Generative AI is raising the bar for what businesses can achieve with automation and a trained AI model.

Take the recent success story of Google and Wendy’s collaboration – an AI chatbot that has automated Wendy’s drive-through service and is trained to understand the various ways in which customers can order from the menu. Customers can drive in and speak through the terminals, and the AI chatbot will take the order – it’s that simple.

Recent research by Goldman Sachs shows that the adoption of generative AI will bring huge transformations to the global economy.

It has the potential to boost global GDP by nearly $7 trillion. That is equivalent to a 7% increase, or the aggregate of the economies of Japan and the UK.

However, the application of generative AI in business isn’t just another buzzword. It is a transformative force that’s reshaping the consulting landscape.

What exactly is generative AI consulting, and how can it revolutionize your decision-making processes? This article aims to demystify the concept, offering a deep dive into its applications and impact on the consulting industry.

Table of Contents

- What is Generative AI Consulting?

- The Business Value of Generative AI Consulting

- Generative AI Consulting Helps with Strategic Decision-Making

- Business Solutions that are Efficient, Automated and Scalable

- Data-Driven Insights

- Ethical and Security-Focused Approach to Implementation

- Case Study: Kanerika’s Generative AI Consulting Solutions

- Implementing Generative AI: A Step-by-Step Guide

- Step 1: Strategy – Identify your Generative AI Use Cases

- Step 2: Evaluation – Choose the Right AI Technologies

- Step 3: Analysis – Leverage Data Analytics and Generative AI for Predictions & More!

- Step 4: Implementation – Integrate your Generative AI to your System

- Grow with Generative AI Consulting – Partner with Kanerika

- FAQs

What is Generative AI Consulting?

Generative AI models have emerged rapidly in the last two decades. In 2006, Ian Goodfellow and his colleagues proposed the first generative adversarial network (GAN). It was a neural network that could generate primitive images by learning from a large dataset of real images.

Now, in 2023, anyone can buy a Midjourney subscription for a few dollars and generate hyper-realistic images or chat with GPT for free and get human-accurate texts. AI is changing business by employing natural language processing technologies. But how do you capitalize on this game-changing technology? You need generative AI consulting to help you solve complex problems with minimum resources.

Consulting agencies are increasingly turning to generative AI. This fusion of human expertise and AI-driven insights would be exciting. It is essentially a three-step process:

- Generative AI consulting identifies opportunities to enhance products, services, and operations.

- Using the advanced capabilities of AI, consultants can sift through complex data.

- Thereafter, they design and implement tailored generative AI solutions for optimal outcomes.

The Business Value of Generative AI Consulting

While generative AI has been making headlines for its various use cases, it is important for businesses to understand how generative AI can bring value to their operations.

Amidst the numerous technologies that dominate the Gen AI space, how can you understand which is the right fit for you?

Generative AI consultants step up and help you navigate your way through all the technologies by guiding you and ensuring your objectives are met. Looking for a quick insight into the business value of generative AI consulting? We have got you covered.

