Gone are the days when banking was synonymous with physical branches and queues. A Forrester report reveals a telling shift – 77% of Canadian customers, 69% of Spanish customers, and 71% of American customers use online banking services at least once a month. This pivot is a testament to the digital transformation in banking—a movement redefining convenience and accessibility in financial services.

Digital transformation in banking isn’t just an upgrade. It’s a complete reinvention of how banks operate and deliver value, providing customers with a seamless experience across various digital channels. It’s about ensuring that banking services are as readily available on a smartphone as they are within the traditional four walls of a bank.

This article will unpack the layers of digital transformation in transaction banking, highlighting how it’s reshaping the landscape for banks and financial institutions. We’ll explore transformative case studies, offering a guide for navigating the digital revolution in the banking sector.

What is Digital Transformation in Banking?

A Deloitte survey highlights a significant rise in online banking adoption since 2020, a trend that has only intensified post-pandemic. In fact, the Digital Banking Platform Market is anticipated to grow at a CAGR of 11.2% from 2021 to 2026.

This shift is powered by robust digital banking platforms that facilitate a smooth transition from traditional to digital services, ensuring banking is accessible anytime, anywhere.

While the essence of banking remains, the delivery and customer engagement methods have undergone a sea change. The rise of fintechs and neobanks, with their tailored experiences, has set a new standard, placing control squarely in the hands of customers.

In the following sections, we’ll dissect the four critical dimensions of digital transformation in commercial banking that are charting the future course for banks and financial institutions.

Process Transformation

Banks are streamlining operations to enhance efficiency and effectiveness. Process mining techniques are instrumental in pinpointing improvement opportunities. McKinsey’s insights reveal that a significant portion of a bank’s budget is tied up in operations, which can be largely automated.

However, banks often lack the visibility into their operations to identify the best candidates for process automation, which is crucial for capitalizing on digital transformation in banking.

Transform Financial Services Business with the Latest Tech!

Partner with Kanerika for Expert Data, AI, and Automation Services

Business Model Transformation

This aspect is about reimagining the traditional banking blueprint to foster growth and seize new opportunities. Deloitte highlights the evolving banking business model, noting the role of gamification in enriching customer experience and the substantial cost savings achieved through process automation, which also enhances the flexibility and accuracy of back-office tasks.

Domain Transformation

By leveraging technology, banks can redefine their products and services, allowing them to venture into and dominate new market territories.

Domain transformation is a testament to the innovative spirit of digital transformation in commercial banking, as it opens doors to uncharted opportunities.

Culture Transformation

The shift towards digital necessitates a cultural metamorphosis within the organization. A culture that understands, embraces, and advances digital change is pivotal.

According to an Accenture report, the banking sector places a high value on culture, with its impact on employee retention being significantly more pronounced than in other industries like healthcare. This cultural shift is not just about product redesign; it’s about fostering a digital-first mindset across the enterprise.

Why Digital Transformation in Banking is Important?

A report from Cornerstone Advisors highlights that 42% of banks have seen a 5% increase in productivity for opening deposit accounts, with 33% reporting similar gains in loan processing. These advancements mark the beginning of a shift towards a comprehensive digital banking ecosystem.

The transformation journey involves breaking down traditional barriers to innovate customer experiences and enhance business capabilities.

Emerging technologies like machine learning, cloud computing, and robotic process automation are key to creating a seamless and personalized customer journey. However, many banks are still in the early stages of implementing these technologies.

Looking ahead, the banking sector must focus on engaging Generation Z, who are keen on shaping their financial futures and demand mobile-centric services. Banks are also leveraging Customer Data Platforms (CDPs) to access real-time data for personalized service offerings.

The rise in self-service options reflects a growing digital maturity, with expectations that over 200 million U.S. consumers will engage with digital banking services, necessitating robust self-service systems.

Furthermore, AI is not just a future concept but a current tool, as evidenced by Bank of America’s virtual assistant, Erica, which exemplifies AI’s role in improving customer interactions.

How Digital Transformation Improves Branch Efficiency and Compliance

The modern banking landscape demands seamless customer service alongside stringent regulatory compliance. Digital transformation provides the solution, enabling branches to operate more efficiently while maintaining robust compliance standards.

