Did you know that insurance companies spend over 60% of their operational costs on claims processing? AI Agents for Insurance Claims Processing are reshaping this high-cost, high-impact function. Claims processing remains one of the most resource-intensive parts of the insurance business, yet manual workflows, inconsistent decision-making, and long settlement cycles continue to strain both insurers and customers.

These AI-driven systems act as intelligent “virtual adjusters” that can analyze documents, detect fraud, evaluate damages, and even communicate with policyholders, all in real-time.

This blog explores how AI agents for insurance claims processing are transforming the industry. They do this by enhancing accuracy, reducing costs, and improving customer experience. Along the way, you’ll learn what these agents are, why they matter, and how they work in real-world scenarios. In addition, we’ll cover their key capabilities, the architecture that powers them, best practices for implementation, and proven success stories from leading insurers.

By the end, you’ll understand how leading insurers are using AI agents to turn claims from a manual bottleneck into a competitive advantage.

Key Takeaways

- AI agents for insurance claims processing deliver unmatched speed, accuracy, and cost efficiency, transforming how insurers manage claims.

- They enable seamless processing of structured and unstructured data, improving fraud detection, settlement speed, and transparency.

- Building success requires clear business alignment, focusing on measurable outcomes and strategic priorities.

- A robust data foundation ensures that AI models receive accurate and high-quality inputs across policy, claim, and IoT data sources.

- Continuous monitoring, governance, and auditability ensure compliance with insurance regulations and build trust.

Streamline, Optimize, and Scale with AI-Powered Agents!

Partner with Kanerika for Expert AI implementation Services

What Are AI Agents in Claims Processing?

AI agents in claims processing are intelligent systems designed to perform autonomous or semi-autonomous tasks within the insurance workflow. These agents handle activities such as claims triage, document review, fraud detection, and customer communication, helping insurers manage growing data volumes and customer expectations with greater precision and speed.

Unlike traditional automation tools or simple RPA (Robotic Process Automation) scripts that follow rigid, rule-based logic, AI agents leverage machine learning, natural language processing (NLP), computer vision, and predictive modeling to make context-aware decisions. This means they can understand documents, interpret claim details, recognize patterns, and even learn from historical data to improve over time.

In practice, AI agents take on multiple roles across the claims lifecycle. They manage intake and triage by classifying claim types and routing them efficiently. Through optical character recognition (OCR) and NLP, they extract information from unstructured sources such as handwritten forms or medical records. Vision-based models enable damage assessment from photos or videos, while predictive models assess fraud probability and suggest settlement recommendations. Additionally, chatbots and voice agents guide customers through filing claims or checking claim status in real-time.

Insurers are increasingly adopting AI agents because they accelerate claims processing, reduce manual workloads, and minimize human error. Beyond efficiency, they enhance customer satisfaction by delivering faster, more transparent claim resolutions, while keeping operational costs under control and ensuring consistent decision-making across all processes.

Why They Matter for Insurance Claims

The insurance industry is experiencing a massive surge in data generated from telematics devices, IoT sensors, customer interactions, and digital documentation. At the same time, growing regulatory pressure for faster and fairer claim settlements makes manual systems increasingly inefficient. Traditional claims processing methods, often dependent on human intervention and legacy workflows, struggle to keep pace with this rising complexity and data volume. As a result, insurers face delays, higher operational costs, and inconsistent decision-making.

This is where AI agents are transforming the landscape of claims management. They bring automation, intelligence, and scalability to every stage of the process. Their importance can be summarized as follows:

- Process structured and unstructured data quickly: AI agents analyze text, images, audio, and video simultaneously to generate actionable insights in seconds.

- Reduce cycle time from days to minutes: Automated triage and decision-making drastically shorten claim settlement timelines.

- Improve consistency and transparency in decisions: AI-driven assessments eliminate subjective bias and maintain regulatory compliance.

- Enhance fraud detection and risk control: Machine learning models detect unusual patterns and prevent fraudulent payouts.

The business impact of these capabilities is profound. Insurers achieve faster claims resolution, lower administrative costs, and greater customer satisfaction through quicker, more reliable processes. Moreover, by leveraging AI agents, companies strengthen their competitive edge, turning claims processing from a cost center into a strategic advantage built on speed, accuracy, and trust.

AI Agents: A Promising New-Era Finance Solution

Explore how AI agents are transforming finance, offering innovative solutions for smarter decision-making and efficiency.

