2.0 to 5.0: AI Driving the Future of Finance

The evolution of accounting has been shaped by AI, beginning with Accounting 2.0, where AI was first applied to automate repetitive, rule-based tasks. This included data entry, invoice processing, and transaction categorization, which reduced human error and freed accountants from routine work. Early AI tools, such as QuickBooks and Xero, introduced these capabilities, laying the foundation for more innovative and efficient financial processes.

With Accounting 3.0 and 4.0, AI advanced beyond basic automation to provide analytics and real-time insights. Accounting 3.0 leveraged AI for predictive analytics, cash flow forecasting, and anomaly detection, enabling accountants to make smarter, data-driven decisions. Accounting 4.0 integrates AI with cloud platforms, offering real-time monitoring, automated compliance, and scenario planning. This helps finance teams to react quickly to changes and gain deeper insights from their data.

Today, Accounting 5.0 represents the full potential of AI in finance, driving strategic decision-making and complex financial modeling. AI platforms like Rillet automate the ledger, integrate with tools such as Salesforce and Stripe, and allow finance teams to close books in hours instead of weeks. While Accounting 2.0 laid the groundwork, modern AI in Accounting 5.0 empowers leaders with predictive insights, risk assessment, and actionable intelligence, transforming accountants into strategic advisors rather than mere number crunchers.

Transform Your Business with AI-Powered Solutions!

Partner with Kanerika for Expert AI implementation Services

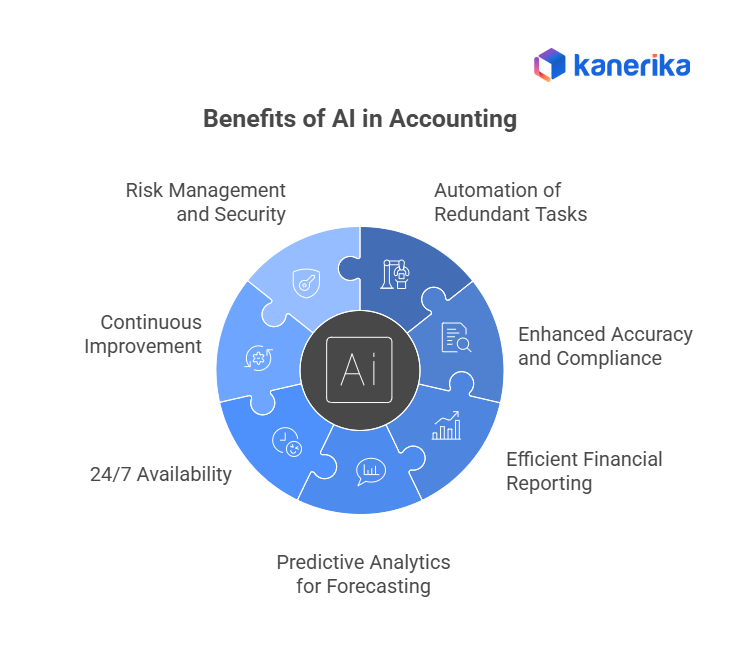

Benefits of AI in Accounting

AI is transforming accounting by automating tasks, improving accuracy, and providing actionable insights. From routine operations to predictive analytics, it helps firms work faster, smarter, and more securely. Here are seven key benefits:

1. Automation of Redundant Tasks

AI efficiently handles repetitive tasks like data entry, transaction categorization, and invoice processing. This reduces errors, saves time, and allows accountants to focus on strategic activities that add value to the business.

2. Enhanced Accuracy and Compliance

AI ensures precise calculations and detects inconsistencies in real time. It also keeps up with evolving tax laws and regulations, helping firms maintain compliance and minimize financial risks.

3. Efficient Financial Reporting

By integrating data from multiple sources, AI provides accurate financial statements and insights in real-time. This speeds up reporting, enhances clarity, and supports better decision-making.

4. Predictive Analytics for Forecasting

AI analyzes historical data to forecast future financial trends and cash flows. These insights enable firms to anticipate market changes, optimize budgets, and make informed strategic decisions.

5. Enhanced Client Service and 24/7 Availability

AI-powered chatbots and virtual assistants provide instant responses, generate reports, and offer personalized insights anytime. This ensures continuous client support and improves overall satisfaction.

6. Continuous Improvement and Streamlined Workflows

Machine learning allows AI systems to evolve and improve over time. This leads to optimized workflows, higher efficiency, and consistent accuracy across accounting processes.

7. Risk Management and Security

AI monitors transactions, identifies anomalies, and flags potential fraud. Combined with predictive analytics and adaptive algorithms, it strengthens data security and safeguards sensitive financial information.

