According to McKinsey, about 40% of finance activities can be fully automated, significantly enhancing efficiency and accuracy in financial operations. Gone are the days of manual ledger entries and investment decisions based on yesterday’s news. Automation in finance has dramatically transformed the sector, shifting from paper-laden desks and time-consuming calculations to instantaneous, algorithm-driven decisions and digital records.

This evolution has not only streamlined financial operations but also enhanced decision-making precision and offered personalized financial insights through apps and software. Today, the financial sector leverages sophisticated technologies to analyze data, offering real-time and predictive insights and revolutionizing how we manage and strategize our finances.

Automation in finance represents a leap toward efficiency, accuracy, and innovation, transforming the traditional financial landscape into a dynamic, data-driven ecosystem.

Fundamentals of Automation in Finance

Automation in finance involves the application of technology to perform financial services and tasks with minimal human intervention. It relies on specialized software, algorithms, and artificial intelligence (AI) to manage processes efficiently.

1. Key Components

- Software and algorithms: You utilize programmed instructions to execute complex calculations and transactions

- AI and machine learning: These technologies enable your systems to improve over time, responding to new data and making predictions or decisions

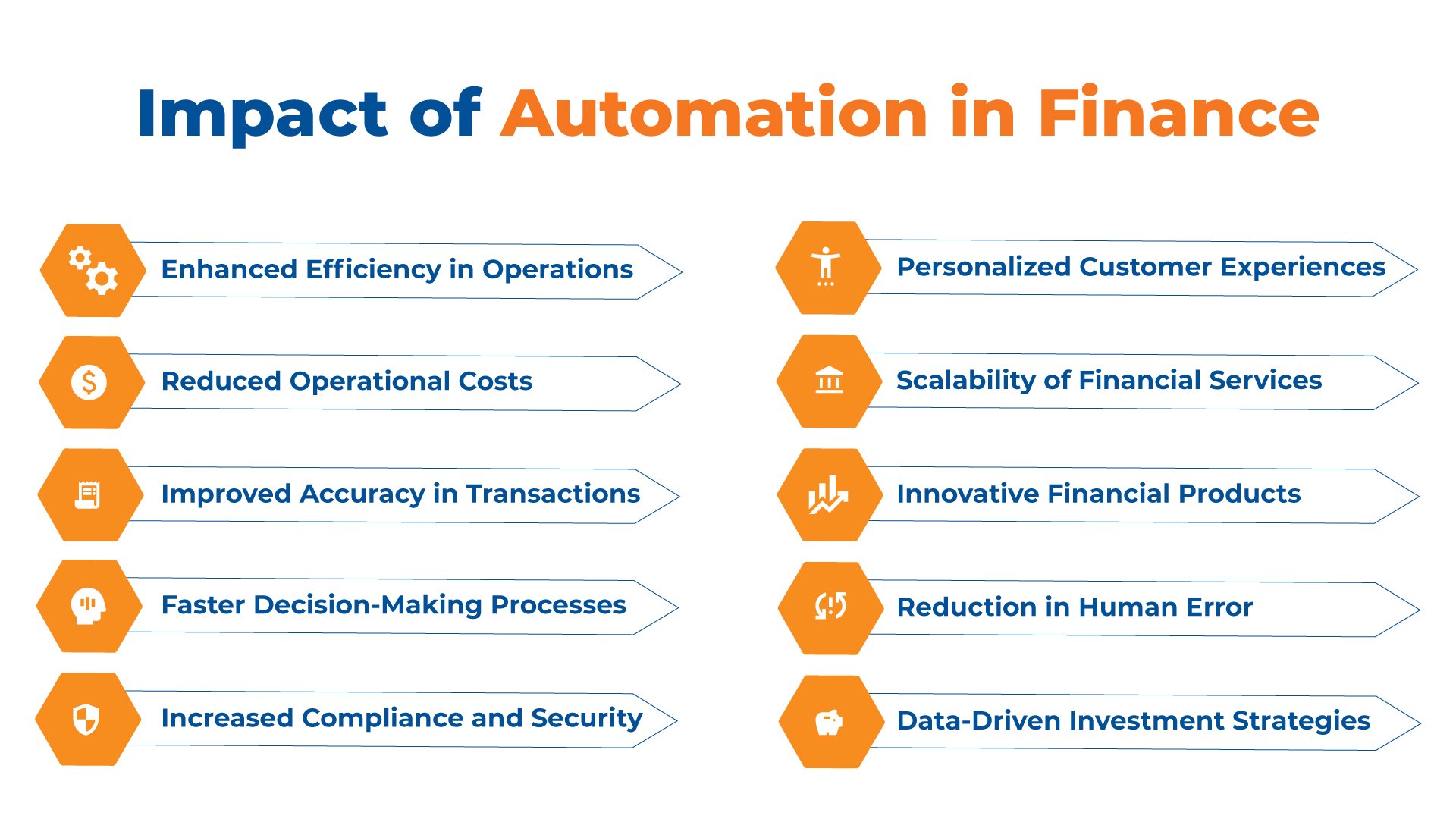

2. Benefits of Automation in Finance

- Efficiency: Speed up transactions and reduce processing times.

- Accuracy: Minimize manual errors in your financial calculations.

- Availability: Access services around the clock without human limitations.