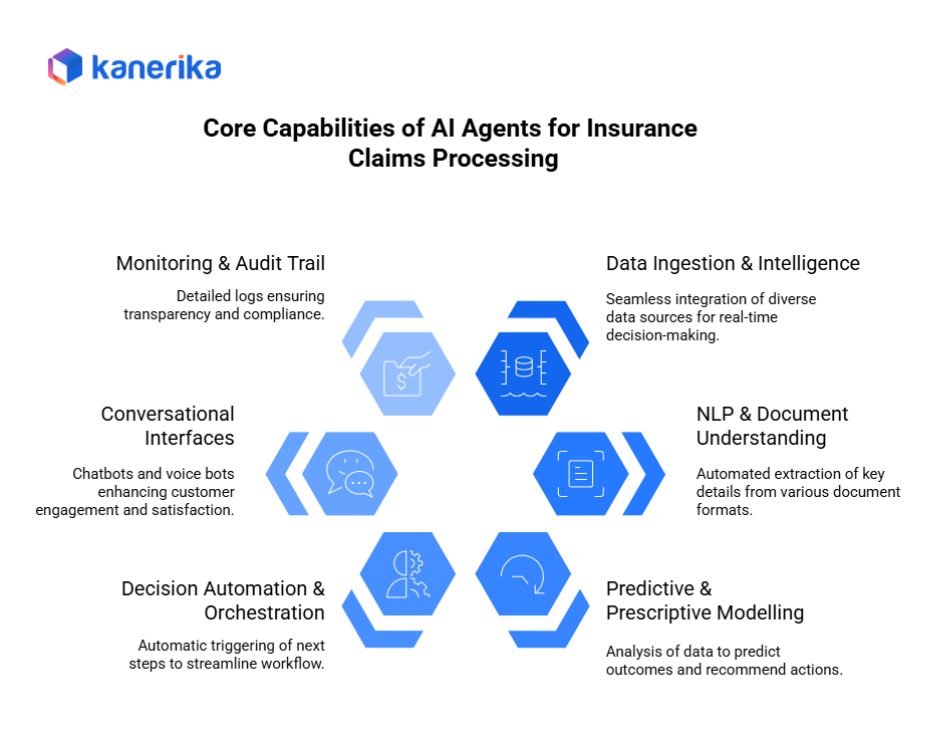

Core Capabilities & Features of AI Agents For Insurance Claims Processing

AI agents bring together advanced technologies that transform how insurers handle claims, from intake to settlement. They also combine data integration, analytics, automation, and communication into one intelligent system, which improves accuracy and efficiency.

1. Data Ingestion & Intelligence

To begin with, AI agents can seamlessly ingest and interpret large volumes of policy, claims, IoT, image, and voice data from multiple systems. Furthermore, they integrate with core insurance platforms, third-party data providers, and external sensors to create a unified and comprehensive view of every claim. As a result, this real-time integration enables faster and more accurate decision-making.

2. NLP + Document Understanding

By leveraging natural language processing (NLP) and computer vision, agents extract key details from PDFs, handwritten forms, and images. In addition, they identify claim numbers, dates, damages, and other essential information without human input. As a result, this reduces manual data entry and significantly speeds up claim verification.

3. Predictive & Prescriptive Modelling

AI models analyze historical and real-time data to predict claim outcomes, detect anomalies, and estimate potential losses. These models can also recommend actions, such as settlement amounts or fraud reviews, making claims handling more proactive than reactive.

4. Decision Automation & Orchestration

Once the data is processed, the AI agent automatically triggers the next steps, such as assigning adjusters, requesting additional documentation, or auto-settling straightforward claims. As a result, this orchestration ensures smooth workflow management and faster resolution.

5. Conversational Interfaces

Chatbots and voice bots assist customers during the First Notice of Loss (FNOL), provide claim status updates, and handle simple queries. This improves engagement and satisfaction while reducing the burden on call centers.

6. Monitoring & Audit Trail

AI agents maintain detailed logs of every decision and interaction, ensuring transparency, accountability, and compliance. These audit trails are vital for regulated industries, providing confidence that every action is explainable and secure.

Together, these capabilities enable insurers to operate faster, smarter, and more transparently, setting up a new standard in claims management.

Architecture & Implementation Flow for AI-Driven Claims

A practical architecture for AI agents in claims follows a clear flow: front end → ingestion → AI agent engine → orchestration → back-office → monitoring & governance.