Practical Applications of AI in Accounting

1. Expense Tracking and Management

Accounting AI technologies have transformed expense tracking by instantly classifying and balancing expenditures. This automation reduces the likelihood of human error while simultaneously enhancing accuracy and saving time. Tools like Fireflies.AI can parse invoices and receipts, extracting pertinent data for easy integration into bookkeeping records.

2. Comprehensive Tax Preparation

Tax Preparation involves complex, rule-based processes that AI is uniquely equipped to handle with precision. AI can analyze vast datasets to identify deductions and credits, ensuring compliance and optimizing tax strategies. These systems utilize patterns and historical data to predict future tax implications, enabling smarter financial decisions.

3. Budgeting and Financial Planning

AI algorithms provide cost forecasts and performance assessments for financial planning and budgeting, enhancing an organization’s ability to make informed financial decisions. By identifying patterns and anomalies, machine learning algorithms provide valuable insights for financial planning. AI-driven models forecast potential outcomes, enabling businesses to plan sound financial plans.

4. Invoice Processing

With remarkable precision, AI automates the laborious process of retrieving data from invoices. This automates the entire accounts payable process, eliminates manual errors, and frees up accountants’ time.

5. Auditing

AI can analyze massive datasets to identify anomalies and potential risks in financial records. This empowers auditors to focus on complex issues, improve audit efficiency, and ensure the financial health of a business.

6. Bookkeeping and Data Entry

Say goodbye to repetitive data entry! AI automates tasks such as recording transactions, performing bank reconciliations, and maintaining the chart of accounts. This allows accountants to dedicate more time to complex analysis and provide valuable financial insights.

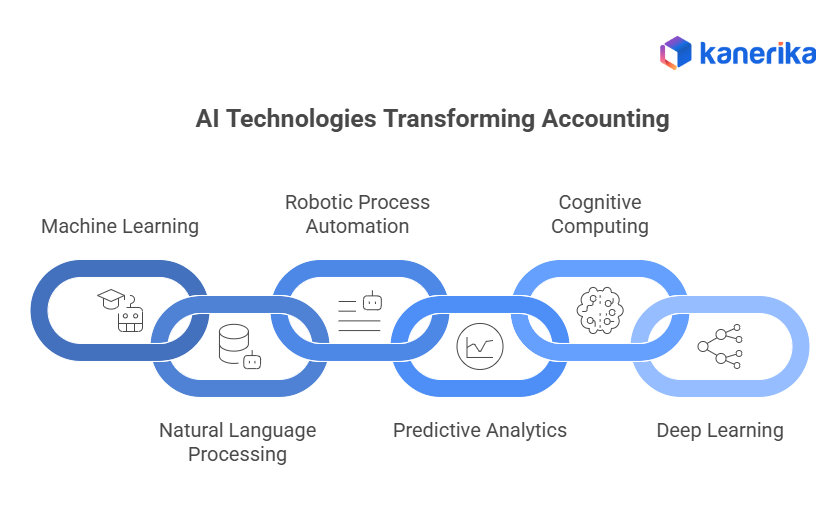

6 Popular AI Technologies Transforming the Accounting Process

AI is transforming the accounting sector by leveraging several key technologies. These technologies automate laborious processes and analyze vast amounts of data to improve the accuracy and efficiency of financial operations. The market for AI in accounting is predicted to increase at a 33.5% CAGR from USD 1.56 billion in 2024 to USD 6.62 billion in 2029. – Markets and Research study

1. Machine Learning Applications

In accounting, machine learning (ML) is a vital component of AI. It includes algorithms that enable machines to learn from and forecast events based on data. By classifying spending, forecasting outcomes, and identifying irregularities in financial data, machine learning reduces the likelihood of human errors and enables automation in the accounting industry. Big data, or large datasets, can be analyzed more precisely using machine learning technologies.

2. Natural Language Processing

Natural Language Processing (NLP) stands as another key AI technology. It equips machines with the ability to comprehend and interpret human language. In accounting, NLP finds application in reading, analyzing financial documents, summarizing reports, and even grasping complex tax legislation. This reduction in time spent on manual data entry empowers accountants to allocate more of their efforts towards strategic activities.

3. Deep Learning and Neural Networks

Deep learning, a subset of machine learning, uses layered neural networks to analyze data. These networks imitate the human brain, processing data through layers of abstract representation. In accounting, deep learning algorithms can detect subtle patterns in financial transactions that indicate potential fraud or accurately predict financial trends. This technology streamlines processes, enabling accountants to focus on strategic tasks. By automating data analysis, deep learning enhances efficiency and accuracy in financial tasks.

4. Data Management and Analysis

Effective data management is crucial for leveraging AI in accounting. It involves handling large amounts of data efficiently, from data extraction to data storage and management. AI tools enhance data analysis accuracy and offer insights into financial health. Accountants can then utilize these insights to inform business decisions and comply with regulatory requirements.