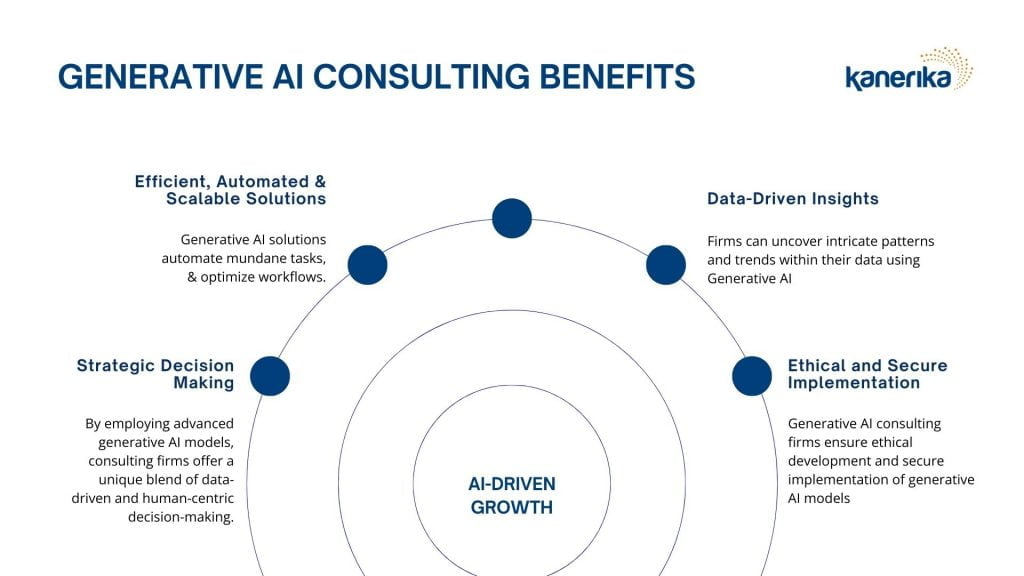

Generative AI Consulting Helps with Strategic Decision-Making

Generative AI consulting is an invaluable asset in shaping strategic business decisions for your organization. By employing advanced generative AI models, consulting firms offer a unique blend of data-driven and human-centric decision-making.

Generative AI services do not simply analyze data. It simulates a multitude of business scenarios. This results in a comprehensive risk assessment. Companies can make informed choices aligned with their long-term objectives.

Through robust generative AI strategy implementation, businesses can anticipate and prepare for future challenges with immense thoroughness.

Business Solutions that are Efficient, Automated and Scalable

Operational excellence is a universal business goal, and generative AI consulting plays a pivotal role in achieving it. By helping automate mundane tasks and optimizing workflows, it significantly enhances operational efficiency for businesses.

But the benefits don’t end there. The solutions offered by generative AI consulting services are inherently scalable. As your business grows, these solutions adapt and become more powerful, with impressive advancements made in six-month windows.

Data-Driven Insights

Data is the lifeblood of modern business, and generative AI consulting companies know how to channel it effectively. They specialize in converting raw data into actionable insights through advanced analytics and modeling techniques.

By applying generative AI to data analytics, these firms can uncover intricate patterns and trends that traditional methods may miss.

Moreover, due to the simplicity of most generative AI tools, businesses can continue using these technologies to derive insights without being dependent on data analysts or engineers.

Ethical and Security-Focused Approach to Implementation

The power of generative AI comes with its own set of responsibilities. Leading firms like Kanerika are setting industry standards by ensuring that all generative AI projects adhere to strict ethical and security guidelines.

The benefit of working with experienced generative AI consulting companies is that businesses do not have to worry about the potential ethical or security issues that may crop up during the implementation of these technologies.

Generative AI consulting firms like Kanerika put a strong emphasis on the ethical development and secure implementation of generative AI models.

Read More – Best Generative AI Tools For Businesses in 2024

Case Study: Kanerika’s Generative AI Consulting Solutions

Enhancing CRM Efficiency by 21%: A Breakthrough with Advanced Generative AI for a Leading ERP Provider.

The Challenge

Our client, a leading ERP provider, faced a series of challenges affecting their business performance. The existing CRM system was not only cumbersome but also ineffective in managing and analyzing sales data. This hindered the company’s ability to make strategic decisions.

Moreover, the absence of a comprehensive dashboard made it difficult to identify KPIs, market trends, and areas for improvement. The result? Lower customer satisfaction and subpar adoption rates. As an AI consulting firm, we needed to redesign the system from the ground up.

The Solution

To tackle these challenges, we employed cutting-edge technologies like generative AI, LLM, and Azure. We leveraged generative AI to create a visually stunning and accessible CRM dashboard that made data management much more efficient.

The dashboard provided a 360-degree view of sales data, enabling precise identification of KPIs and market trends. LLM technology further enhanced the user interface, making it incredibly intuitive and user-friendly.

Read More: What is Data Visualization?

