Even in 2023, the haunting legacy of Bernie Madoff’s financial scandal lingers in the financial world. Madoff, once a Wall Street titan, orchestrated history’s most massive Ponzi scheme through his company, Bernard L. Madoff Investment Securities LLC.

Over 17 years, he fabricated stock trades and invented brokerage accounts, cunningly deceiving 40,000 investors and pilfering $19 billion. If only financial institutions had generative AI back in the day to detect these financial anomalies and fraud!

Generative AI in financial services and banking can find transaction anomalies, like unusual locations or devices, and flag possible threats automatically, with minimal assistance from humans.

This is different from traditional methods that often require large teams that comb through data and manually try to identify financial discrepancies. This automation through generative AI reduces the reliance on extensive, costly fraud detection departments and minimizes human errors.

Recent data from MarketResearch.biz reveals a surging interest in generative AI in financial services and banking. The global market is set to skyrocket from USD 847.2 million in 2022 to an astounding USD 9,475.2 million by 2032, boasting a CAGR of 28.1%. In today’s blog article, we will highlight the top 10 use cases of Generative AI in financial services and banking that are transforming the industry.

Table of Contents

- What is Generative AI?

- The Rise of Generative AI in Financial Services

- Use Case 1 – Fraud Detection

- Use Case 2 – Conversational Finance

- Use Case 3 – Applicant-Friendly Loan Denials

- Use Case 4 – Algorithmic Trading

- Use Case 5 – Back-Office Automation

- Use Case 6 – Modernizing Applications

- Use Case 7 – Invoice and Document Analysis

- Use Case 8 – Financial Forecasting

- Use Case 9 – Data Privacy

- Use Case 10 – Risk Management

- Choosing the Right Partner for Generative AI Projects

- Kanerika – Creating the Future of BSFI with Generative AI

- FAQs

What is Generative AI?

Forbes says generative AI is largely viewed as the most popular application of artificial intelligence. It has the unique ability to generate novel content based on previous information and large datasets. Beyond text, Generative AI can also produce images, music, and even write code. These models, trained on vast datasets, recognize patterns, allowing them to create new data resembling their training input.

A prime example is OpenAI’s GPT-4 or Google’s Bard, which produces human-like text, often indistinguishable from human-written content. The key distinction between traditional and generative AI lies in their functions. While the former primarily analyzes data and predicts, the latter creates new data, mirroring its training set.

Accenture’s report, “A New Era of Generative AI for Everyone,” envisions generative AI as an enhancer of human capabilities, signaling a transformative shift in work and business practices.

The Rise of Generative AI in Financial Services

Generative AI, known for its ability to learn from expansive datasets, is making waves in finance. Unlike Robotic Process Automation (RPA) which handles repetitive tasks, Generative AI takes a step further and analyzes historical data, identifies patterns, and adapts to changing scenarios.

The banking sector especially, is witnessing transformative applications of AI with enterprise business intelligence platforms: from AI-driven chatbots like ChatGPT for customer service to advanced fraud detection and personalized banking services.

An Accenture report suggests that such AI models can impact up to 90% of all working hours in the banking industry by introducing automation and minimizing repetitive tasks among employees. The same report also predicts that by 2028, a 30% surge in productivity can be expected from banking employees. Deutsche Bank’s collaboration with Google Cloud’s generative AI exemplifies this shift, aiming to provide analysts with deeper insights and faster task execution, ultimately boosting employee productivity.

That being said, let’s dive deeper into how generative AI in financial services and banking is influencing the industry:

Use Case 1 – Fraud Detection

The first of the use cases of generative AI in financial services and banking is linked to the looming threat of cybercrime. Cybercrime costs are predicted to soar from $6 trillion in 2021 to $10.5 trillion by 2025, which has intensified the focus on data security. Generative AI in financial services and banking offers a solution, adeptly tracking transaction details and flagging anomalies, minimizing manual reviews and errors.