5. Robotic Process Automation (RPA)

Repetitive, rule-based processes, such as data entry, invoice processing, and reconciliation, can be automated with RPA. It can perform routine calculations, extract data from multiple sources, and enter it into accounting software to save time and reduce manual errors.

6. Cognitive Automation

It combines AI technologies such as machine learning, NLP, and RPA to mimic human intelligence in performing complex accounting tasks. It can handle tasks that involve decision-making, problem-solving, and understanding unstructured data.

Top 6 AI Tools and Software Every Accountant Must Know

1. Truewind

Truewind is an AI-powered digital accountant designed to automate core accounting tasks, reducing manual effort and increasing accuracy. It automates processes like transaction classification, reconciliation, and financial reporting. Truewind’s AI capabilities enable businesses to close their books faster and gain real-time insights into their financial health. The platform’s user-friendly interface and integration with various accounting systems make it accessible for businesses of all sizes.

2. Vic.ai

Vic.ai specializes in automating accounts payable (AP) processes using AI, streamlining invoice processing and expense management. Its features include autonomous invoice processing, early payment discount identification, and real-time spend insights. Vic.ai’s proprietary deep-learning algorithms continuously improve, adapting to the unique needs of each client. This hybrid approach ensures that businesses receive personalized service while benefiting from the efficiency of AI automation.

3. Sage Intacct

Sage Intacct is a cloud-based financial management platform that integrates AI to streamline financial processes. Its features include automated bank reconciliation, expense tracking, and real-time financial reporting. The platform’s AI capabilities offer real-time financial insights, anomaly detection, and predictive analytics, enabling businesses to make informed decisions. Sage Intacct’s scalability and customization options make it an ideal solution for organizations with diverse financial needs.

4. BlackLine with Verity AI

BlackLine, powered by Verity AI, offers a connected and auditable platform for financial operations, enhancing accuracy and efficiency. Its features include automated account reconciliation, journal entries, variance analysis, and predictive guidance. Verity AI streamlines manual effort by drafting narratives and distilling large volumes of financial data into clear, actionable outputs. The platform’s capabilities make it a valuable tool for organizations aiming to streamline their financial processes and reduce fraud.

5. KPMG Clara

KPMG Clara is an AI-powered audit platform that integrates machine learning to automate audit tasks and enhance decision-making. Its features include automated audit procedures, financial report analysis, and support for disclosure checklists. The platform’s AI capabilities assist audit teams by refining risk assessments, developing testing procedures, and improving audit documentation. KPMG Clara’s integration of AI enhances the quality and efficiency of audits, ensuring comprehensive and targeted reviews.

6. Puzzle

Puzzle is an AI-powered accounting platform tailored for API-native startups, offering developer-focused integrations. Its features include automated transaction categorization, reconciliation, and financial reporting. Puzzle’s AI capabilities automatically generate financial statements, accrual schedules, and reconciliations, freeing users to focus on anomalies. The platform’s self-service setup and guided solutions keep costs low until tax time, making it a cost-effective choice for startups seeking scalable accounting solutions.

AI in Robotics: Pushing Boundaries and Creating New Possibilities

Explore how AI in robotics is creating new possibilities, enhancing efficiency, and driving innovation across sectors.

AI Adoption in Accounting: 5 Key Considerations and Challenges Ahead

1. Data Quality and Management

AI systems rely heavily on accurate, complete, and well-structured financial data. Inconsistent or messy data can lead to incorrect analyses, reporting errors, and flawed decision-making. Firms need to invest in proper data cleaning, standardization, and governance to fully leverage the capabilities of AI.

2. Regulatory Compliance

Accounting is a highly regulated field, and AI tools must comply with tax laws, auditing standards, and financial regulations. Regular updates and validation of AI systems are essential to ensure adherence to local and international guidelines, reducing the risk of non-compliance penalties.

3. Integration with Existing Systems

Successful AI adoption depends on the smooth integration of AI with existing ERP, accounting software, and CRM systems. Without proper integration, AI tools may operate in silos, causing inefficiencies or data mismatches. Evaluating compatibility and planning a phased implementation can help maintain operational continuity.

4. Skill Development and Workforce Adaptation

As AI automates repetitive tasks such as data entry and reconciliation, accountants must adapt to new roles that focus on analysis, strategy, and advisory services. Upskilling staff through training programs and workshops ensures they can collaborate effectively with AI tools and make the most of their insights.

5. Cybersecurity and Ethical Considerations

AI systems handle sensitive financial and client data, making them vulnerable to cyberattacks. Firms must implement robust security protocols and closely monitor AI outputs to prevent data breaches and ensure the ethical decision-making process. Additionally, oversight is necessary to avoid bias in AI predictions that could impact financial reporting or strategic decisions.