3. Application Theories

- Robotic Process Automation (RPA): This allows you to replicate repetitive tasks, such as data entry, quickly and reliably

- Data Analysis and Reporting: Tools process large volumes of data to generate insights and reports. As a result, your decision-making is more data-driven

4. Areas of Impact

A. Banking

The banking sector benefits from automation through advanced fraud detection systems, real-time customer support chatbots, and streamlined mobile payment solutions. These innovations enhance security, customer engagement, and operational efficiency.

B. Investments

Automation has revolutionized investments with the advent of robo-advisors and sophisticated algorithmic trading platforms, providing tailored investment advice and optimizing trading operations. This enables informed decision-making and operational efficiency for both individual investors and financial institutions.

C. Personal Finance

Personal finance management has been transformed by apps that offer comprehensive budgeting, expense tracking, and financial planning tools. These applications provide valuable insights into spending patterns, suggest savings strategies, and help set financial goals, making personal finance management more intuitive and proactive.

D. Insurance:

Automation in the insurance industry streamlines processes from policy underwriting to claims processing. Automated systems improve accuracy in risk assessment, offer personalized insurance products, and expedite the claims process, enhancing customer satisfaction and operational efficiency. The use of telematics in auto insurance and automated damage assessment tools in property insurance are examples of how automation is being applied to tailor policies and claims to individual needs more effectively.