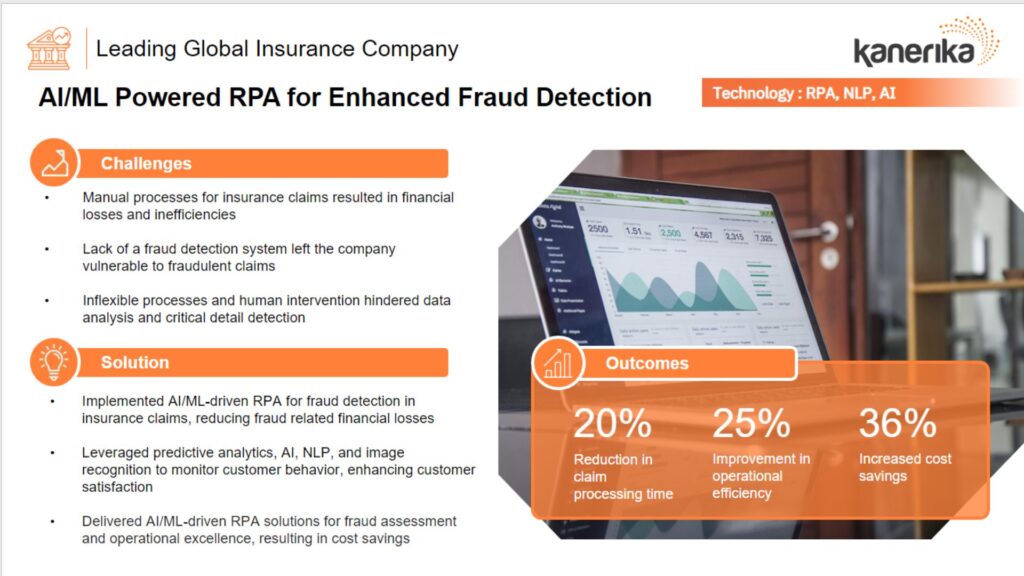

Parallelly, in the insurance domain, a leading global company faced challenges stemming from manual claim processes, resulting in financial losses and inefficiencies. The absence of a fraud detection system exposed them to fraudulent claims, and rigid, human-dependent processes hindered efficient data analysis.

Enter Kanerika, which implemented an AI/ML-driven solution tailored for fraud detection in insurance claims. The outcome was a 20% reduction in claim processing time, a 25% boost in operational efficiency, and a significant 36% increase in cost savings.

Kanerika Case Study: Using AI and ML driven RPA to identify fraud in insurance claims

Use Case 2 – Conversational Finance

According to a study by Forrester, 72% of customers believe products are more valuable when tailored to their personal needs. This sentiment underscores the rising importance of Conversational Finance in the modern financial ecosystem.

Generative AI, with its prowess in crafting human-like text, is at the forefront of this transformation. By harnessing natural language processing (NLP), understanding (NLU), and generation (NLG), conversational AI offers human-like interactions through chatbots and virtual assistants.

Morgan Stanley’s use of OpenAI-powered chatbots exemplifies this shift in Conversational Finance. These chatbots support financial advisors by leveraging the firm’s extensive internal research and data, offering instant, personalized insights.

Major financial institutions, such as Bank of America and Wells Fargo, have also embraced this technology, integrating conversational AI into their virtual assistants. The outcome? Enhanced customer support, bespoke financial advice, and prompt payment notifications, all culminating in an enriched banking experience for users.

Read More – Best Generative AI Tools For Businesses in 2024

Use Case 3 – Applicant-Friendly Loan Denials

The third of the use cases of generative AI in financial services and banking covers loan denials. A recent Forbes Advisor survey unveiled intriguing insights: 42.4% of business owners utilized their loan funds for business expansion, while equipment purchases and marketing accounted for 29.4% and 28.6%, respectively. Such figures underscore the pivotal role loans play in shaping business trajectories.

Against this backdrop, the banking sector’s reliance on AI, especially in loan decision-making, becomes evident. AI aids in meticulously evaluating creditworthiness, setting apt credit limits, and tailoring loan pricing. Generative AI, with its ability to analyze vast data points—from credit scores to subtle shifts in financial behaviors—offers a deeper dive, identifying potential red flags.

However, the crux lies in transparency. AI-driven loan decisions, especially denials, need to be clear and understandable. Enter the conditional generative adversarial network (GAN), a specialized form of Generative AI. It crafts user-friendly explanations for loan denials, hierarchically organizing reasons, and ensuring that feedback is insightful and easy to grasp.

Read more: A Generative AI CTO and CIO Guide For 2023

Use Case 4 – Algorithmic Trading

As discussed earlier, generative AI in financial services and banking empowers financial planners with insightful data. With the generative AI in Trading Market projected to soar from $156 million in 2022 to an impressive $1,417 million by 2032, the potential is undeniable.

AI algorithms, by generating synthetic data, can adeptly model market dynamics, curate innovative trading strategies, and enhance portfolio management. The integration of generative AI in finance promises to elevate the quality of trading decisions, refining both trading strategies and investment portfolios.

Use Case 5 – Back-Office Automation

The fifth of the use cases of generative AI in financial services and banking cover the growing demand for automation in back-office tasks. A Thomson Reuters study revealed that 78% of professionals believed tools like ChatGPT could enhance tasks, with 52% advocating for generative AI in legal and tax roles.

