Business intelligence is one of the most preferred technology choices for enterprises of all sizes worldwide. The United States of America has the highest BI adoption rate globally, standing at 30.9%, and is also the largest revenue generator in the BI sector, with an estimated $13.15 billion in 2023.

BI is a strategic approach to transforming raw data into clear, concise information that empowers businesses to make smarter decisions, optimize operations, and gain a competitive edge. In this guide, we’ll delve into its core functionalities, explore its applications across various departments, and help you understand the steps involved to build a winning BI strategy.

Transform Your Business with Data!

Partner with Kanerika for Expert Data & AI implementation Services

What is Business Intelligence?

Organizations today generate massive amounts of data – customer transactions, marketing campaigns, production logs, financial records, and the list goes on. But data itself is just a collection of numbers and text. The true magic lies in extracting valuable insights from this data, and that’s where BI comes in.

Business intelligence (BI) can be understood as a combination of strategies, technologies, and practices that organizations use to analyze their data and gain valuable insights. It’s essentially all about turning raw data into actionable information that can inform better decision-making across all levels of a business.

How Business Intelligence Works: Understanding the 5 Core Components

Business Data Intelligence works by combining these components into a streamlined process.

1. Data Collection

This process involves gathering raw data from various sources both within and outside the organization. Internal data sources include transactional databases, CRM systems, and operational metrics, while external data can come from market research, social media, and third-party data vendors.

Internal Sources:

- CRM (Customer Relationship Management) systems: Track customer interactions, sales history, and purchase behavior

- ERP (Enterprise Resource Planning) systems: Manage financial data, inventory levels, and production processes

- Marketing automation platforms: Provide data on campaign performance, website traffic, and customer engagement

- Human Resource Management (HRM) systems: Store employee information, performance data, and training records

External Sources:

- Market research reports: Offer insights on industry trends, customer preferences, and competitor analysis

- Social media data: Uncover customer sentiment, brand perception, and emerging trends in the market

- Government databases: Provide demographic information, economic indicators, and industry-specific statistics

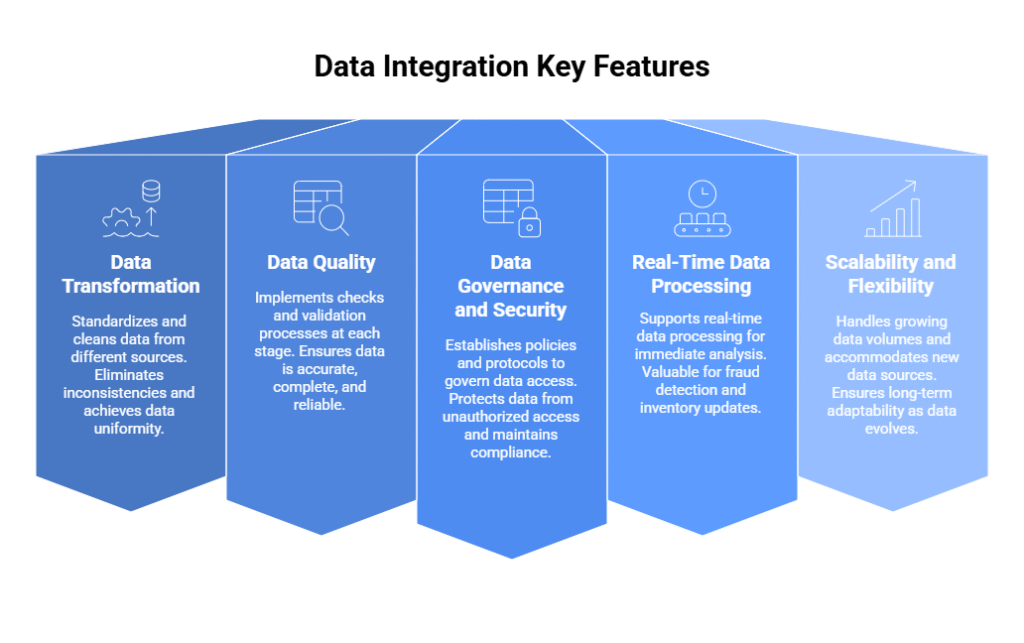

2. Data Integration

After collecting the data, it is brought together from multiple, often disparate, sources and merged into a unified, cohesive dataset. This stage involves cleaning, transforming, and standardizing the data to ensure it can be analyzed together.