Streamlining Operations Through Automation

Digital transformation revolutionizes branch operations by automating routine tasks that previously consumed valuable staff time. Customer onboarding now happens through integrated platforms that instantly verify identities, check compliance databases, and populate documentation automatically. For business onboarding, banks also need to validate company registration details, confirm authorized signatories, and identify beneficial owners- steps typically handled through Know Your Business (KYB) to reduce fraud risk and meet compliance requirements. Transaction processing becomes seamless, with intelligent systems handling deposits, withdrawals, and transfers while staff focus on complex customer needs and relationship building.

Real-Time Compliance Monitoring

Traditional periodic audits give way to continuous monitoring systems that flag potential compliance issues as they occur. Transaction monitoring algorithms identify suspicious patterns instantly, while automated reporting ensures regulatory submissions meet strict deadlines. Comprehensive audit trails document every action, enabling branches to produce detailed regulatory reports within hours rather than weeks.

Enhanced Data Analytics and Customer Experience

Centralized digital platforms provide real-time operational insights, helping managers track performance indicators and optimize resource allocation. Predictive analytics anticipate customer needs and staffing requirements, reducing wait times while controlling costs. Mobile systems empower staff to assist customers anywhere in the branch, while self-service kiosks handle routine transactions and reduce queues.

Security and Cost Benefits

Multi-layered digital security includes biometric authentication, advanced encryption, and real-time fraud detection systems. These improvements protect customer assets while maintaining detailed compliance records. Although requiring initial investment, digital transformation delivers significant long-term savings through reduced manual labor, eliminated paper systems, and improved staff productivity.

Digital transformation future-proofs branch operations, enabling quick adaptation to changing regulations and customer expectations through flexible, cloud-based systems that integrate new capabilities seamlessly.