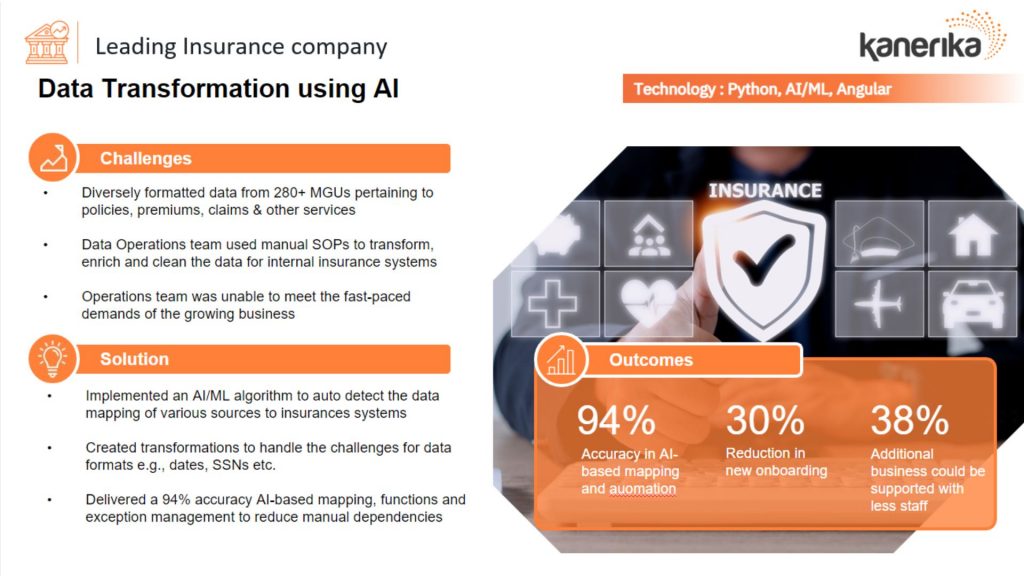

Highlighting this trend is Kanerika’s AI solution for a leading US insurance company that had scattered data all across their systems that required manual human processing, which further slowed down the company’s growth.

Kanerika’s implemented AI/ML algorithms along with a data transformation process that achieved 94% accuracy in AI-based mapping, functions, and exception management to reduce manual dependencies. The result was an impressive 30% reduction in new onboarding, and 38% of additional business could be supported with less staff. A massive win for the company was achieved through automation and AI.

Read more: Generative AI for Healthcare: Benefits and Use Cases

Use Case 6 – Modernizing Applications

The banking sector, a cornerstone of global finance, is feeling the urgency to modernize. An IBM Institute for Business Value survey underscored this, revealing that 64% of banking CEOs saw application modernization as a way to unlock the full potential of generative AI in financial services and banking.

Gen AI is modernizing workflows tailored for banking systems, generating reference architectures like Terraform, and crafting detailed plans. The technology delves into existing banking software code, extracting crucial business rules, suggesting transitions from monolithic structures to agile microservices, and pinpointing refactoring opportunities.

Addressing the challenges of developer bandwidth within banks, generative AI in banking automates repetitive tasks. A standout feature is its ability to automate the conversion of legacy banking code, facilitating transitions like COBOL to Java.

Use Case 7 – Invoice and Document Analysis

Navigating the vast sea of financial documents, from annual reports and invoices to earnings calls, is a daunting task for banks. Our seventh in the series of use cases of generative AI in financial services and banking covers invoice and document analysis.

Generative AI in financial services and banking emerges as a game-changer, adeptly summarizing and extracting key insights and enhancing decision-making. Banks, often mired in internal document summarization, can now redirect their focus to client engagement. This is especially useful for financial institutions that need an automated process to review and clear invoices within the stipulated time period.