- Data Extraction: Extracting relevant data from various sources in their native formats

- Data Transformation: Transforming the extracted data into a consistent format suitable for analysis. This might include cleaning inconsistencies, handling missing values, and standardizing units

- Data Loading: Loading the transformed data into a central repository, such as a data warehouse or data lake

3. Data Management

Data management encompasses several key aspects like cleaning, sorting, and safeguarding sensitive information.

- Data Quality: Maintaining data accuracy and completeness by identifying and resolving errors, inconsistencies, and missing values

- Data Governance: Establishing policies and procedures for data access, ownership, and usage to ensure responsible data utilization

- Data Security: Implementing safeguards to protect sensitive data from unauthorized access, breaches, and loss

4. Data Analysis

Using analytical techniques like statistical analysis, machine learning, and predictive modeling, BI tools identify trends, correlations, and anomalies in the data.

- Descriptive Analytics: Provides a summary of past performance, answering “what happened” questions. For instance, what were the sales figures for the previous quarter? How many website visitors did we have last month?

- Diagnostic Analytics: Dives deeper to identify the “why” behind trends and issues. Imagine asking questions like, why are sales declining in a specific region? What factors contribute to customer churn?

- Predictive Analytics: Leverages statistical models and machine learning to forecast future trends. This allows you to answer “what if” questions. Predict what the demand for your product will be next year or how a price change might affect revenue

- Prescriptive Analytics: Goes beyond just predictions. It recommends specific actions to optimize performance based on the analysis. Imagine getting insights like “adjusting marketing campaigns in region X can potentially boost sales by Y%.”

5. Data Visualization

Data visualizations are the storytellers of BI. They take complex data and present it in a visually appealing and easily understandable format – dashboards, charts, graphs, or heatmaps.

- Charts and Graphs: Bar charts, line graphs, and pie charts effectively illustrate trends, comparisons, and relationships within the data

- Dashboards: Interactive dashboards provide a comprehensive overview of key metrics and KPIs (Key Performance Indicators), allowing for real-time monitoring and analysis

- Maps: Geographical visualizations can reveal regional trends and patterns in customer behavior or sales performance

Benefits of Business Intelligence

1. Accurate Reporting and Monitoring of KPIs

Business Intelligence tools allow businesses to quickly generate reports and monitor key performance indicators, improving efficiency and decision-making.

2. Improved Business Insights

It helps get valuable insights by analyzing data from various sources, enabling organizations to make more informed and strategic business decisions. By providing clear and concise data visualizations and analysis, BI allows leaders to make informed decisions based on concrete evidence.

3. Enhanced Decision-Making

With BI, organizations get accurate, up-to-date, and quality data which they can use for performing analysis quickly. Access to dashboards and reports helps managers spot trends and patterns, making it easier to plan business strategies effectively.

4. Increased Efficiency

BI automates data collection, analysis, and reporting processes, reducing manual effort. This saves time and improves productivity, allowing employees to focus on strategic tasks rather than routine data management.

Partner with Kanerika to Modernize Your Enterprise Operations with High-Impact Data & AI Solutions

5. Operational Optimization

Organizations can identify bottlenecks, inefficiencies, and areas of improvement within their operations. For instance, supply chains can be optimized based on predictive models generated through BI.

6. Competitive Advantage

Gaining insights into market trends, competitor strategies, and customer behavior gives businesses a competitive edge. They can respond proactively to market shifts and capitalize on opportunities before their competitors.