1. Front end (customer portal/chatbot)

Customers file First Notice of Loss (FNOL) via web, mobile, or voice bots. They upload forms, photos, and videos, and receive real-time status updates.

2. Ingestion layer

Next, streaming and batch pipelines ingest data from core systems and uploads. Connectors normalize formats and attach metadata (claim ID, policy ID, timestamps). De-duplication and basic validation run here.

3. AI agent engine (NLP/vision/predictive)

Then, AI services extract and analyze content:

- NLP/OCR for forms, emails, adjuster notes, and PDFs.

- Computer vision for damage assessment from images and videos.

- Predictive models for severity scores, liability estimation, and fraud risk.

- Prescriptive logic to recommend next best actions or settlement ranges.

4. Orchestration & workflow engine

After scoring, the rules and policies route work. The engine can auto-settle low-value claims, request missing documents, or assign an adjuster for complex cases. Human-in-the-loop steps capture approvals and exceptions.

5. Back-office systems (P&C core, payments)

Finally, outcomes sync to the policy administration, claims management, and payments systems. Notifications update brokers, repair networks, and customers.

6. Monitoring & governance layer

Continuously capture audit logs, model inputs/outputs, and user actions. Dashboards track SLA compliance, cycle time, auto-settle rates, and fraud catch. Decision traceability supports reviews and regulatory checks.

7. Data sources

Policy admin systems, claims systems, IoT/telematics, photos/videos, repair estimates, and external feeds (e.g., weather, geolocation, parts/repair cost indexes).

8. Agent governance

Enforce access control, redaction for PII/PHI, and explainability for model decisions. Maintain human-in-loop on contested or high-impact outcomes. Version models and workflows; promote only after validation.

9. Scalability

Use cloud-native deployment with elastic compute, multi-tenant workspaces, and regional data zones. This design lets global insurers roll out agents across countries while meeting data residency and compliance requirements.

