The insurance industry runs on data, but the real challenge is turning that data into clear, actionable insights fast enough to guide decisions. Claims records, customer profiles, policy details, risk assessments, and market trends all move through different systems. As a result, teams often struggle to see the whole picture. This is where Insurance Business Intelligence becomes essential. BI helps insurers bring all their data together so they can understand patterns, manage risk better, and improve how policies and claims are handled.

Recent industry reports show how big this need has become. For instance, the Swiss Report found that global insurance data volumes have grown more than 30% each year. Additionally, Deloitte highlights that over half of insurers believe their current reporting tools are too slow to support real-time decision-making, emphasizing the need for modernization and AI-driven analytics. With rising competition and customer expectations, the ability to analyze data quickly has become a core benefit in underwriting, pricing, fraud detection, and customer service.

In this blog, you will learn how Insurance Business Intelligence works, why it matters for modern insurers, and how leading companies use it to improve performance across claims, underwriting, and customer experience.

Key Takeaways

- Insurance Business Intelligence (BI) consolidates data from multiple systems, enabling insurers to gain faster, clearer insights for underwriting, claims, risk assessment, and customer service.

- Core BI components include data ingestion, storage, transformation, predictive analytics, dashboards, and governance, ensuring accuracy, compliance, and real-time decision-making.

- Practical BI tools include ETL platforms (Informatica, Talend), cloud warehouses (Snowflake, BigQuery, Azure Synapse), visualization tools (Power BI, Tableau, Qlik), and ML/analytics platforms (SAS, Databricks, Python/R).

- Key challenges in BI adoption include fragmented legacy systems, poor data quality, strict compliance requirements, high storage/processing demands, talent gaps, and resistance to automation.

- Measurable BI success is demonstrated through real-world use cases, including AMBA Insurance and leading insurers using AI-powered automation, in faster claims processing, accurate underwriting, reduced fraud, improved customer retention, operational efficiency, financial forecasting, and strategic decision-making.

Transform Your Insurance Data into Actionable Insights!

Partner with Kanerika to leverage cutting-edge BI solutions.

How Can Insurance Companies Use Business Intelligence

Insurance companies rely heavily on data. In turn, Business Intelligence helps them turn that data into clear, valuable insights. With BI tools, insurers can look at past trends, predict future risks, understand customer behavior, and make faster decisions across underwriting, claims, and customer service. As insurance operations become more digital, BI allows companies to manage large datasets, improve accuracy, and reduce manual work. This supports smoother workflows, better reporting, and better control over performance numbers.

Key ways insurers use BI include:

- Risk assessment and underwriting: BI helps underwriters properly assess risk using historical data, claim patterns, population variables, and forecast models. This improves pricing methods and reduces exposure to high-risk profiles.

- Claims management and fraud detection: Insurance BI platforms identify suspicious claims by analyzing unusual patterns and past fraud cases. Faster detection reduces losses and reduces false claims.

- Customer segmentation and personalization: BI tools allow insurers to study customer behavior, buying patterns, renewal trends, and service interactions. This helps in creating targeted insurance products and personalized policy bundles.

- Operational performance tracking: Insurance companies use BI dashboards to monitor KPIs like claim resolution time, customer satisfaction, premium collection, and agent performance.

- Sales and distribution analytics: BI supports agents and brokers by looking at lead quality, conversion rates, and high-value customer segments. As a result, this leads to more effective sales methods.