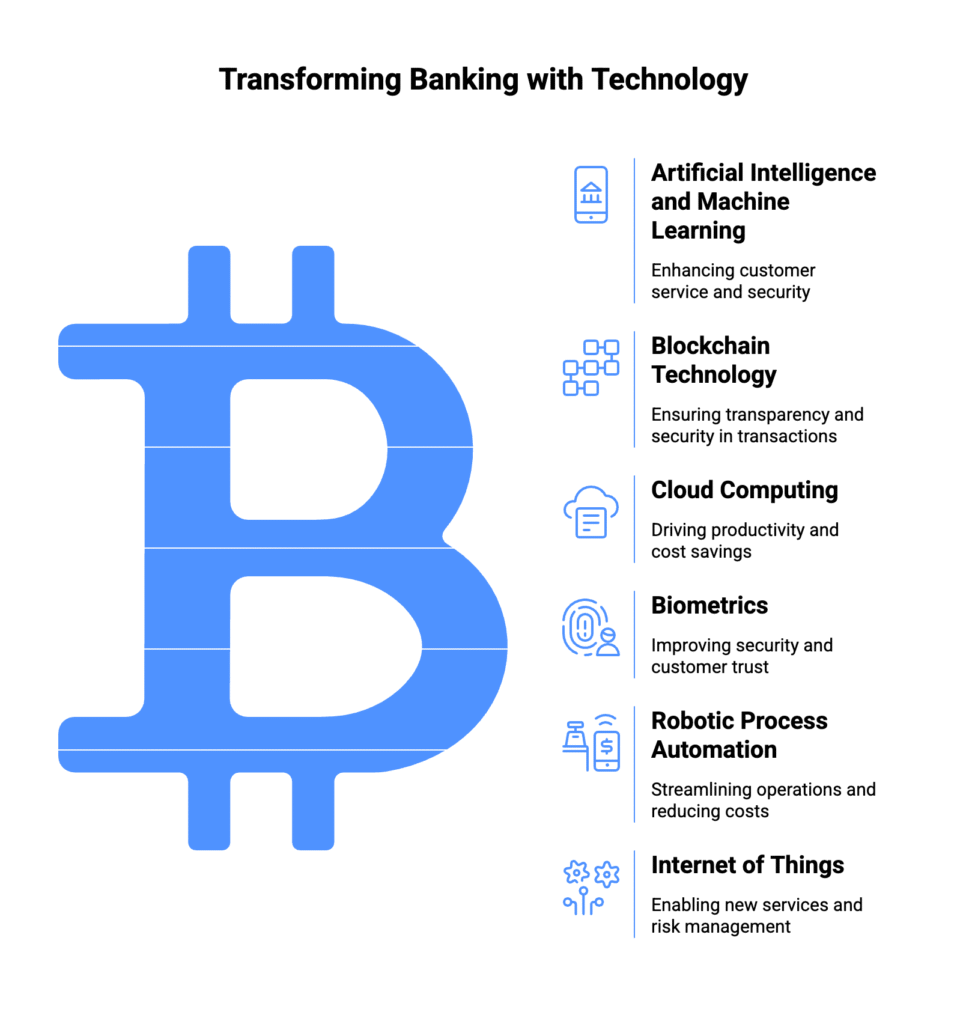

Technological Innovations in Digital Transformation in Banking

The banking sector is undergoing a seismic shift with the integration of a suite of advanced technologies that each offer their unique advantages. Here’s how each technology is playing a pivotal role in transforming digital banking infrastructure:

Artificial Intelligence and Machine Learning

AI and ML are at the forefront, from enhancing customer service with chatbots to bolstering security through fraud detection. The AI in banking market, valued at $3.88 billion in 2020, is expected to skyrocket to $64.03 billion by 2030. ML algorithms excel in real-time data analysis, identifying anomalies that could indicate fraud, a critical tool for the 75% of large banks that are already deploying AI technologies.

Blockchain Technology

Blockchain is revolutionizing banking with its promise of transparency and security, particularly in identity verification and transaction integrity. With predictions that 10% of GDP will be blockchain-stored by 2025, the banking sector’s blockchain market size is anticipated to hit $20.03 billion by 2024.

Cloud Computing

Initially met with skepticism during its release, cloud computing has become a cornerstone for banking today. It is driving productivity and instant service delivery. Bank of America’s cloud initiatives saved $2 billion in a year, showcasing the technology’s impact in saving costs and improving efficiency.

What Is Data Strategy Consulting? A Complete Guide

Explore how businesses in 2025 are leveraging expert guidance to align data, technology, and goals—unlocking smarter decisions and scalable growth.

Biometrics

With password vulnerabilities exposed, biometrics has become a banking security linchpin. It’s not just for ATMs and in-person transactions; online banking security is also being redefined. Visa’s survey indicates a 65% consumer preference for biometrics over traditional security methods, emphasizing its importance for customer trust.

Robotic Process Automation (RPA)

RPA is streamlining banking by automating routine tasks, reducing costs, and alleviating staff workloads. Its compatibility with legacy systems makes it a quick win for banks looking to modernize efficiently without spending too much resources and time.

Internet of Things (IoT)

IoT extends banking’s reach, enabling services like biometric authorization and contactless payments, and enhancing risk management through data exchange. It is helping banks with creating tailored customer experiences through real-time data that ultimately help in customer relationship management.

Benefits of Digital Transformation in Banking and Financial Services

Improved Customer Experience that Leads to Better Growth

In the digital age, customer experience is the battleground for banks. Institutions that prioritize customer experience are growing 3.2 times faster than their peers. With 72% of consumers ready to switch to a competitor after one bad experience, the stakes couldn’t be higher.

Neobanks, providing digital-only banking is at the forefront of this transformation, utilizing digital-only models and cutting-edge technology to deliver highly personalized services. They offer seamless, efficient services and utilize blockchain for rapid cross-border payments, alongside AI-driven chatbots for 24/7 customer support. This leads to better digital transformation in transaction banking for customers.

Banks are now turning to integrated data systems to provide customized advice, as seen with Siemens Financial Services’ collaboration with Zendesk, which improved customer service by presenting a unified view of customer interactions.