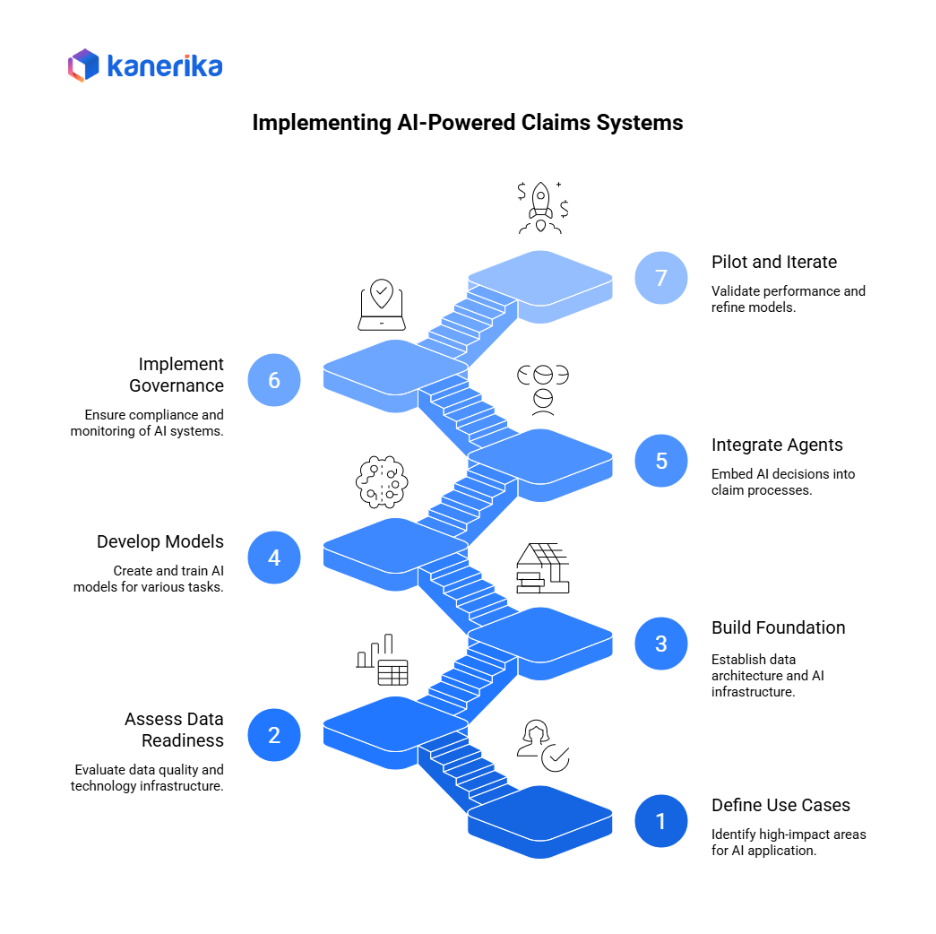

Implementation Roadmap for Insurers: Building AI-Powered Claims Systems

Implementing AI agents for insurance claims processing requires a phased roadmap that blends technology readiness with business alignment. Each stage builds the foundation for secure, compliant, and scalable automation.

Step 1: Define Use Cases & Business Value

Start by identifying high-impact areas such as triage, FNOL automation, fraud detection, or damage assessment. Focus on measurable outcomes like reduced cycle time or improved accuracy before expanding further.

Step 2: Assess Data Readiness & Technology Stack

Evaluate current data quality and sources — policy admin data, claims records, IoT streams, and images. Assess tools for document ingestion, image storage, and AI model deployment. Determine gaps in integration or infrastructure.

Step 3: Build the Foundation

Establish a data lake or Lakehouse architecture to handle structured and unstructured assets. Set up storage for forms, videos, and images. Deploy the AI infrastructure (Databricks, Azure ML, or AWS Sagemaker) to train and host models securely.

Step 4: Develop and Train Models

Create NLP models for document parsing, vision models for damage classification, and anomaly models for fraud detection. Build agent workflows to automate decision-making. Train models on labeled historical claims data to improve accuracy.

Step 5: Integrate Agents into Claim Processes

Use APIs and orchestration tools to embed AI decisions into the claims lifecycle. Enable human-in-the-loop reviews for exceptions and regulatory compliance.

Step 6: Implement Governance & Monitoring

Ensure audit trails, decision logs, and explainability reports are active. Monitor key metrics—processing time, fraud detection rates, and customer satisfaction. Align with insurance regulations for transparency.

Step 7: Pilot, Measure, and Iterate

To begin with, run a limited pilot to validate performance. Then, measure reductions in claim cycle time, manual effort, and error rates. Finally, use the feedback to refine models and scale deployment gradually.

Implementation Tips:

- Start small with a focused use case.

- Involve adjusters and claims teams early.

- Maintain high data quality and labeled datasets.

- Train and deploy models incrementally for better reliability.

By following this roadmap, insurers can deploy AI-driven claims automation confidently, balancing innovation with compliance and human oversight.

Best Practices & Pitfalls to Avoid During Insurance Claim Processing

Deploying AI agents in insurance claims can deliver exceptional efficiency — but only when guided by the right strategy and safeguards. The following best practices and pitfalls outline how insurers can maximize value while avoiding costly missteps.

Best Practices

- Align agent strategy with business goals and metrics: Clearly link automation outcomes to measurable KPIs such as claim cycle reduction, accuracy, and customer satisfaction.

- Start with high-impact workflows: Focus first on high-volume, low-complexity claims (e.g., auto damage estimation, document extraction) to prove ROI and gain user trust.

- Ensure data quality and integration: Build a clean, unified data foundation; handle structured and unstructured ingestion (images, PDFs, IoT feeds) effectively.

- Maintain human-in-loop oversight: Keep adjusters involved for exceptions, ambiguous claims, or regulatory checks to balance automation with judgment.

- Monitor and retrain continuously: Track model accuracy, drift, and error rates. Regularly retrain models on new data and update workflows to reflect business and compliance changes.

Pitfalls to Avoid

- Over-automating too quickly: Rapid rollouts can erode adjuster confidence and risk compliance issues if oversight is lacking.

- Ignoring unstructured data: Skipping images, documents, or voice inputs can limit agent intelligence and accuracy.

- Underestimating feature engineering effort: Poor data preprocessing and limited labeled data often degrade model performance.

- Deploying without governance: Launching models without compliance validation, monitoring, or audit logging invites risk.

To begin with, deploying AI agents isn’t a one-time effort. In fact, ongoing training, governance, and optimization are essential for maintaining performance, trust, and regulatory alignment. Therefore, successful insurers treat AI as a continuously evolving capability, not just a technology upgrade.