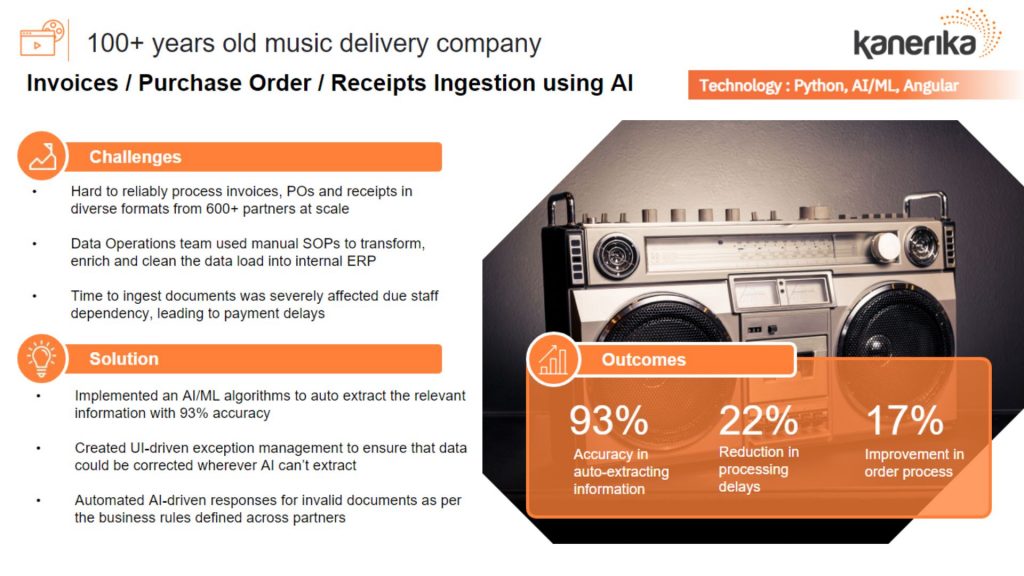

Highlighting the transformative power of AI in invoice processing is Kanerika’s solution for a century-old music delivery company. Challenged with processing diverse invoices from 600+ partners, manual methods led to payment delays.

Kanerika implemented AI/ML algorithms, achieving 93% accuracy in auto-extracting information. We introduced a UI-driven exception management system and automated AI-driven responses for invalid documents. The result? A 22% reduction in processing delays and a 17% boost in the order process.

Read more: A Comprehensive Guide for Choosing the Right AI and Machine Learning Consulting Firm in 2023

Use Case 8 – Financial Forecasting

The realm of finance thrives on accurate predictions. An IBM study highlighted that AI-driven financial forecasting reduced forecast errors by over 20% for many companies. By analyzing historical data, it identifies patterns, enabling banks to simulate diverse financial visualizations and strategize accordingly. Additionally, it generates synthetic data, enriching analyses.

Furthermore, generative AI in banking excels at automating the creation of comprehensive financial reports, including balance sheets and income statements.

Use Case 9 – Data Privacy

Our ninth use case of generative AI in financial services and banking navigates data privacy in banking. This is especially challenging under stringent regulations like GDPR that govern data privacy. Generative AI in financial services and banking offers a solution: synthetic data. Unlike real customer data, synthetic data, crafted by models like GANs, mirrors real patterns without compromising individual privacy.

This ensures GDPR compliance while retaining the data’s utility. Banks can leverage this synthetic data by training machine learning models to make pivotal decisions, such as determining credit eligibility.

Read more: How To Leverage AI Assistance For Business Growth: A 5-Step Guide

Use Case 10 – Risk Management

“By 2025, risk functions in banks will likely need to be fundamentally different than they are

today. As hard as it may be to believe, the next ten years in risk management may be subject to more transformation than the last decade.” – McKinsey & Co.

Banks recognize the indispensable value of generative AI in banking for risk mitigation. By identifying patterns from past data, generative AI offers early alerts on potential risks, enabling banks to act promptly, safeguarding profitability, and fortifying the financial ecosystem.

Choosing the Right Partner for Generative AI Projects

Companies wanting to use generative AI in financial services and banking need to be clear about why they need it. Depending on their industry and what they want the AI to do, they need AI solutions that fit their specific needs and data.

There are many steps to getting AI right, from picking the best algorithms and adding them to current systems to making sure data is safe and follows rules. That’s why it’s so important for companies to pick the right AI consulting partner. Here’s why working with AI experts can help:

Read more: Generative AI Consulting: Driving Business Growth With AI

Tried and Tested Methods

A good partner will have a clear plan that has worked well in the past. Their experience can make the AI setup faster and safer, and they’ll know how to avoid common mistakes.

Ready-to-Use Tools

A partner with a set of tools and methods can make a big difference. They can help build the AI solution that’s just right for your needs. These tools can help at every step, from gathering and looking at data to keeping an eye on the AI once it’s running.

Knowledge and Expertise

A reliable partner knows a lot about generative AI and about your industry. This means they can make an AI solution that tackles your specific problems and opportunities. If you’re in healthcare, for example, they’ll also know the rules and ethics for using AI in that field.

Help with Change

Adding new technology can be hard. A good partner will help your team get used to the new AI tools. They’ll train your people and help your company get ready for the changes AI will bring.

Kanerika – Creating the Future of BSFI with Generative AI

Generative AI’s transformative potential in financial services and banking is undeniable, offering solutions from conversational finance to algorithmic trading.

With over 20 years of proven experience in data management and AI/ML, Kanerika offers robust, end-to-end solutions that are ethically sound and compliant with emerging regulations. Our team of 100+ skilled professionals is well-versed in cloud, BI, AI/ML, and generative AI, and has integrated AI-driven solutions across the financial spectrum, ensuring institutions harness AI’s full potential.

As the future beckons, partnering with Kanerika ensures you’re ahead of the curve, leveraging cutting-edge solutions. Dive into the future of generative AI in financial services and banking with us.

1. What is generative AI in banking and finance?

2. Which banks are using generative AI?

3. What are the risks of generative AI for banks?

4. How will generative AI impact financial services?