Structured Risk Management that Prevents Failure of Banks

The downfall of Silicon Valley Bank (SVB) underscores a stark lesson in risk management. The bank’s failure, resulting in over $40 billion in lost shareholder value, could have been mitigated with proper risk oversight. James C. Lam, a risk management expert, highlights several lapses: the lack of a full-time Chief Risk Officer (CRO) during a pivotal period, an unchaired risk committee, and members without deep risk management expertise.

Analytical models at SVB failed to prompt action despite predicting severe equity declines in the event of rising interest rates—a scenario that materialized as the Federal Reserve increased rates.

Additionally, SVB’s public disclosures were questioned for omitting crucial information on how rate changes could affect equity, a departure from previous transparency.

This incident is an important reminder for the banking industry to enforce empowered risk management, which is a cornerstone of digital transformation in commercial banking within the banking sector.

Improved Operational Efficiency that Leads to Cost Savings

Operational efficiency in the banking sector hinges on a strategic overhaul of processes, as detailed in a McKinsey report. A notable UK bank’s meticulous examination of its operations revealed that a mere 15 processes were responsible for the lion’s share—80 percent—of its costs.

By deploying an integrated set of improvement levers, banks can systematically reimagine and revamp these processes, aligning them more closely with current customer demands and sidestepping outdated legacy systems. This allows banks to improve their digital transformation in transaction banking for customers.

Additionally, this approach’s efficacy is evidenced by a European bank in the McKinsey report. By reengineering its top 15 processes with a customer-centric focus, the bank slashed costs by 35 percent and elevated its net promoter score by 40 percent.

7 Ways an AI Agent for Data Analysis Saves Time and Speeds Up Insights

Ready to stop wrangling data and start making faster, smarter decisions? Discover how an AI Agent can streamline your analysis, reduce manual effort, and deliver insights in seconds—not hours.

Case Studies of Successful Digital Transformation by Kanerika

The first case study involves the implementation of AI/ML-powered Robotic Process Automation (RPA) to enhance fraud detection in insurance.

Previously, manual processes led to significant financial losses and inefficiencies, with no system to detect fraudulent claims. The solution integrated predictive analytics, AI, NLP, and image recognition to monitor customer behavior.

The results were impressive:

- a 20% reduction in claim processing time

- a 25% improvement in operational efficiency

- a 36% increase in cost savings.

The second digital transformation banking case study involved automating data processing for a client bogged down by manual Excel entries.

The results:

- a 50% enhancement in partner engagement

- a 65% acceleration in partner onboarding

This was achieved through the integration of FLIP and Power BI. It standardized data formats and provided actionable insights, streamlining decision-making.

These successes underscore Kanerika’s role in driving forward digital transformation with robust, measurable outcomes.

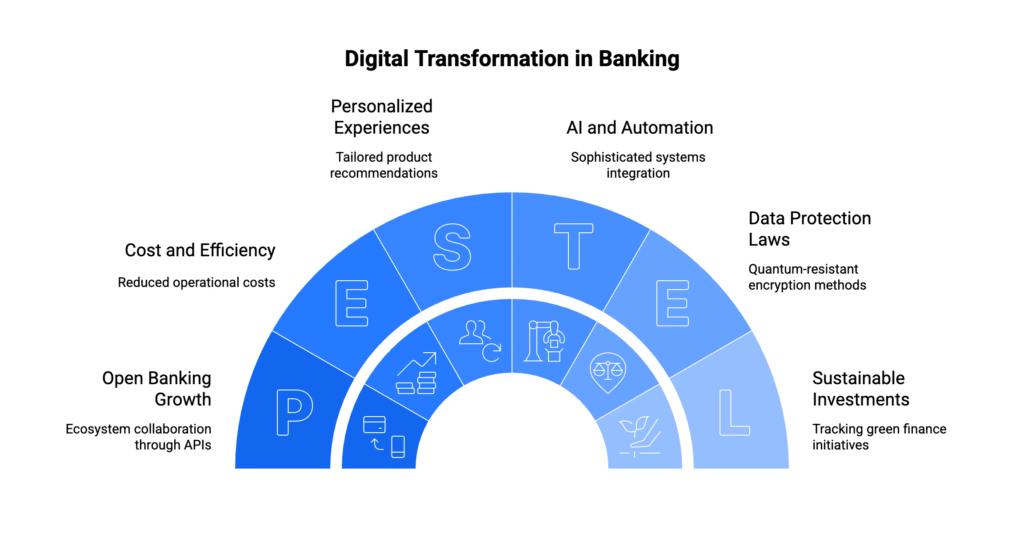

Future Trends in Digital Transformation in Banking

The banking industry stands at the threshold of unprecedented technological evolution. As digital transformation accelerates, emerging trends are reshaping how financial institutions operate, serve customers, and compete in an increasingly digital marketplace.