Real-World Use Cases & Customer Stories

Across the insurance industry, companies are increasingly embracing AI agents for insurance claims processing to drive efficiency, transparency, and customer satisfaction. For example, the following two verified cases show how insurers have implemented these solutions and what lessons they learned along the way.

1. Aviva (UK)

Aviva deployed more than 80 AI models across its claims operations, resulting in reduced liability-assessment times by up to 23 days and improved claim routing accuracy by 30 %. The insurer also achieved greater customer satisfaction by cutting complaint volumes by nearly 65%.

The use of AI agents enabled Aviva to automate the triaging of complex claims and accelerate decision-making in its motor claims business.

2. Roots / Leading U.S. P&C Carrier

A major U.S. property-and-casualty insurer worked with AI-agent provider Roots to automate claims processing. The insurer achieved a 99% straight-through processing rate and a 60% increase in claim throughput volume in under six months.

This drastic shift meant most claims were resolved without manual intervention, freeing adjusters to handle complex or exceptional cases.

Key Lessons Learned

- Early adjuster involvement: Both organizations involved claims-adjuster teams early to validate AI-agent workflows and ensure practical alignment.

- Transparency in agent decisions: Processes included audit trails, decision logs, and human-in-loop checkpoints to build trust and regulatory readiness.

- Governance built in from the start: By embedding access controls, lineage tracking, and model versioning during deployment, these insurers avoided future rework and compliance concerns.

These stories demonstrate that when insurers apply a clear strategy, integrate AI agents thoughtfully, and maintain strong governance, they can achieve faster claims resolution, improved operational performance, and stronger competitive positioning.

AI Agents: A Promising New-Era Finance Solution

Explore how AI agents are transforming finance, offering innovative solutions for smarter decision-making and efficiency.

Kanerika’s Claims Adjudicator Copilot

A strong example of applied AI in insurance is Kanerika’s Claims Adjudicator Copilot.

This system supports claims analysts by improving how they review and assess claims. It uses past claim records to identify and present similar historical cases, helping analysts make faster and more informed decisions.

Rather than replacing people, the Copilot works alongside analysts. It takes care of repetitive checks and data comparisons, so teams can focus on reviewing complex or unusual claims. This balance between automation and human judgment helps insurers process claims with greater accuracy, consistency, and speed.

By combining data-driven insights with real-time decision support, Kanerika’s model demonstrates how AI agents can turn claims adjudication into a more efficient and reliable process.

Transform Your Business with Kanerika’s AI Solutions

Kanerika brings deep expertise in agentic AI and machine learning, helping businesses transform how they operate. From manufacturing and retail to finance and healthcare, we build AI solutions that improve productivity, reduce costs, and support innovation. Our focus is on solving real-world problems with models that are tailored to each industry’s needs.

We’ve developed purpose-built AI and generative AI tools that help organizations overcome bottlenecks, streamline workflows, and scale with confidence. These solutions cover a wide range of use cases—faster information retrieval, video analysis, real-time data processing, smart surveillance, and inventory optimization. In areas like finance and operations, our AI agents support tasks such as sales forecasting, financial planning, data validation, and vendor evaluation.

At Kanerika, we design AI systems that deliver measurable results. Whether it’s improving decision-making, automating complex processes, or enabling smarter pricing strategies, our models are built to adapt and perform. By combining deep technical knowledge with industry-specific insight, we help businesses stay efficient, agile, and ready for what’s next.

With Kanerika as your partner, achieve sustainable growth and success through AI solutions that redefine your business approach. Let’s work together to build a future of innovation and excellence.

Boost Productivity and Efficiency with Next-Gen AI Agents!

Partner with Kanerika for Expert AI implementation Services

FAQs

How do AI agents differ from chatbots or RPA?

Traditional bots follow scripts.

AI agents think and act.

They use machine learning and language models to make independent decisions rather than just executing predefined commands.

What technologies make these agents work?

They combine:

- OCR (reads documents)

- LLMs (understands and writes text)

- Predictive analytics (assesses risk)

- Generative AI (summarizes and explains documents)

What challenges do insurers face when adopting AI agents?

- Data privacy and security.

- Integrating with old systems.

- Compliance with 2025 AI regulations (like the EU AI Act).

- Avoiding bias in automated decisions.

What’s next for AI agents in insurance?

Expect multi-agent systems, where several AI agents — one for risk, one for fraud, one for customer care- work together under human supervision. The next step is to fully explain and transparently claim decisions.