What Are the Key Components of Insurance BI

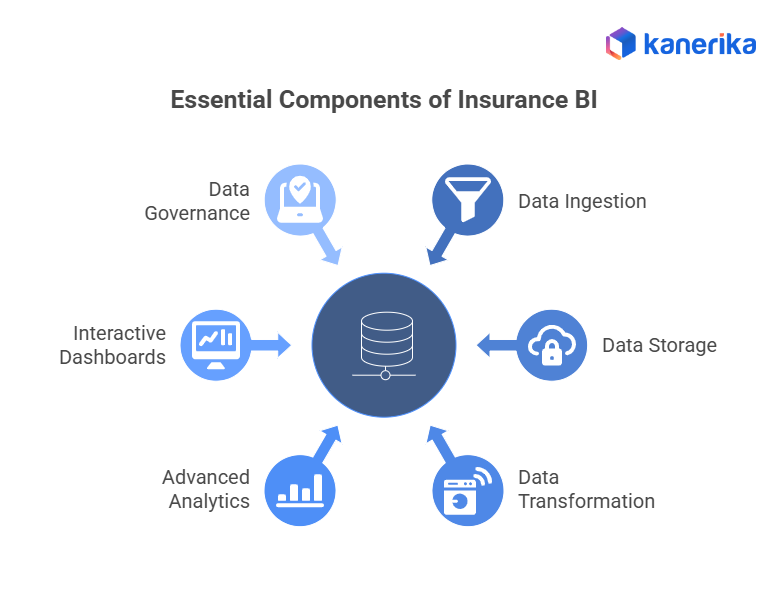

Insurance Business Intelligence relies on several core parts that work together to deliver clean, accurate, and reliable insights. These parts create a structured BI system for carriers, brokers, and insurance service providers. Moreover, they make sure that data flows smoothly from collection to analytics and reporting. This supports real-time decision-making and meets compliance needs. The main parts of Insurance BI include:

1. Data Ingestion and Integration

This involves collecting data from policy systems, CRMs, claims systems, IoT devices, financial systems, customer portals, and outside datasets. A strong data integration layer makes sure that insurers capture every critical data point needed for a complete review.

2. Data Storage and Data Warehouses

Insurance companies store processed data in cloud data warehouses or data lakes. For example, platforms such as Snowflake, Azure Synapse, BigQuery, and Databricks enable insurers to keep large datasets secure, scalable, and easily accessible.

3. Data Transformation and Cleansing

The data transformation layer organizes messy data, removes duplicates, fixes errors, and adds more context to datasets. This step ensures that actuaries, analysts, and underwriters rely on consistent, accurate datasets.

4. Advanced Analytics and Predictive Modeling

Predictive analytics plays a major role in insurance BI. In fact, machine learning models help forecast claim likelihood, customer churn, fraud activity, underwriting risk, and premium pricing trends.

5. Interactive Dashboards and Reporting

BI dashboards give teams a real-time view of how operations are performing. Tools like Power BI, Tableau, and Qlik help insurers see trends, compare performance across regions, and create automated regulatory reports.

6. Data Governance and Compliance

Insurance companies must follow strict rules for customer data, claim records, and financial transactions. Strong governance ensures data privacy and audit readiness, and follows industry rules such as IRDAI guidelines, GDPR, and SOC 2 standards.

Which Tools and Technologies Are Most Effective for Insurance BI

Insurance Business Intelligence needs tools that can handle large amounts of structured and unstructured data from policy systems, claims systems, customer portals, vehicle tracking devices, IoT sensors, and outside risk databases. The most effective BI tools for insurance support predictive analytics, real-time reporting, risk scoring, insurance math modeling, and regulatory compliance.

Insurance BI technology typically falls under four types: data integration, data storage, analytics platforms, and industry-specific systems. Together, they create a complete BI system for insurers.

1. Data Integration and ETL Tools

Insurance BI depends on the ability to combine data from policy systems, claims platforms, CRM tools, and financial software.

- Informatica: Used by insurers for large-scale data integration, cleaning, matching, and data management. It helps maintain accuracy for regulatory reporting and underwriting analytics.

- Talend: Popular for bringing together different insurance data sources. This is especially true for claims, billing, agent onboarding, and customer history.

- Azure Data Factory and AWS Glue: Cloud-based ETL tools used to automate collection from legacy systems, outside risk sources, and IoT devices like vehicle tracking or home sensors.

2. Cloud Data Warehouses for Insurance Analytics

Insurers rely on scalable storage because historical claims, policy records, and vehicle tracking data grow rapidly.

- Snowflake: Strong fit for insurers due to its flexible compute, secure sharing, and ability to manage large regulatory datasets.

- Google BigQuery: Used for near real-time claim review, fraud detection, and risk modeling when speed is a priority.

- Azure Synapse Analytics: Helps insurers bring together policy, billing, and claims data with advanced analytics. In addition, it offers easy integration with Power BI.

3. BI and Visualization Tools

These tools help business teams view claim dashboards, premium trends, loss ratios, agent performance, and customer behavior insights.

- Power BI: Common in insurance companies for KPI dashboards, premium trend reports, and compliance reporting.

- Tableau: Used by actuaries and risk teams to look at claim severity, loss development trends, and underwriting performance.

- Qlik Sense: Helps insurers explore connections between data points such as claim type, location, vehicle age, or medical history.