Read More – Telematics in Insurance: How It Works and Benefits You

Read More – Customer Service Automation: Proven Ways To Enable Efficiency

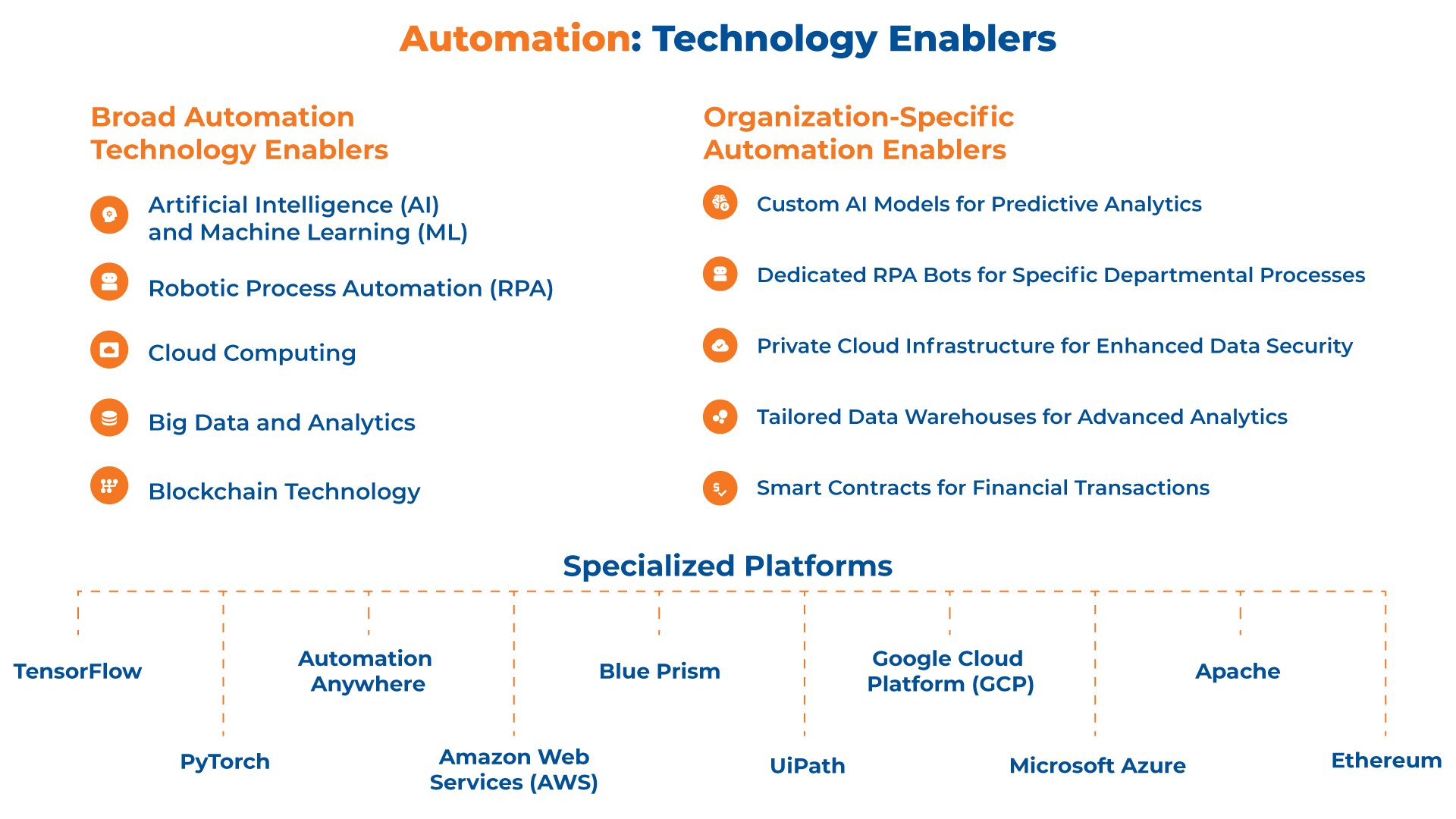

Technology Enablers of Automation in Finance

In the context of finance, certain technologies have emerged as pivotal for automation, significantly enhancing efficiency and accuracy. Here’s an overview of the key enablers:

1. Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are at the forefront, optimizing financial algorithms and predictive modeling. Your robo-advisors use AI to make investment suggestions, while ML helps in fraud detection by learning and identifying patterns that suggest fraudulent activities.

2. Robotic Process Automation

Robotic Process Automation (RPA) streamlines repetitive tasks in finance. Your financial institutions employ RPA to ensure transactions, managing data, and processing loans occur without human intervention, reducing time and errors.

3. Blockchain Technology

Blockchain secures transactions with a decentralized ledger, making your financial transactions tamper-proof. It enhances transparency in your financial operations, particularly in cross-border payments, and ensures the immutability of records.

4. Data Analytics and Big Data

Data Analytics and Big Data empower you with insights derived from large volumes of financial data. Banks use analytics to offer you personalized services, while risk managers assess big data for evaluating credit risk and market trends.

5. Cloud Computing

Cloud Computing provides scalability and accessibility for your financial services. It allows banks to offer you mobile banking solutions and ensures real-time data processing, which is vital for dynamic financial markets.

Operational Efficiency from Automation in Finance

Operational efficiency in finance is key to increasing productivity and competitiveness. Through automation, your institution can streamline processes, enhance risk management, improve fraud detection mechanisms, and elevate the standard of customer service.

1. Process Optimization

You can achieve process optimization by automating repetitive tasks. For example, Robotic Process Automation (RPA) can handle data entry, account reconciliation, and report generation. This reduces manual errors and frees up your staff to focus on more strategic tasks.