7. Financial Management:

BI tools can analyze expenses, revenues, and profit margins to identify financial inefficiencies. They help detect wasteful spending and improve budgeting, ultimately driving higher profitability.

8. Risk Reduction

Business Intelligence offers predictive analysis that helps businesses anticipate and mitigate potential risks. For instance, companies can spot potential fraud, identify supply chain risks, or foresee market fluctuations.

Case Study: Data Consolidation and Reporting Using Power BI

The client is an edible oil manufacturer and dealer who uses SAP systems for all major company transactions. They faced challenges with unstructured data, making real-time reporting on sales, deliveries, payments, and distribution a complex task. Inconsistent and delayed insights due to dispersed SAP and non-SAP data hindered accurate decision-making

Kanerika resolved its data management problems through the following:

- Consolidated and centralized SAP and non-SAP data sources, providing insights for accurate decision-making

- Streamlined integration of financial and HR data, ensuring synchronization enhancing overall business performance

- Automated integration processes to eliminate manual efforts and minimize error risks, saving cost and improving efficiency

Best Practices for Building a Winning Business Intelligence Strategy

1. Understand Objectives and Key Performance Indicators (KPIs):

Begin by identifying the goals that the BI strategy should support, such as boosting sales, improving customer satisfaction, or enhancing operational efficiency. From these goals, derive specific KPIs to measure success.

2. Assess Current Data Infrastructure

Analyze the existing data infrastructure to understand current capabilities and identify gaps. Determine the sources of data, quality, and how it’s managed. This will guide decisions on new tools or processes that need to be incorporated.

3. Identify Stakeholders and Involve Them:

Include key stakeholders from various departments (IT, finance, marketing, etc.) in the planning process. Their input will help tailor the BI strategy to the organization’s specific needs, ensuring better adoption later.

4. Choose the Right BI Tools

Evaluate different BI tools based on the organization’s data infrastructure, size, and goals. Consider factors like ease of use, integration with existing systems, scalability, and cost.

5. Establish a Data Governance Framework

Implement rules and protocols to ensure data quality, security, and privacy. Define roles and responsibilities for data management to ensure accuracy and compliance.

6. Create a Data Integration Plan

Develop a plan to aggregate data from different sources into a unified data warehouse. This step ensures that your BI tools can analyze a complete and consistent dataset.

7. Develop Data Models and Reports

Design data models that align with your KPIs, ensuring relevant data is available for analysis. Create reports and dashboards tailored to different users and departments.

8. Train Users and Foster a Data-Driven Culture

Conduct training sessions to help stakeholders understand and use BI tools effectively. Cultivate a culture that values data-driven decisions, encouraging employees to rely on insights generated.

9. Implement and Monitor the Strategy

Roll out the BI solution gradually to address potential issues early on. Monitor performance regularly and refine the strategy to adapt to evolving business needs.

10. Review and Update

Regularly review the strategy’s effectiveness, gathering feedback from users and adjusting tools, processes, and objectives to maintain alignment with business goals.

Top Business Intelligence (BI) Tools

1. Tableau

Known for its powerful data visualization capabilities, Tableau offers an easy-to-use drag-and-drop interface. It integrates seamlessly with multiple data sources, enabling users to create interactive dashboards for comprehensive insights. If you’re looking to leverage these features, you might want to hire Tableau developers to build custom solutions.

2. Microsoft Power BI

A cloud-based BI tool, Power BI provides robust data visualization and reporting features. Users can build and share reports with real-time data from various sources, and it integrates well with other Microsoft products. For businesses looking to maximize these features, it’s wise to hire Power BI developers.

3. Qlik Sense

Qlik Sense features associative data indexing to reveal hidden connections and trends. Its flexible self-service analytics enable users to build their own dashboards and apps.