4. Advanced Analytics and Predictive Modeling

Insurance BI increasingly depends on machine learning for risk scoring, fraud detection, and churn prediction.

- SAS Analytics: A top choice for insurance math modeling, pricing methods, and solvency review. Known for its strong statistical engine.

- Databricks: Used for building ML models for fraud scoring, risk forecasting, and disaster modeling.

- Python and R: Essential for building forecast models for claims likelihood, customer lifetime value, and premium improvement.

5. Insurance Core Systems Feeding BI

These systems create the raw operational data needed to power BI dashboards.

- Guidewire InsuranceSuite: Provides organized data from policy, billing, and claims modules, ideal for analytics.

- Duck Creek: Helps BI tools access policy and claims data without manual pulling.

- Majesco: Widely used for bringing core insurance data into BI systems for underwriting and claim insights.

Insurance Data Analytics: Trends, Use-Cases & Benefits in 2025

Insurance data analytics: discover trends, use‑cases, and benefits for smarter, data‑driven insurance

What Are the Challenges in Implementing BI in Insurance

Implementing Business Intelligence in insurance is complex. This is because insurers work with regulated data, legacy systems, and high amounts of historical information. BI adoption needs strong management, accurate data, and a modern setup. Below are the major challenges insurers commonly face.

1. Fragmented Legacy Architecture

Many insurers still operate on older mainframe systems that hold years of policy and claim history. These systems are complex to connect with modern BI tools. As a result, they slow down data movement.

2. Inconsistent Data Quality

Insurance data often arrives from multiple channels such as agents, brokers, call centers, mobile apps, and partner networks. This leads to duplicate customer profiles, mismatched claim numbers, incomplete policy details, and outdated records. Poor-quality data affects risk models and regulatory reporting.

3. Strict Compliance and Audit Requirements

Insurance BI setups must comply with rules such as IRDAI, HIPAA, GDPR, and SOC standards. Maintaining privacy, audit logs, role-based access, and secure storage adds difficulty to the BI setup.

4. High Storage and Processing Demands

Historical claims, vehicle tracking data, medical documents, and high-resolution images increase storage needs. Additionally, forecast models and fraud analytics also need powerful computing resources.

5. Talent Gaps in Data and Analytics

Insurers need BI developers, data engineers, actuaries with analytics skills, ML experts, and data management specialists. Limited availability of skilled professionals slows down BI adoption.

6. Resistance to Automation and New Workflows

Many insurance teams still rely on Excel-based reporting. Shifting to automated dashboards and forecast insights requires new skills and a change in mindset. As a result, this takes time to adopt.

7. Real-Time Data Needs

Modern insurance operations require instant insights for fraud detection, claim processing, and emergency customer service. However, setting up real-time pipelines with streaming data technologies can be challenging and costly.

How Do Insurance Companies Measure BI Success?

Business Intelligence helps insurance companies transform data into valuable insights across claims, underwriting, customer experience, fraud detection, and financial management. Measuring BI success involves looking at both operational and strategic outcomes. Key numbers include claim cycle time, underwriting accuracy, policy conversion, churn reduction, fraud detection effectiveness, financial reporting precision, and overall operational efficiency. Successful BI adoption delivers not just faster reporting but also improved decision-making, forecast insights, and measurable business growth.

1. Claims Performance Measurement

Insurance companies review claims performance through KPIs such as claim processing time, claim accuracy, error rates, and customer satisfaction. BI dashboards allow teams to monitor workflow bottlenecks, identify high-volume claim types, and improve claim routing to boost efficiency. Furthermore, real-time analytics also help predict claim severity and prioritize resources effectively.

Example: Allstate uses analytics-driven claims sorting to group claims by difficulty and urgency automatically. This enables faster resolution of high-priority claims while maintaining accuracy and ensuring compliance. Therefore, this demonstrates a clear BI impact on operational efficiency.

2. Underwriting and Risk Assessment

Improvements in risk review, premium accuracy, loss ratios, and decision speed measure BI’s success in underwriting. Forecast models analyze historical claims, customer behavior, external data (such as vehicle tracking or population risk factors), and emerging risk trends to support better underwriting.

Example: Progressive uses vehicle tracking and forecast analytics to review driving behavior and assess risk profiles. BI dashboards help underwriters adjust premiums more accurately. Consequently, this reduces potential losses and improves portfolio performance.