- Automated Data Entry: Faster, accurate transactions with 24/7 operation

- Account Reconciliation: Minimized discrepancies and real-time monitoring

2. Risk Management

Automated systems in risk management employ advanced analytics to predict and mitigate risks. They provide you with timely insights and alerts, enabling proactive decision-making.

- Credit Scoring Models: Real-time assessment with greater accuracy

- Compliance Monitoring: Automated tracking to ensure regulatory adherence

3. Fraud Detection

Automation tools utilize machine learning algorithms to detect and prevent fraud more effectively. These systems learn from historical data to identify patterns indicative of fraudulent activity, ensuring your financial security is robust.

- Pattern Recognition: Spot anomalies that suggest fraudulent behavior

- Alert Systems: Immediate notification to accelerate response times

4. Customer Service Improvement

By integrating automation into your customer service platform, you achieve faster response times and personalized assistance. Chatbots and AI-driven interfaces can efficiently handle common inquiries, allowing you to focus on complex customer needs.

- Chatbots: Provide instantaneous, 24/7 customer support

- Personalized Experiences: AI tailors services to individual customer profiles

Challenges of Automation in Finance

As finance continues to integrate automation technologies, several key challenges need your attention to ensure successful implementation and sustained benefits.

1. Data Privacy and Security Concerns

You must understand the criticality of data security in automation. Automating financial transactions and processes involves handling sensitive financial data, which poses a risk of cyber threats. Encrypting data transfers and maintaining robust cybersecurity measures are non-negotiable practices to protect against breaches.

2. Integration with Legacy Systems

Automated solutions often struggle to synchronize with outdated legacy systems that many financial institutions still use. For you, this means dedicating resources to updating or replacing these systems to be compatible with new automation technologies, which can be both costly and time-consuming.

3. Skilling and Workforce Transition

You must recognize that as automation takes hold, reskilling your workforce is imperative. The shift may lead to job displacement but also creates opportunities for employees to engage in more complex and analytical work that cannot be automated.

4. Regulatory and Ethical Implications

You’re required to constantly stay abreast of financial regulations that govern the use of automation, as non-compliance can result in heavy penalties. Furthermore, ethical implications such as algorithmic bias and decision transparency within automated systems require your ongoing attention to uphold fairness and accountability.

Case Studies

JPMorgan Chase & Co.

You might be familiar with COIN, an AI program developed by JPMorgan Chase that automates financial document reviews. It’s reported that COIN has led to 700,000 hours of legal work being performed in just seconds.

- Automation Benefits: Reduced human error, time-saving

- Achievements: Saved thousands of hours annually

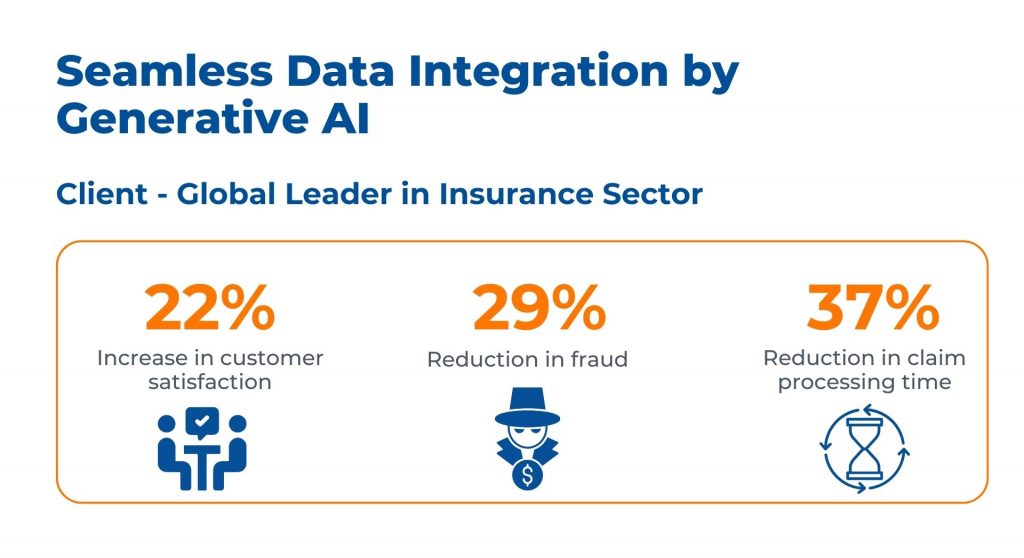

Kanerika Case Study

Enhancing Data Integration with Generative AI

A global leader in the insurance sector faced significant challenges in data integration, hindering operational efficiency and decision-making processes