The Outcome

The results were nothing short of spectacular:

- 10% increase in customer retention

- Sales and revenue experienced a 14% uptick

- Accuracy in identifying KPIs increased by 22%

In summary, our Generative AI-powered CRM dashboard didn’t just solve the client’s problems—it set a new industry standard for efficiency, user satisfaction, and data-driven decision-making.

Implementing Generative AI: A Step-by-Step Guide

As we’ve seen from the case study in the earlier paragraph, generative AI’s ability to work with data and prompts creates strong collaboration with other technologies.

This enables businesses to firmly focus on strategy and the right technological implementation, with the execution carried out smoothly by generative AI models.

But how can your business harness this potential? The answer lies in a structured approach to implementing generative AI. It has to be one that aligns with your unique business needs and objectives.

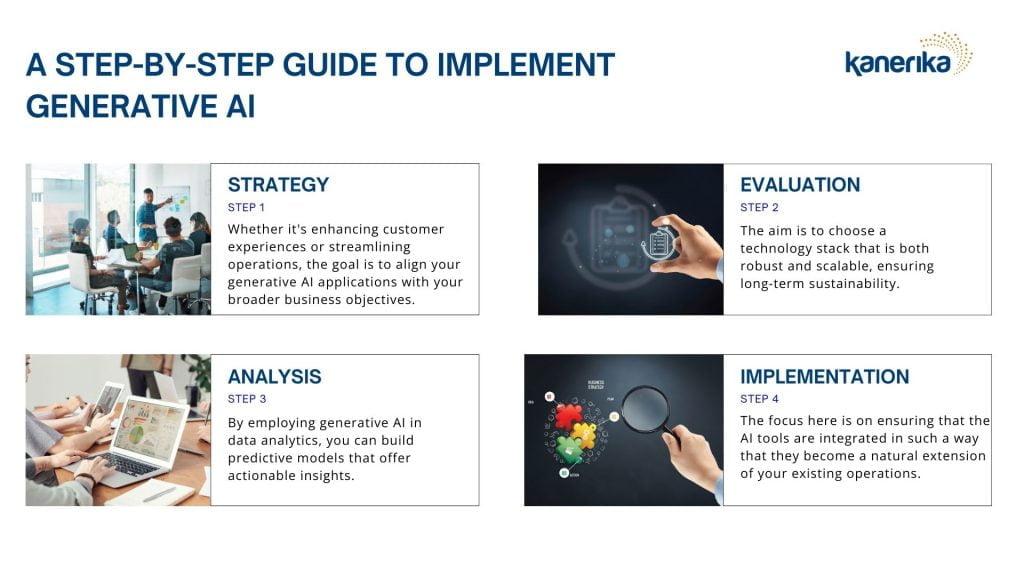

Let’s break down the journey into four manageable steps that you can employ with your generative AI consultants.

Step 1: Strategy – Identify your Generative AI Use Cases

The first step in generative AI in consulting is understanding how it can be inserted without affecting or upsetting the existing processes. This involves identifying the specific Generative AI use cases where it can add value.

Read More: Navigating Challenges For Generative AI Use Cases

Whether it’s enhancing customer experiences or streamlining operations, the goal is to align your generative AI applications with your broader business objectives. For example, many businesses in customer care have started using GPT 3.5 to power their chatbots.

Consulting services specializing in generative AI can be invaluable at this stage, helping you pinpoint areas for improvement and potential ROI.

Step 2: Evaluation – Choose the Right AI Technologies

For generative AI in business to be successful, one has to be careful about selecting the right technologies and tools. It’s not just about jumping on the latest tech bandwagon. It is more about selecting technologies that align with your specific needs and challenges.

Generative AI models come in various forms, and consulting firms specializing in AI strategy consulting can guide you through this maze.

The aim is to choose a technology stack that is both robust and scalable, ensuring long-term sustainability. This evaluation will help you realize which LLM models or tech providers like AWS are best suited for your generative AI needs.