1. Artificial Intelligence and Machine Learning Integration

AI-powered banking is moving beyond basic chatbots to sophisticated systems that predict customer needs, detect fraud in real-time, and automate complex decision-making processes. Machine learning algorithms will enable hyper-personalized banking experiences, offering tailored product recommendations and customized financial advice based on individual spending patterns and life events. Credit scoring models will become more nuanced, incorporating alternative data sources to provide fairer assessments and expand financial inclusion.

2. Open Banking and API Economy

The future of banking lies in ecosystem collaboration through open banking platforms. APIs will enable seamless integration between banks and fintech partners, creating comprehensive financial service networks. Customers will access multiple financial products through single interfaces, while banks leverage third-party innovations without extensive in-house development. This trend will blur traditional banking boundaries, fostering competition and innovation while improving customer choice and convenience.

3. Blockchain and Decentralized Finance

Blockchain technology will revolutionize banking infrastructure, enabling faster cross-border payments, transparent transaction records, and reduced operational costs. Smart contracts will automate loan processing, insurance claims, and compliance procedures. While traditional banks adapt blockchain for efficiency gains, decentralized finance (DeFi) protocols will challenge conventional banking models.

4. Voice and Conversational Banking

Voice-activated banking through smart speakers and mobile assistants will become mainstream. It will allow customers to check balances, make payments, and receive financial guidance through natural conversation. Advanced natural language processing will enable complex transaction requests and financial planning discussions, making banking more accessible and intuitive.

5. Quantum Computing and Advanced Security

As quantum computing emerges, banks will need quantum-resistant encryption methods to protect customer data. Simultaneously, quantum technology will enhance risk modeling, portfolio optimization, and fraud detection capabilities, providing competitive advantages to early adopters.

6. Sustainability and ESG Integration

Digital platforms will integrate environmental, social, and governance (ESG) metrics into banking decisions. AI will assess the sustainability impact of loans and investments, while blockchain will provide transparent tracking of green finance initiatives. Customers will access carbon footprint tracking and sustainable investment options through digital banking platforms.

These trends will create more efficient, personalized, and inclusive banking experiences. However, there still will be new challenges around regulation, security, and customer trust.

Our IMPACT Framework for Banking Digital Transformation

At Kanerika, we leverage our proven IMPACT methodology to drive successful digital transformation projects in banking, focusing on delivering measurable outcomes that enhance customer experience, operational efficiency, and regulatory compliance.

I – Identify Digital Transformation Opportunities

Our banking experts conduct comprehensive assessments of your current technology landscape, identifying critical areas where digital transformation can deliver maximum value. We analyze customer journey pain points, operational bottlenecks, compliance gaps, and competitive disadvantages to pinpoint high-impact transformation opportunities. This includes evaluating legacy core banking systems, outdated customer interfaces, manual compliance processes, and inefficient branch operations that are hindering growth and customer satisfaction.

LangChain Vs LangGraph: Which Is Better For AI Agent Workflows In 2025?

Which framework leads the way for AI agent workflows in 2025? Uncover the strengths, differences, and best-fit use cases in our latest breakdown.

M – Map the Optimal Digital Banking Path

Based on our assessment findings, we develop a strategic roadmap that aligns digital transformation initiatives with your business objectives and regulatory requirements. Our mapping process considers regulatory constraints, integration complexities, customer impact, and resource availability to create a phased approach that minimizes disruption while maximizing benefits. We prioritize initiatives based on ROI potential, regulatory urgency, and customer value creation.