4. SAP BusinessObjects

A comprehensive suite offering data discovery, visualization, and reporting tools. SAP BusinessObjects integrates with SAP’s ERP software, providing in-depth insights for organizations already using SAP systems.]

5. Looker

Acquired by Google Cloud, Looker provides powerful data exploration and visualization. Its modeling layer makes it easy to define metrics and build custom dashboards.

6. Domo

Domo is a cloud-based platform known for its scalability and collaborative data dashboards. It connects with hundreds of data sources and provides tools to build apps that automate workflows.

7. IBM Cognos Analytics

IBM Cognos combines AI and machine learning to offer predictive insights, data visualization, and automated reporting. Its natural language querying makes data exploration accessible to non-technical users.

8. Sisense

Sisense specializes in handling large data sets and offers both cloud and on-premises deployment. Its analytics capabilities provide actionable insights through intuitive dashboards.

Partner with Kanerika to Modernize Your Enterprise Operations with High-Impact Data & AI Solutions

Business Intelligence at Work: Applications Across Industries

2. Logistics and Supply Chain Management

BI systems can track every link of the supply chain in real-time, providing insights into inventory levels, demand forecasting, and vendor performance. This data can improve inventory management, reduce delays, and optimize distribution routes. Predictive analytics can also help identify potential bottlenecks and mitigate risks before they occur.

3. Manufacturing

Manufacturers use BI to monitor production lines, optimize machine efficiency, and reduce downtime. By analyzing historical production data, companies can identify trends and inefficiencies to streamline production schedules. Quality control data also ensures products meet regulatory standards.

4. Insurance

Insurance companies employ BI tools to assess risk, detect fraud, and improve customer profiling. By analyzing historical claims data, companies can predict future claim trends and adjust premiums accordingly. BI also helps insurance firms segment customers for tailored marketing.

5. BFSI (Banking, Financial Services, and Insurance)

In the BFSI sector, BI systems help identify profitable customer segments, assess credit risks, and detect suspicious transactions to combat fraud. Dashboards can track key financial metrics in real-time, enabling quick adjustments to lending policies and investment strategies. BI also assists in ensuring compliance with financial regulations.

5. Retail

BI analyzes customer data, sales patterns, and inventory to optimize pricing strategies and personalize marketing campaigns. Retailers can use BI to track consumer preferences, improve product recommendations, and manage inventory levels. For example, analyzing past purchasing behavior helps stores identify high-demand products and avoid stockouts, ultimately enhancing customer satisfaction.

6. Healthcare

Healthcare organizations use BI to improve patient care, manage resources, and ensure compliance. Analyzing patient data enables hospitals to identify high-risk patients and reduce readmission rates. BI also helps track resource utilization to optimize staffing and minimize equipment downtime. Additionally, predictive analytics can identify disease outbreaks or forecast patient admission trends, helping facilities prepare effectively.

Case Study: Business Transformation with Power BI in Healthcare

The client is a prominent global HealthTech enterprise. They sought immediate access to a business intelligence dashboard to tackle challenges from aging populations, budget reductions, rising expenses, and apprehensions about patient safety within the medical device sector. By utilizing the Immense capabilities of Power BI, Kanerika addresses these challenges by:

- Implementing comprehensive medical device lifecycle tracking and data architecture using MSFT Power BI use cases

- Transforming legacy data into a new platform for real-time analysis, resulting in improved business intelligence using Power BI templates for healthcare

- Deploying solution on Azure cloud, enabling scalable performance, data aggregation, and decision-making

Stay Ahead in Data Management with Kanerika’s Advanced BI Solutions

As a leader in data analytics and management, Kanerika is your go-to consulting partner for utilizing your business data efficiently. By leveraging a wide range of cutting-edge business intelligence tools and technologies, we empower organizations to transform their processes, boost productivity, enhance efficiency, and drive superior performance.

