Innovation and automation are revolutionizing the insurance industry. Gone are the days of manual processing and guesswork. Thanks to technological advancements, insurers can now leverage the power of data analytics to make intelligent business decisions. In this article, we’ll examine how insurance data analytics is transforming the industry.

Let’s delve into the details and learn more.

What is Data Analytics?

Data Analytics is the process of collecting, analyzing, and extracting relevant insights from various data sources to help an insurance business.

At its core, data analytics is used to help insurers make better decisions and improve their operations.

Data analytics can help insurance companies:

- improve their pricing and underwriting

- offer better customer service and marketing

- provide efficient claims and fraud management

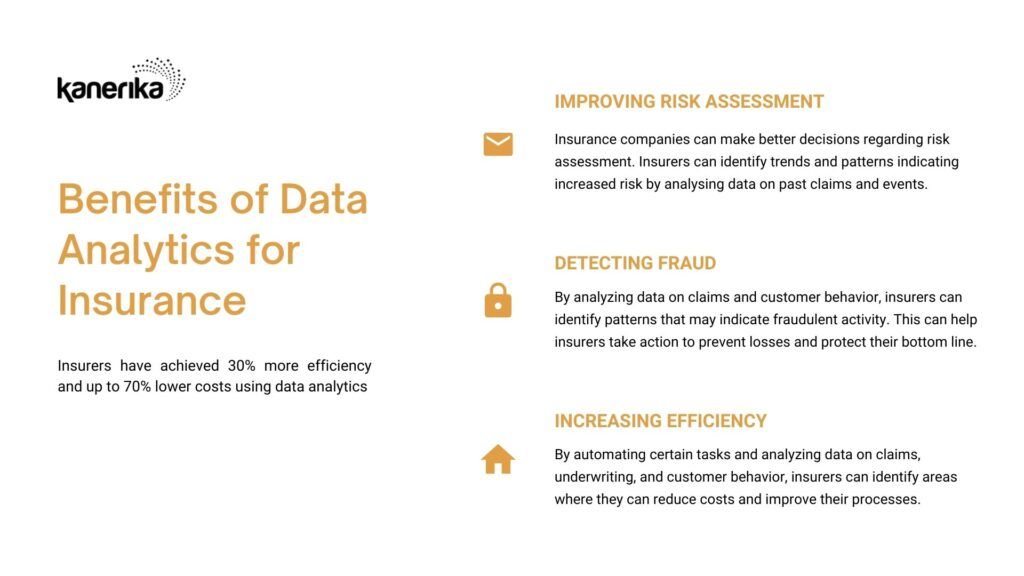

Benefits of Insurance Data Analytics

Did you know insurance companies invested $3.6 billion in data analytics in 2021?

By using it, insurers have achieved 30% more efficiency, up to 70% lower costs, and over 50% higher fraud detection rates.

Insurance companies can use data analytics to make better decisions regarding risk assessment. Insurers can identify trends and patterns indicating increased risk by analysing data on past claims and events. This can help insurers adjust their policies and pricing to reflect better the risks they insure against.

Data analytics can help companies streamline their operations and improve efficiency. By automating certain tasks and analyzing data on claims, underwriting, and customer behavior, insurers can identify areas where they can reduce costs and improve their processes.

The insurance sector can use data analytics to understand its customers better and provide more personalized service. With a thorough understanding of customer behavior, preferences, and claims history, insurers can tailor their offerings to meet the needs of their customers better. This will definitely improve customer satisfaction and raise retention rates.

Data analytics can help insurance companies identify instances of fraud and abuse. By analyzing data on claims and customer behavior, insurers can identify patterns that may indicate fraudulent activity. This can help insurers take action to prevent losses and protect their bottom line. It will also help to prevent fraudsters from taking advantage of the system.

Companies can use data analytics to improve their financial performance by identifying areas of risk and opportunity. By analyzing data, insurers can decide better where to invest their resources. This can help insurers increase their profitability while also reducing their risk exposure.

Challenges of Implementing Insurance Data Analytics

Did you know insurance companies invested $3.6 billion in data analytics in 2021?

Insurance companies always look for ways to improve their services and stay ahead of the competition. One of the ways they can achieve this is through the use of data analytics.

However, implementing it is not without challenges.

One of the main challenges of insurance data analytics is the quality and availability of data. Insurers need access to high-quality data to perform accurate analyses and make informed decisions. However, data can often be inaccurate or outdated, which can hinder the effectiveness of the process.

Data Quality and Availability

Another challenge of data analytics is the need for technical expertise. Analyzing data requires specialized skills and knowledge. Insurers may struggle to find or develop the necessary talent for insurance data analytics. Additionally, the rapid technological change means insurers must stay up-to-date with the latest tools and techniques to remain competitive.

Technical Expertise

Legacy systems and processes can make implementing data analytics in many insurance companies difficult. These systems may not be designed to handle large data volumes or integrate with insurance data analytics tools. Additionally, many processes may be manual or paper-based, making capturing and analysing data difficult.

Legacy Systems and Processes

Data security and privacy are major concerns for insurers implementing data analytics. Insurers must ensure their data is secure and protected from data breaches while implementing insurance data analytics. Also, insurers must comply with regulations around data privacy.

Data Security and Privacy

Finally, cultural resistance can be a challenge for insurers implementing insurance data analytics. Employees may resist change, particularly if they feel it will undermine their existing roles. There may be a lack of understanding or trust around data analytics, making it difficult to get stakeholder cooperation.

Cultural Resistance

Finally, cultural resistance can be a challenge for insurers implementing insurance data analytics. Employees may resist change, particularly if they feel it will undermine their existing roles. There may be a lack of understanding or trust around data analytics, making it difficult to get stakeholder cooperation.

Read More – 7 Big Data Use Cases and Trends In Insurance

Introducing FLIP — The Zero-Code DataOps Tool for Insurance Companies

FLIP is a zero-code tool for DataOps Automation that has been built for data-focused companies.

In the rapidly evolving landscape of the insurance industry, FLIP emerges as a game-changer. This AI-powered data operations platform revolutionizes how businesses scale their operations, streamline data transformation, ensure quality, and achieve end-to-end visibility. With its no/low code automation, proactive alerting, and complex data transformation capabilities, FLIP is the key to unlocking the full potential of your data assets.

FLIP offers a powerful no/low code automation framework that empowers IT leaders to effortlessly automate intricate data transformation tasks without the need for extensive coding. With FLIP’s advanced alerting mechanisms, you get real-time notifications on missed or delayed data, enabling prompt action and ensuring uninterrupted data flow. Moreover, FLIP’s complex data transformation capabilities equip you with the tools to derive meaningful insights and generate precise reports from your data.

With AI, low-code development, and cloud compatibility, FLIP stands out as a comprehensive and powerful platform in the market. Don’t let the complexities of data transformation slow you down. Leverage the power of FLIP and take your insurance data analytics to the next level.

Contact us today to get started with FLIP!