How Kanerika Uses AI to Solve Real Business Problems

Kanerika utilizes agentic AI and machine learning to enable businesses to work smarter. We’ve built solutions for various industries, including manufacturing, retail, finance, and healthcare. These tools help teams cut costs, improve productivity, and solve real problems—not just automate tasks.

Our AI models are designed to meet specific business needs. Whether it’s speeding up data processing, analyzing videos, or optimizing inventory, we design systems that fit the job. For finance and operations, our AI assists with sales forecasting, financial planning, data verification, and vendor evaluation. For growth-focused teams, we provide pricing insights and scenario analysis to support informed decision-making.

We focus on results, not just tech. Kanerika’s agentic AI governance ensures every system is safe, accountable, and easy to manage. Our goal is to help businesses scale with confidence, knowing their AI is working reliably and responsibly.

Transform Your Business with AI-Powered Solutions!

Partner with Kanerika for Expert AI implementation Services

Frequently Asked Questions

How is AI used in accounting?

AI streamlines accounting by automating repetitive tasks like data entry and invoice processing, freeing human accountants for higher-level analysis and decision-making. It also enhances accuracy by minimizing human error and provides insightful predictions through analyzing financial trends. Essentially, AI acts as a powerful tool to boost efficiency and improve the quality of financial insights. This allows accountants to focus on strategic advisory rather than tedious manual work.

Which big 4 accounting firms are using AI?

All Big Four accounting firms (Deloitte, EY, KPMG, PwC) are actively incorporating AI into their services. They’re using it across the board, from automating audits and tax processes to enhancing client consulting and risk management. This isn’t just about individual tools; it’s a strategic shift towards AI-powered insights and efficiency gains. The specific AI technologies and applications vary by firm and project, but widespread adoption is a key trend.

What is the future of AI in accounting?

AI’s future in accounting is one of enhanced efficiency and strategic decision-making. Expect automation of repetitive tasks like data entry and reconciliation, freeing up human accountants for higher-level analysis and advisory roles. This shift will demand professionals adapt to using AI tools and focus on developing uniquely human skills like critical thinking and client communication. Ultimately, AI will be a powerful partner, not a replacement, for accountants.

Is AI going to replace accountants?

No, AI won’t replace accountants entirely, but it will transform the role. Think of AI as a powerful tool automating tedious tasks like data entry, leaving accountants free for higher-level analysis, strategic planning, and client interaction. The future accountant will be a skilled interpreter of AI-generated insights, not just a number cruncher.

Where is AI used in banking?

AI’s role in banking is vast! It powers fraud detection by analyzing transactions in real-time, personalizes customer service through chatbots and tailored offers, and streamlines loan applications with automated credit scoring. Essentially, it’s improving efficiency and security across the board.

Can AI solve accounting problems?

AI can significantly assist with accounting, automating tasks like data entry and basic analysis. However, it doesn’t replace human accountants; complex judgment, ethical considerations, and nuanced understanding of regulations still require human expertise. Think of AI as a powerful tool, not a complete solution.

When was AI first used in accounting?

AI, specifically in the form of expert systems, saw its first applications in accounting during the 1980s. These early systems helped automate complex decision-making and analysis. This marked the initial integration of AI concepts into the field.

How many accountants use AI?

While an exact global number is hard to track, AI use among accountants is definitely on the rise. A significant and growing percentage of firms and individual practitioners are integrating AI tools. They use AI to boost efficiency, automate tasks, and improve data analysis. This adoption is expected to continue expanding rapidly across the profession.

How to use AI in bookkeeping?

AI in bookkeeping automates repetitive tasks like data entry and categorizing transactions. It learns your financial patterns to process data quickly and accurately, reducing errors. This frees up time for you to focus on analyzing your finances and making smarter decisions, boosting overall efficiency.

Will AI replace accountants by 2030?

No, AI is unlikely to fully replace accountants by 2030. Instead, it will automate many routine tasks like data entry and reconciliation. Accountants will evolve, focusing more on strategic analysis, complex problem-solving, and client advisory services. Their roles will transform, requiring new skills to work alongside AI tools.

Will accountants exist in 10 years?

Yes, accountants will certainly exist in 10 years, though their roles will evolve significantly. Automation will handle routine data entry and repetitive tasks. Accountants will focus more on strategic analysis, interpreting financial data, and providing valuable business advice. Their expertise will shift towards consultation and future-oriented insights.

What is the best AI tool for accounting?

There isn’t a single best AI tool for all accounting needs. The ideal choice depends on your specific tasks, such as automating data entry, invoice processing, or financial analysis. Focus on tools that integrate with your existing software and address your biggest pain points.