With a proven track record of successful BI project implementations across diverse industries, including healthcare, logistics, and finance, Kanerika has the expertise to tackle any data challenge hindering your business operations. Our team of seasoned BI consultants combines deep technical know-how with a keen understanding of industry-specific requirements to deliver tailored solutions that deliver tangible results.

Kanerika’s BI adoption framework is a proven, phased methodology designed to de-risk BI projects and accelerate value realization. We apply this framework across industries and geographies, customizing each engagement to client needs and organizational maturity.

1. Vision and Readiness Assessment

- Conduct executive workshops to clarify strategic objectives.

- Assess current data infrastructure, governance, and BI maturity.

- Identify key stakeholders and sponsors.

- Establish success criteria and measurable KPIs.

2. Data Discovery and Mapping

- Inventory all available data sources (structured and unstructured).

- Map data flows, interdependencies, and data quality issues.

- Define priority use-cases (e.g., sales analytics, operational monitoring).

3. Architecture and Platform Selection

- Evaluate cloud-native vs. on-premises BI tools.

- Benchmark leading platforms (Power BI, Tableau, Qlik, SAP, etc.) for business fit.

- Design an extensible data warehouse/lake/mesh architecture.

4. Data Integration and Governance Enablement

- Migrate and consolidate data into unified repositories.

- Implement ETL/ELT pipelines, ensuring data quality, lineage, and master data management.

- Establish robust governance, privacy, and compliance practices (GDPR, HIPAA, etc.).

5. Analytics Layer and Visualization

- Develop role-based dashboards and drilldown reports for each stakeholder group.

- Apply advanced analytics: forecasting, clustering, anomaly detection.

- Embed data storytelling and action-oriented insights.

6. Change Management, Training, and Adoption

- Execute multi-level user training and documentation.

- Run pilot programs and gather feedback for iterative improvements.

- Cultivate a “data-first” culture through workshops and leadership engagement.

7. Continuous Improvement and Scaling

- Monitor KPIs and BI adoption rates.

- Roll out additional data sources and analytics modules.

- Evolve governance, security, and workflows as needs grow.

This structured approach ensures not just a technically robust BI solution, but an adopted one that delivers continuous business value.

Transform Your Business with Data!

Partner with Kanerika for Expert Data & AI implementation Services

Getting Started: How Kanerika Supports Your BI Journey

Whether you’re at the initial scoping stage or mid-way through a stalled BI project, Kanerika offers:

- Executive strategy workshops and readiness assessments

- Data landscape mapping and platform selection guidance

- Custom integration development and data quality remediation

- Full implementation, migration, and change management support

- Post-launch monitoring, improvement, and managed BI services

Our team brings deep BI experience, cross-industry expertise, and an unwavering commitment to trust, transparency, and partnership.

Frequently Asked Questions

What is meant by business intelligence?

Business intelligence (BI) is essentially using data to make smarter business decisions. It involves collecting, analyzing, and interpreting data from various sources to reveal trends, patterns, and insights that weren’t readily apparent. This empowers businesses to improve efficiency, boost profitability, and gain a competitive edge. Ultimately, BI transforms raw data into actionable knowledge.

What are the 5 stages of business intelligence?

Business intelligence isn’t a five-stage *process*, but rather a cyclical journey. It involves (1) data gathering & cleansing, (2) data analysis & exploration, revealing patterns, (3) insightful reporting & visualization, and (4) making strategic decisions based on those insights. Finally, (5) monitoring & adjusting strategies based on ongoing performance, feeds back into the cycle.

What is an example of a business intelligence?

Business intelligence (BI) uses data to improve decision-making. A simple example is a retailer analyzing sales data to see which products sell best and in which locations, allowing them to optimize inventory and marketing. Essentially, it’s turning raw data into actionable insights that drive business growth. This could also involve forecasting future trends based on past patterns.

What is the main purpose of business intelligence?