Challenges:

- Manual Integration: Tedious manual processes led to errors, delays, and compliance risks

- Limited Insights: Existing solutions hindered decision-making and customer experience

- Emerging Data Complexity: Wearable devices and electronic health records added integration complexity

Solution:

- Automated Extraction with Kafka: Enabled efficient data consolidation, reducing errors

- Standardized Data Using Talend: Ensured consistency and compatibility organization-wide

- Gen AI Models (TensorFlow, PyTorch): Minimized manual efforts, aligning and integrating data seamlessly

Outcome:

- Customer Satisfaction: Achieved a 22% increase

- Fraud Reduction: Realized a 29% decrease

- Claim Processing Efficiency: Experienced a 37% reduction in processing time

Future Trends in Finance Automation

As you navigate through the evolving landscape of finance, expect to see a marked shift towards more sophisticated automation solutions. Soon, Artificial Intelligence (AI) and Machine Learning (ML) will drive financial services to new heights of efficiency.

1. Advanced Automation with RPA and AI:

The use of Robotic Process Automation (RPA) and Artificial Intelligence (AI) in finance is set to deepen, moving beyond basic task automation to more complex, cognitive automation. These technologies are transforming finance by automating routine tasks and enabling more sophisticated analysis and decision-making processes. RPA and AI technologies are becoming more accessible, secure, and capable of integrating with existing IT systems, thus facilitating a broader adoption across finance functions.

2. Cognitive Automation Technologies:

The adoption of machine-learning algorithms and natural-language processing tools represents a significant trend in finance automation. Advanced cognitive technologies, which are still in development, are being increasingly utilized to automate complex tasks such as data analysis and decision support. They have the potential to significantly enhance the strategic role of finance by providing deeper insights and predictions based on large volumes of data.

3. Digitization and Data-Driven Decision-Making:

The push towards digitization in finance is leading to the automation of business workflows and a focus on leveraging data for insights. CFOs are looking to AI to automate workflows and analyze the vast amounts of data now available to finance functions. This trend is about transforming manual, time-intensive processes into automated, efficient operations that can generate meaningful business insights, thus enhancing the strategic value of finance.

4. Agile Finance Operations:

Embracing an agile operating model in finance is becoming necessary to respond quickly to market changes. This involves reengineering processes around automation technologies and adopting a more flexible, project-based approach to finance tasks. An agile finance function can quickly shift focus to the most pressing business issues, leveraging automation and digital tools to streamline processes and improve efficiency.

Kanerika: Your Automation Partner

At Kanerika, we understand the transformative power of automation in today’s digital era. Our recognition as one of the Top 10 Most Recommended RPA Start-Ups in 2022 by CIO Insider magazine underscores our commitment to excellence and innovation in the field of automation. The Kanerika team comprises certified consultants partnered with leading RPA vendors such as Automation Anywhere, UiPath, and Blue Prism, equipping us with the expertise to implement sophisticated automation solutions tailored to your specific needs.

Moreover, our approach is built on a foundation of scalability and security, ensuring that as your business grows, your automation solutions evolve in tandem without ever compromising the integrity of your data. We prioritize creating a secure automation environment that you can trust, incorporating the latest in encryption, access control, and auditing practices.

Moreover, our commitment to your success doesn’t end with the implementation of solutions. We offer ongoing support to address any challenges that may arise, ensuring that you always have the assistance you need to maximize the benefits of your automation investment—choosing Kanerika as your automation partner means choosing a path to enhanced efficiency, scalability, and security, all supported by a team dedicated to your success in the digital-first world.