3. Customer Retention and Experience

Insurance BI helps monitor policyholder behavior, churn risk, and satisfaction across touchpoints. Successful BI adoption leads to higher retention, more effective cross-sell and upsell campaigns, and better decision-making in customer support. In addition, insights from BI can drive personalized product offerings and tailored communication.

Example: MetLife uses BI analytics to track policy lapse risk and customer engagement patterns. By targeting customers with personalized campaigns, the company increases renewal rates. As a result, this enhances the overall customer experience.

4. Fraud Detection and Prevention

Fraud detection is a critical number for BI success. Insurers use analytics to identify odd patterns in claims, detect patterns of suspicious activity, and reduce payout losses. Effective BI systems provide forecast alerts, case prioritization, and data visualization for fraud investigators.

Example: AXA uses machine learning and BI-powered odd pattern detection to flag unusual claims. The system reduces fraudulent payouts, speeds up investigation timelines, and ensures accurate claims processing.

5. Financial Forecasting and Reporting

BI enables insurers to create accurate, timely financial reports and forecast predictions. Success is measured by reduced reporting cycles, improved accuracy of premium and claims forecasting, and compliance with regulatory requirements. Automated dashboards provide executives with real-time insights into revenue, losses, and capital strength.

Example: Zurich Insurance uses company-wide BI solutions to automate financial reporting and global premium forecasting. Faster, accurate financial insights support strategic planning. Additionally, this ensures regulatory compliance.

6. Operational Efficiency

Operational efficiency numbers include processing speed, employee productivity, workload distribution, and error reduction. BI dashboards help identify slow processes across departments. As a result, insurers can improve workflows and allocate resources effectively.

Example: Prudential Financial monitors claims, policy servicing, and underwriting workflows using BI dashboards. Insights from BI help redistribute workload, reduce backlog, and improve overall operational performance.

7. Strategic Decision-Making and Predictive Insights

Beyond operational KPIs, insurers also measure BI success by how well it supports strategic decision-making. Forecast insights can inform product development, pricing methods, risk reduction, and market growth. Strong BI adoption empowers leadership to make proactive, data-driven decisions.

Example: AIG uses BI and forecast analytics to anticipate market trends, improve portfolio risk, and launch new insurance products based on data-driven insights. Therefore, this demonstrates the strategic value of BI at a company level.

AMBA Insurance — Transforming Reporting with Smarter Data

Challenge

AMBA Insurance faced slow, error-prone reporting due to messy data across teams. Manual consolidation caused delays in decision-making. This was especially true during periods of high data volume.

Solution

A data transformation solution using Microsoft Power BI was implemented to consolidate and organize data. Automated reporting workflows were created, enabling real-time dashboards and centralized, clean data models. This removed manual consolidation and reduced mismatches.

Results

- Reporting became faster and more reliable, allowing real-time insights.

- Manual effort was significantly reduced across teams.

- Data accuracy improved. As a result, this provided decision-makers with consistent and timely information.

Leading Insurance Provider — Using AI to Detect Fraud Faster

Challenge

The insurer relied heavily on manual claims review. This was slow and limited the ability to detect fraudulent claims. This caused delays in claim approvals, increased the risk of fraud, and led to higher operational costs.

Solution

An AI- and ML-powered Robotic Process Automation system was built to scan claims and automatically flag suspicious ones. The system used odd pattern detection, natural language processing, and image recognition. Suspicious claims were routed for deeper manual review. Therefore, this is balanced automation with human oversight.

Results

- Claim processing time decreased by 20%.

- Operational efficiency improved by 25%.

- Cost savings reached 36 percent due to reduced fraud-related losses and manual effort.

Transforming Insurance Operations with Kanerika’s Intelligent Automation

Kanerika helps insurance companies modernize operations through data-driven automation and AI-powered workflows. Our solutions address key challenges, including manual claims processing, policy management, slow processes, and compliance risks. By using advanced analytics and automation, we enable insurers to improve accuracy, reduce turnaround times, and deliver better customer experiences.

As a Microsoft Solutions Partner for Data and AI, Kanerika brings together platforms like Azure, Power BI, and Databricks to build secure, scalable systems. Our services include data migration, forecast analytics, and intelligent document processing. This ensures insurers can handle large volumes of data while maintaining compliance with global standards such as ISO 27001, ISO 27701, SOC 2, and GDPR.