Step 3: Analysis – Leverage Data Analytics and Generative AI for Predictions & More!

Data is the cornerstone of generative AI in decision-making. But it’s not just about collecting data; it’s about making it work for you. This is where data analytics and modeling come into play.

By employing generative AI in data analytics, you can build predictive models that offer actionable insights. These models can identify trends, forecast outcomes, and recommend actions, making them an indispensable tool. IBM has already been researching this for potential medical and pharmaceutical applications such as drug discovery and predictive health analytics.

Step 4: Implementation – Integrate your Generative AI to your System

The final piece of the puzzle is integrating your chosen generative AI solutions into your existing systems. This is often easier said than done, given the complexities involved. However, with the right generative AI consulting companies by your side, this process can be seamless.

The focus here is on ensuring that the AI tools are not just implemented but also integrated in such a way that they become a natural extension of your existing operations.

A great example of this implementation would be tools such as Adobe and Canva. They have integrated generative AI into their creative software, allowing for seamless access to the many benefits of LLM’s.

Grow with Generative AI Consulting – Partner with Kanerika

We’ve explored the huge potential of generative AI, and one thing is clear – the future is brimming with opportunities. But to navigate this complex landscape, you need a partner who understands both technology and your business needs.

That’s where Kanerika comes in.

Kanerika is a trusted consulting partner for global enterprises. We are committed to making businesses more efficient through hyper-automated processes, well-integrated systems, and intelligent operations.

So why wait? Skyrocket your growth with AI-powered innovation and take your business to the next level. Partner with Kanerika and unlock the power of generative AI for your business.

Book a free Generative AI consultation with us today!

FAQs

1) How will AI change business?

A) AI is revolutionizing business by automating tasks, optimizing workflows, and providing data-driven insights for strategic decision-making. It has the potential to boost global GDP significantly and is reshaping various industries, including consulting.

2) How are companies using generative AI?

A) Companies are using generative AI to automate services, enhance customer experiences, and make data-driven decisions. For example, Google and Wendy’s collaborated on an AI chatbot to automate Wendy’s drive-through service.

3) What are generative AI services?

A) Generative AI services involve the use of advanced AI models to simulate business scenarios, analyze complex data, and design tailored solutions for optimal outcomes. These services help in strategic decision-making, operational efficiency, and risk assessment.

4) What is the difference between generative AI and AI?

A) While AI encompasses a broad range of technologies designed to mimic human intelligence, generative AI focuses on creating new data or scenarios based on existing data. It’s a specialized subset of AI that can generate text, images, and other types of data.

5) Do chatbots use generative AI?

A) Yes, some advanced chatbots use generative AI to understand and respond to customer queries in a more natural and context-aware manner. For example, the AI chatbot in Wendy’s drive-through service is trained to understand various ways customers might order from the menu.

6) What algorithms are used in generative AI?

A) Generative Adversarial Networks (GANs) are commonly used in generative AI. These networks consist of two neural networks, the generator and the discriminator, that work in tandem to create new, synthetic instances of data from the original data.

7) Is generative AI deep learning or machine learning?

A) Generative AI often uses deep learning techniques, especially when it comes to complex tasks like generating images or text. Deep learning is a subset of machine learning, making generative AI a field that intersects with both.

8) How is generative AI used in consulting?

A) In consulting, generative AI is used to identify opportunities to enhance products, services, and operations. Consultants use advanced AI capabilities to sift through complex data and design tailored solutions. It aids in strategic decision-making, operational efficiency, and comprehensive risk assessment.

9) Who are the top players in generative AI?

A) Companies like Google, IBM, and specialized consulting firms like Kanerika are leading the way in generative AI. They are setting industry standards in ethical development and secure implementation of generative AI models.

10) What problem does generative AI solve?

A) Generative AI solves the problem of complexity in data analysis and decision-making. It can simulate multiple business scenarios for comprehensive risk assessment, automate mundane tasks, and provide actionable insights through advanced analytics and modeling techniques.