P – Prove Value Through Strategic Pilots

Before full-scale implementation, we design and execute targeted pilot programs that demonstrate the value of proposed digital solutions. These pilots might include automated loan processing for specific customer segments, AI-powered fraud detection for select transaction types, or mobile banking features for targeted demographics. Pilot programs allow us to validate assumptions, refine solutions, and build stakeholder confidence while generating early wins that support broader transformation efforts.

A – Analyze Performance and Compliance Benefits

We establish comprehensive metrics and monitoring systems to track the performance of digital banking solutions against key performance indicators. Our analysis covers operational efficiency gains, customer satisfaction improvements, compliance enhancement, cost reduction, and revenue generation. Regular performance reviews ensure that digital transformation initiatives continue delivering expected benefits while identifying opportunities for optimization and expansion.

C – Create Milestone-Based Implementation Plans

Our implementation approach breaks complex banking transformations into manageable, milestone-driven phases. Each milestone represents a specific achievement such as core system integration, customer portal launch, or compliance automation deployment. This structured approach ensures steady progress, allows for course corrections, and provides regular opportunities to celebrate successes and communicate value to stakeholders.

T – Transform Your Banking Technology Stack

The final phase involves seamless deployment of digital solutions across your banking infrastructure. We manage the complete transformation process, including data migration, system integration, staff training, and customer communication. Our change management expertise ensures smooth adoption while maintaining operational continuity and regulatory compliance throughout the transformation journey.

The IMPACT framework has enabled banking institutions to achieve significant improvements in customer satisfaction, operational efficiency, and competitive positioning while maintaining the highest standards of security and regulatory compliance.

FAQs

What is the digital transformation of banks?

The timeline for banking digital transformation varies significantly based on scope and complexity. Simple initiatives like mobile app enhancements or chatbot implementation can take 3-6 months, while comprehensive core banking system modernization typically requires 18-36 months. Phased approaches are most effective, allowing banks to realize benefits incrementally while managing risk. Factors affecting timeline include legacy system complexity, regulatory requirements, data migration needs, and organizational change management requirements.

What are the four pillars of digital transformation in banking?

The four pillars of digital transformation in banking are:

1. Customer Experience: Creating seamless, personalized, and omnichannel customer journeys through digital interfaces, mobile banking, and AI-powered services

2. Operational Excellence: Automating processes, optimizing workflows, and implementing intelligent systems to improve efficiency and reduce costs

3. Technology Infrastructure: Modernizing core banking systems, adopting cloud computing, and building scalable, secure, and flexible IT architectures

4. Data and Analytics: Leveraging big data, artificial intelligence, and advanced analytics to drive insights, enable predictive capabilities, and support data-driven decision making

What are the four types of digital transformation?

The four types of digital transformation are:

- Process Transformation: Redesigning and automating business processes using digital technologies to improve efficiency, reduce errors, and accelerate service delivery

- Business Model Transformation: Fundamentally changing how the organization creates, delivers, and captures value through new digital products, services, and revenue streams

- Domain Transformation: Expanding into new industries or market segments using digital capabilities and platforms

- Cultural/Organizational Transformation: Changing organizational mindset, skills, and culture to embrace digital-first thinking, agile methodologies, and continuous innovation

What are the main security and compliance concerns with digital banking transformation?

Key security concerns include data protection, cyber threat prevention, and maintaining customer privacy during digital transitions. Banks must implement robust encryption, multi-factor authentication, and real-time fraud detection systems. Compliance challenges involve meeting evolving regulations like PCI DSS, GDPR, and local banking laws while maintaining audit trails and regulatory reporting capabilities. The key is building security and compliance into the transformation from the beginning rather than treating them as afterthoughts.

How much does digital transformation in banking typically cost?

Digital transformation costs vary widely based on bank size, project scope, and current technology maturity. Small to mid-size banks might invest $1-5 million for basic digitalization, while major institutions often spend $50-200 million on comprehensive transformations. However, the ROI typically justifies the investment through operational cost reductions, improved customer retention, new revenue streams, and regulatory efficiency gains. Most banks see positive returns within 2-3 years of implementation.