Business intelligence (BI) helps companies make smarter decisions by turning data into actionable insights. It essentially provides a clear, concise view of the past, present, and potential future of the business. This allows for proactive strategy adjustments and improved performance across all areas. Ultimately, BI aims to boost profitability and competitive advantage.

What is AI business intelligence?

AI-powered business intelligence uses artificial intelligence to analyze data far faster and more deeply than traditional methods. It automates insights discovery, identifying trends and patterns humans might miss, leading to better, faster decision-making. Think of it as giving your data analysis superpowers, enabling predictive capabilities and proactive strategies. Essentially, it’s BI on steroids.

What are the benefits of business intelligence?

Business intelligence (BI) gives you a clear, 360° view of your business, revealing hidden trends and opportunities. It empowers better, data-driven decision-making, leading to improved efficiency and profitability. Essentially, BI transforms raw data into actionable insights that drive strategic advantage. This ultimately enhances competitiveness and boosts the bottom line.

Where is business intelligence used?

Business intelligence (BI) tools are used virtually everywhere data needs to drive better decisions. Think strategic planning, identifying market trends, optimizing operations, and improving customer relationships. Essentially, any area where understanding patterns and insights from data can give a company a competitive edge benefits from BI. It’s a powerful tool for maximizing efficiency and profitability across all departments.

What are the 4 components of business intelligence?

Business intelligence (BI) isn’t just one thing; it’s a synergistic blend of four key areas. You need data collection & warehousing (the raw material), data processing & analysis (transforming it into insights), reporting & visualization (making sense of it), and finally, action & decision-making (using those insights). Each component supports the others to create a complete BI system.

What is business intelligence in one word?

Insight. Business intelligence isn’t just data; it’s the actionable understanding gleaned from that data. It transforms raw facts into strategic advantage. Essentially, it’s about informed decision-making.

What is BA in business intelligence?

BA in Business Intelligence isn’t a specific degree; it’s a *role*. Business Analysts (BAs) working in Business Intelligence use data analysis to improve decision-making. They bridge the gap between technical experts and business stakeholders, translating data insights into actionable strategies. Essentially, they’re the storytellers of data, revealing hidden trends and opportunities.

What is the value of business intelligence?

Business intelligence (BI) translates raw data into actionable insights. Its value lies in improved decision-making, leading to better strategic planning and increased profitability. Essentially, BI helps you understand your business better, anticipate challenges, and capitalize on opportunities – giving you a competitive edge. It’s about turning data into dollars.

What does a business intelligence role do?

Business Intelligence (BI) roles translate raw data into actionable insights. We essentially act as detectives, uncovering hidden trends and patterns to help companies make smarter decisions. This involves using analytical tools and techniques to improve efficiency, boost revenue, and gain a competitive edge. Think of us as the company’s strategic advisors, powered by data.

What is the knowledge of business intelligence?

Business intelligence (BI) knowledge is essentially understanding how data can be used to make better business decisions. It’s about leveraging insights gleaned from analyzing data – sales figures, customer behavior, market trends – to improve efficiency, profitability, and strategic planning. Think of it as using data to see the “big picture” and anticipate future opportunities and challenges. Essentially, it’s data-driven decision-making.

How does Coca-Cola use business intelligence?

Coca-Cola leverages business intelligence to deeply understand consumer preferences, optimizing product development and marketing campaigns. They analyze vast sales data to pinpoint successful strategies and predict future trends, ensuring efficient resource allocation. This data-driven approach also helps them manage supply chains, react to market changes swiftly, and personalize customer experiences globally. Ultimately, it’s about staying ahead of the competition through informed decision-making.

What are the goals of business intelligence?

Business intelligence (BI) aims to turn raw data into actionable insights. Its goals are to improve decision-making by revealing trends, predicting future outcomes, and ultimately boosting profitability and efficiency. Essentially, BI helps businesses understand their performance, their customers, and their markets better. This leads to smarter strategies and a competitive advantage.