From AI-powered claims automation to real-time fraud detection and policy lifecycle management, Kanerika’s solutions help insurers achieve measurable results. We combine deep industry knowledge with cutting-edge technology to deliver systems that reduce operational costs, enhance compliance, and improve customer engagement.

Maximize Efficiency with Insurance Business Intelligence!

Partner with Kanerika to turn complex data into clear insights.

FAQs

How would the insurance industry use business intelligence?

Insurance companies leverage business intelligence (BI) to analyze massive datasets—claims, customer profiles, market trends—identifying profitable segments and risks. This allows for better pricing strategies, personalized offerings, and proactive fraud detection. Essentially, BI helps insurers make smarter, data-driven decisions across all aspects of their operations, boosting efficiency and profitability. Improved customer retention is another key benefit through targeted service enhancements.

How can AI be used in the insurance industry?

AI revolutionizes insurance by rapidly assessing risks, automating claims processing, and personalizing premiums. This means faster payouts for customers, reduced operational costs for insurers, and more accurate risk profiling leading to fairer pricing. Ultimately, AI helps build more efficient and customer-centric insurance experiences. It also unlocks opportunities for new, innovative insurance products tailored to individual needs.

How is business analytics used in insurance?

Insurance companies use business analytics to better understand risk. By analyzing vast datasets of claims, customer behavior, and market trends, they can refine pricing models, detect fraud more effectively, and personalize customer experiences. Ultimately, this leads to improved profitability and more competitive offerings.

What is IoT insurance?

IoT insurance covers the risks associated with your internet-connected devices. It protects you from financial losses stemming from malfunctions, cyberattacks, or data breaches impacting your smart home, wearables, or industrial IoT systems. Essentially, it’s insurance for the digital world’s physical assets and the data they generate. Think of it as extending traditional insurance to the interconnected reality of the Internet of Things.

What is the role of artificial intelligence in the insurance industry of India?

AI in Indian insurance streamlines operations, from faster claim processing and fraud detection to personalized risk assessment and improved customer service. It’s driving efficiency gains and enabling insurers to offer more tailored products. Ultimately, AI is reshaping the Indian insurance landscape by boosting both profitability and customer satisfaction. This technology promises to make insurance more accessible and affordable for a wider population.

How does Coca-Cola use business intelligence?

Coca-Cola leverages business intelligence to deeply understand consumer preferences, optimizing product development and marketing campaigns. This involves analyzing vast datasets on sales, social media sentiment, and market trends to anticipate demand and personalize their offerings. Ultimately, this data-driven approach helps them make strategic decisions, improving efficiency and boosting profitability across their global operations. They essentially use data to stay ahead of the curve and resonate with their diverse customer base.

Which company use business intelligence?

Virtually any company that wants a competitive edge uses some form of business intelligence. It’s not just for large corporations; even small businesses leverage BI to understand customer behavior, optimize operations, and improve decision-making. The scale and sophistication of BI tools vary depending on company size and needs, but the core principle of data-driven insights is universal. Essentially, if a company values data-informed choices, they use BI in some capacity.

How is artificial intelligence and data analytics used in life insurance?

Life insurance leverages AI and data analytics to drastically improve underwriting processes. AI algorithms analyze vast datasets to assess risk more accurately and efficiently, leading to faster approvals and potentially more tailored pricing. Data analytics helps identify trends and predict future claims, allowing insurers to better manage risk and optimize their portfolios. This ultimately benefits both the company and the policyholders.

Who uses business intelligence?

Anyone who needs to make better decisions using data uses business intelligence. This ranges from CEOs strategizing company-wide growth to sales managers optimizing their teams’ performance. Essentially, BI empowers anyone needing actionable insights from complex data to improve efficiency and profitability. It’s not just for executives; it’s for anyone who wants data-driven answers.

Why is business intelligence useful?

Business intelligence (BI) helps you see the big picture by turning raw data into actionable insights. It reveals hidden trends and patterns, allowing for better decision-making based on facts, not guesswork. Ultimately, this boosts efficiency, improves profitability, and gives you a competitive edge. It’s like having a crystal ball, but powered by data analysis.

How is business intelligence used in business?

Business intelligence (BI) helps companies make smarter decisions by turning raw data into usable insights. It reveals trends, patterns, and potential problems, allowing for proactive strategies instead of reactive ones. Essentially, BI helps businesses understand their performance, their customers, and their market, leading to improved efficiency and profitability. Think of it as a powerful magnifying glass for your business operations.

How is AI used in insurance?

AI streamlines insurance processes from start to finish. It rapidly analyzes vast datasets to assess risk more accurately, personalize premiums, and detect fraud, leading to faster claims processing and better customer experiences. Essentially, AI boosts efficiency and improves decision-making across the entire insurance lifecycle. This ultimately makes insurance more affordable and accessible.

Which of the following is the main benefit of business intelligence?

Business intelligence (BI) primarily helps organizations make better, data-driven decisions. It transforms raw data into actionable insights, revealing hidden trends and opportunities. Ultimately, this leads to improved efficiency, profitability, and a stronger competitive edge. BI isn’t just about reporting; it’s about proactive strategic planning.

What is the role of business intelligence in the healthcare industry?

Business intelligence (BI) in healthcare helps organizations make smarter decisions using data. It transforms raw patient data, operational metrics, and financial information into actionable insights for improved care delivery, cost reduction, and better resource allocation. Essentially, BI helps healthcare providers be more efficient, effective, and ultimately, patient-centered. This includes everything from predicting outbreaks to optimizing staffing levels.

What are the 7 pillars of insurance?

The 7 pillars of insurance are core principles ensuring fairness and clarity in policies. They cover concepts like honesty from everyone involved, having a financial stake in what’s insured, and restoring you to your financial position before a loss. These principles also address identifying the main cause of damage and taking steps to prevent further losses.

How can I use AI in my insurance business?

AI can automate tasks like claims processing and customer service with intelligent chatbots. It helps analyze vast data to detect fraud and assess risks more accurately. This allows for faster operations, better personalized policies, and improved client experiences.

What are the four types of business intelligence?

The four types of Business Intelligence help businesses understand their data from past to future. They are: Descriptive BI, showing what happened; and Diagnostic BI, explaining why it happened. Then there’s Predictive BI, forecasting what will happen; and Prescriptive BI, suggesting what to do next.

What are the 3 DS of insurance?

The ‘3 Ds’ commonly refer to these key insurance concepts: 1. Disclosure: Your duty to provide all important, honest information to your insurer. 2. Duty of Utmost Good Faith: Both you and the insurer must act with complete honesty and integrity. 3. Damages: The financial compensation or repair provided for a covered loss.

What are the 5 C's of insurance?

The 5 C’s of insurance refer to key aspects when evaluating a policy: Coverage (what risks are protected), Cost (your premium), Claims (the process for getting paid), Company (the insurer’s reliability), and Conditions (the policy’s rules and exclusions).

What are the 4 C's of insurance?

The 4 C’s of insurance highlight key policy features and services. These are Coverage, outlining what risks your policy protects you from, and Cost, the price you pay for this protection. They also include Claims, how you get paid for a covered loss, and Customer Service, the support you receive from your insurer.

What are the 5 P's of insurance?

The 5 P’s of insurance are: Product (what the policy covers), Price (the cost or premium), Place (how and where you buy it), Promotion (how it’s marketed), and People (the customers, agents, and staff involved). These elements define how an insurance service is offered and delivered, covering all aspects from the coverage itself to who provides it.

What are the 6 C's of insurance?

The 6 C’s of insurance highlight key aspects to understand about a policy. They generally refer to: Cost (your premium), Coverage (what’s protected), and Conditions (the policy rules). Also important are Claims (how you get paid), Convenience (ease of service), and Care (customer support).

What are the 7ps of insurance?

The 7Ps of insurance are a framework covering key aspects of delivering insurance services. They include: Product (the policy itself), Price (the premium), Place (how it’s sold), and Promotion (how it’s advertised). They also cover People (staff and agents), Process (how services like claims are handled), and Physical Evidence (tangible items like policy documents or brand visuals).

What are the four major insurances?

The four main types of insurance people commonly need are Health, Auto, Homeowners (or Renters), and Life insurance. These provide financial protection against medical costs, vehicle accidents, property damage, or loss of income due to an untimely death.

What are the six basic principles of insurance?

Insurance relies on several core ideas: you must be honest and have a real financial stake in what’s insured. The goal is to restore you to your previous financial state after a loss, without allowing you to profit. Insurers can recover costs from responsible third parties or share losses with other policies, provided the damage is directly caused by a covered event.